New regulations requiring breach reporting have been released, which brokers will need to comply with. The industry was also the focus of a recent watchdog report on money laundering

New regulations affecting mortgage brokers will help build customer trust and should be a positive for the industry in the lead-up to the remuneration review in 2022, industry experts believe.

Brokers are now expected to report “reportable situations” as part of new breach reporting regulations that came in on 1 October. The reforms are a result of the Hayne banking royal commission, which raised concerns about the industry’s failure to report dishonest, deliberate, deceptive and negligent behaviour.

In a statement, ASIC deputy chair Karen Chester said the new obligations would address concerns about the timeliness of breach reporting. Analysis in 2018 revealed it took more than four years on average for large financial institutions to identify incidents that proved to be significant breaches.

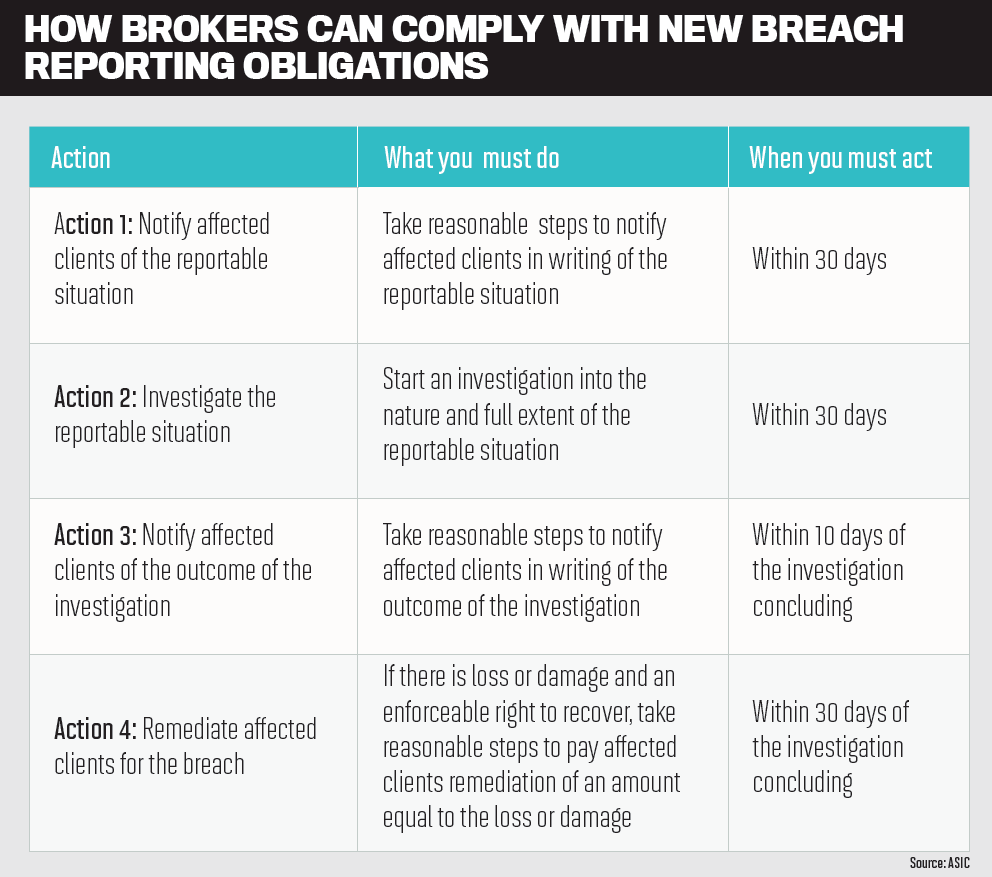

Australian financial services and credit licensees must report to ASIC significant or likely breaches of core obligations, as well as investigations that continue for more than 30 days into whether a significant breach of core obligations has occurred, and the outcomes of those investigations; gross negligence or serious fraud; and serious compliance concerns about individual financial advisers or mortgage brokers operating under another licence.

Aggregators have been preparing their brokers for the reform, which is complemented by the “notify, investigate and remediate” obligations that also came into effect on 1 October. Loan Market ran a webinar on all upcoming regulations at the start of September, making sure brokers were across the changes and understood how they would need to report any breaches. The group has a focus on “compliance by design”, and its MyCRM platform has the tools brokers need.

“As with the introduction of the best interests duty, breach reporting should build even more trust between brokers and customers as they’ll know – by law – that their broker is held to the highest standard,” said Loan Market’s chief regulation and compliance officer, David McQueen.

“Any legislation that creates transparency and increases guidance for aggregators and brokers is positive. However, while we whole-heartedly want to remove the minority that do the wrong thing, it will also be important that we protect brokers – the majority – who are doing the right thing.

“It needs to be recognised that reported breaches may not be the broker’s fault, and in these instances our role as an aggregator is to support a fair investigation that ensures that brokers are not unfairly penalised.”

Broker fraud was also called out recently in financial crime watchdog AUSTRAC’s report on the risks of money laundering and terrorism financing. The big four and other domestic banks were given a ‘high’ risk rating.

AUSTRAC’s report found that loan application fraud was the banks’ second most commonly reported fraud, usually involving fraudulent identity documents and forged or altered payslips.

When ranking the risk exposures of various banking products, AUSTRAC assigned home loans a high vulnerability perception rating. The watchdog’s assessment said there was a high known or suspected criminal misuse of home loans.

The report cited cases in which fraud had been enabled by mortgage brokers. One example involved a large-scale loan application fraud operation that had been enabled by several mortgage brokers. It “involved high-level document forgery and was believed to be orchestrated by a serious and organised crime group”, the report said.

In another example, a number of brokers were helping known criminals secure home loans, knowing the loans were to be repaid with illicit funds.

MFAA CEO Mike Felton said that while fraud was an issue affecting every industry, the high-value settlements in the broking sector made it a prime target for cyber-criminal activity. He said it was important that the industry embraced the initiatives addressing misconduct and fraud.

“Some fraud, as has historically been the case, will inevitably be related to broker misconduct, and it is obviously in everyone’s interests that we do everything we can to expose and manage misconduct within our industry,” said Felton.

Also coming into play on 1 October is ASIC’s reference checking protocol, which requires mortgage brokers to be subjected to a comprehensive reference check when moving to a new licensee or industry. While the MFAA believes the legislation on this still needs strengthening, it is hoped that it will replace the letters of separation process.

“Once these reforms have been implemented, our industry will have aligned interests and expectations through an unrivalled best interests duty, mitigated and managed conflicts through remuneration reforms, and improved information sharing and reporting of misconduct. I believe this leaves us well placed to proudly and confidently lean into the impending 2022 review,” said Felton, referring to the review of broker remuneration set for next year.