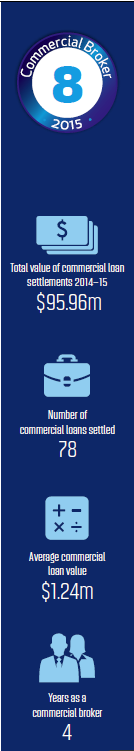

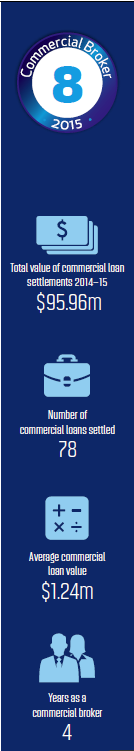

Mark Churchill of Allfin Finance is number eight in the MPA Top 10 Commercial Brokers 2015.

#8 MARK CHURCHILL

ALLFIN FINANCE, SOUTH MELBOURNE

Mark Churchill specialises in commercial finance for the healthcare market, including pharmacies, dentists and doctors. He set up Allfin Financial Services in 2010 after a decade of healthcare finance at NAB and then Commonwealth Bank.

MPA: What distinguishes you from an average commercial broker?

Allfin are predominately brokers to the healthcare segment. In order to compete in the market, we have had to be specialists – not only just in general healthcare, but also in modalities under this banner. We started with specialising in pharmacy predominately, and only when we got that right did we move to dental and now general medical. Each modality has its challenges, but the theory remains the same across the board, so what we learn in one modality we can adapt to another.

MPA: Do you focus on any particular area of commercial lending? Why?

Most of our lending begins with the goodwill component of the business. We have set up a systematic approach where we can look at any healthcare business and understand the security value of the business and service ability based on cash flow to determine the likely bank appetite for the transaction.

The attraction to the client is that we can review any new business purchase without the client having to go through the cost of engaging accountants and valuers in the initial stages, while insuring speed to market so the client can make a confident bid for the business.

Engaging the client at the early stages not only gives them confidence, but also allows us to ensure that the transaction is set up properly from the start so we can move the process through to settlement in a timely manner. This builds confidence with the client and allows us to build a long-term relationship, which in turn gives us the opportunity to review their other facilities.

MPA: Would you term yourself an advisor? How do you present yourself to clients?

I believe we now have to be more than an advisor, given the long-term relationship we want to build with the clients. It’s not just about advising them on the initial acquisition or refinance, but to be there when their covenant reporting is due, in which case you become a business coach, negotiator and advisor.

MPA: Is every loan different, or are there similar scenarios you frequently encounter?

In theory, most transactions will follow the same methodology, but essentially every transaction has its own intricacies. There is no such thing as a ‘cookie cutter’ approach anymore in an ever-changing regulatory environment, but I guess that is why [brokers] will always be valuable contributors to the industry.

MPA: Do you see opportunities in your area of broking over the next 12 months, or is it time to consolidate?

I still see plenty of opportunity, and there are segments that are calling out for commercial brokers; however, there may be a need for some consolidation so that we have the capital to finance these segments.

ALLFIN FINANCE, SOUTH MELBOURNE

Mark Churchill specialises in commercial finance for the healthcare market, including pharmacies, dentists and doctors. He set up Allfin Financial Services in 2010 after a decade of healthcare finance at NAB and then Commonwealth Bank.

MPA: What distinguishes you from an average commercial broker?

Allfin are predominately brokers to the healthcare segment. In order to compete in the market, we have had to be specialists – not only just in general healthcare, but also in modalities under this banner. We started with specialising in pharmacy predominately, and only when we got that right did we move to dental and now general medical. Each modality has its challenges, but the theory remains the same across the board, so what we learn in one modality we can adapt to another.

MPA: Do you focus on any particular area of commercial lending? Why?

Most of our lending begins with the goodwill component of the business. We have set up a systematic approach where we can look at any healthcare business and understand the security value of the business and service ability based on cash flow to determine the likely bank appetite for the transaction.

The attraction to the client is that we can review any new business purchase without the client having to go through the cost of engaging accountants and valuers in the initial stages, while insuring speed to market so the client can make a confident bid for the business.

Engaging the client at the early stages not only gives them confidence, but also allows us to ensure that the transaction is set up properly from the start so we can move the process through to settlement in a timely manner. This builds confidence with the client and allows us to build a long-term relationship, which in turn gives us the opportunity to review their other facilities.

MPA: Would you term yourself an advisor? How do you present yourself to clients?

I believe we now have to be more than an advisor, given the long-term relationship we want to build with the clients. It’s not just about advising them on the initial acquisition or refinance, but to be there when their covenant reporting is due, in which case you become a business coach, negotiator and advisor.

MPA: Is every loan different, or are there similar scenarios you frequently encounter?

In theory, most transactions will follow the same methodology, but essentially every transaction has its own intricacies. There is no such thing as a ‘cookie cutter’ approach anymore in an ever-changing regulatory environment, but I guess that is why [brokers] will always be valuable contributors to the industry.

MPA: Do you see opportunities in your area of broking over the next 12 months, or is it time to consolidate?

I still see plenty of opportunity, and there are segments that are calling out for commercial brokers; however, there may be a need for some consolidation so that we have the capital to finance these segments.