Rate changes noticeably slowed in the past week

The mortgage industry saw several variable rate changes over the past week, marked particularly by National Australia Bank’s significant rate reduction.

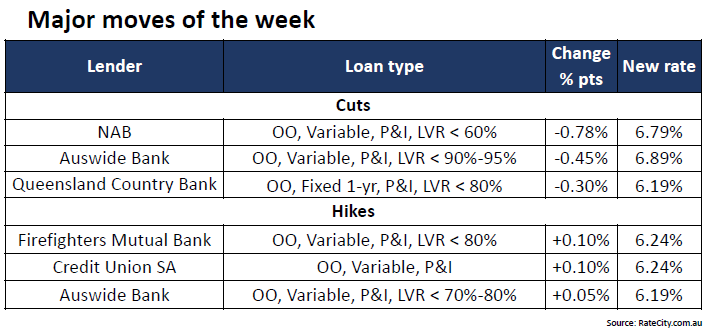

The major bank, according to the latest RateCity interest rates weekly wrap-up, slashed its variable rates for owner-occupier home loans with a loan-to-value ratio (LVR) under 60%, reducing it by 0.78 percentage points down to 6.79%.

However, Sally Tindall (pictured), research director at RateCity.com.au, pointed out that NAB’s reduced rates simply represent more accurately the actual rates that customers receive.

“This change was not so much a decision by the bank to offer big discounts to potential new customers taking out its package loan, but rather a strategic decision to better align its advertised rates with the rates that customers end up getting,” Tindall said.

“For years, banks – the big banks, in particular – have employed a strategy whereby they advertise unrealistically high prices on their package home loans which then allows them to offer customers sizeable individualised ‘discounts’ from this rate. NAB’s move follows a similar decision by CBA to drop its package home loan rate prices in November 2022, leaving both Westpac and ANZ with inflated high prices.”

Other lenders also adjusted their rates, though Tindall noted a significant slowdown in rate changes among the more than 115 lenders listed on the RateCity.com.au database.

Auswide Bank lowered its rates for owner-occupier, variable, and principal and interest loans with LVRs between 90% and 95% by 0.45 percentage points, bringing the rate down to 6.89%. Similarly, Queensland Country Bank cut its one-year fixed rate for owner-occupiers with an LVR under 80% by 0.30 percentage points to 6.19%.

RateCity reported rate increases as well, with Firefighters Mutual Bank and Credit Union SA raising their rates on owner-occupier variable loans for principal and interest by 0.10 percentage points to 6.24%. Auswide Bank also increased its rate slightly by 0.05 percentage points for owner-occupier variable loans with LVRs between 70% and 80%, setting its new rate at 6.19%.

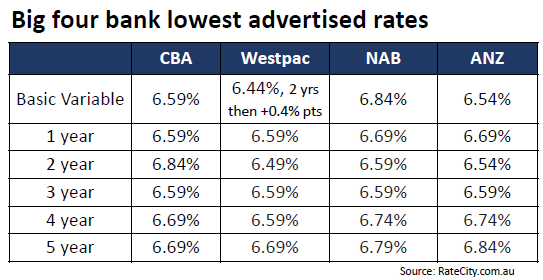

Among the lenders with the lowest advertised variable rates, Abal Bank continues to lead with a rate of 5.75%, followed by G&C Mutual Bank at 5.80% and a group including Police Bank, Bank of Heritage Isle, and Border Bank at 5.84%.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.