Bank of the Year reflects on successful 2022

After winning MSA National Bank of the Year at the Australian Mortgage Awards 2022 for the second year running, Bankwest could be excused for resting on its laurels.

But as Ian Rakhit, general manager third party (pictured above), knows too well after a 37-year career in financial services, success in banking requires an ongoing commitment to excellence and a close partnership with brokers.

The non-major bank not only won Bank of the Year but also picked up the award for Best Industry Marketing Campaign at the AMAs.

“Bankwest strives to be the best bank for brokers in the country, and we can only achieve that by working collaboratively with brokers to understand and address their needs, enabling them to deliver the best possible experience for customers,” Rakhit says.

“Bankwest strives to be the best bank for brokers in the country, and we can only achieve that by working collaboratively with brokers to understand and address their needs, enabling them to deliver the best possible experience for customers,” Rakhit says.

“I’m tremendously proud of my third party colleagues, as well as our critical broker network, and grateful for the recognition we have received over the past 12 months, because it’s a reflection of the authentic, invaluable, collaborative relationship that exists between Bankwest and brokers.”

Rakhit says brokers are vitally important to Bankwest and a key pillar of the bank’s business. “We make no secret of the fact that more than 80% of our home loan customers arrive at Bankwest through a broker.”

Bankwest’s commitment to supporting and investing in its broker network is in line with the bank’s ambitions to be there for more home loan customers nationally, says Rakhit.

“We’re in constant conversations with brokers and actively seeking feedback and listening to what they tell us so we can improve or create the processes and tools that support them in delivering the best possible experience for customers.”

Digital innovation

Rakhit says feedback from brokers has helped Bankwest create a fully digital home loan process that is a faster and far more simple and efficient experience for brokers and their customers.

This includes features ranging from free digital valuations to application processing and submission with digital signing, through to dispersal.

“Our unique case-ownership model and one-stop-shop Bankwest Broker Portal also means our broker network is empowered to self-serve most of their requirements – but when they need us, our colleagues are always available,” Rakhit says.

“We’ve also been working closely with brokers to develop a new support tool that we look forward to unveiling soon.”

Bankwest is committed to investing in the third party network via innovation, with new digital tools or practical support for brokers when needed, says Rakhit.

“We see that investment through the market-leading solutions in the Bankwest Broker Portal and our continual improvement and addition to the tools and services available to brokers.”

The bank is also recruiting more broker development managers to support its network, particularly through its unique case-ownership model.

Educating brokers

Rakhit says Bankwest also provides learning opportunities for brokers, to support their personal and professional development. One example is the Bankwest Broker Learning Library, launched in 2021.

“It provides brokers with ongoing professional development resources, a comprehensive bank of insights, videos and content for growing a business, while our Connect Event series is designed to motivate and empower brokers,” says Rakhit.

Brokers also have complimentary access to Bankwest’s Health and Wellbeing Assistant program – a confidential service that connects brokers with trained coaches for when they need extra support, whether it’s physical, mental, social or financial.

Home truths

Home truths

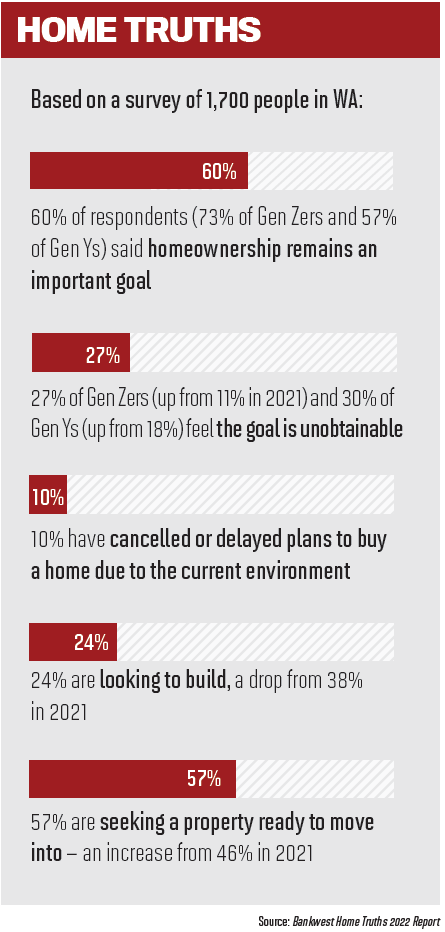

The results of Bankwest’s annual Home Truths survey are revealed in a valuable attitudinal report that the bank commissions to provide insights into the perceptions, intentions, preferences and behaviours of current and aspiring homeowners across Australia.

For Bankwest it’s a means of ensuring it remains informed about the current attitudes of current and prospective homeowners. “It enables us to share critical insights with stakeholders to ensure they are supported in delivering the best possible experience for customers,” says Rakhit.

Bankwest’s 2022 Home Truths report shows there are clear affordability concerns across the country. More young people feel homeownership is less achievable, Rakhit says. That’s most evident in WA, where the report shows a jump in the proportion of Gen Z homebuyers who feel the goal is unobtainable, from 11% to 27% between 2021 and 2022; for millennials this was also up (18% to 30%).

“However, Home Truths also told us the ‘Great Australian Dream’ remains alive for most aspiring homeowners, with more than 60% of people telling us that the goal remained important to them,” Rakhit says.

Rising costs of materials and transport, skilled labour shortages and supply issues are also affecting the market nationally, but the effects are different between states.

About 10% of Home Truths respondents said they had cancelled or delayed plans to buy a home because of the current environment, but WA again stood out with significant shifts in homebuyers’ purchasing intentions.

The number of those looking to build has also fallen significantly in the past year, from 38% to 24%, while those seeking a property ready to move into rose from 46% to 57%. Even those looking to renovate increased (from 13% to 18%). “That would appear to be a direct response to the challenges facing the construction industry, given the reduction in a preference to build, an increased desire for already-established houses, and those not even wanting to move,” says Rakhit.

The driving goals

Customers are at the heart of everything Bankwest does, says Rakhit, whether it’s the bank’s proprietary colleagues focused on delivering the best possible experience, or its third party team ensuring brokers are best supported to do the same.

“We get to work in a collaborative environment in which all our colleagues are supporting each other and pulling towards the same goal as we look to support more customers across Australia to put a roof over their heads.

“We pride ourselves on supporting our more than one million customers across the country, and we embrace diversity and inclusivity to ensure our workforce reflects those customers and communities we exist to support.”

Bankwest has a clear ambition to serve more home loan customers nationwide, and with more than 80% of its home loan disbursals broker-originated, “we have a goal to be the leading bank for brokers across Australia”, Rakhit says.

“We’re in a strong position on the East Coast to grow as a homeowner-focused digital bank due to our distinct brand, first-class broker services and digital investment plans,” he says.

“We’ll continue to be a leading retail bank in our home state, a Perth-based national business that WA can be proud of and a major employer that offers new career opportunities for West Australians in the future.”