Liberty talks about the space others are pulling out of

Liberty talks about the space others are pulling out of

Macquarie’s announcement that it would cease SMSF lending from 30 April made it the last of the bigger banks to drop this product. But as the appetite for this investment type continues, the gap between supply and demand is growing.

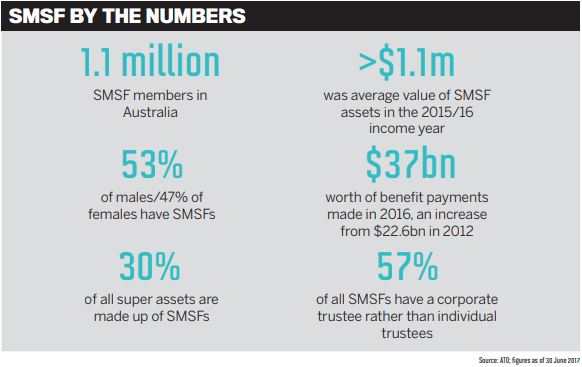

Brokers may have fewer options, but it is also an opportunity for growth and diversification. Added to this, the royal commission highlighted a number of shortcomings of the superannuation industry. With numerous high-profile funds apparently no longer delivering the requisite returns, there is considerable discussion about the best path forward. It’s no real surprise, then, that self-managed super funds are becoming an increasingly popular option.

Rather than delegating management of their superannuation funds, SMSF investors directly control the way their superannuation is managed. It’s a program designed to encourage Australians to actively invest in their future, and by doing so increase the funds they have available during retirement. Recent ATO data indicates that 53% of existing SMSFs have been established for more than 10 years.

However, their numbers have steadily grown; from 2012 to 2017, growth in the number of SMSFs averaged almost 5% annually. Total contributions to SMSFs also increased by 21% in the five years to 2016. But where are the funds being invested? According to John Mohnacheff, national sales manager at Liberty, an increasing number of Australians are looking at using their SMSFs to invest in property.

“People wanted to be able to engage with savings beyond the traditional, passive way,” says Mohnacheff.

It’s a phenomenon born out of an increased desire for control over the future, as well as to look for reliable investment options. “Most Australians have a rough idea where their super is invested,” says Mohnacheff. “But very few could give you a detailed breakdown of dollar amounts, how diverse it is or how well those markets are faring. For an increasing number of Australians, leaving it up to chance just isn’t good enough any more.”

Perhaps the most significant advantage, says Mohnacheff, is that utilising an SMSF allows for a wider distribution – and more rapid redistribution – of assets.

“Probably the biggest advantage is the ability to diversify the superannuation portfolio,” he says. “Property is a natural fit for that process, provided the investor has done their homework properly and demonstrated that they will be able to repay the loan of course.”

A changing market

Mohnacheff suggests that brokers should welcome the opportunities borrowing through an SMSF presents. “Brokers shouldn’t be scared of the prospect of lending to people who want to borrow via an SMSF,” he says.

“If the client has spoken to their advisers and done their due diligence, the process is exactly like any other home or commercial loan. It’s just in a different vehicle.”

However, Mohnacheff is quick to point out that brokers should not involve themselves in the advisory process. “The home loan broker should never, ever offer any advice or become involved in that process,” he says.

“All the broker should be doing is facilitating the loan process as normal.”

“If the client has spoken to their advisers and done their due diligence, the [SMSF] process is exactly like any other home or commercial loan” John Mohnacheff, national sales manager, at Liberty

Mohnacheff notes that Liberty does not provide advice around investments either. Rather, they will approve or refuse a loan on the basis of the application and supplementary information that a broker provides.

But while neither the lender or broker provides direct advice around investment decisions, that doesn’t mean they don’t have a responsibility to the borrower.

Securing approval

So what can brokers do to help their clients’ loans get approval? Mohnacheff says it’s down to a variety of factors.

“Brokers should seek to understand their customers’ financial objectives and circumstances and provide that information to their lender.” Brokers and clients need to be cautious when submitting a loan for consideration, says Mohnacheff.

All the relevant materials need to be provided, to give a holistic overview of both the client’s financial circumstances and the property they’re looking at purchasing. “We remain committed to responsible SMSF lending.

That means we are very discerning about which properties we’ll lend against,” says Mohnacheff. “However, property is cyclic, and if the client’s chosen property has a history of providing sound rental income, then it has promise in the long term.”

A question of commitment

Mohnacheff doesn’t think investing through an SMSF is ideal for everyone – it’s heavily dependent on the individual’s abilities and commitment to a long-term project.

“It’s not a hobby. If you’re a passive investor or you’re not sure what you’re doing, it’s best to leave it to the professionals,” he says. “And if you want to invest for fun, do it outside of your superannuation.”

Nonetheless, he remains confident that the number of investors looking to invest in property via their SMSFs will continue to grow. Brokers will need to be ready for the clients who come through their doors.

“There are plenty of sophisticated investors out there,” Mohnacheff says. “And they’re looking to plan their lives in retirement. We need to be able to help them do that.”