Take a look at the clients, processes, marketing and stats of our elite independent brokerages for 2015

When you start mistaking settlement totals for phone numbers, you know you’re dealing with some serious operators.

That was our immediate reaction at MPA on receiving applications for this year’s Top 10 Independent Brokerages – there were more applications than ever, of better quality than ever. We’re confident the brokerages that made it into our Top 10 are amongst the best in Australia.

Over the next few pages, you’ll read the secrets of some incredibly talented brokers, as ranked by a combination of performance metrics. However, this report is also about teams – we only accepted nominations from brokerages with a minimum of five brokers. In fact, some of the most interesting insights in this report concern topics like uniform processing, internal referrals and performance tracking. In our centre spread, you can read about these metrics and see stats about the entire Top 10 on issues like lead generation, back-office staff and reasons for going independent.

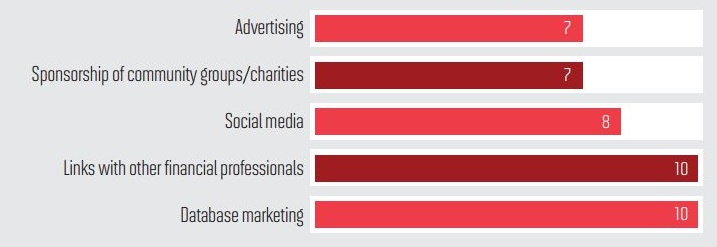

It’s not easy to go it alone. Not only do the big franchises wield enormous marketing budgets, but a number of aggregators and even lenders, such as Connective and Liberty Financial, are moving into franchise-come-retail aggregation models. However, these independent brokerages aren’t looking for TV airtime or walk-in clients; they want to be known to the right people. Whilst some brokerages target specific groups of clients, such as investors, all rely heavily on referrals and have cultivated long-standing links with other financial professionals to better service clients.

It’s not MPA’s place to give a verdict on the franchise versus independent debate; you can read these top brokers’ thoughts for yourself and see the merits of both models. However, we do believe this report shows that success as an independent brokerage is certainly possible, and demonstrates how freedom to innovate can pay of handsomely. Finally, we’d like to thank all those brokerages who took the time to apply this year, whether or not they appear in this list.

WHAT AN ELITE INDEPENDENT BROKERAGE LOOKS LIKE IN 2015

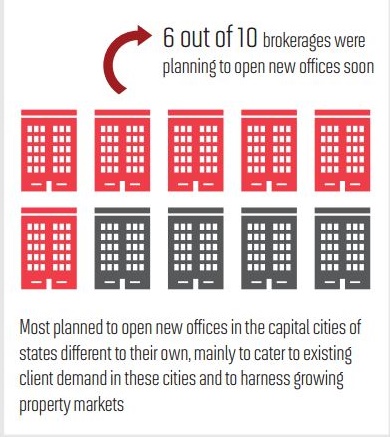

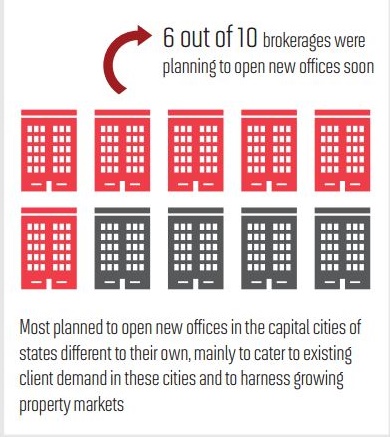

1. EXPANSION

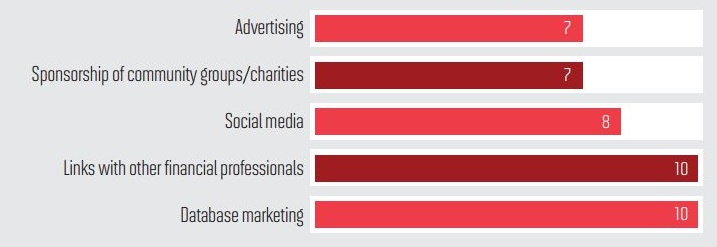

2. LEAD GENERATION STRATEGIES

3. CONSIDERING GOING INDEPENDENT?

“You have the ability to be agile and make decisions in real time; we run a very test-and-learn environment here, where we try lots of new ideas … being independent allows you to do that. [It] allows you to really spread your wings with the type of business you want to run and develop”

Jason Back

The Australian Lending

and Investment Centre

“I think it comes down to skill sets: If you’re a first-timer or new to the industry, you might sink if you go out on your own. It comes down to the support requirements of each broker. We’ve got a lot of experience, so I don’t think an affiation with an Aussie is required”

Daniel Green

Green Finance Group

“Independent brokers can be more robust, run the business how they choose, and they own the business at the end of the day – however big or small it is, it’s theirs. There are reasons for both models, and they’re both successful; it’s about what the brokers want"

Jeremy Fisher

1st Street Home Loans

4. HOW OUR TOP 10 INDEPENDENT BROKERAGES COMPARE TO MPA’S OTHER REPORTS

Top 10 Independent Brokerages vs Top 10 Franchise Brokerages

On average, independents had a far bigger total loan book – $1.21b as opposed to $737m for the franchises

Their total settlements over the preceding 12 months were also bigger

– although the property market changed significantly between the publication of the two reports

On average, independent brokerages are bigger, with nine loan writers as opposed to five loan writers at franchise brokerages

Top 10 Independent Brokerages vs Top 100 Brokers

Six of the top 10 brokers from our Top 100 Brokers report work at the brokerages in this year’s Top 10 Independent Brokerages report

The average broker at the average independent brokerage in this year’s Top 10

– writing $58m worth of business – was not far of last year’s entry point for the Top 100 brokers ($62m)

5. METHODOLOGY

This year we opened up applications for the Top 10 Independent Brokerages to all brokerages with clearly independent branding and with more than fine staff in a single office. (Previously we asked aggregators to nominate high-performing brokerages.)

The insistence on limiting applications to five or more writers in a single office was so our report would highlight examples of excellent management and

team-building, rather than the brilliance individual brokers, although you’ll find a number of such brokers at these brokerages.

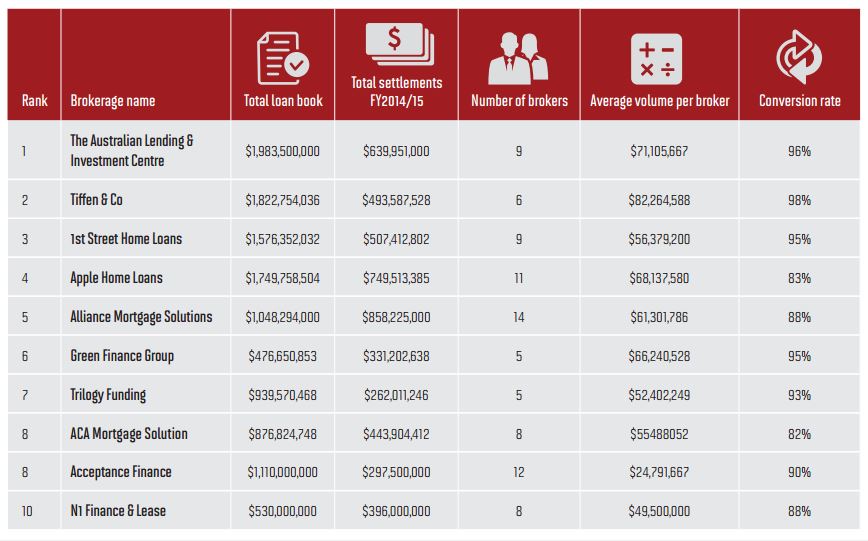

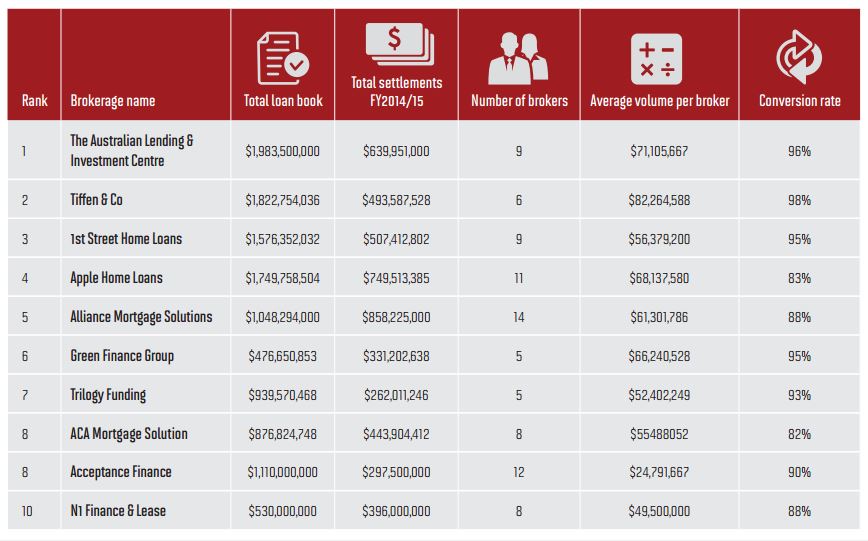

The ranking of brokerages resulted from a combination of metrics, including total loan book value, performance over the past financial year, average volume per broker/loan writer and conversion rate. Of these, we placed particular emphasis on the last financial year’s performance to favour brokerages that had continually improved their business and give newer brokerages a fair chance.

That was our immediate reaction at MPA on receiving applications for this year’s Top 10 Independent Brokerages – there were more applications than ever, of better quality than ever. We’re confident the brokerages that made it into our Top 10 are amongst the best in Australia.

Over the next few pages, you’ll read the secrets of some incredibly talented brokers, as ranked by a combination of performance metrics. However, this report is also about teams – we only accepted nominations from brokerages with a minimum of five brokers. In fact, some of the most interesting insights in this report concern topics like uniform processing, internal referrals and performance tracking. In our centre spread, you can read about these metrics and see stats about the entire Top 10 on issues like lead generation, back-office staff and reasons for going independent.

It’s not easy to go it alone. Not only do the big franchises wield enormous marketing budgets, but a number of aggregators and even lenders, such as Connective and Liberty Financial, are moving into franchise-come-retail aggregation models. However, these independent brokerages aren’t looking for TV airtime or walk-in clients; they want to be known to the right people. Whilst some brokerages target specific groups of clients, such as investors, all rely heavily on referrals and have cultivated long-standing links with other financial professionals to better service clients.

It’s not MPA’s place to give a verdict on the franchise versus independent debate; you can read these top brokers’ thoughts for yourself and see the merits of both models. However, we do believe this report shows that success as an independent brokerage is certainly possible, and demonstrates how freedom to innovate can pay of handsomely. Finally, we’d like to thank all those brokerages who took the time to apply this year, whether or not they appear in this list.

WHAT AN ELITE INDEPENDENT BROKERAGE LOOKS LIKE IN 2015

1. EXPANSION

2. LEAD GENERATION STRATEGIES

3. CONSIDERING GOING INDEPENDENT?

“You have the ability to be agile and make decisions in real time; we run a very test-and-learn environment here, where we try lots of new ideas … being independent allows you to do that. [It] allows you to really spread your wings with the type of business you want to run and develop”

Jason Back

The Australian Lending

and Investment Centre

“I think it comes down to skill sets: If you’re a first-timer or new to the industry, you might sink if you go out on your own. It comes down to the support requirements of each broker. We’ve got a lot of experience, so I don’t think an affiation with an Aussie is required”

Daniel Green

Green Finance Group

“Independent brokers can be more robust, run the business how they choose, and they own the business at the end of the day – however big or small it is, it’s theirs. There are reasons for both models, and they’re both successful; it’s about what the brokers want"

Jeremy Fisher

1st Street Home Loans

4. HOW OUR TOP 10 INDEPENDENT BROKERAGES COMPARE TO MPA’S OTHER REPORTS

Top 10 Independent Brokerages vs Top 10 Franchise Brokerages

On average, independents had a far bigger total loan book – $1.21b as opposed to $737m for the franchises

Their total settlements over the preceding 12 months were also bigger

– although the property market changed significantly between the publication of the two reports

On average, independent brokerages are bigger, with nine loan writers as opposed to five loan writers at franchise brokerages

Top 10 Independent Brokerages vs Top 100 Brokers

Six of the top 10 brokers from our Top 100 Brokers report work at the brokerages in this year’s Top 10 Independent Brokerages report

The average broker at the average independent brokerage in this year’s Top 10

– writing $58m worth of business – was not far of last year’s entry point for the Top 100 brokers ($62m)

5. METHODOLOGY

This year we opened up applications for the Top 10 Independent Brokerages to all brokerages with clearly independent branding and with more than fine staff in a single office. (Previously we asked aggregators to nominate high-performing brokerages.)

The insistence on limiting applications to five or more writers in a single office was so our report would highlight examples of excellent management and

team-building, rather than the brilliance individual brokers, although you’ll find a number of such brokers at these brokerages.

The ranking of brokerages resulted from a combination of metrics, including total loan book value, performance over the past financial year, average volume per broker/loan writer and conversion rate. Of these, we placed particular emphasis on the last financial year’s performance to favour brokerages that had continually improved their business and give newer brokerages a fair chance.