Alt-doc loans are helping SME customers who can’t provide traditional means of income verification

There’s no doubt that Australia is a nation of small businesses.

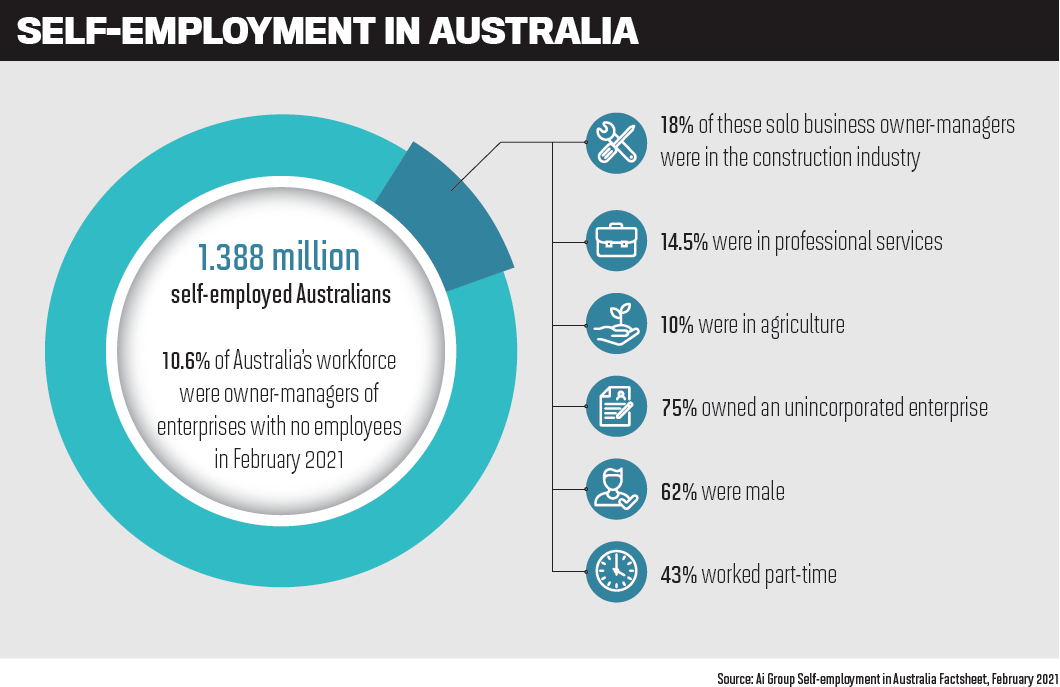

Of the estimated 2.4 million businesses nationwide in June 2021, 1.4 million were sole traders, according to the ABS. In 2020/21, the number of small businesses employing one to four people grew by 92,945 (15.2%) to 699,623. This is a massive market of potential clients for brokers. Sole traders and small business owners don’t fit the same profile as PAYG customers, but that’s where alt-doc lending can provide a solution.

Thinktank general manager partnerships and distribution Peter Vala (pictured immediately below), Pepper Money general manager mortgages and commercial lending Barry Saoud, and RedZed general manager distribution Chris Calvert discuss how alt-doc loans assist brokers and their clients.

Alt-doc lending explained

Vala says alt-doc lending allows borrowers to use other forms of income verification to prove serviceability, rather than tax returns and financial statements typically covering the most recent two financial years.

“Alt-doc can be used for both commercial and residential loans,” he says. “At Thinktank we offer alt-doc products ideal for all self-employed, SMEs and trusts.”

He says borrowers with complex financial situations are particularly attracted to this type of lending, preferring it to a full-doc facility because of the ease of the income certification process – which saves time as well as the cost and inconvenience of producing full financial statements and taxation returns.

While Thinktank doesn’t accept credit-impaired applicants, Vala says credit-impaired is a broad term, and often what is considered impaired may be suitably mitigated in the case of minor or explainable defaults.

“It’s why we always recommend brokers talk to their Thinktank relationship manager to workshop each transaction to see how we can best assist their client.”

Saoud says that with more Australians choosing to start their own businesses, alt-doc lending is becoming more common.

“Brokers and their customers should approach alt-doc lending with confidence,” he says. “Just because your customer doesn’t have the standard income documentation, it doesn’t mean they and their family are any less worthy of a loan than any other borrower.”

Providing a loan to the self-employed does not mean fewer forms of documentation but involves using alternative documentation to prove serviceability, he says.

“Alt-doc simply means the borrower has an alternative set of documents to verify their income, compared to those documents that many traditional lenders require for full-doc loans.”

Using the information in these documents, Pepper Money calculates loan serviceability from the business’s earnings at the present time, rather than a tax return that can be over a year old.

“Importantly, all loans, regardless of documentation provided, are subject to the same enquiry, verification and assessment, including credit checks and repayment histories,” says Saoud.

Calvert says alt-doc lending involves loans made to customers who are typically unable to provide traditional income verification such as weekly or monthly payslips or up-to-date tax returns and notices of assessment, so they provide alternative documentation such as accountant declarations or BAS statements.

“At RedZed, the typical alt-doc customer is a self-employed business owner who may not to be up to date with the lodgement of their tax affairs or may have complex business structures,” he says.

“We recognise that each customer has a unique set of circumstances, and we cater for this by offering several alternative methods of income variation for our self-employed applicants.”

Calvert says these can include:

- accountant verification

- two quarterly Business Activity Statements

- business bank statements

- interim financials, contracts and invoices

RedZed offers a range of residential and commercial loan products, all with varying levels of credit impairment allowed, says Calvert (pictured immediately below).

Loan products

Pepper Money takes a real-life approach to assessing applications, and there is no automated decisioning, says Saoud. Its credit assessors manually review each deal and ask questions to get a more detailed view of the borrower’s circumstances before they start making decisions.

Saoud says the non-bank lender considers several forms of alternative documents, including BAS and business bank statements.

“A cornerstone of our alt-doc home loan is the Pepper accountant’s letter, which acts as a firm and stringent guide for accountants when verifying the income that their self-employed customer earns.

“Our individual assessment of loans and risk-based pricing enables us to be more flexible with our credit policy than traditional lenders in the market.”

Saoud says a broker’s client still has to prove they can repay their loan, and Pepper Money still has to verify their income.

“The majority of our credit assessment is the same as the banks – we simply have an appetite and flexibility to cater for a broader range of clients.”

Calvert says RedZed offers a range of residential and commercial alt-doc loan products. “In the residential suite we have four distinct loan products comprising SE Prime, Reward, Recharge and Refresh, which are tailored to meet different borrower risk profiles.”

One major advantage of RedZed’s residential products is that business owners can use their principal personal assets (house or investment property) to assess equity for business use, says Calvert.

RedZed’s commercial alt-doc products are Prime and Reset. These also cater to a range of customer risk profiles, with the added benefit of no annual reviews and up to a 30-year loan term.

“RedZed’s constant focus is to deliver an optimal customer experience,” Calvert says. “This is evident in the way we work with our brokers to provide flexible loan options with alternative methods of income verification, as well as our practical approach to credit decisions.”

He says the product offering is backed up by RedZed’s target maximum 48-hour turnaround times, its common-sense approach to underwriting, and direct access to credit decision-makers.

“Our credit assessors understand the nuances of self-employed lending and are prepared to workshop applications with their brokers, which provides RedZed with a distinct point of difference.”

Vala says Thinktank has always offered commercial alt-doc loans in the form of quick-doc and mid-doc options and recently added a mid-doc residential product.

“Alt-docs are a great alternative for borrowers who may find it difficult for one reason or another to access funding if they were to rely on their financial statements alone,” he says.

Historical financial statements provide an indication of future earnings, but they don’t always provide the most up-to-date picture of the customer’s trading performance and cash flow.

“This was brought into sharp focus during the COVID lockdowns, where trading patterns were significantly impacted,” Vala says.

Thinktank’s mid-doc products enable borrowers to provide either one account-ant’s letter, their last two BAS statements, or six months of trading statements as alternative means of verifying their self-certification of income. The non-bank lender’s commercial quick-doc facility relies on self-certification alone.

“Our flexible options can either be for the short or long term but are typically written for 25–30 years,” says Vala. “Borrowers can also convert an existing mid-doc product to full-doc at no cost should they decide to seek a slightly lower rate – provided the serviceability support provided meets our lending criteria at the time.”

Loan trends

Calvert says the last two years have been extremely challenging for the self-employed sector, with repeated pandemic lockdowns affecting businesses and their ability to borrow. He says despite these challenging times, RedZed has remained committed to helping self-employed Australians realise their dreams.

“Non-bank lenders such as RedZed have played a critical role in the survival and growth of the approximately 2.3 million Australians that are self-employed.”

RedZed recently commissioned the RedZed Self-Employed Business Index, a first-of-its-kind study to take the pulse of this critical segment of the Australian economy. Calvert says one of the most significant findings was that only 16% of respondents believed it was easy to secure a loan from a bank.

A big reason for the self-employed borrower’s poor customer experience at banks is due to these lenders’ systems not being geared up to consider the individual circumstances of this type of customer.

Calvert says that unlike the typical PAYG customer who can provide their most recent monthly payslips, more often than not the self-employed business owner has a different financial model. “They require a more specialised lender with credit assessors that possess a more specific skill set to understand the customer’s business.”

Vala says the greatest demand in the last two years has been for Thinktank’s mid-doc product, especially from SMEs and self-employed borrowers looking to purchase, refinance and release equity.

“We see this trend only getting stronger, which is why we have revised our offering to the market to now include loans up to $4m per single security for commercial property security with LVRs of up to 80%,” he says.

“It’s not surprising that non-bank lenders are extremely active in this market with our ability to adapt and respond quickly to the needs of the broker and their clients.”

Pepper Money believes there will be an increase in customer demand as self-employed customers seek alternative solutions that support their goals and look at their current situation, says Saoud.

“The market is huge – low-doc lending plays a major part in Australia’s lending land-scape,” he says.

He adds that research shows that up to 40% of commercial lending is being fulfilled in the non-bank lending space, and a large portion of this is low-doc.

The impacts of COVID

Vala says the pandemic and lockdowns have intensified demand for alt-doc loans, with many businesses experiencing fluctuations in earnings.

“Rather than preparing a detailed cash flow forecast or a three-way financial analysis, the ease of a self-certification and one form of income verification is a major attraction for brokers and their clients,” says Vala.

At Pepper Money, Saoud says, “we’ve been seeing an increase in alt-doc loans in the past 12 months. Plenty of businesses were impacted by COVID-19, affecting their revenue for the year.

“With Pepper Money’s ability to consider alternative sources of income verification, such as the last six months’ business bank statements or BAS, we can gain a solid under-standing of the customer’s income and loan affordability as it stands today.”

Calvert says that despite COVID, RedZed’s business index survey showed that 72% of business owners remained confident about their future, and 87% drew satisfaction from their businesses.

Benefits of alt-doc loans

Saoud (pictured immediately below) says that at Pepper Money “we believe small business owners and sole traders are greatly underserved, and providing these types of borrowers with an alternative option is incredibly rewarding”.

Helping self-employed clients presents a significant opportunity for a broker to evolve and develop their business to offer more than just mortgage lending. By fully understanding clients’ goals and growth plans, Saoud says brokers can help them navigate the path to achieving this growth through commercial mortgages or asset finance.

“We believe upskilling brokers is a critical component of increasing awareness of these solutions for borrowers,” he says. “Our broker support team ensures we’re providing brokers with the in-depth knowledge they need.”

A key focus for Pepper Money is helping brokers identify when and why an alt-doc solution may be suitable and understand the reasoning behind the way it calculates serviceability.

Referral partners also play a huge role in this type of lending, says Saoud, with accountants, solicitors and financial planners some of the best referral sources for brokers.

Calvert agrees that understanding and utilising alt-doc lending can have many benefits for broker businesses. “It provides opportunities for customers that might have otherwise struggled to obtain funding and could also open the door to their accountants and there-fore potential future referral opportunities.”

He says it also gives brokers access to a segment that is underserviced yet more loyal. It offers them diversified income streams as these customers’ needs are greater than those of most PAYG borrowers.

“RedZed has specialised in self-employed and alt-doc lending since inception 15 years ago. Our BDMs are highly experienced and operate portfolios sizes that allow them to be very hands-on with their brokers.”

Vala says the greatest value of alt-docs is their ability to reduce the time and complexity involved in arranging finance.

“Thinktank is a strong and long-standing advocate for diversification and broker education, and our dedicated relationship managers are always available to make the alt-doc process for commercial or residential loans as seamless as possible.”

Rising inflation, interest rates

Calvert says RedZed is seeing signs of some borrowers becoming more cautious with their lending requirements following interest rate rises. “Many borrowers and even brokers would not have been in the market when we were last in a rising rate environment; however, the fundamentals of responsible lending do not change.”

He says brokers and lenders still need to assess borrowers’ capacity to service proposed loans without hardship and ensure appropriate buffers are in place.

“This is a time for calm heads and following prudent lending practices. RedZed remains committed to supporting the self-employed sector during this time of uncertainty by providing common-sense loan solutions that are practical and responsible.”

Saoud says alt-doc loans can potentially assist customers’ future borrowing as the equity growth in their home can then be used to build a property portfolio, or the client can use that equity to purchase a commercial property for their business.

“In order to ensure that self-employed homebuyers are not locked out of the market, brokers have an opportunity to reassure these customers that there are still options for them,” he says.

“Growth in the alt-doc lending space is really dependent on broker education and understanding of how lenders like us can help their self-employed customers that are looking for alternatives and looking for loans.”

Alt-doc products come at a slight premium in interest rate compared to full-doc and are not immune to rate increases, says Vala. But Thinktank offers the option to convert to a lower-rate full-doc loan when the time is right.

Vala says a borrower’s financial position needs to be carefully considered, which may include options Thinktank can offer to improve cash flow and profitability, which are separate to setting various buffers in place in the event that rate rises continue.

“We are always here to help brokers find the right solution for their client and encourage brokers to reach out to their aggregator partners to arrange a Thinktank education session or contact their relationship manager direct.”