Sarah Megginson explains how you can protect your business form becoming an 'unwitting participant' of mortgage fraud.

Sarah Megginson explains how you can protect your business form becoming an 'unwitting participant' of mortgage fraud.

As with every profession, the mortgage industry will always battle with a small number of sophisticated scammers prepared to go to elaborate lengths to work the system.

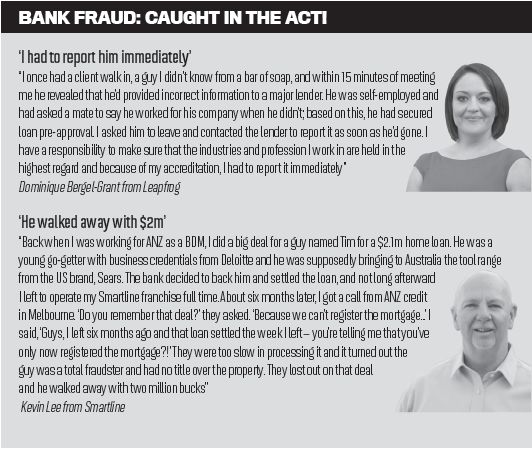

“There’s got to be one or two bad eggs out there – it’s the law of averages,” Smartline franchisee Kevin Lee said. “There was a study I once read about that said if you put 100 people in a room and give each of them the opportunity to do something dishonest for their own benefit, over 30% will do it if they know they won’t get caught.”

If we know that mortgage fraud is going to happen, then what can you do as a broker to best protect yourself from becoming an unwitting participant?

Get to know your clients

Cultivating strong relationships with your clients will make it much easier to pick up on potential gaps in an application, such as a missing dependent or suddenly repaid car loan, says Dominique Bergel-Grant from Leapfrog Home Loans. “It’s important for mortgage brokers to get to know their clients and they shouldn’t just deal with one person in a couple – they should get to know every applicant on the file,” she advised. “If you don’t take into consideration maternity leave or changes in cash flow, you’re not doing your clients any favours.”

Have good systems in place

Insist on viewing original documents

“We had one case where a broker was alerted to tiny changes to the font on a document, and it was such a sophisticated false document that even the lender hadn’t picked up on it,” said Bergel-Grant. “It’s a constant learning curve, because people will keep adapting to technology, but if you’re receiving original documents that’s one way to minimise the chance for fraud.”

Triple check before you file

Most borrowers “don’t have a fraud mindset”, explains mortgage credit adviser Tim Boyle, but that doesn’t mean they’ll always be 100% upfront with you. “I often come across ‘innocent mistakes’, where a bank statement isn’t provided, and that turns out to be the one where the account went over the limit,” he said. The lesson for brokers? Triple check every document before you lodge and always be on the lookout for red flags.

Prioritise compliance

Broking aggregators play “a crucial role in compliance and reporting, as they manage the broker’s software and therefore loan records,” Boyle said. “My aggregator has a strong, supportive compliance team and compulsory quarterly reporting of our loan compliance. I know they spend a lot of time auditing individual loan applications and they’re prepared to take action if these are not up to scratch.”

Be vigilant, as it’s your livelihood at stake

“My old man taught me that it takes a lifetime to build a reputation and only three minutes to destroy it,” said Lee. “This is particularly true as a broker; everything’s at stake. There are huge repercussions if one of your clients engages in fraudulent practices as you could lose your accreditation, and I know that with Smartline if you lose it with one lender, then you’re cut from Smartline – and then your income is gone.”

As with every profession, the mortgage industry will always battle with a small number of sophisticated scammers prepared to go to elaborate lengths to work the system.

“There’s got to be one or two bad eggs out there – it’s the law of averages,” Smartline franchisee Kevin Lee said. “There was a study I once read about that said if you put 100 people in a room and give each of them the opportunity to do something dishonest for their own benefit, over 30% will do it if they know they won’t get caught.”

If we know that mortgage fraud is going to happen, then what can you do as a broker to best protect yourself from becoming an unwitting participant?

Get to know your clients

Cultivating strong relationships with your clients will make it much easier to pick up on potential gaps in an application, such as a missing dependent or suddenly repaid car loan, says Dominique Bergel-Grant from Leapfrog Home Loans. “It’s important for mortgage brokers to get to know their clients and they shouldn’t just deal with one person in a couple – they should get to know every applicant on the file,” she advised. “If you don’t take into consideration maternity leave or changes in cash flow, you’re not doing your clients any favours.”

Have good systems in place

If a situation unfolds whereby one of your clients submits fraudulent paperwork, only you will be able to prove that you weren’t complicit in the deception. “If you’ve genuinely done everything right and have your systems and processes in place, then you’ll be able to demonstrate that you’re doing the best you can to protect yourself and your accreditation,” she said.

Insist on viewing original documents

“We had one case where a broker was alerted to tiny changes to the font on a document, and it was such a sophisticated false document that even the lender hadn’t picked up on it,” said Bergel-Grant. “It’s a constant learning curve, because people will keep adapting to technology, but if you’re receiving original documents that’s one way to minimise the chance for fraud.”

Triple check before you file

Most borrowers “don’t have a fraud mindset”, explains mortgage credit adviser Tim Boyle, but that doesn’t mean they’ll always be 100% upfront with you. “I often come across ‘innocent mistakes’, where a bank statement isn’t provided, and that turns out to be the one where the account went over the limit,” he said. The lesson for brokers? Triple check every document before you lodge and always be on the lookout for red flags.

Prioritise compliance

Broking aggregators play “a crucial role in compliance and reporting, as they manage the broker’s software and therefore loan records,” Boyle said. “My aggregator has a strong, supportive compliance team and compulsory quarterly reporting of our loan compliance. I know they spend a lot of time auditing individual loan applications and they’re prepared to take action if these are not up to scratch.”

Be vigilant, as it’s your livelihood at stake

“My old man taught me that it takes a lifetime to build a reputation and only three minutes to destroy it,” said Lee. “This is particularly true as a broker; everything’s at stake. There are huge repercussions if one of your clients engages in fraudulent practices as you could lose your accreditation, and I know that with Smartline if you lose it with one lender, then you’re cut from Smartline – and then your income is gone.”