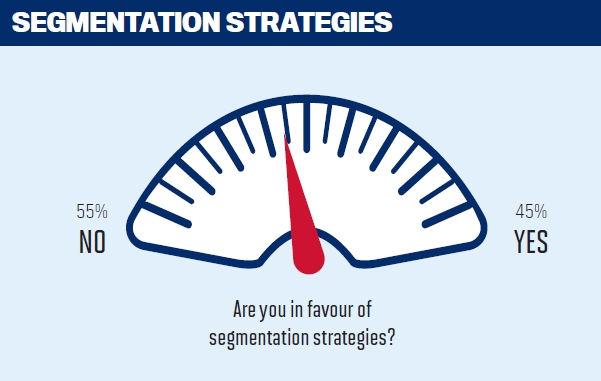

Our Brokers on Banks survey shows segmentation remains the most divisive issue, splitting the industry in half

Our Brokers on Banks survey shows segmentation remains the most divisive issue, splitting the industry in half

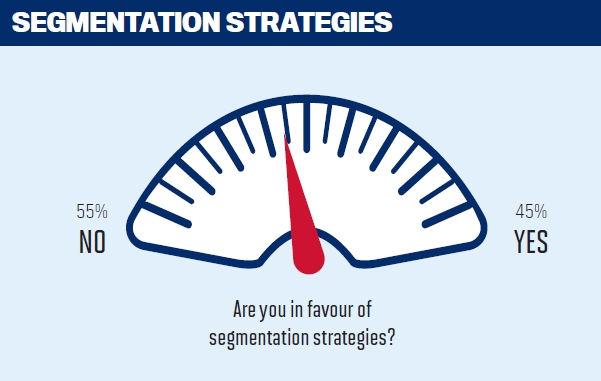

Few issues in the industry – even including commission and channel conflict – divides brokers as much as segmentation strategies, our recent Brokers on Banks survey suggests. Asked ‘Are you in favour of segmentation strategies?’, 45% replied yes, and 55% replies no.

Interestingly this statistic remains very similar to what it was in last year’s survey, where the same question was asked and 54% approved of segmentation strategies; the 9% shift isn’t particularly significant. And this steady divide remains despite year-on-year improvements in broker sentiment regarding areas like commission; 84% said it had improved in 2015, compared to 76% last year.

Some clues to broker opinions of both side of the segmentation divide can be found in the comments they made. “It segments the client, more than the broker”, wrote one respondent, a view reiterated by many; whatever the reputation of the broker, they felt their clients deserved equal service from banks. The brokers suggested segmentation could backfire; knowing their clients would receive worse service for those banks where the broker had second-tier status, they avoided putting deals through these banks.

Some clues to broker opinions of both side of the segmentation divide can be found in the comments they made. “It segments the client, more than the broker”, wrote one respondent, a view reiterated by many; whatever the reputation of the broker, they felt their clients deserved equal service from banks. The brokers suggested segmentation could backfire; knowing their clients would receive worse service for those banks where the broker had second-tier status, they avoided putting deals through these banks.

From the 45% in favour of segmentation various examples of excellent service were put forward. “Professionals like us benefit greatly from Top Segment provisions” noted one respondent “and in turn would increase business with that specific Lender accordingly in due course”, although the particular respondent believed segmentation should be done by the quality of a broker’s applications, not the quantity.

A big concern was voiced about the challenges posed to new brokers by segmentation. According to one respondent “It is the brokers coming up who need support and don't get it. They are after all the "rainmakers" of the future. As a relatively new person to the Industry I am turned off and prejudiced against lenders like Westpac that rub your nose in the fact that you are not premium.”

Some brokers called for a more subdued promotion of segmentation, which rewarded more productive brokers whilst not discouraging new entrants, with ANZ’s approach being singled out for praise. One respondent also came up with a novel solution to the problem, suggesting that “banks should be able to give "efficiency dividends' for accurate applications, but ONLY if they are prepared to pay "penalties" for screwing up.”

Few issues in the industry – even including commission and channel conflict – divides brokers as much as segmentation strategies, our recent Brokers on Banks survey suggests. Asked ‘Are you in favour of segmentation strategies?’, 45% replied yes, and 55% replies no.

Interestingly this statistic remains very similar to what it was in last year’s survey, where the same question was asked and 54% approved of segmentation strategies; the 9% shift isn’t particularly significant. And this steady divide remains despite year-on-year improvements in broker sentiment regarding areas like commission; 84% said it had improved in 2015, compared to 76% last year.

Some clues to broker opinions of both side of the segmentation divide can be found in the comments they made. “It segments the client, more than the broker”, wrote one respondent, a view reiterated by many; whatever the reputation of the broker, they felt their clients deserved equal service from banks. The brokers suggested segmentation could backfire; knowing their clients would receive worse service for those banks where the broker had second-tier status, they avoided putting deals through these banks.

Some clues to broker opinions of both side of the segmentation divide can be found in the comments they made. “It segments the client, more than the broker”, wrote one respondent, a view reiterated by many; whatever the reputation of the broker, they felt their clients deserved equal service from banks. The brokers suggested segmentation could backfire; knowing their clients would receive worse service for those banks where the broker had second-tier status, they avoided putting deals through these banks.From the 45% in favour of segmentation various examples of excellent service were put forward. “Professionals like us benefit greatly from Top Segment provisions” noted one respondent “and in turn would increase business with that specific Lender accordingly in due course”, although the particular respondent believed segmentation should be done by the quality of a broker’s applications, not the quantity.

A big concern was voiced about the challenges posed to new brokers by segmentation. According to one respondent “It is the brokers coming up who need support and don't get it. They are after all the "rainmakers" of the future. As a relatively new person to the Industry I am turned off and prejudiced against lenders like Westpac that rub your nose in the fact that you are not premium.”

Some brokers called for a more subdued promotion of segmentation, which rewarded more productive brokers whilst not discouraging new entrants, with ANZ’s approach being singled out for praise. One respondent also came up with a novel solution to the problem, suggesting that “banks should be able to give "efficiency dividends' for accurate applications, but ONLY if they are prepared to pay "penalties" for screwing up.”