A huge shift in wealth and demographics means older women are becoming the clients brokers can’t afford to miss

Gender is coming back into Australian financial services in a big way.

Brokers and lenders will be accustomed to categorising their clients by certain attributes: wealth, location, age and risk appetite. But now gender is re-emerging as a factor in business decisions with the identification of a new ideal client type: the mature female consumer.

Of course, the mature female consumer has always been there; what’s changed is in the last few months

There are two diffrent types of referrals, according to Sharryn Huggett, an experienced commercial broker operating in Canberra. She works with professional women, often executives, and find they come to her through either professional or social referrals. “Business people tend to

refer other business people, because they’re in the same industry. If you’ve got someone working in the government, they’ll be talking to people they associate with on weekends.” Business leads “tend to be a little more experienced” in finance, are aware of their own financial power and want strategic advice.

refer other business people, because they’re in the same industry. If you’ve got someone working in the government, they’ll be talking to people they associate with on weekends.” Business leads “tend to be a little more experienced” in finance, are aware of their own financial power and want strategic advice.

Whilst not strictly referrals, women often exert a large amount of influence within couples who choose to use a broker. Long finds that in owner-occupied scenarios, “typically it’s the woman driving the appointments, driving the purchase prices …women have a wider range of what they’re looking at and probably do a bit more research, and as such, value the model of a broker more than a man does in that couple scenario”.

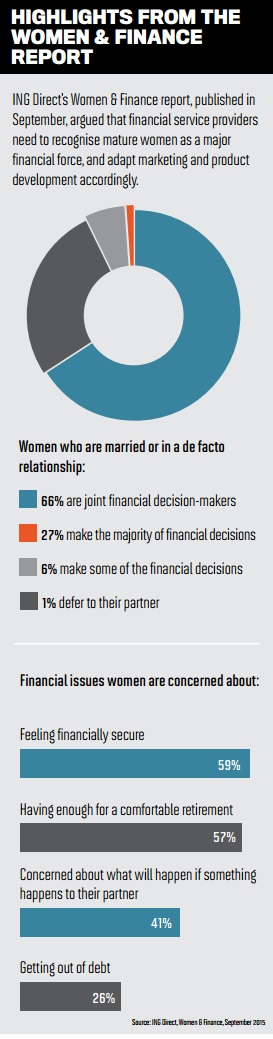

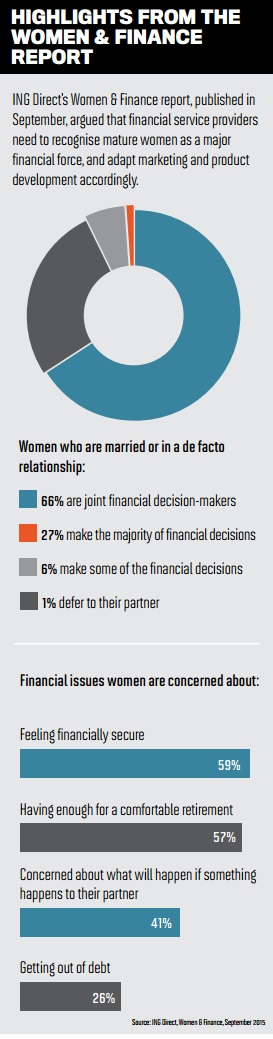

Add to that some of the statistics in ING their male counterparts. The report claims that women don’t necessarily value getting the highest return on investment: “They prioritise safety, capital protection and predictability of returns over the possibility of earning a higher return.” It also suggested women tend to take more time, ask more questions and are less inclined to make decisions on the spot.

In Glenwood, Long typically sees female clients with deposits two to three times bigger than those of their male counterparts – sometimes unusually high given their salaries. “The women are certainly more conservative,” she says. “They want to look at the numbers; their risk appetite isn’t as high as with the men.”

Whilst these women going into property investment were strategy-driven, they were typically looking to try first with one property, unlike men, who “are very goal-oriented – five properties, 10 properties; they can almost always give me a number.” However, with couples, she notes, the tables are turned, and women often drive the home-buying process.

The experience of Canberra commercial broker Huggett illustrates the diversity within the mature female consumer category. “I’ve got accountants, solicitors, developers, restaurateurs, right through to a female cattle rancher,” she says. “These women tend to be quite powerful and focused.” Her clients aren’t financially conservative. Quite the opposite – being used to putting assets and income on the line, they were very confident in the strategies they were taking, whether building a property portfolio or expanding their businesses.

Such high-net-worth women don’t operate independently, Huggett says. “They look to their accountants, solicitors and advisors; they tend to take on board as much information as they can to assist in their business. They tend to have more of an eyes-wide-open look at investing in their portfolio.” It’s hugely important to work as part of this team of professionals, she adds, in a long-term partnership with the client rather than a transactional relationship. “You’re working together as a team, step-by-step as they grow, and understanding their business is a very important factor.”

Given the huge diffrences between female property investment clients, it pays to be cautious with generalisations, MFAA CEO Hayden says. In some cases, adapting the look and feel of a product can be useful in order to relay a message that resonates with a gender, she notes, but “women from 35 to 55 relate very differently to women below 35 or above 55, as do men. It’s not about ‘let’s make it a pink colour and simplify the language’. Let’s segment the market to the targets we’re after.”

Room for improvementWhen it comes to addressing the mature female consumer, lenders are certainly jumping on the bandwagon, but there’s no reason brokers shouldn’t do the

same. Evidently specific research is thin on the ground; ING Direct’s report was useful but addressed the full spectrum of financial services, not just mortgages. For brokerages to radically change their hiring, marketing and processing more research would encourage them to take that step.

same. Evidently specific research is thin on the ground; ING Direct’s report was useful but addressed the full spectrum of financial services, not just mortgages. For brokerages to radically change their hiring, marketing and processing more research would encourage them to take that step.

This certainly isn’t a trend that brokers can ignore, as everyone interviewed for this piece agreed. “The female consumer in 2015 is driving huge changes in the property market,” says ALIC managing director Back. “Women are looking for choice in how and who they receive their advice from.”

Long sees the changes as the culmination of long-term trends: “As the generations come through, women as a whole are becoming more money-savvy, savings-savvy and investment-savvy.” That doesn’t mean differences in risk appetite will disappear overnight, so the traditional model of broking – whilst attractive to women seeking advice – won’t provide the best methods for presenting options like property investment.

The new wave of savvy female clients won’t be the same as their male counterparts, which is why there are opportunities for brokers who make the leap first, as Huggett concludes. “I can see more and more business in executive women seeking finance, and seeking finance in their own right. Women should be seeking to be leaders in their own destiny, and it’ll be important that they can direct their own financial future.”

Brokers and lenders will be accustomed to categorising their clients by certain attributes: wealth, location, age and risk appetite. But now gender is re-emerging as a factor in business decisions with the identification of a new ideal client type: the mature female consumer.

Of course, the mature female consumer has always been there; what’s changed is in the last few months

is that lenders have started to notice. A new report from ING Direct claimed that “women will be the main benefitiaries of a massive intergenerational transfer of wealth” and criticised the development and marketing of financial products “through a predominantly male lens”. Other banks and mortgage franchises have also got in on the act; ANZ have a dedicated advice service for women, while Choice Home Loans partnered with the Mamamia Women’s network to host an event for women who wanted to learn more about finance.

Lenders are finally waking up to the possibility of women as sole financial decisionmakers, but are brokers also

Lenders are finally waking up to the possibility of women as sole financial decisionmakers, but are brokers also

guilty of overlooking women? Thirty-three per cent of women now own their own home, and 40% of women surveyed by ING said they’d be the primary decision-maker in any property purchase today. Furthermore, women are increasingly choosing to live alone; 1.1 million women over 60 will be living alone by 2031, according to the Australian Bureau of Statistics.

But it’s not even as simple as comparing your client base to these statistics, or even aiming for a 50/50 split. As MPA has found, there are many reasons women are more likely to use a broker’s services – and recommend that broker to others.

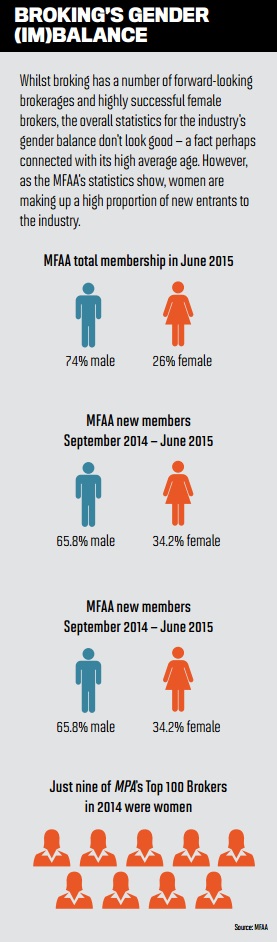

Female consumers and female brokers For some brokerages, an increase female consumers is a reason to hire more female brokers. Jason Back, managing director of The Australian Lending and Investment Centre, MPA’s number-one independent brokerage, revealed why ALIC are hiring with consumers in mind: “We believe that our industry suffers from both the issue of an ageing workforce as well as poor ratio of women in finance. With over 54% of our population being female, why would we not look to engage with the majority demographic through the talented and empowered women in our business and look to grow that model into the future?”

This opinion was not shared by all the brokers MPA talked to. Bianca Long,principal of Mortgage Choice Glenwood, said that women approaching her because of her gender is a rarity. “The reality is, overall, men and women don’t care what your gender is, and they’re not overly concerned about your age. They just want someone who’s good, who knows what they’re doing, and someone they can trust.”

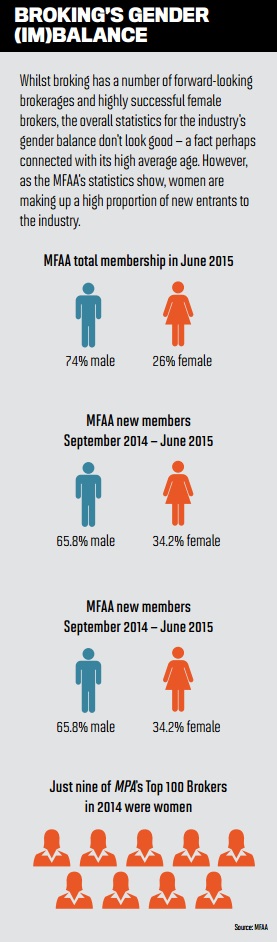

We also talked to Brendan Wright of aggregator FAST, who have run their Women in Business seminars since 2013. The industry does have a problem, he believes: “Whilst progress is being made, we are in an industry where the ratio of males to females is tilted fairly significantly towards males.” Building rapport is important, he argued, but “the benefit to our industry in having a good representation and balance in gender, ethnicity, experience and thinking, is that we can cater to a broader range of consumer and business owner preferences. This will enable sustainable growth for many years to come.”

MFAA CEO Siobhan Hayden took a similar view. “In certain situations, men build stronger relationships with men, and there are occasions where women are better at building relationships with women, but I’d never use that as a general yardstick.” She believes the MFAA’s role should be identifying the barriers keeping the broking profession from better reflecting the composition of Australia’s consumers.

Switch on the referral machine

Brokerages where hiring isn’t an option, or isn’t necessary, should take notice of the ING Direct report’s conclusions on the marketing and presentation of financial products. Lisa Claes, executive director of customer delivery at ING Direct and the architect of the Women & Finance report, picked out communication as “the greatest opportunity for the industry”, and argued financial providers should address “female nuances seeking greater access to information, simple and straightforward communication, and clear advice.”All of these characteristics also happen to be highlights of the traditional broker proposition. However, brokers may still need to adapt their processes, beginning by recognising the importance of referrals forfemale consumers. ING’s report quoted Kathleen Burns Kingsbury, who suggested brokers are ‘referral machines’ who “enjoy giving feedback and making recommendations on social networks”.

MFAA chief Hayden agrees with this view. “We inherently do ask our peers and share our experiences more often than our male counterparts.” Mortgage Choice’s Bianca Long also agrees ‘wholeheartedly’: “Women are typically more inclined to discuss their personal business with their friends than men.” With 54% of new business at her brokerage driven by referrals, she finds certain women provide multiple, regular referrals,

hilst referrals from men are more scattered.

But it’s not even as simple as comparing your client base to these statistics, or even aiming for a 50/50 split. As MPA has found, there are many reasons women are more likely to use a broker’s services – and recommend that broker to others.

Female consumers and female brokers For some brokerages, an increase female consumers is a reason to hire more female brokers. Jason Back, managing director of The Australian Lending and Investment Centre, MPA’s number-one independent brokerage, revealed why ALIC are hiring with consumers in mind: “We believe that our industry suffers from both the issue of an ageing workforce as well as poor ratio of women in finance. With over 54% of our population being female, why would we not look to engage with the majority demographic through the talented and empowered women in our business and look to grow that model into the future?”

This opinion was not shared by all the brokers MPA talked to. Bianca Long,principal of Mortgage Choice Glenwood, said that women approaching her because of her gender is a rarity. “The reality is, overall, men and women don’t care what your gender is, and they’re not overly concerned about your age. They just want someone who’s good, who knows what they’re doing, and someone they can trust.”

We also talked to Brendan Wright of aggregator FAST, who have run their Women in Business seminars since 2013. The industry does have a problem, he believes: “Whilst progress is being made, we are in an industry where the ratio of males to females is tilted fairly significantly towards males.” Building rapport is important, he argued, but “the benefit to our industry in having a good representation and balance in gender, ethnicity, experience and thinking, is that we can cater to a broader range of consumer and business owner preferences. This will enable sustainable growth for many years to come.”

MFAA CEO Siobhan Hayden took a similar view. “In certain situations, men build stronger relationships with men, and there are occasions where women are better at building relationships with women, but I’d never use that as a general yardstick.” She believes the MFAA’s role should be identifying the barriers keeping the broking profession from better reflecting the composition of Australia’s consumers.

Switch on the referral machine

Brokerages where hiring isn’t an option, or isn’t necessary, should take notice of the ING Direct report’s conclusions on the marketing and presentation of financial products. Lisa Claes, executive director of customer delivery at ING Direct and the architect of the Women & Finance report, picked out communication as “the greatest opportunity for the industry”, and argued financial providers should address “female nuances seeking greater access to information, simple and straightforward communication, and clear advice.”All of these characteristics also happen to be highlights of the traditional broker proposition. However, brokers may still need to adapt their processes, beginning by recognising the importance of referrals forfemale consumers. ING’s report quoted Kathleen Burns Kingsbury, who suggested brokers are ‘referral machines’ who “enjoy giving feedback and making recommendations on social networks”.

MFAA chief Hayden agrees with this view. “We inherently do ask our peers and share our experiences more often than our male counterparts.” Mortgage Choice’s Bianca Long also agrees ‘wholeheartedly’: “Women are typically more inclined to discuss their personal business with their friends than men.” With 54% of new business at her brokerage driven by referrals, she finds certain women provide multiple, regular referrals,

hilst referrals from men are more scattered.

There are two diffrent types of referrals, according to Sharryn Huggett, an experienced commercial broker operating in Canberra. She works with professional women, often executives, and find they come to her through either professional or social referrals. “Business people tend to

refer other business people, because they’re in the same industry. If you’ve got someone working in the government, they’ll be talking to people they associate with on weekends.” Business leads “tend to be a little more experienced” in finance, are aware of their own financial power and want strategic advice.

refer other business people, because they’re in the same industry. If you’ve got someone working in the government, they’ll be talking to people they associate with on weekends.” Business leads “tend to be a little more experienced” in finance, are aware of their own financial power and want strategic advice.

Whilst not strictly referrals, women often exert a large amount of influence within couples who choose to use a broker. Long finds that in owner-occupied scenarios, “typically it’s the woman driving the appointments, driving the purchase prices …women have a wider range of what they’re looking at and probably do a bit more research, and as such, value the model of a broker more than a man does in that couple scenario”.

Add to that some of the statistics in ING their male counterparts. The report claims that women don’t necessarily value getting the highest return on investment: “They prioritise safety, capital protection and predictability of returns over the possibility of earning a higher return.” It also suggested women tend to take more time, ask more questions and are less inclined to make decisions on the spot.

In Glenwood, Long typically sees female clients with deposits two to three times bigger than those of their male counterparts – sometimes unusually high given their salaries. “The women are certainly more conservative,” she says. “They want to look at the numbers; their risk appetite isn’t as high as with the men.”

Whilst these women going into property investment were strategy-driven, they were typically looking to try first with one property, unlike men, who “are very goal-oriented – five properties, 10 properties; they can almost always give me a number.” However, with couples, she notes, the tables are turned, and women often drive the home-buying process.

The experience of Canberra commercial broker Huggett illustrates the diversity within the mature female consumer category. “I’ve got accountants, solicitors, developers, restaurateurs, right through to a female cattle rancher,” she says. “These women tend to be quite powerful and focused.” Her clients aren’t financially conservative. Quite the opposite – being used to putting assets and income on the line, they were very confident in the strategies they were taking, whether building a property portfolio or expanding their businesses.

Such high-net-worth women don’t operate independently, Huggett says. “They look to their accountants, solicitors and advisors; they tend to take on board as much information as they can to assist in their business. They tend to have more of an eyes-wide-open look at investing in their portfolio.” It’s hugely important to work as part of this team of professionals, she adds, in a long-term partnership with the client rather than a transactional relationship. “You’re working together as a team, step-by-step as they grow, and understanding their business is a very important factor.”

Given the huge diffrences between female property investment clients, it pays to be cautious with generalisations, MFAA CEO Hayden says. In some cases, adapting the look and feel of a product can be useful in order to relay a message that resonates with a gender, she notes, but “women from 35 to 55 relate very differently to women below 35 or above 55, as do men. It’s not about ‘let’s make it a pink colour and simplify the language’. Let’s segment the market to the targets we’re after.”

Room for improvementWhen it comes to addressing the mature female consumer, lenders are certainly jumping on the bandwagon, but there’s no reason brokers shouldn’t do the

same. Evidently specific research is thin on the ground; ING Direct’s report was useful but addressed the full spectrum of financial services, not just mortgages. For brokerages to radically change their hiring, marketing and processing more research would encourage them to take that step.

same. Evidently specific research is thin on the ground; ING Direct’s report was useful but addressed the full spectrum of financial services, not just mortgages. For brokerages to radically change their hiring, marketing and processing more research would encourage them to take that step.

This certainly isn’t a trend that brokers can ignore, as everyone interviewed for this piece agreed. “The female consumer in 2015 is driving huge changes in the property market,” says ALIC managing director Back. “Women are looking for choice in how and who they receive their advice from.”

Long sees the changes as the culmination of long-term trends: “As the generations come through, women as a whole are becoming more money-savvy, savings-savvy and investment-savvy.” That doesn’t mean differences in risk appetite will disappear overnight, so the traditional model of broking – whilst attractive to women seeking advice – won’t provide the best methods for presenting options like property investment.

The new wave of savvy female clients won’t be the same as their male counterparts, which is why there are opportunities for brokers who make the leap first, as Huggett concludes. “I can see more and more business in executive women seeking finance, and seeking finance in their own right. Women should be seeking to be leaders in their own destiny, and it’ll be important that they can direct their own financial future.”