Housing might not have been on the agenda of the federal budget, but it could still significantly impact the market. MPA editor Sam Richardson argues that brokers should take a second look

Housing might not have been on the agenda of the federal budget, but it could still significantly impact the market. MPA editor Sam Richardson argues that brokers should take a second look

HOW EXACTLY is the federal budget like entertainment? If anything, it’s a dramatic farce – a succession of plainly intentional ‘leaks’, reporters being locked indoors for an entire day and the questionable suggestion that watching the budget on TV is a genuine evening leisure activity. Labelling the budget boring is permissible for media commentators, but for financial professionals, it’s a cop-out.

Certainly, the budget is subdued compared to last year’s, and admittedly, the 2015 budget is not particularly housing-centric. Indeed, there is only one provision that directly relates to property: the introduction of fees for foreign buyers. The budget’s ‘headlines’, such as the support for small businesses, childhood care subsidies and the ‘Netflix tax’, won’t have much in the way for direct consequences for mortgage brokers.

You’ve got to delve deeper, and take a wider view of the context of this budget, to see why brokers really should pay attention to it. We’re seeing a change in the government’s austerity rhetoric at the very time that APRA are tightening lenders’ criteria; ramifications for commercial and investment specialist brokers; and finally, the prospect of ‘downsizers’ creating major shifts in the housing and reverse mortgages market. Clearly, it’s time to think of the budget less as primetime entertainment and more as essential reading.

Confidence

With a tagline of ‘jobs, growth and opportunity’, this was quickly dubbed a confidence budget, in stark contrast to last year’s ‘budget emergency’. That reaction was deliberate, explains ING Direct’s head of treasury Michael Witts.

“Last year it was, ‘We’re going to hell in a handbasket ... this time round, Hockey was saying – before the budget and on the back of the RBA rate cut – ‘Now’s the time to spend’ … it was almost inciting people to

recklessly borrow money. So the rhetoric around the government has completely changed.”

At the time of writing, early indicators did suggest confidence had increased amongst the Australian public. The ANZ/Roy Morgan Consumer Confidence Index increased from 111 to 115 in the week of the budget, the highest level since November 2014. Whilst sentiment is now above its long-term trend, and retail spending has improved, surging confidence is not guaranteed, warns ANZ chief economist Warren Hogan: “The fragility of confidence over the last 18 months or so suggests that a continuing improvement cannot be taken for granted, even in the presence of rising asset markets and low interest rates.”

What initial confidence surveys can’t tell us is the difference between relief at the budget and the sort of genuine confidence that prompts increased spending and investment. The ABC’s post-budget polling found that although the majority of people saw this year’s budget as better than last year’s, they’re still heavily divided on whether the economy is heading into right direction (40% no to 35% yes).

Rhetoric still matters in persuading Australian households to start spending again, ING’s Witts argues. “Australian consumers are so pessimistic, you’d swear they’re in Greece,” he says. “We’ve got record-low interest rates, those who own or our buying houses have seen their wealth go up considerably, and 6% unemployment means 94% employment. We’re in a very good position, but that message hasn’t been getting through to people.”

The only danger, he notes, is that debates over the budget in the Senate could distract public attention from the budget’s positive message.

The issue of foreign buyers and application fees was discussed extensively before the budget, and indeed is covered in detail by our News Analysis piece in MPA 15.05. The plan is for the Australian Tax Office to draw up a comprehensive register of foreign ownership of land and real estate, although it won’t cover all land until July 2016.

A system of fees also will be introduced, starting at $5,000 for properties valued at under $1m, then $10,000 for properties valued at $1–2m, rising from there in increments of $10,000 per additional $1m. These are relatively small sums – commenting on these numbers prior to the budget, leading broker Justin Doobov of Intelligent Finance noted that “it looks like they’re just trying to recoup the administration costs”, whilst 2014 No. 1 Top 100 broker Raymond Xue of ACA Mortgage Solutions believed the fees would only put foreign investors off if multiplied by 10.

The $5,000 fee is the result of a number of calculations, chief amongst them the desire of the government to show to the public it is controlling foreign investment, whilst in practice encouraging as much of it as possible. Most of the foreign investor specialist brokers we spoke to believed they had succeeded in that; Donald Tang of Alliance Mortgage Solutions argued that “the regulation reforms are actually helping brokers to have fair competition and a better working environment … by stopping the black sheep [who] continue ruining the market and spreading negative messages”.

Downsizers

DownsizersIt’s some of the apparently unrelated provisions in the budget that could have the biggest impact on the housing market. You may have overlooked changes to the age pension wealth threshold; the maximum assets you can own whilst still being eligible for a state pension are down to $823,000 for couples. The ABC estimates that 91,000 people will lose their pensions and another 235,000 will have their pensions reduced.

Can you see the link with housing yet? Martin North of Digital Finance Analytics can; he claims this change could cause a flood of ‘downsizers’ – older people trading the family home for a small property and potentially an investment property on top. This will cause major turbulence in the market, he argues.

“There’s significant weight in these downtraders’ sector – there’s 1.2 million downtraders at the moment who are thinking of doing something in a little while. It may bring forward some of that activity, just at the time when up-traders, those who are those looking to buy a bigger property, are actually reducing in number.”

Whilst the family home is excluded from the $823,000 threshold, many retirees previously on the state pension will need to find a new source of income. Selling the family home and acquiring an investment property would provide that income, hence North’s argument. With many perceiving the housing market at its peak, the urge to sell has never been higher, pushing those who were just considering selling up into action. Of course, there are other ways to release equity from the house; a revival of the reverse mortgage market now looks much more likely.

Downsizing won’t be such a smooth transition, however – as North hinted, up-traders are facing considerable challenges. “The banks’ lending criteria are being tightened slightly, their income isn’t growing so fast, and they haven’t necessarily the ability to buy those big properties,” he says. “So there’s potentially disequilibrium between supply and demand in this sector of the market – more people trying to sell than people trying to buy – and that can have an impact on the market.”

North’s theory is exactly that – a theory. However, he claims that DFA’s weekly Household Survey of 26,000 households is starting to show a shift in attitudes, as more people consider downsizing since the budget. Combining that data with assumptions about tightening lending criteria, the DFA’s modelling forecasts the number of downtraders will increase by 12%. It also predicts the number of up-traders to fall by 16%.

Putting the budget in its place

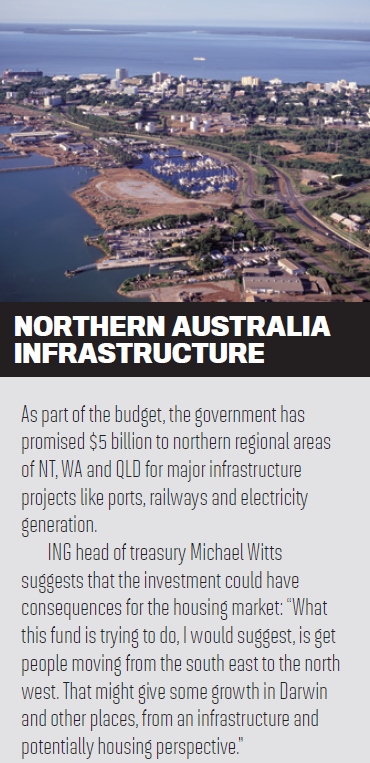

For the housing market, it’s not the budget but the timing of the budget that stops it being boring. A budget focused on raising confidence couldn’t exactly cool the housing market at the same time, and housing affordability issues weren’t tackled at all. These will be investigated by an inquiry about home ownership by the House of Representatives’ Economics Committee, reporting at the end of this year. That doesn’t mean regulators will reduce the pressure on lenders. In fact, if the budget does prompt an increase in confidence and thus spending, then regulators will be called upon even more to restrain investment in Sydney and Melbourne. Yet if the economy continues to slide, regulators will still have cause for concern as people increasingly turn to property investment for a decent return on their savings.

Finally, when it comes to interest rates, we may have reached the bottom of the trough. Peter Jolly, global head of research at NAB, argued that, following the budget, the RBA will be highly reluctant to cut interest rates again, and he expects them to sit at the 2% mark until 2016. By that point, Australians will be able to judge for themselves whether the budget really was so boring for the economy after all.