Top 100 broker Bren Rodda tells MPA about the realities of doing business in Australia’s northernmost city

Beyond the bright lights of the big cities there really is another Australia: 2.97 million square miles of bush, jungle, desert and beaches.

Not that you’ll hear much about it in MPA; for all the extraordinary wildlife, weather and culture you can find in places like the Northern Territory, you won’t find many brokers there – or people, for that matter. Few people means few customers, and that means housing markets can be heavily dependent on mining and infrastructure projects and tend towards boom and bust, as regional WA brokers are now finding out.

Which is what makes it all the more impressive that Bren Rodda, Loan Market’s man in Darwin, has repeatedly appeared in MPA’s Top 100 Brokers report, coming 74th in 2015 and the Territory’s sole representative that year. That wasn’t all; Rodda was also a finalist in 2015’s Australian Mortgage Awards in the category of Broker of the Year – Insurance.

MPA recently caught up with Rodda to fi nd out how one builds a leading broking business in the Top End, and whether other brokers should follow his footsteps north..JPG)

Moving to a boomtown

Rodda doesn’t have a background in Darwin, or in broking; he’s from South Australia, and his wife’s from Queensland, and they met while working at SeaWorld. In fact, Rodda’s job prior to broking was as far as it’s possible to get from the traditional banking route: he worked for many years as a stuntman, performing and living in Japan, Malaysia, America, Canada, and eventually China, when he and his wife decided to go into broking.

Looking to move back to Australia, they originally considered setting up in the Gold Coast. However, the timing was not ideal, Rodda recalls: “Mid-GFC, my brother, who was on the Gold Coast, said, ‘Just do not do it on the Gold Coast; you’ll go broke’. There was just nothing happening there.” Instead, they took the recommendation of a friend already in the industry. “He said to me, ‘Hey look, Darwin is on fi re compared to the rest of the country’ … he would have upped and moved his family here, and I trusted his recommendation and went, ‘All right, Darwin it is then’.”

Looking to move back to Australia, they originally considered setting up in the Gold Coast. However, the timing was not ideal, Rodda recalls: “Mid-GFC, my brother, who was on the Gold Coast, said, ‘Just do not do it on the Gold Coast; you’ll go broke’. There was just nothing happening there.” Instead, they took the recommendation of a friend already in the industry. “He said to me, ‘Hey look, Darwin is on fi re compared to the rest of the country’ … he would have upped and moved his family here, and I trusted his recommendation and went, ‘All right, Darwin it is then’.”

They started the brokerage in April 2009. Seven years later, Rodda is convinced it was the “best move we ever made”.

In economic terms it certainly was. The NT’s economy thrived on construction projects, such as the ongoing INPEX Ichthys gas plant project near Darwin, which has a budget of $34bn. However, the housing market peaked in late 2014. Rodda reckons “the market has definitely dropped off a bit, but I think it’s more of a correction rather than the market going down, as it was extremely expensive. Now you can get into property at decent prices, where it should be”. CoreLogic RP Data recorded a 2.5% decrease in dwelling values in the year to January 2016.

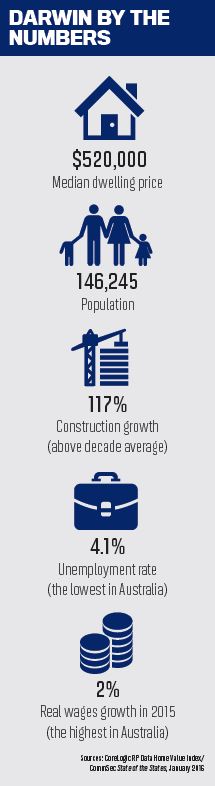

Darwin is still far from cheap – the average property cost $520,000 in January, according to CoreLogic RP Data, and the NT’s other economic indicators are still strong. CommSec’s State of the States report for January put the NT at third, leading in construction and economic growth but held back by low population growth and a 17% fall in housing finance, reflecting the price correction Rodda sees occurring. While CommSec predicts a tough couple of years ahead for the NT, the government committed to $5bn of Northern Australia infrastructure spending in its 2015 Federal Budget.

Darwin as a housing market

As a broker, Rodda thinks Darwin is an “awesome” place to operate a business. He and his wife were originally based in a Ray White real estate office, and while the brand has changed, the referral relationship with real estate agents has continued. In addition to Rodda, they now have three other brokers and one admin employee.

As for clients, the brokerage specialises in “all things residential”, Rodda explains. “We’re not chasing just first home buyers or just investors; we’ve got to have fingers in all the pies really.”

First home buyers played a major role until their grant was substantially scaled even compared to what we could have got 12 months ago,” Rodda says.

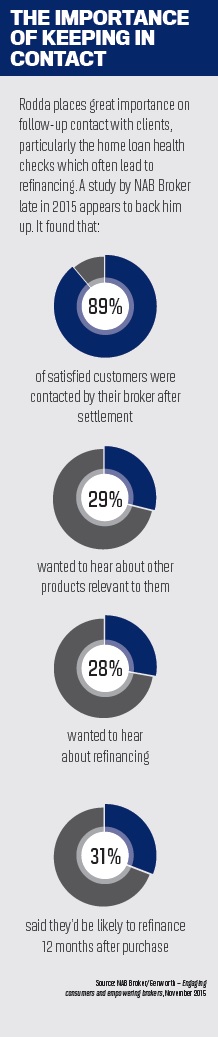

It’s vital that the brokerage is proactive in bringing in customers for these health checks, Rodda explains. “We’ve just got to be on our book and making sure their loan is competitive, because if they look online and it’s not competitive they’re going to pack up and leave … we’re on that all the time.”

The brokerage also does a large number of pre-approvals, which are necessary in Darwin because of the city’s fondness for auctions.

Rodda also deals with a large number of FIFO (fl y-in fl y-out) workers, who present particular challenges. “Most people have a good amount of email access, but we defi nitely have to be flexible with our hours,” Rodda notes. At the INPEX gas plant, for example, “the workers on that leave at 4am in the morning and get home at six that night; they just can’t come in during the day”. It’s thus impossible for them to go to a bank – but equally, they’ll only go to a broker who does after-hours appointments. Thus, “a 7pm appointment is a bit of a norm when you’re dealing with mining crew up here”, Rodda notes.

Big name in a small town

Big name in a small town

In common with other Top 100 Brokers, most of Rodda’s clients come from referrals, both personal and professional. Darwin is “small enough that you can get to be known within the industry, but it’s large enough that you can write plenty of business”, Rodda explains. That effect works both ways of course. “Darwin is still a community, albeit a big one, and word can get around if you do a good job – I’m sure word would get around if you did a bad job.”

With pre-approvals a must, real estate agents need to get brokers involved early on, Rodda says. “Those agents understand that if they’re going to sell something at auction, they need to get the customer in to do a pre-approval.” Similarly, clients for home loan health checks come from accountants and financial planner referrals.

Both the brokerage and its referral partners use what Rodda terms a “car yard approach”, making sure the prospective homeowners are covered not only for their finance but also by insurance. This is part of a broker’s duty of care and referral fees are not paid, Rodda explains. “I think it comes across better when there’s not referral fees involved, because then you’re legitimately saying ‘you need to get covered for this – I’m not getting paid, but I need to know’.”

Darwin boasts a large number of brokers, and Rodda believes that’s due to the banks’ relative weakness in the area. “The banks’ staff turnover is huge up here, so my customers have had me for the last seven or eight years, and they’re going to have me for the next 20 years, and with a branch manager they can’t guarantee that.”

It’s not only bank staff coming and going. With all its construction projects, Darwin’s population is highly transient, making the banks’ job even harder.

“People come and go all the time,” Rodda says. “Someone moves from down south and they don’t have a relationship with a bank, so they’re open to speaking to a broker.”

This has had another beneficial effect: Rodda’s clients have frequently left the NT but kept in contact, so Rodda finds himself writing loans for properties nationwide. “The good thing with this industry is if you’ve got access to phone and email, it doesn’t make any difference if they’re on the Gold Coast or in Melbourne,” Rodda explains. “We can still do the loan … it doesn’t have to be face-to-face any more.”

Conclusion

Writing $78,442,979 worth of loans in the 2014/15 financial year in a town of fewer than 150,000 inhabitants, Rodda demonstrates that location is no barrier to building a heavyweight brokerage. That’s not to say location doesn’t matter – Darwin is a unique place to operate, and one that in some ways is particularly suited to the broker proposition – not to mention the attractions of the NT’s laid-back lifestyle. Outside the brokerage, Rodda is introducing his two sons to waterskiing, and is a keen motorbike rider. “I’ve got a motorbike track in the front yard, which probably annoys the neighbours, but I love it!”

However, Rodda’s success has been driven by an approach to broking that’s applicable Australia-wide. It’s all about staying in contact, and having the structures in the brokerage to facilitate this, Rodda concludes. “There’s not a day when I sit down at my desk and think, what am I going to do today? There’s always reminders to do stuff; fixed rate expiries coming up, interest-only periods finishing, one-month settlement anniversaries coming up … it is a long-term relationship, and if you are looking for more business, the best form of advertising is your own customers.”

WORKING WITH REAL ESTATE AGENTS

Having originally shared an office with real estate agents, Rodda still works closely with them, and they’re a valuable source of referrals. If you’re planning to work more closely with real estate agents, keep in mind the following:

• Train your referrers

If necessary, develop a script for agents so you’re getting ‘warm referrals’ to clients; ie “award-winning broker … will be calling you; he/she’s a great person to talk to”.

• Keep everyone updated

Real estate agents will want to know how their clients are doing. Loan Market’s eBroker app tracks the progress of referred leads and keeps all parties updated, while assisting performance management; and other CRM programs are available.

• Be mindful of regulation

As well as following NCCP guidelines on referral arrangements, it’s vital to prevent any backflow of information; for example, you can tell an agent a client has been approved, but not for how much, which could put them in a conflict of interest.

Not that you’ll hear much about it in MPA; for all the extraordinary wildlife, weather and culture you can find in places like the Northern Territory, you won’t find many brokers there – or people, for that matter. Few people means few customers, and that means housing markets can be heavily dependent on mining and infrastructure projects and tend towards boom and bust, as regional WA brokers are now finding out.

Which is what makes it all the more impressive that Bren Rodda, Loan Market’s man in Darwin, has repeatedly appeared in MPA’s Top 100 Brokers report, coming 74th in 2015 and the Territory’s sole representative that year. That wasn’t all; Rodda was also a finalist in 2015’s Australian Mortgage Awards in the category of Broker of the Year – Insurance.

MPA recently caught up with Rodda to fi nd out how one builds a leading broking business in the Top End, and whether other brokers should follow his footsteps north.

.JPG)

Moving to a boomtown

Rodda doesn’t have a background in Darwin, or in broking; he’s from South Australia, and his wife’s from Queensland, and they met while working at SeaWorld. In fact, Rodda’s job prior to broking was as far as it’s possible to get from the traditional banking route: he worked for many years as a stuntman, performing and living in Japan, Malaysia, America, Canada, and eventually China, when he and his wife decided to go into broking.

Looking to move back to Australia, they originally considered setting up in the Gold Coast. However, the timing was not ideal, Rodda recalls: “Mid-GFC, my brother, who was on the Gold Coast, said, ‘Just do not do it on the Gold Coast; you’ll go broke’. There was just nothing happening there.” Instead, they took the recommendation of a friend already in the industry. “He said to me, ‘Hey look, Darwin is on fi re compared to the rest of the country’ … he would have upped and moved his family here, and I trusted his recommendation and went, ‘All right, Darwin it is then’.”

Looking to move back to Australia, they originally considered setting up in the Gold Coast. However, the timing was not ideal, Rodda recalls: “Mid-GFC, my brother, who was on the Gold Coast, said, ‘Just do not do it on the Gold Coast; you’ll go broke’. There was just nothing happening there.” Instead, they took the recommendation of a friend already in the industry. “He said to me, ‘Hey look, Darwin is on fi re compared to the rest of the country’ … he would have upped and moved his family here, and I trusted his recommendation and went, ‘All right, Darwin it is then’.” They started the brokerage in April 2009. Seven years later, Rodda is convinced it was the “best move we ever made”.

In economic terms it certainly was. The NT’s economy thrived on construction projects, such as the ongoing INPEX Ichthys gas plant project near Darwin, which has a budget of $34bn. However, the housing market peaked in late 2014. Rodda reckons “the market has definitely dropped off a bit, but I think it’s more of a correction rather than the market going down, as it was extremely expensive. Now you can get into property at decent prices, where it should be”. CoreLogic RP Data recorded a 2.5% decrease in dwelling values in the year to January 2016.

Darwin is still far from cheap – the average property cost $520,000 in January, according to CoreLogic RP Data, and the NT’s other economic indicators are still strong. CommSec’s State of the States report for January put the NT at third, leading in construction and economic growth but held back by low population growth and a 17% fall in housing finance, reflecting the price correction Rodda sees occurring. While CommSec predicts a tough couple of years ahead for the NT, the government committed to $5bn of Northern Australia infrastructure spending in its 2015 Federal Budget.

Darwin as a housing market

As a broker, Rodda thinks Darwin is an “awesome” place to operate a business. He and his wife were originally based in a Ray White real estate office, and while the brand has changed, the referral relationship with real estate agents has continued. In addition to Rodda, they now have three other brokers and one admin employee.

As for clients, the brokerage specialises in “all things residential”, Rodda explains. “We’re not chasing just first home buyers or just investors; we’ve got to have fingers in all the pies really.”

First home buyers played a major role until their grant was substantially scaled even compared to what we could have got 12 months ago,” Rodda says.

It’s vital that the brokerage is proactive in bringing in customers for these health checks, Rodda explains. “We’ve just got to be on our book and making sure their loan is competitive, because if they look online and it’s not competitive they’re going to pack up and leave … we’re on that all the time.”

The brokerage also does a large number of pre-approvals, which are necessary in Darwin because of the city’s fondness for auctions.

Rodda also deals with a large number of FIFO (fl y-in fl y-out) workers, who present particular challenges. “Most people have a good amount of email access, but we defi nitely have to be flexible with our hours,” Rodda notes. At the INPEX gas plant, for example, “the workers on that leave at 4am in the morning and get home at six that night; they just can’t come in during the day”. It’s thus impossible for them to go to a bank – but equally, they’ll only go to a broker who does after-hours appointments. Thus, “a 7pm appointment is a bit of a norm when you’re dealing with mining crew up here”, Rodda notes.

Big name in a small town

Big name in a small townIn common with other Top 100 Brokers, most of Rodda’s clients come from referrals, both personal and professional. Darwin is “small enough that you can get to be known within the industry, but it’s large enough that you can write plenty of business”, Rodda explains. That effect works both ways of course. “Darwin is still a community, albeit a big one, and word can get around if you do a good job – I’m sure word would get around if you did a bad job.”

With pre-approvals a must, real estate agents need to get brokers involved early on, Rodda says. “Those agents understand that if they’re going to sell something at auction, they need to get the customer in to do a pre-approval.” Similarly, clients for home loan health checks come from accountants and financial planner referrals.

Both the brokerage and its referral partners use what Rodda terms a “car yard approach”, making sure the prospective homeowners are covered not only for their finance but also by insurance. This is part of a broker’s duty of care and referral fees are not paid, Rodda explains. “I think it comes across better when there’s not referral fees involved, because then you’re legitimately saying ‘you need to get covered for this – I’m not getting paid, but I need to know’.”

Darwin boasts a large number of brokers, and Rodda believes that’s due to the banks’ relative weakness in the area. “The banks’ staff turnover is huge up here, so my customers have had me for the last seven or eight years, and they’re going to have me for the next 20 years, and with a branch manager they can’t guarantee that.”

It’s not only bank staff coming and going. With all its construction projects, Darwin’s population is highly transient, making the banks’ job even harder.

“People come and go all the time,” Rodda says. “Someone moves from down south and they don’t have a relationship with a bank, so they’re open to speaking to a broker.”

This has had another beneficial effect: Rodda’s clients have frequently left the NT but kept in contact, so Rodda finds himself writing loans for properties nationwide. “The good thing with this industry is if you’ve got access to phone and email, it doesn’t make any difference if they’re on the Gold Coast or in Melbourne,” Rodda explains. “We can still do the loan … it doesn’t have to be face-to-face any more.”

Conclusion

Writing $78,442,979 worth of loans in the 2014/15 financial year in a town of fewer than 150,000 inhabitants, Rodda demonstrates that location is no barrier to building a heavyweight brokerage. That’s not to say location doesn’t matter – Darwin is a unique place to operate, and one that in some ways is particularly suited to the broker proposition – not to mention the attractions of the NT’s laid-back lifestyle. Outside the brokerage, Rodda is introducing his two sons to waterskiing, and is a keen motorbike rider. “I’ve got a motorbike track in the front yard, which probably annoys the neighbours, but I love it!”

However, Rodda’s success has been driven by an approach to broking that’s applicable Australia-wide. It’s all about staying in contact, and having the structures in the brokerage to facilitate this, Rodda concludes. “There’s not a day when I sit down at my desk and think, what am I going to do today? There’s always reminders to do stuff; fixed rate expiries coming up, interest-only periods finishing, one-month settlement anniversaries coming up … it is a long-term relationship, and if you are looking for more business, the best form of advertising is your own customers.”

WORKING WITH REAL ESTATE AGENTS

Having originally shared an office with real estate agents, Rodda still works closely with them, and they’re a valuable source of referrals. If you’re planning to work more closely with real estate agents, keep in mind the following:

• Train your referrers

If necessary, develop a script for agents so you’re getting ‘warm referrals’ to clients; ie “award-winning broker … will be calling you; he/she’s a great person to talk to”.

• Keep everyone updated

Real estate agents will want to know how their clients are doing. Loan Market’s eBroker app tracks the progress of referred leads and keeps all parties updated, while assisting performance management; and other CRM programs are available.

• Be mindful of regulation

As well as following NCCP guidelines on referral arrangements, it’s vital to prevent any backflow of information; for example, you can tell an agent a client has been approved, but not for how much, which could put them in a conflict of interest.