With 2016 set to be a year of regulation and inquiries, ASIC and brokers are struggling to see eye-to-eye. Industry bodies, experts and ASIC say what’s gone wrong, and how this relationship could be improved.

Navigating Regulation is part and parcel of running a business. Occasionally however, it determines the future direction, not only of a business, but of an entire industry, as it did in 2008/9 with the passing of the National Consumer Credit Protection Act. Eight years on, 2016/17 looks likely to have an equally strong impact on brokers’ businesses, driven by a perfect storm of regulatory and political activity.

At the request of the Assistant Treasurer, brokers’ remuneration is set to be investigated by ASIC, who are themselves the subject of a government ‘capability review’ – just one of many consequences of 2014’s Financial System Inquiry. That’s not to mention debates over user-pays funding, interest-only lending and more.

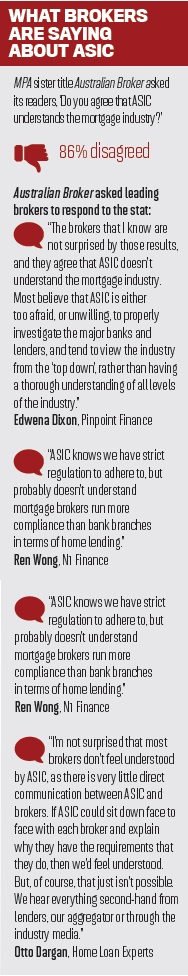

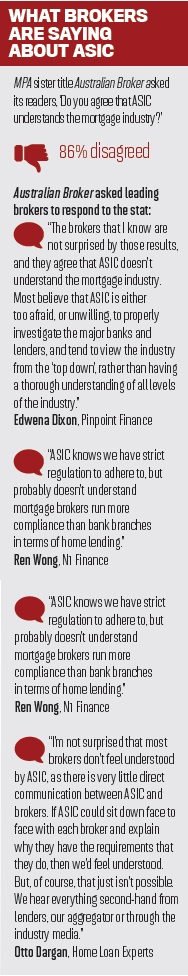

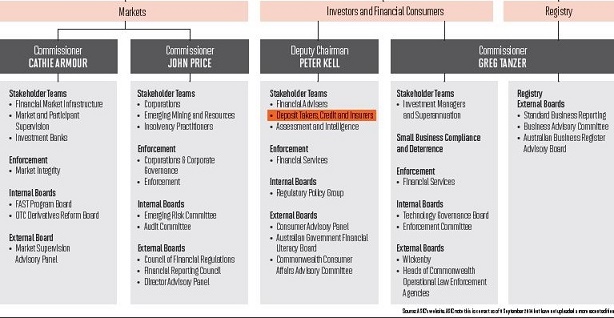

In short, brokers and ASIC will need to closely engage with each other – more than they have at any time since the NCCP. Yet, a recent poll by MPA sister-title Australian Broker found that understanding between the industry and regulators appears to be at alarming lows. The magazine asked its readers, ‘Do you agree that ASIC understands the mortgage industry?’, and 86% of respondents disagreed. The magazine took the results of the poll to several prominent brokers, who provided suggestions for this lack of trust.

What they found is that brokers have four areas of concern: that ASIC doesn’t understand the technical aspects of brokers’ compliance procedures; that ASIC should instead be investigating the banks; and fi nally – and crucially – that ASIC don’t communicate enough with brokers or industry associations. Undoubtedly, current debates, such as over interest-only lending, have not endeared the regulator to brokers, and this dissatisfaction appears both more deeply engrained and wide-ranging. Therefore, this article will also look beyond current debates, examining where communication between brokers and their regulator has broken down, and what can be done to repair the relationship.

engrained and wide-ranging. Therefore, this article will also look beyond current debates, examining where communication between brokers and their regulator has broken down, and what can be done to repair the relationship.

1 Broking’s industry bodies and ASIC

Beginning with ASIC’s understanding of the industry, it seems that brokers hold a very different view to their own industry associations. MPA put the 86% statistic to the FBAA’s Peter White, whose reply was unequivocal. “Unfortunately, that is the brokers’ problem,” he explained. “ASIC understands brokers, and to say that they don’t is very, very wrong.”

Drawing on his work with regulators from the introduction of the NCCP onwards, White insisted that “ASIC’s got some enormous skillsets and [people] who understand broking very, very well”.

Similarly, the MFAA’s CEO Siobhan Hayden doesn’t believe the statistic is completely fair. “They [ASIC] are fairly well versed,” she said. “They come out to some of our broker events, they talk to brokers, they engage with us regularly. They have a good understanding of how brokers work and how they’re remunerated.”

Indeed, ASIC personnel have attended recent broker events, including the FBAA’s national conference last November, where they addressed attendees and then answered brokers’ questions.

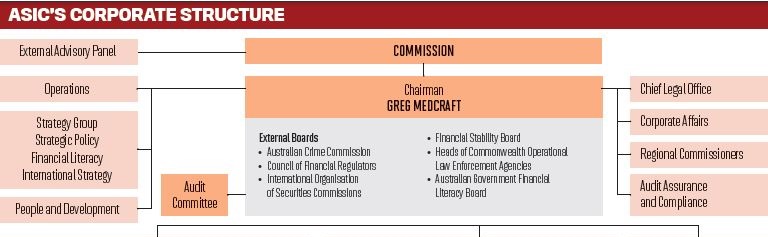

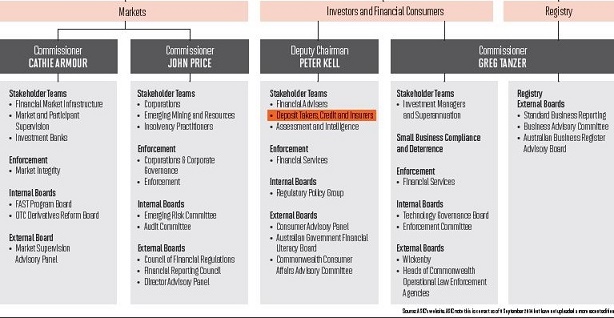

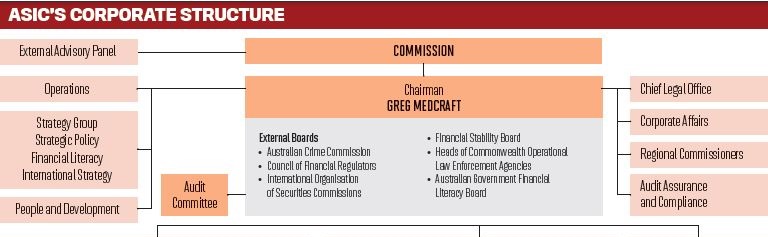

Within ASIC’s corporate structure – illustrated in our box out – there are several individuals of whom brokers should be aware. The MFAA point to Michael Saadat, senior executive leader of deposit takers, credit & insurers (which includes brokers), who is overseen by ASIC deputy chair Peter Kell. In terms of experience, Saadat worked in compliance at ASIC, Citibank and previously PwC, while Kell comes from a consumer protection background, at ASIC, the Australian Competition and Consumer Commission and CHOICE. Both are well established in their jobs – Saadat has been at ASIC since 2005 (excluding a brief two year spell at Citibank), Kell from 1998-2004, rejoining the regulator in 2013.

2 How ASIC relates to other regulators

Saadat and Kell certainly have the experience to understand broking, but they’re not the only decision makers brokers have to deal with. Australia’s regulatory framework has several layers, of which ASIC is just one. As FBAA chief White notes, ASIC isn’t necessarily the decision maker, but instead the ‘policeman’ tasked with enforcing them. The Treasury sets ASIC’s priorities and is thus the cause of much misunderstanding. “We get changes of ministers on a regular basis now,” says White. “Not all the ministers understand brokers on a federal level.” The remuneration inquiry, for instance, was announced by assistant treasurer Kelly O’Dwyer, although the inquiry itself will e carried out by ASIC.

The importance of the Federal Government in fi nancial regulation was underlined by the MFAA’s appointment of a professional lobbyist, GRACosway, which CEO Hayden says at the time was a response to members who believed government needed to be educated about broking. “It is clear from media comments in the past 12 months that some representatives of Reserve Bank of Australia (RBA), Australian Prudential Regulation Authority (APRA) and Treasury do not have a detailed understanding of our industry and this needs to change,” says Hayden.

Indeed, while not the subject of this article, APRA have enormous infl uence over brokers. As Hayden puts it, brokers are not APRA’s ‘direct customers’ – the organisation regulates lenders – but deals with brokers as a distribution channel of those lenders. APRA regularly makes comments about brokerintroduced loans, as they did in 2015, but has a much lower level of engagement – it meets with the MFAA around twice a year, unlike ASIC’s quarterly consultations. The two have clashed, notably in August last year when APRA chairman Wayne Byres warns that broker-originated loans were ‘higher risk’.

While ASIC and APRA co-ordinate through the Council of Financial Regulators, brokers who approach ASIC about APRA policies (or vice versa) will get nowhere, leading to frustration and confusion between the two. “I think sometimes the mandates ASIC and APRA have are not well understood by brokers”, MFAA CEO Hayden tells MPA. “I understand why, when a broker’s business is affected by these changes, they do get a sense of frustration from it, but sometimes it’s not channelled at the correct regulator.” She mentioned complaints by brokers aimed at ASIC about recent bank rate rises and serviceability changes – measures that were driven by APRA.

measures that were driven by APRA.

3 Where communication is failing

Both the MFAA and FBAA see broker misinformation as a cause for their distrust of ASIC, but it’s also a symptom. What it indicates is that a significant number of brokers aren’t being provided with the information so that they can deal with the appropriate regulator at the right time – and it’s not the fi rst time this problem has been raised. In 2013, ASIC commissioned a report into its stakeholders – including brokers – where ‘clearly communicating what ASIC is doing’ was among four key limitations identified by ASIC Chairman Greg Medcraft in his introduction to the report.

In response, Medcraft proposed four measures, two of which related to ASIC’s MoneySmart fi nancial literacy program for consumers, the others being to improve social media channels and review ASIC’s website. He defended ASIC’s record on communication, noting the organisation sends out around 300 media releases and takes part in 100 interviews a year. With tens of thousands of stakeholders, a large quantity of communication is understandably necessary, yet brokers still don’t appear to be getting the information they need.

ASIC’s communication directly with brokers and the press is generally to the point, relating to the results of individual enforcement actions, bans and other penalties. There are notable exceptions: ASIC’s publicly available corporate plans (which are generalist in scope); Saadat’s talk at the FBAA’s conference; and deputy chairman Kell’s interview with Australian Broker in April 2015, in which he discussed the ASIC’s focus on interest-only lending for the year ahead. Overall, however, ASIC rarely discusses future priorities or coming regulation in public, despite this being exactly the sort of information brokers need.

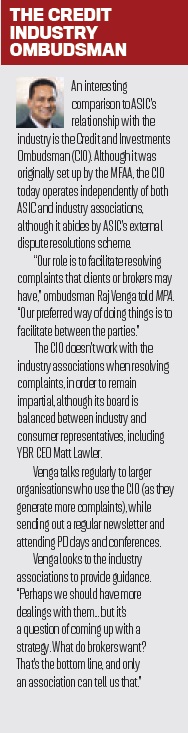

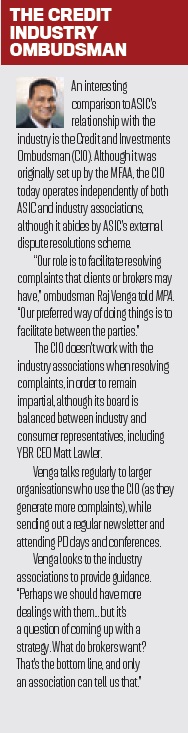

So how does ASIC consult and communicate with brokers? The answer – or rather the impression brokers get – is almost entirely through the two industry bodies, the MFAA and FBAA.

There are good reasons for a top-down approach, MFAA CEO Hayden explains. “They just don’t have the resources to adequately engage with all the brokers that may seek them out with enquiries or questions to ASIC.” The MFAA invites ASIC personnel to its PD days and relays its messages through its email and LinkedIn networks, in part because ASIC are “defi nitely not resourced adequately to directly support the market”. Indeed, a glance at ASIC’s budget (illustrated in the accompanying sidebar) shows that just five per cent of its budget for credit licensees goes into engagement and education.

Both the MFAA and FBAA told MPA that ASIC involves them throughout the development of regulation, but as White puts it, “What you’ll see when it becomes public domain is nearing the end of the stick”. Until that point, ASIC’s dealings take place not only behind closed doors, but under the understanding that everything discussed is confi dential. That explains why, when consultation papers do appear, the regulation they discuss is relatively fully formed. The advantage of this for brokers is that the consultations are more relevant, both in their subject matter and timing, Hayden explains. “It’s prudent to talk about information when it’s meaningful and you’re wanting feedback.”

There’s another reason why ASIC deals with industry bodies, according to FBAA CEO White. “The whole objective of writing regulation is not about achieving commercial bias,” he notes. “If I’m the head of a major brokerage or aggregator, and I’m pushing hard on the door of a regulator for something, it’s probably because it’s got a commercial advantage for me.” ASIC can deal with industry associations as “representatives of the total marketplace.”

While most major players in broking tend to deal with ASIC through the MFAA and FBAA, ASIC themselves say they also deal directly with major brokerages and aggregators. AFG managing director Brett McKeon revealed in a January letter to brokers that he’d met with representatives of ASIC and APRA, in addition to two senators.

Indeed, as regulation begins to really affect brokers businesses, one would expect an increasing number of aggregators and franchises to directly challenge the regulators. Their arguments are undoubtedly commercially biased, but their insights and data may nevertheless be valid, meaning regulators and legislators will (and indeed already do) listen to them. As ASIC tells MPA: “We are conscious that some perspectives are only available directly from the firms themselves.”

4 Finding a new approach to communication

Practically, the disadvantage of the behind closed-doors approach is that brokers experience new regulation as a fait accompli, with their opinion or expertise seemingly ignored by the regulator. So how can ASIC challenge that perception? MPA looked at the relationship between broking and regulation in New Zealand and how small business stakeholders can be better integrated in the

regulatory process.

Despite being a much smaller market than Australia, regulation of brokers and financial advisors in New Zealand makes for an interesting comparison. The MFAA has been working increasingly closely with New Zealand’s Professional Adviser’s Association, who will be involved in the MFAA’s Darwin and Beyond conference in June, and who, since 2012, represent brokers and financial advisors to the New Zealand regulator, the Financial Markets Authority.

MPA spoke to PAA board member Angus Dale-Jones about the difference between regulator-industry engagement in Australia and New Zealand. Dale-Jones is well equipped to make the comparison, having worked at ASIC for 17 years, including time as WA regional commissioner, before moving to the New Zealand Securities Commission, the predecessor of the FMA. As in Australia, the FMA are looking to strengthen financial services regulation, Dale-Jones tells us, but are doing so in a much more positive way.

Crucially, the way regulation is developed in New Zealand is “superbly better then Australia”, as Dale-Jones puts it. This is thanks to an extra layer in the process – the Code Committee, which is made up of 11 industry figures appointed by the FMA. The committee originally drew up and now periodically reviews the New Zealand code for financial advisors.

“It’s proved to be incredibly flexible and useful in the New Zealand context,” Dale Jones explains. “It’s meant that advisors and their associations have been able to get on board with the committee and understand their objectives and the direction of their thinking.”

According to Dale-Jones, the committee is a way of drawing on the expertise of “current practitioners who understand today’s issues.” It also means that minor changes to the code don’t have to involve changes in legislation, as the committee can make these changes. Moreover, Dale-Jones believes such regulator industry convergence isn’t just a New Zealand phenomenon. “In the past decade, around the world there has been a colossal change in the interaction between professional associations, industry bodies and the regulators,” he says. “Now it is seeking more of a convergence between those players, looking at ways of getting outcomes that makes everybody happy, so you’re starting to see far greater interest in self-regulatory solutions.”

5 Moving towards self-regulation in Australia

5 Moving towards self-regulation in Australia

With regulatory initiative trickling down from government or even international level – such as the raising of bank capital requirements – Australia doesn’t appear to have a particularly self-regulating financial system, at least in the third-party mortgage space. Indeed, one might presume the level of misunderstanding between brokers and ASIC would stop such an initiative in its tracks. Nevertheless, there are a number of reasons why brokers should make themselves part of the regulatory process.

Whether or not they seek it, ASIC needs brokers’ input. One major changeover in the past 12 months has been ASIC’s use of industry-generated reports, according to MFAA CEO Hayden. “What I’ve tried to bring to the table, with the support of the board, is getting our hands on more data… Things like the Ernst and Young report, which [involved] 700 customers and nine key lenders in our industry, was really well received by ASIC. Michael Saadat and Robert Allen both called me and said, ‘That’s great information – how often will you run it?’”

our hands on more data… Things like the Ernst and Young report, which [involved] 700 customers and nine key lenders in our industry, was really well received by ASIC. Michael Saadat and Robert Allen both called me and said, ‘That’s great information – how often will you run it?’”

Similar one-off reports will appear throughout the year, including a study at the major banks’ loan books by accountancy giant Deloitte to counter APRA’s comments about the risks relating to broker-originated loans. In late February, the MFAA released the first in a series of regular reports, the Industry Intelligence Service (IIS), providing regular twice-yearly statistics on brokers, in conjunction with business benchmarking firm Comparator.

In order for their reports to have the most impact, the MFAA has begun consulting with ASIC before commissioning reports. “We’re not an agent of them as such,” notes Hayden. “But we’re trying to ensure that if we’re investing money in this analysis, that we’re meeting the stakeholders’ requirements – not just aggregators and brokers, but ASIC as well… I don’t think they’ve got the time or the resources to do the detailed analysis that we conduct.”

Industry-driven reports have two beneficial effects. Firstly, by dictating the focus of the reports the industry can help influence the terms of the debate at a regulatory level, for example, countering accusations of broker commission distorting the market by showing how much the average broker actually makes (as the MFAA’s abovementioned benchmarking studies reveal). It also helps correct inaccuracies in reporting by external players, such as by consumer advocacy group CHOICE, which talked to just five homebuyers for their report slamming brokers back in May 2015.

Secondly, by showing the willingness to rigorously investigate itself, the industry demonstrates to ASIC it has the right culture. This might sound vague, but ensuring industries have the right culture, rather than simply processes, is the new focus of financial regulators worldwide, and ASIC is no exception.

“Culture is a significant driver of the behaviour of firms,” ASIC chairman Medcraft wrote in ASIC’s Corporate Plan 2015/16 to 2018/19. “Where we find a firm’s culture is lacking, it is a red flag that there may be broader regulatory problems.”

Following from this, ASIC’s 2016 forum is titled ‘Culture Shock’, with culture being the main talking point. The wider financial community is following suit. In January 2016, ANZ bank was roundly criticised for the ‘toxic culture’ of its trading department, leading to major management changes.

Ultimately, the industry doesn’t just have an incentive to report upon itself, it has a responsibility, as FBAA CEO White explains. “ASIC can only police what they see. Some things go under the radar … if no-one’s brought it to attention [but] how can they? They’re reliant on us, the industry, to tell them what’s going on.”

6 What can you do?

By virtue of their size and public profile, the MFAA, FBAA, major franchises and aggregators all have a responsibility to involve themselves in regulation – but what about the individual broker? While acknowledging ASIC’s preference to work through industry associations, the MFAA and FBAA are keen to get their members more closely involved in responding to regulation.

That starts with an engaged broker effectively communicating their opinion on a new piece of regulation, notes White. “It’s one thing to make a momentary stand on a blog site, but the real depth comes from when people send in their submissions to their industry bodies, or write to their parliamentarian, but if people don’t come to us, we can’t express their view.

“You’ve got to be prepared to put some time in to get results. That time may be an email, or it may be getting more involved in the council, or at board level, of an industry body.”

For brokers who want to go further, the FBAA has a number of national and state representative positions, while the MFAA has various panels for different types of brokers and female brokers (i.e. the Women In Mortgage Broking Network). Hayden sends out a CEO column to members of these panels and believes there is definitely more scope for engagement. Although, she said: “Most people are too busy with their own jobs to worry about that and they rely on their industry association to manage it on their behalf.”

It’s this point which is crucial – negotiating regulatory politics is not what a broker is best at, nor what earns them a living. The vast majority who don’t want to get involved rely on ASIC to understand their industry and regulate accordingly, which is why it’s so alarming that 86% of polled brokers don’t believe that is the case.

As an industry, broking is increasingly producing the data and reporting that underresourced industry regulators need, driven by those brokers and industry leaders – often outside the MFAA and FBAA – who do care about the culture of third party channels. In return, these brokers and leaders need a regulator who actively and publicly engages with them and systematically integrates their expertise into its regulation.

ASIC RESPONDS

MPA asked ASIC to respond to the key points in this article. Here’s what they told us:

“ASIC engages in regular and ongoing communication with all sectors of the credit industry. A key way we do this is via industry peak bodies, and with more than 5,000 credit licensees, and more than 25,000 authorised credit representatives, the broker peak bodies play an important role. However, this is not the only way we engage with industry.

“ASIC delivers presentations to national industry events, such as the FBAA National Conference on the Gold Coast and the MFAA National Conference, including from ASIC Deputy Chair Peter Kell . In addition, ASIC staff regularly attend and make presentations at state-based industry functions for both the MFAA and FBAA and use those forums to discuss current industry issues and regulatory priorities.

“We are speaking in all states at the upcoming MFAA Broker 2020 series. We write articles for and engage in interviews with industry publications. And ASIC does have direct discussions and engagement with the larger mortgage broking and aggregator businesses, as we are conscious that some perspectives are only available directly from the firms themselves.”

ASIC advises brokers to look at the regulator guides on their website, including RG 209 on Responsible Lending, RG 205 on General Conduct, and INFO 146 on Responsible Lending. With regard to their regulation of lenders, they point to recent action taken against Bank of Queensland, Wide Bay (now Auswide Bank) and CUA in addition to their interest-only and low doc lending reviews.

They then conclude: “We do, however, believe that brokers play a very significant role in arranging lending, and that it is critical that consumers have trust and confidence in the broking industry, as well as lenders… ASIC’s job is to enforce the laws that are passed by Parliament so that, ultimately, consumers benefit from a safe and well-functioning market. There may be disagreement in some parts of industry about these laws, but that does not mean ASIC doesn’t understand the industry.”

At the request of the Assistant Treasurer, brokers’ remuneration is set to be investigated by ASIC, who are themselves the subject of a government ‘capability review’ – just one of many consequences of 2014’s Financial System Inquiry. That’s not to mention debates over user-pays funding, interest-only lending and more.

In short, brokers and ASIC will need to closely engage with each other – more than they have at any time since the NCCP. Yet, a recent poll by MPA sister-title Australian Broker found that understanding between the industry and regulators appears to be at alarming lows. The magazine asked its readers, ‘Do you agree that ASIC understands the mortgage industry?’, and 86% of respondents disagreed. The magazine took the results of the poll to several prominent brokers, who provided suggestions for this lack of trust.

What they found is that brokers have four areas of concern: that ASIC doesn’t understand the technical aspects of brokers’ compliance procedures; that ASIC should instead be investigating the banks; and fi nally – and crucially – that ASIC don’t communicate enough with brokers or industry associations. Undoubtedly, current debates, such as over interest-only lending, have not endeared the regulator to brokers, and this dissatisfaction appears both more deeply

engrained and wide-ranging. Therefore, this article will also look beyond current debates, examining where communication between brokers and their regulator has broken down, and what can be done to repair the relationship.

engrained and wide-ranging. Therefore, this article will also look beyond current debates, examining where communication between brokers and their regulator has broken down, and what can be done to repair the relationship.1 Broking’s industry bodies and ASIC

Beginning with ASIC’s understanding of the industry, it seems that brokers hold a very different view to their own industry associations. MPA put the 86% statistic to the FBAA’s Peter White, whose reply was unequivocal. “Unfortunately, that is the brokers’ problem,” he explained. “ASIC understands brokers, and to say that they don’t is very, very wrong.”

Drawing on his work with regulators from the introduction of the NCCP onwards, White insisted that “ASIC’s got some enormous skillsets and [people] who understand broking very, very well”.

Similarly, the MFAA’s CEO Siobhan Hayden doesn’t believe the statistic is completely fair. “They [ASIC] are fairly well versed,” she said. “They come out to some of our broker events, they talk to brokers, they engage with us regularly. They have a good understanding of how brokers work and how they’re remunerated.”

Indeed, ASIC personnel have attended recent broker events, including the FBAA’s national conference last November, where they addressed attendees and then answered brokers’ questions.

Within ASIC’s corporate structure – illustrated in our box out – there are several individuals of whom brokers should be aware. The MFAA point to Michael Saadat, senior executive leader of deposit takers, credit & insurers (which includes brokers), who is overseen by ASIC deputy chair Peter Kell. In terms of experience, Saadat worked in compliance at ASIC, Citibank and previously PwC, while Kell comes from a consumer protection background, at ASIC, the Australian Competition and Consumer Commission and CHOICE. Both are well established in their jobs – Saadat has been at ASIC since 2005 (excluding a brief two year spell at Citibank), Kell from 1998-2004, rejoining the regulator in 2013.

2 How ASIC relates to other regulators

Saadat and Kell certainly have the experience to understand broking, but they’re not the only decision makers brokers have to deal with. Australia’s regulatory framework has several layers, of which ASIC is just one. As FBAA chief White notes, ASIC isn’t necessarily the decision maker, but instead the ‘policeman’ tasked with enforcing them. The Treasury sets ASIC’s priorities and is thus the cause of much misunderstanding. “We get changes of ministers on a regular basis now,” says White. “Not all the ministers understand brokers on a federal level.” The remuneration inquiry, for instance, was announced by assistant treasurer Kelly O’Dwyer, although the inquiry itself will e carried out by ASIC.

The importance of the Federal Government in fi nancial regulation was underlined by the MFAA’s appointment of a professional lobbyist, GRACosway, which CEO Hayden says at the time was a response to members who believed government needed to be educated about broking. “It is clear from media comments in the past 12 months that some representatives of Reserve Bank of Australia (RBA), Australian Prudential Regulation Authority (APRA) and Treasury do not have a detailed understanding of our industry and this needs to change,” says Hayden.

Indeed, while not the subject of this article, APRA have enormous infl uence over brokers. As Hayden puts it, brokers are not APRA’s ‘direct customers’ – the organisation regulates lenders – but deals with brokers as a distribution channel of those lenders. APRA regularly makes comments about brokerintroduced loans, as they did in 2015, but has a much lower level of engagement – it meets with the MFAA around twice a year, unlike ASIC’s quarterly consultations. The two have clashed, notably in August last year when APRA chairman Wayne Byres warns that broker-originated loans were ‘higher risk’.

While ASIC and APRA co-ordinate through the Council of Financial Regulators, brokers who approach ASIC about APRA policies (or vice versa) will get nowhere, leading to frustration and confusion between the two. “I think sometimes the mandates ASIC and APRA have are not well understood by brokers”, MFAA CEO Hayden tells MPA. “I understand why, when a broker’s business is affected by these changes, they do get a sense of frustration from it, but sometimes it’s not channelled at the correct regulator.” She mentioned complaints by brokers aimed at ASIC about recent bank rate rises and serviceability changes –

measures that were driven by APRA.

measures that were driven by APRA.3 Where communication is failing

Both the MFAA and FBAA see broker misinformation as a cause for their distrust of ASIC, but it’s also a symptom. What it indicates is that a significant number of brokers aren’t being provided with the information so that they can deal with the appropriate regulator at the right time – and it’s not the fi rst time this problem has been raised. In 2013, ASIC commissioned a report into its stakeholders – including brokers – where ‘clearly communicating what ASIC is doing’ was among four key limitations identified by ASIC Chairman Greg Medcraft in his introduction to the report.

In response, Medcraft proposed four measures, two of which related to ASIC’s MoneySmart fi nancial literacy program for consumers, the others being to improve social media channels and review ASIC’s website. He defended ASIC’s record on communication, noting the organisation sends out around 300 media releases and takes part in 100 interviews a year. With tens of thousands of stakeholders, a large quantity of communication is understandably necessary, yet brokers still don’t appear to be getting the information they need.

ASIC’s communication directly with brokers and the press is generally to the point, relating to the results of individual enforcement actions, bans and other penalties. There are notable exceptions: ASIC’s publicly available corporate plans (which are generalist in scope); Saadat’s talk at the FBAA’s conference; and deputy chairman Kell’s interview with Australian Broker in April 2015, in which he discussed the ASIC’s focus on interest-only lending for the year ahead. Overall, however, ASIC rarely discusses future priorities or coming regulation in public, despite this being exactly the sort of information brokers need.

So how does ASIC consult and communicate with brokers? The answer – or rather the impression brokers get – is almost entirely through the two industry bodies, the MFAA and FBAA.

There are good reasons for a top-down approach, MFAA CEO Hayden explains. “They just don’t have the resources to adequately engage with all the brokers that may seek them out with enquiries or questions to ASIC.” The MFAA invites ASIC personnel to its PD days and relays its messages through its email and LinkedIn networks, in part because ASIC are “defi nitely not resourced adequately to directly support the market”. Indeed, a glance at ASIC’s budget (illustrated in the accompanying sidebar) shows that just five per cent of its budget for credit licensees goes into engagement and education.

Both the MFAA and FBAA told MPA that ASIC involves them throughout the development of regulation, but as White puts it, “What you’ll see when it becomes public domain is nearing the end of the stick”. Until that point, ASIC’s dealings take place not only behind closed doors, but under the understanding that everything discussed is confi dential. That explains why, when consultation papers do appear, the regulation they discuss is relatively fully formed. The advantage of this for brokers is that the consultations are more relevant, both in their subject matter and timing, Hayden explains. “It’s prudent to talk about information when it’s meaningful and you’re wanting feedback.”

There’s another reason why ASIC deals with industry bodies, according to FBAA CEO White. “The whole objective of writing regulation is not about achieving commercial bias,” he notes. “If I’m the head of a major brokerage or aggregator, and I’m pushing hard on the door of a regulator for something, it’s probably because it’s got a commercial advantage for me.” ASIC can deal with industry associations as “representatives of the total marketplace.”

While most major players in broking tend to deal with ASIC through the MFAA and FBAA, ASIC themselves say they also deal directly with major brokerages and aggregators. AFG managing director Brett McKeon revealed in a January letter to brokers that he’d met with representatives of ASIC and APRA, in addition to two senators.

Indeed, as regulation begins to really affect brokers businesses, one would expect an increasing number of aggregators and franchises to directly challenge the regulators. Their arguments are undoubtedly commercially biased, but their insights and data may nevertheless be valid, meaning regulators and legislators will (and indeed already do) listen to them. As ASIC tells MPA: “We are conscious that some perspectives are only available directly from the firms themselves.”

4 Finding a new approach to communication

Practically, the disadvantage of the behind closed-doors approach is that brokers experience new regulation as a fait accompli, with their opinion or expertise seemingly ignored by the regulator. So how can ASIC challenge that perception? MPA looked at the relationship between broking and regulation in New Zealand and how small business stakeholders can be better integrated in the

regulatory process.

Despite being a much smaller market than Australia, regulation of brokers and financial advisors in New Zealand makes for an interesting comparison. The MFAA has been working increasingly closely with New Zealand’s Professional Adviser’s Association, who will be involved in the MFAA’s Darwin and Beyond conference in June, and who, since 2012, represent brokers and financial advisors to the New Zealand regulator, the Financial Markets Authority.

MPA spoke to PAA board member Angus Dale-Jones about the difference between regulator-industry engagement in Australia and New Zealand. Dale-Jones is well equipped to make the comparison, having worked at ASIC for 17 years, including time as WA regional commissioner, before moving to the New Zealand Securities Commission, the predecessor of the FMA. As in Australia, the FMA are looking to strengthen financial services regulation, Dale-Jones tells us, but are doing so in a much more positive way.

Crucially, the way regulation is developed in New Zealand is “superbly better then Australia”, as Dale-Jones puts it. This is thanks to an extra layer in the process – the Code Committee, which is made up of 11 industry figures appointed by the FMA. The committee originally drew up and now periodically reviews the New Zealand code for financial advisors.

“It’s proved to be incredibly flexible and useful in the New Zealand context,” Dale Jones explains. “It’s meant that advisors and their associations have been able to get on board with the committee and understand their objectives and the direction of their thinking.”

According to Dale-Jones, the committee is a way of drawing on the expertise of “current practitioners who understand today’s issues.” It also means that minor changes to the code don’t have to involve changes in legislation, as the committee can make these changes. Moreover, Dale-Jones believes such regulator industry convergence isn’t just a New Zealand phenomenon. “In the past decade, around the world there has been a colossal change in the interaction between professional associations, industry bodies and the regulators,” he says. “Now it is seeking more of a convergence between those players, looking at ways of getting outcomes that makes everybody happy, so you’re starting to see far greater interest in self-regulatory solutions.”

5 Moving towards self-regulation in Australia

5 Moving towards self-regulation in AustraliaWith regulatory initiative trickling down from government or even international level – such as the raising of bank capital requirements – Australia doesn’t appear to have a particularly self-regulating financial system, at least in the third-party mortgage space. Indeed, one might presume the level of misunderstanding between brokers and ASIC would stop such an initiative in its tracks. Nevertheless, there are a number of reasons why brokers should make themselves part of the regulatory process.

Whether or not they seek it, ASIC needs brokers’ input. One major changeover in the past 12 months has been ASIC’s use of industry-generated reports, according to MFAA CEO Hayden. “What I’ve tried to bring to the table, with the support of the board, is getting

our hands on more data… Things like the Ernst and Young report, which [involved] 700 customers and nine key lenders in our industry, was really well received by ASIC. Michael Saadat and Robert Allen both called me and said, ‘That’s great information – how often will you run it?’”

our hands on more data… Things like the Ernst and Young report, which [involved] 700 customers and nine key lenders in our industry, was really well received by ASIC. Michael Saadat and Robert Allen both called me and said, ‘That’s great information – how often will you run it?’”Similar one-off reports will appear throughout the year, including a study at the major banks’ loan books by accountancy giant Deloitte to counter APRA’s comments about the risks relating to broker-originated loans. In late February, the MFAA released the first in a series of regular reports, the Industry Intelligence Service (IIS), providing regular twice-yearly statistics on brokers, in conjunction with business benchmarking firm Comparator.

In order for their reports to have the most impact, the MFAA has begun consulting with ASIC before commissioning reports. “We’re not an agent of them as such,” notes Hayden. “But we’re trying to ensure that if we’re investing money in this analysis, that we’re meeting the stakeholders’ requirements – not just aggregators and brokers, but ASIC as well… I don’t think they’ve got the time or the resources to do the detailed analysis that we conduct.”

Industry-driven reports have two beneficial effects. Firstly, by dictating the focus of the reports the industry can help influence the terms of the debate at a regulatory level, for example, countering accusations of broker commission distorting the market by showing how much the average broker actually makes (as the MFAA’s abovementioned benchmarking studies reveal). It also helps correct inaccuracies in reporting by external players, such as by consumer advocacy group CHOICE, which talked to just five homebuyers for their report slamming brokers back in May 2015.

Secondly, by showing the willingness to rigorously investigate itself, the industry demonstrates to ASIC it has the right culture. This might sound vague, but ensuring industries have the right culture, rather than simply processes, is the new focus of financial regulators worldwide, and ASIC is no exception.

“Culture is a significant driver of the behaviour of firms,” ASIC chairman Medcraft wrote in ASIC’s Corporate Plan 2015/16 to 2018/19. “Where we find a firm’s culture is lacking, it is a red flag that there may be broader regulatory problems.”

Following from this, ASIC’s 2016 forum is titled ‘Culture Shock’, with culture being the main talking point. The wider financial community is following suit. In January 2016, ANZ bank was roundly criticised for the ‘toxic culture’ of its trading department, leading to major management changes.

Ultimately, the industry doesn’t just have an incentive to report upon itself, it has a responsibility, as FBAA CEO White explains. “ASIC can only police what they see. Some things go under the radar … if no-one’s brought it to attention [but] how can they? They’re reliant on us, the industry, to tell them what’s going on.”

6 What can you do?

By virtue of their size and public profile, the MFAA, FBAA, major franchises and aggregators all have a responsibility to involve themselves in regulation – but what about the individual broker? While acknowledging ASIC’s preference to work through industry associations, the MFAA and FBAA are keen to get their members more closely involved in responding to regulation.

That starts with an engaged broker effectively communicating their opinion on a new piece of regulation, notes White. “It’s one thing to make a momentary stand on a blog site, but the real depth comes from when people send in their submissions to their industry bodies, or write to their parliamentarian, but if people don’t come to us, we can’t express their view.

“You’ve got to be prepared to put some time in to get results. That time may be an email, or it may be getting more involved in the council, or at board level, of an industry body.”

For brokers who want to go further, the FBAA has a number of national and state representative positions, while the MFAA has various panels for different types of brokers and female brokers (i.e. the Women In Mortgage Broking Network). Hayden sends out a CEO column to members of these panels and believes there is definitely more scope for engagement. Although, she said: “Most people are too busy with their own jobs to worry about that and they rely on their industry association to manage it on their behalf.”

It’s this point which is crucial – negotiating regulatory politics is not what a broker is best at, nor what earns them a living. The vast majority who don’t want to get involved rely on ASIC to understand their industry and regulate accordingly, which is why it’s so alarming that 86% of polled brokers don’t believe that is the case.

As an industry, broking is increasingly producing the data and reporting that underresourced industry regulators need, driven by those brokers and industry leaders – often outside the MFAA and FBAA – who do care about the culture of third party channels. In return, these brokers and leaders need a regulator who actively and publicly engages with them and systematically integrates their expertise into its regulation.

ASIC RESPONDS

MPA asked ASIC to respond to the key points in this article. Here’s what they told us:

“ASIC engages in regular and ongoing communication with all sectors of the credit industry. A key way we do this is via industry peak bodies, and with more than 5,000 credit licensees, and more than 25,000 authorised credit representatives, the broker peak bodies play an important role. However, this is not the only way we engage with industry.

“ASIC delivers presentations to national industry events, such as the FBAA National Conference on the Gold Coast and the MFAA National Conference, including from ASIC Deputy Chair Peter Kell . In addition, ASIC staff regularly attend and make presentations at state-based industry functions for both the MFAA and FBAA and use those forums to discuss current industry issues and regulatory priorities.

“We are speaking in all states at the upcoming MFAA Broker 2020 series. We write articles for and engage in interviews with industry publications. And ASIC does have direct discussions and engagement with the larger mortgage broking and aggregator businesses, as we are conscious that some perspectives are only available directly from the firms themselves.”

ASIC advises brokers to look at the regulator guides on their website, including RG 209 on Responsible Lending, RG 205 on General Conduct, and INFO 146 on Responsible Lending. With regard to their regulation of lenders, they point to recent action taken against Bank of Queensland, Wide Bay (now Auswide Bank) and CUA in addition to their interest-only and low doc lending reviews.

They then conclude: “We do, however, believe that brokers play a very significant role in arranging lending, and that it is critical that consumers have trust and confidence in the broking industry, as well as lenders… ASIC’s job is to enforce the laws that are passed by Parliament so that, ultimately, consumers benefit from a safe and well-functioning market. There may be disagreement in some parts of industry about these laws, but that does not mean ASIC doesn’t understand the industry.”