We reveal who topped the rankings, and what brokers think about APRA’s changes, and commission, channel conflict and more

We reveal who topped the rankings, and what brokers think about APRA’s changes, and commission, channel conflict and more

The bank-broker relationship status is undoubtedly ‘complicated’. Banks want to attract brokers, but brokers have few of the benefits of being a customer; years after clawback was outlawed for customers, it continues to apply to brokers, for example. Conversely, banks now have to distribute more than 50% of home loans through salespeople who are not salaried employees, and whose value proposition revolves in part around the banks’ failings.

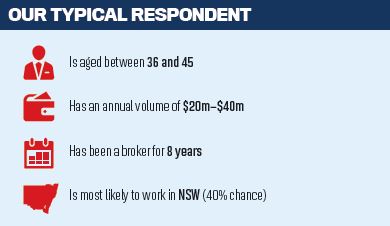

It’s also a relationship that both parties take incredibly seriously, and that’s why, for the past 13 years, MPA has charted its course in our Brokers on Banks report. Using an online survey we have collected brokers’ views on all the banks – not just the majors – providing what we believe to be the most comprehensive picture of bank activity in the broker channel. We also cover topical issues, with APRA’s lending changes very much on the agenda of 2016’s survey.

comprehensive picture of bank activity in the broker channel. We also cover topical issues, with APRA’s lending changes very much on the agenda of 2016’s survey.

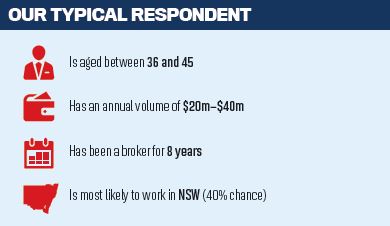

We’ve made a number of changes to this year’s Brokers on Banks report. In order to attract more respondents, we made questions far more specific, and cut out a number of questions we believed were vague or no longer relevant, such as the category ‘Overall service’. Encouragingly, the number of brokers taking this survey more than doubled from last year, producing a more accurate reflection of the broking channel’s views.

What have we found? For a start, brokers are more critical of banks than they were last year, particularly about the way banks responded to APRA’s rulings on investor lending and capital requirements. Channel conflict remains a problem for the majority of brokers, with essentially unchanging statistics suggesting banks overall haven’t made any progress in this area. Nevertheless, a handful of banks – including a growing contingent of non-majors – continue to drive improvement in service levels, and brokers have recognised their efforts in the rankings. This year’s top bank – and indeed all of those in the top five – doesn’t just excel in one category; it delivers across all. As for the rest … well, as one of our respondents put it, it’s time for ‘less talk, and more action’.

doesn’t just excel in one category; it delivers across all. As for the rest … well, as one of our respondents put it, it’s time for ‘less talk, and more action’.

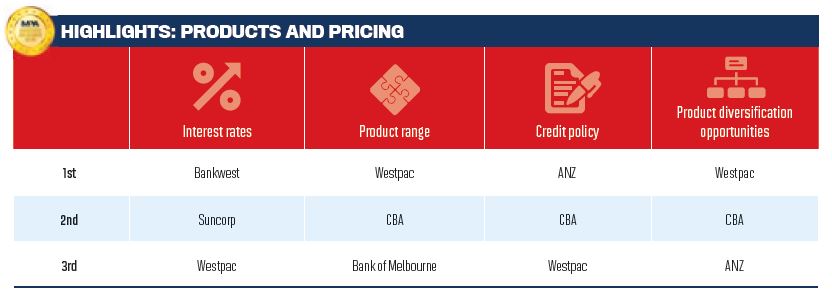

THE PRODUCTS AND PRICING

Products continue to improve, but brokers aren’t happy with how the banks responded to APRA’s interventions over the past year

IF ANY year was likely to feature a rapid deterioration in products and pricing, 2015 would be it. With APRA forcing banks to limit investor lending growth to 10%, and then pushing them to raise capital requirements, we saw not one but two out-of-cycle rate rises. Although the RBA looks likely to further reduce the cash rate, the move to a two-tier system – with investors paying more than owner-occupiers – may well be permanent.

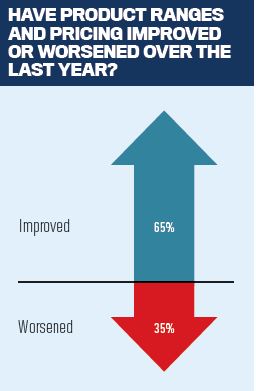

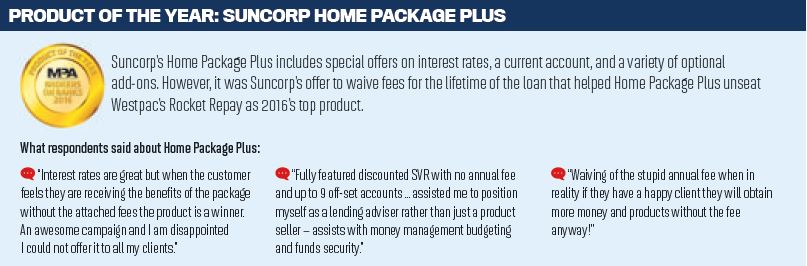

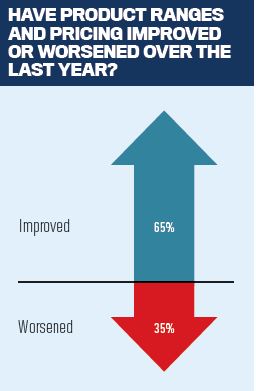

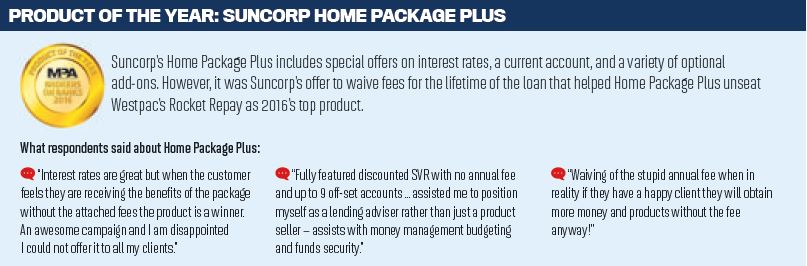

It’s therefore impressive that the majority of brokers still think banks’ products and pricing have improved. That’s down from last year’s result, when 95% saw improvement, to 65% of brokers this year, but still a positive net result. This year also saw a new top product, Suncorp’s Home Package Plus, and comments suggest the non-major managed to genuinely impress brokers despite the interest rate rises.

What Suncorp and other successful banks this year have done is move the conversation away from rate. Suncorp waived its $400 per annum fee for the entire lifespan of the Home Package Plus product, and this move was mentioned by brokers again and again. “Interest rates are great,” wrote one respondent, “but when the customer feels they are receiving the benefits of the package without the attached fees the product is a winner … I am disappointed I could not offer it to all my clients.”

All of 2016’s top products were package products. As several brokers pointed out, the addition of multiple offset accounts and offer features positioned the broker as a holistic adviser rather than a salesperson, an increasingly important distinction in today’s crowded market.

distinction in today’s crowded market.

When it came to APRA’s changes, however, brokers were less than impressed by the banks: 65% of respondents thought banks hadn’t dealt with the changes in a fair way for new and existing clients. Going further, we asked respondents whether APRA was solely to blame for changes in product and pricing.

While most brokers understood APRA’s role, a very large number of comments accused the banks of taking advantage of the situation. “Not entirely,” one broker answered. “APRA have played a large part in product and pricing changes but it was the banks’ reaction to the requirements that has impacted on the market.”

Comments addressed a number of specific points. There was a suspicion that banks had known about APRA’s intentions well in advance but had only made changes at the last moment, causing confusion for clients. Other respondents questioned the logic of raising rates for existing investor clients, if the intention was to reduce the number of new investor loans. Finally, some brokers were concerned that serviceability changes were making it harder than ever for first home buyers to get into the property market.

Indeed the extent of this dissatisfaction has the potential to threaten banks’ market share. Respondents were asked whether they were now more willing to consider non-bank lenders and alternatives, and two-thirds said they were. Non-banks haven’t been restricted by APRA’s rulings and so are able to offer more flexible serviceability and increasingly competitive rates. However, a number of brokers said they remained reluctant. One respondent

Indeed the extent of this dissatisfaction has the potential to threaten banks’ market share. Respondents were asked whether they were now more willing to consider non-bank lenders and alternatives, and two-thirds said they were. Non-banks haven’t been restricted by APRA’s rulings and so are able to offer more flexible serviceability and increasingly competitive rates. However, a number of brokers said they remained reluctant. One respondent  explained that they would “where the client is happy to use a non-bank lender yes however most clients whilst happy to not use the Big 4 want an offset account with all the features which restricts using the non-bank lenders to a large degree.”

explained that they would “where the client is happy to use a non-bank lender yes however most clients whilst happy to not use the Big 4 want an offset account with all the features which restricts using the non-bank lenders to a large degree.”

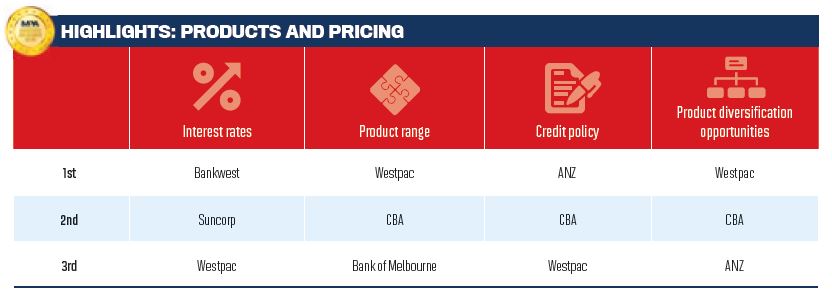

Perhaps it’s reasons like this that explain why this year’s rankings weren’t all that different, with non-majors excelling on interest rates and the Westpac/CBA/ANZ trio dominating product range, diversification and credit policy. Banks should be on high alert, however, to prevent their broker partners from looking elsewhere for finance.

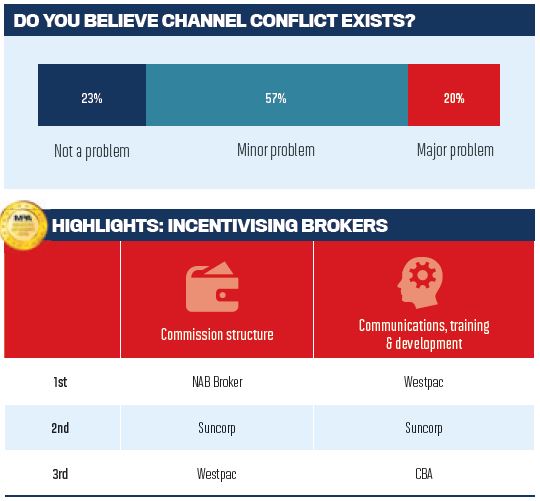

INCENTIVISING BROKERS

Commission has improved, but it’s segmentation strategies that are emerging as a powerful way to incentivise brokers

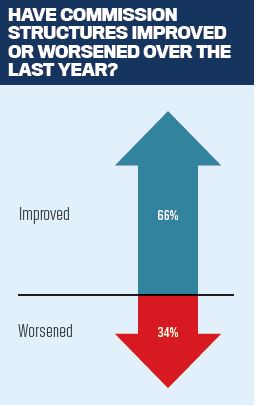

BY ANY measure, competition based on commission rates should be going out of fashion. Banks told us in 2015 that commission would play less of a role going forward; and ASIC’s inquiry into broker remuneration – which reports later this year – has put the topic in the public spotlight like never before. Fee-for-service arrangements are again being considered by brokers as a way to reassure distrustful consumers. Yet despite all this, brokers told MPA that commission levels were improving.

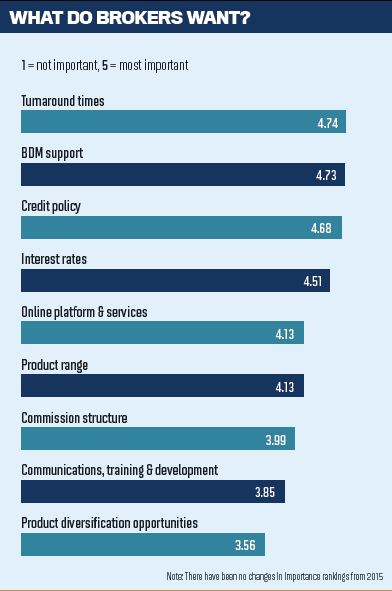

Survey results for 2016 mirrored 2015, with commission being brokers’ seventh most important priority (ie not so important).

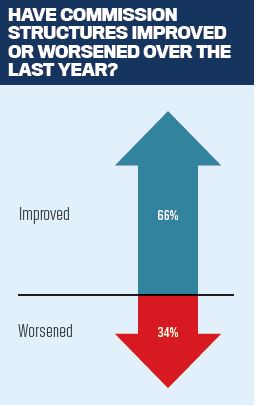

Nevertheless, brokers have noticed changes, with 66% of respondents saying commission levels had improved since last year. NAB Broker has been the beneficiary of this, with Suncorp and Westpac also performing strongly. The category of ‘Communications, training and development’ was again topped by Westpac, accompanied by Suncorp and CBA.

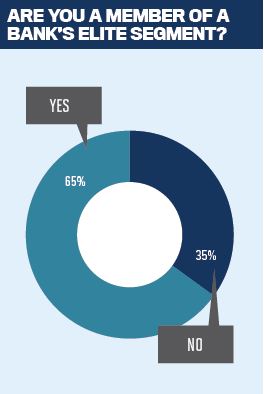

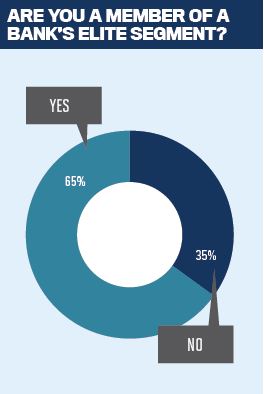

What’s become particularly apparent this year is the impact of segmentation strategies. Last year we asked survey respondents simply whether they were in favour of banks’ elite streams – such as Westpac’s Platinum Brokers or CBA’s Diamond Brokers. This year we asked them if they were a member of such a stream, and if so, which one. Astonishingly, 65% of respondents were members of an elite stream,

with Westpac’s and CBA’s segments being strongly represented.

It’s tempting to jump to the conclusion that because of these brokers certain banks performed strongly in overall rankings. That would be premature – no single bank’s elitestream brokers made up a sizeable percentage of overall respondents, and it doesn’t explain why some non-majors excelled this year. Nevertheless, it seems that elite-stream brokers are formidable brand advocates, and perhaps that’s for good reason.

Being part of elite segments offers various benefits. The three that were mentioned by almost all respondents were improved turnaround times, free upfront valuations, and access to credit assessors. Some of these turnaround times were extremely competitive – including same-day and 48-hour offers – and had the biggest impact on brokers, given turnaround times have for several years been brokers’ top priority when picking a bank.

Overall, respondents said being part of an elite stream ‘makes me look good’. Given that the majority of Brokers on Banks respondents were part of elite streams, some being members of several, this raises the question of whether such benefits will be regarded as the ‘new normal’ for brokers – a question discussed in the ‘Technology, turnaround and service’ section of this report (p26).

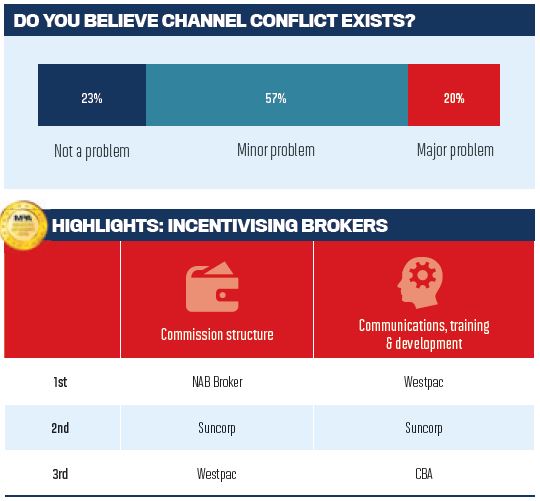

On the other side of the coin, channel conflict and clawbacks remain sources of dissatisfaction for brokers. The results for both were relatively similar to last year, with 77% of brokers saying channel conflict was a problem; 2015’s fi gure was also 77%.

Evidently, banks have done little to deal with this problem, with branches continuing to undercut brokers. Indeed a number of recent stories in the national press have focused on the ease of getting fi nance from branches, including accusations of poorly educated staff , lax assessments and fraudulent documents – and commentators in this survey mentioned all these factors. Where banks were named, they were mainly major banks.

Clawback remains a problem but for a minority, with around seven out of 10 brokers saying it wasn’t a problem.

The FBAA made clawbacks a topic of furious debate in 2015 and these results suggest many brokers don’t take this view, with numerous commentators condemning churning. However, many brokers believed some banks were ‘cut-throat’ and deliberately opportunistic in claiming clawbacks, making no allowances for special cases. This leaves banks facing a dilemma – make money off clawbacks or use the opportunity to curry favour with brokers. Brokers’ comments suggest that different banks have adopted different responses.

TECHNOLOGY, TURNAROUND, AND SERVICE

Turnaround times continue to improve, and BDMs continue to impress; indeed excelling in both categories is integral to securing a broker’s business.

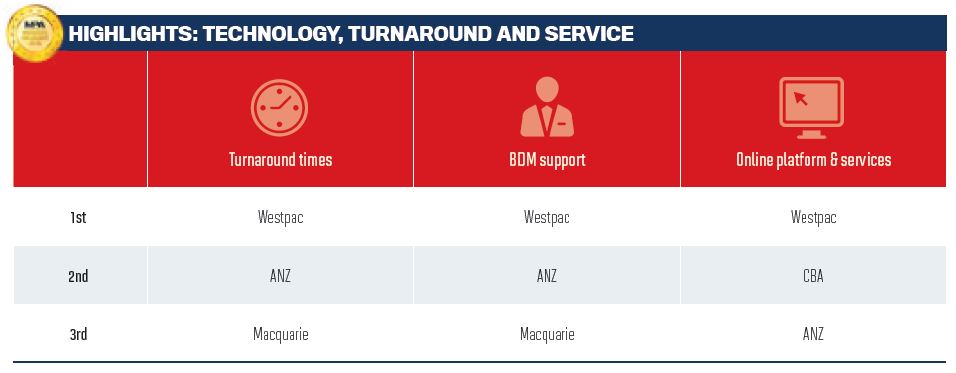

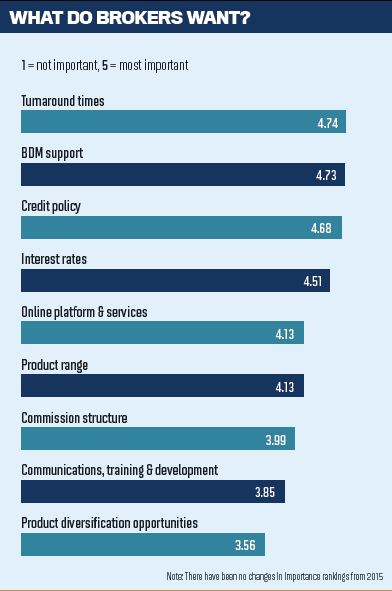

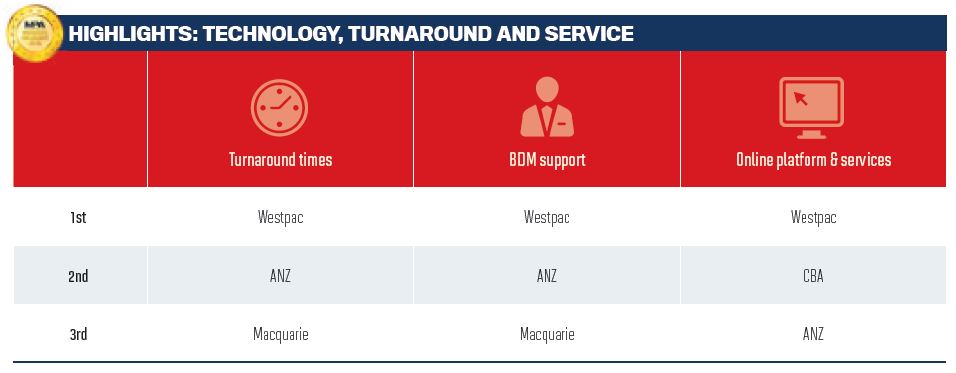

If you're a bank, turnaround times and BDM support simply cannot be ignored if you want to deal with brokers. It’s been that way for quite a while; turnaround times and BDM support were brokers’ first and second priorities again this year (we removed the category ‘Overall service’, believing it to be too vague). It’s no coincidence that the bank that topped both of these rankings went on to win ‘Bank of the Year’.

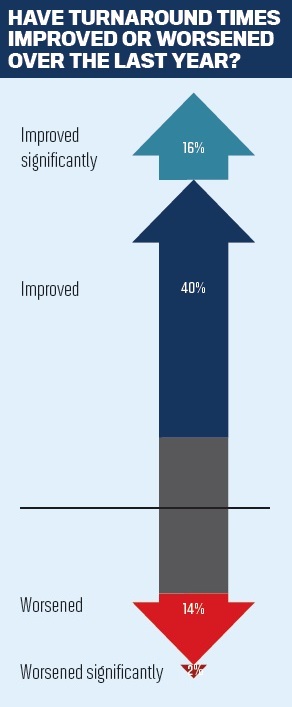

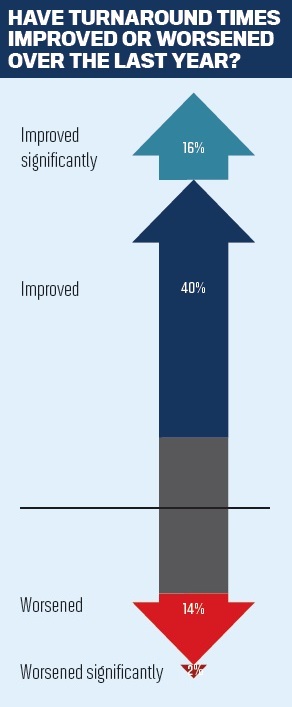

Turnaround times have continued to improve; 56% of brokers thought so, and 16% believed they’d got worse, with the remainder seeing no change. These results were almost identical to last year’s, reflecting the vast amount of investment by certain banks into staff and processing. It’s noticeable that in the rankings the banks that dominated turnaround times also dominated BDM support. Indeed Westpac and ANZ made this a priority in 2015; Westpac’s Tony MacRae told MPA after last year’s survey that the bank had increased its BDM numbers by 30% in a year.

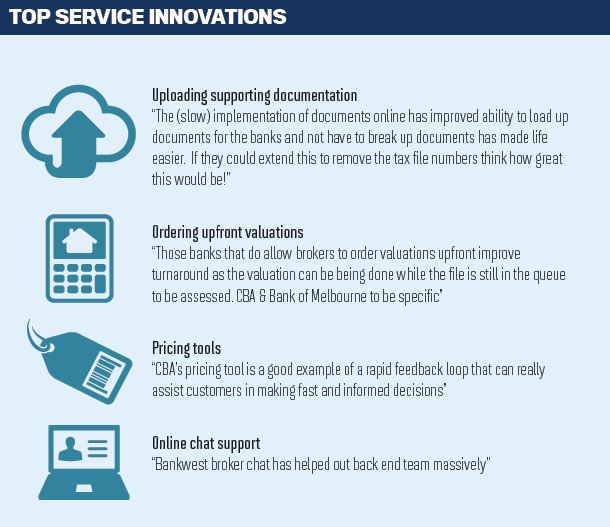

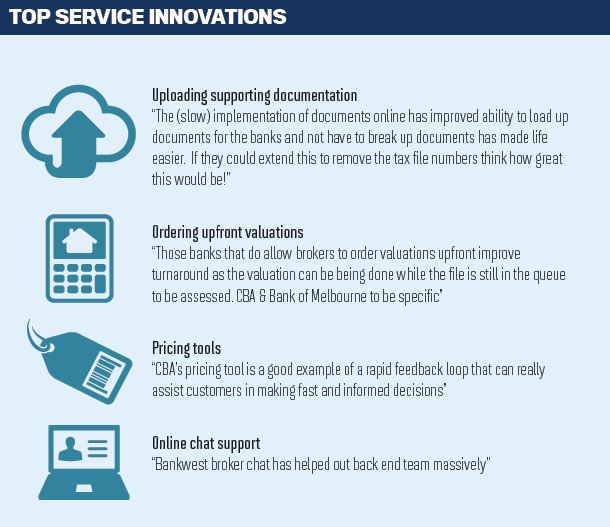

To an extent, these results imply that maintaining excellent turnaround times is dependent on quality BDMs. We asked brokers whether new technology had improved turnaround times, and many confirmed it had. Online uploading of documents – as opposed to sending hard copies in – was the most noted improvement, and being able to easily order upfront valuations was also popular. Yet being dependent on technology could be a problem. “CBA is more automated now,” commented one respondent, “but that just slows everything up because nobody can make a decision and files continually get stuck in the system”. According to our respondents, when technology breaks down, BDMs play a crucial role in getting the process moving again. See comments on this year’s standout BDMs in the ‘What you’re saying’ section of this report (p28); suffice to say these BDMs earned brokers’ trust by escalating deals, including taking them right to the top if necessary.

Unfortunately the efforts of these excellent BDMs were often undermined by incompetent BDMs or credit staff, creating problems that technology could only go some way to fix.

“Applications are dependent on humans to keep the work flow going,” noted one broker, complimenting Macquarie, where “vanilla deals will be instantly approved so no waiting in the queue for an assessor to pick up”.

Indeed, undereducated and uncommunicative credit staff were among the biggest sources of dissatisfaction for brokers. Overall, our broker respondents wanted a single person to contact who had the ability to solve problems quickly.

Finally, a comment on segmentation strategies. In the ‘Incentivising brokers’ section of this report (p24), we noted that many respondents to the survey were members of elite streams (eg CBA’s Diamond Brokers), and that they had told MPA this status confi rmed important benefi ts in terms of turnaround time and credit support. In Westpac’s case, the bank’s strong contingent of elite-stream brokers appeared to receive excellent service, as refl ected in its rankings. However, other banks with similar schemes – such as CBA and St.George – didn’t perform quite as well in service categories.

That suggests two things: firstly, that a glossy elite broker proposition doesn’t raise service levels by itself; and secondly, that investment in those schemes could be depriving other brokers of the good service they could be receiving. Both should be of concern to banks.

could be depriving other brokers of the good service they could be receiving. Both should be of concern to banks.

WHAT YOU’RE SAYING

Numbers go a long way, but if you really want to understand brokers, you need to read their comments

THIS IS the second year we’ve included a section dedicated to comments, and they continue to provide important insights that numbers alone can’t provide. Using comments requires care, because of course they are individual views, in a survey of many hundreds of brokers. There is also a perception that commenters are invariably negative; the MFAA’s CEO, Siobhan Hayden, recently warned brokers to be careful about what they post in online comment forums as they risk damaging the industry’s reputation.

For this report, however, we received a good balance of positive and negative comments. Most importantly, these comments were specific, explaining why the respondent had come to their particular conclusion on an issue or view of a particular bank.

Where specific banks were mentioned, we’ve decided to leave these in; you should of course look at the individual rankings to get an idea if the comment reflects the experience of most brokers.

This section does not attempt a complete analysis of every comment in the survey, but instead highlights a few comments that we thought were particularly reflective of the survey and/or insightful.

Our ‘Star Comment’ went further, placing what we regard as internal industry issues in a new light. We would like to thank all those who took the time to provide meaningful comments in this year’s Brokers on Banks survey.

DECONSTRUCTING COMMENTS

We asked brokers how banks could win their business, and counted the top technical terms that came up. Word analysis doesn’t give you the context a word was used in, but it gives you a good idea of what gets brokers talking.

-Turnaround [times]

-BDM

-Credit policy

-Support

-Interest [rates]

STAR COMMENT

One Victorian broker will be flaunting a new Apple Watch after coming up with this year’s Star Comment. While it’s a little cheesy, the comment touches on that essential truth that clients aren’t buying a mortgage, they’re buying a home – and buying into the great Australian dream.

Q: Tell us in 25 words or less: How can banks win more of your business in 2016?

“My job is to make my clients dreams come true, I need the banks help to make this happen! Support in this is crucial!”

BANKS GOING ABOVE AND BEYOND

•“My BDM worked hard with me to ensure a client who’s purchaser looks like rescinding which meant there would be a terrible chain reaction Has now set up a bridging loan that was approved as an exception. Client had been distraught and not sleeping then was extremely relieved at the outcome.”

•“Provided formal approval within 24 hours to enable client to purchase a property on a Friday afternoon prior to auction with additional pricing discount AND annual fee waiver for life of loan.”

•“Westpac, ANZ and Bankwest all promoted my status to their elite broker programs and this has made a big difference for clients. Turnaround times escalations, free upfront valuations, client satisfaction back end support, pricing discretion etc.”

•“My BDM Sam Tang went out of his way to seek for a file review by head of credit. This action reversed the decision on the deal and the client was able to refinance and save $20k in interest each year.”

•“Helped on a personal level. Had a complicated deal and BDM as well as state lending manager and state credit manager got personally involved to complete the deal in a timely manner and even went out and saw the customer at his place of business. Gave customer extra reassurance.”

BANKS FALLING WELL SHORT OF TARGET

•“Despite multiple messages left by the client’s family and myself I could not get a call back from the ‘Distress/Hardship’ team. The client had an acute health issue family had the presence of mind to communicate to the lender and myself. I contacted Bankwest on their behalf to ensure that Bankwest were aware and in receipt of relevant medical evidence etc... No return of call. Awful.”

•“Changed a loan over to them by a customer going into a branch to deposit cash with the teller asking them they could get a better rate simply by talking to a lending manager.”

•“Very poor service by their valuation panel. Took over 5 days for a valuer to contact one of my customers. When he did book appointment [the] valuer was over an hour late. Valuation over $100000 under recent comparable sales. Unable to get application approved. Had it approved with CBA 3 days later.”

•“Sent the letters out advising of changes faster than any other bank announcement – re investment rate changes. Clients were very shocked and didn’t even have a chance to contact them.”

•“Terrible turnaround times delayed numerous of our settlements. Unable to reach BDM unable to reach settlement team unable to reach credit officer. Only contact is mortgage central which they know nothing and each time it’s a different person.”

•“Branch has undercut brokers’ business by offering 3.99% variable for owner occupied loan and higher cash incentives. This has happened twice.”

FRESH THINKING

•Subject: Channel conflict

“It’s slowly getting better but generally it’s uneducated staff that cause issues. Lenders need to better train and educate their staff on the role of the broker especially as our market share continues to increase.”

•Subject: Elite broker streams

“Gives me access to upfront valuations which can speed up applications and give customers an answer quicker. This improves the customer experience and makes me look good!”

•Subject: Clawbacks

“The threat is concerning however all loans under threat have been reviewed and altered/switched for the most competitive options. It’s a good chance to get in touch with clients.”

•Subject: Service levels

“Provide BDM support and same time turnarounds regardless of how much business we put your way. Our clients are about to become your clients, and they are embarking on some of the biggest, most complex financial transaction of their life. Give them an amazing experience and they will be advocates.”

•Subject: Regulatory changes

“Be a leader in communicating to clients how regulatory changes will impact on product pricing by creating YouTube videos, articles on their website. Educate customers.”

•Subject: BDM support

“BDM support is imperative. Being based in Tassie, we aren’t provided with as many PD Days etc. A strong, reliable point of contact is far more important than 10bps of bonus commission.”

FINAL RESULTS

We reveal 2016’s Bank of the Year and present a bank-by-bank analysis of the top 10 performers

.JPG) Position in 2015: 1st

Position in 2015: 1st

For the second year running Westpac has claimed the Bank of the Year title, and its results are at least as impressive as last year’s. The key seems to be consistency: Westpac is among the top fi ve banks in every individual category, and topped the crucial turnaround time and BDM categories. It was also number one for communications, training and development, online platform and services, product range, and product diversification opportunities.

What’s evident is that Westpac has a large number of loyal brokers, many of whom are part of their Platinum Broker segment. In numerous comments these brokers noted the excellent service they’d received, not only in terms of turnaround times but also when BDMs and other credit staff stepped in when deals looked like they might go wrong. Following last year’s survey, Tony MacRae told MPA the bank had doubled the number of brokers in its elite segments in 12 months, explaining that “it’s not just a volume play: it’s the quality of business they deliver to us, the relationship we have with them, so it’s multifaceted.”

The danger for Westpac may well lie in the consequences of its success with segmentation. Brokers who aren’t members of these streams may avoid Westpac because they’re worried about being discriminated against when it comes to allocating BDMs and prioritising deals.

.JPG) Position in 2015: 2nd

Position in 2015: 2nd

Commonwealth Bank is the runner-up again this year, with very strong performance rankings for its product range, credit policy, product diversifi cation opportunities, communications, training and development and online platform.

.JPG) Position in 2015: 3rd

Position in 2015: 3rd

ANZ’s place in the overall top five appears increasingly unassailable, with consistent top five performance across almost all categories and a win in the credit policy category. Additional hiring and training of BDMs, as well as Saturday processing, has clearly paid off in a big way for ANZ.

To further improve, ANZ needs to improve brokers’ perceptions of its commission structure and interest rates. Its results for both were deeply disappointing this year (the lowest score of all banks for interest rates).

Position in 2015: 8th

Position in 2015: 8th

Suncorp has shot up the charts to earn the title of 2016’s top non-major. It has excelled in traditional non-major areas of strength like interest rates, while competing with the majors in key areas such as turnaround times and BDM support. Waiving the fees on its Home Package Plus product appears to have garnered a large amount of goodwill from brokers.

However, staying in the top five will be a challenge: to do so Suncorp needs to keep putting out competitive offers.

Position in 2015: 4th

Position in 2015: 4th

Macquarie has long competed with the majors in our Brokers on Banks survey, and this year was no exception. Most importantly, it has continued to excel in the areas most important to brokers: turnaround times and BDM support.

What’s preventing Macquarie from rising higher are results outside the top five for online platform and service, interest rates, product range and product diversification opportunities. Macquarie needs to look beyond its traditional strengths to these other areas, and invest accordingly.

Position in 2015: 5th

Position in 2015: 5th

NAB Broker will surely be disappointed in this result; after all, they were fi rst in 2014’s Brokers on Banks survey. To add insult to injury, this result came despite ranking first for commission structure this year, with top fi ve results for BDM support and turnaround times.

Clearly, NAB Broker has reason for concern and should also consider channel conflict – a number of complaints specifi cally referred to NAB branches.

Position in 2015: 11th

Position in 2015: 11th

Rising up the rankings, Bank of Melbourne secured top five results for online platform and services, interest rates, product range and product diversification opportunities, a good scoop for a non-major. It also outperformed other banks in the St.George Group.

Securing top five places in other areas – and thus a better overall result – will be BOM’s target for next year. Credit policy might be an area to focus on, with BOM narrowly missing out on the top five

this year.

.JPG) Position in 2015: 6th

Position in 2015: 6th

A slight fall in the rankings for Bankwest was balanced by winning in the interest rates category, and a top five finish for its product range. Bankwest’s online broker chat function, which we highlighted in last year’s report, continued to be positively mentioned in broker comments.

Position in 2015: 15th

Position in 2015: 15th

St.George has seen a considerable improvement in its rankings from last year, aided by solid results across all categories. However, in no category has it made the top five, suggesting brokers don’t see this non-major excelling in any particular area.

.JPG) Position in 2015: 7th

Position in 2015: 7th

ING Direct achieved a top five result for interest rates, but a slight slide down the rankings will come as a disappointment for the non-major bank. It has been brought down by poor results in the credit policy and online platform and service categories.

OVERALL RESULTS

OVERALL RESULTS

To come up with the overall result, we took an average of every other category combined. This means every category had an equal impact on the final result. We would advise you to also look at the importance ranking at the start of this report to see which categories matter most to brokers.

The bank-broker relationship status is undoubtedly ‘complicated’. Banks want to attract brokers, but brokers have few of the benefits of being a customer; years after clawback was outlawed for customers, it continues to apply to brokers, for example. Conversely, banks now have to distribute more than 50% of home loans through salespeople who are not salaried employees, and whose value proposition revolves in part around the banks’ failings.

It’s also a relationship that both parties take incredibly seriously, and that’s why, for the past 13 years, MPA has charted its course in our Brokers on Banks report. Using an online survey we have collected brokers’ views on all the banks – not just the majors – providing what we believe to be the most

comprehensive picture of bank activity in the broker channel. We also cover topical issues, with APRA’s lending changes very much on the agenda of 2016’s survey.

comprehensive picture of bank activity in the broker channel. We also cover topical issues, with APRA’s lending changes very much on the agenda of 2016’s survey.We’ve made a number of changes to this year’s Brokers on Banks report. In order to attract more respondents, we made questions far more specific, and cut out a number of questions we believed were vague or no longer relevant, such as the category ‘Overall service’. Encouragingly, the number of brokers taking this survey more than doubled from last year, producing a more accurate reflection of the broking channel’s views.

What have we found? For a start, brokers are more critical of banks than they were last year, particularly about the way banks responded to APRA’s rulings on investor lending and capital requirements. Channel conflict remains a problem for the majority of brokers, with essentially unchanging statistics suggesting banks overall haven’t made any progress in this area. Nevertheless, a handful of banks – including a growing contingent of non-majors – continue to drive improvement in service levels, and brokers have recognised their efforts in the rankings. This year’s top bank – and indeed all of those in the top five –

doesn’t just excel in one category; it delivers across all. As for the rest … well, as one of our respondents put it, it’s time for ‘less talk, and more action’.

doesn’t just excel in one category; it delivers across all. As for the rest … well, as one of our respondents put it, it’s time for ‘less talk, and more action’.THE PRODUCTS AND PRICING

Products continue to improve, but brokers aren’t happy with how the banks responded to APRA’s interventions over the past year

IF ANY year was likely to feature a rapid deterioration in products and pricing, 2015 would be it. With APRA forcing banks to limit investor lending growth to 10%, and then pushing them to raise capital requirements, we saw not one but two out-of-cycle rate rises. Although the RBA looks likely to further reduce the cash rate, the move to a two-tier system – with investors paying more than owner-occupiers – may well be permanent.

It’s therefore impressive that the majority of brokers still think banks’ products and pricing have improved. That’s down from last year’s result, when 95% saw improvement, to 65% of brokers this year, but still a positive net result. This year also saw a new top product, Suncorp’s Home Package Plus, and comments suggest the non-major managed to genuinely impress brokers despite the interest rate rises.

What Suncorp and other successful banks this year have done is move the conversation away from rate. Suncorp waived its $400 per annum fee for the entire lifespan of the Home Package Plus product, and this move was mentioned by brokers again and again. “Interest rates are great,” wrote one respondent, “but when the customer feels they are receiving the benefits of the package without the attached fees the product is a winner … I am disappointed I could not offer it to all my clients.”

All of 2016’s top products were package products. As several brokers pointed out, the addition of multiple offset accounts and offer features positioned the broker as a holistic adviser rather than a salesperson, an increasingly important

distinction in today’s crowded market.

distinction in today’s crowded market.When it came to APRA’s changes, however, brokers were less than impressed by the banks: 65% of respondents thought banks hadn’t dealt with the changes in a fair way for new and existing clients. Going further, we asked respondents whether APRA was solely to blame for changes in product and pricing.

While most brokers understood APRA’s role, a very large number of comments accused the banks of taking advantage of the situation. “Not entirely,” one broker answered. “APRA have played a large part in product and pricing changes but it was the banks’ reaction to the requirements that has impacted on the market.”

Comments addressed a number of specific points. There was a suspicion that banks had known about APRA’s intentions well in advance but had only made changes at the last moment, causing confusion for clients. Other respondents questioned the logic of raising rates for existing investor clients, if the intention was to reduce the number of new investor loans. Finally, some brokers were concerned that serviceability changes were making it harder than ever for first home buyers to get into the property market.

Indeed the extent of this dissatisfaction has the potential to threaten banks’ market share. Respondents were asked whether they were now more willing to consider non-bank lenders and alternatives, and two-thirds said they were. Non-banks haven’t been restricted by APRA’s rulings and so are able to offer more flexible serviceability and increasingly competitive rates. However, a number of brokers said they remained reluctant. One respondent

Indeed the extent of this dissatisfaction has the potential to threaten banks’ market share. Respondents were asked whether they were now more willing to consider non-bank lenders and alternatives, and two-thirds said they were. Non-banks haven’t been restricted by APRA’s rulings and so are able to offer more flexible serviceability and increasingly competitive rates. However, a number of brokers said they remained reluctant. One respondent  explained that they would “where the client is happy to use a non-bank lender yes however most clients whilst happy to not use the Big 4 want an offset account with all the features which restricts using the non-bank lenders to a large degree.”

explained that they would “where the client is happy to use a non-bank lender yes however most clients whilst happy to not use the Big 4 want an offset account with all the features which restricts using the non-bank lenders to a large degree.”Perhaps it’s reasons like this that explain why this year’s rankings weren’t all that different, with non-majors excelling on interest rates and the Westpac/CBA/ANZ trio dominating product range, diversification and credit policy. Banks should be on high alert, however, to prevent their broker partners from looking elsewhere for finance.

INCENTIVISING BROKERS

Commission has improved, but it’s segmentation strategies that are emerging as a powerful way to incentivise brokers

BY ANY measure, competition based on commission rates should be going out of fashion. Banks told us in 2015 that commission would play less of a role going forward; and ASIC’s inquiry into broker remuneration – which reports later this year – has put the topic in the public spotlight like never before. Fee-for-service arrangements are again being considered by brokers as a way to reassure distrustful consumers. Yet despite all this, brokers told MPA that commission levels were improving.

Survey results for 2016 mirrored 2015, with commission being brokers’ seventh most important priority (ie not so important).

Nevertheless, brokers have noticed changes, with 66% of respondents saying commission levels had improved since last year. NAB Broker has been the beneficiary of this, with Suncorp and Westpac also performing strongly. The category of ‘Communications, training and development’ was again topped by Westpac, accompanied by Suncorp and CBA.

What’s become particularly apparent this year is the impact of segmentation strategies. Last year we asked survey respondents simply whether they were in favour of banks’ elite streams – such as Westpac’s Platinum Brokers or CBA’s Diamond Brokers. This year we asked them if they were a member of such a stream, and if so, which one. Astonishingly, 65% of respondents were members of an elite stream,

with Westpac’s and CBA’s segments being strongly represented.

It’s tempting to jump to the conclusion that because of these brokers certain banks performed strongly in overall rankings. That would be premature – no single bank’s elitestream brokers made up a sizeable percentage of overall respondents, and it doesn’t explain why some non-majors excelled this year. Nevertheless, it seems that elite-stream brokers are formidable brand advocates, and perhaps that’s for good reason.

Being part of elite segments offers various benefits. The three that were mentioned by almost all respondents were improved turnaround times, free upfront valuations, and access to credit assessors. Some of these turnaround times were extremely competitive – including same-day and 48-hour offers – and had the biggest impact on brokers, given turnaround times have for several years been brokers’ top priority when picking a bank.

Overall, respondents said being part of an elite stream ‘makes me look good’. Given that the majority of Brokers on Banks respondents were part of elite streams, some being members of several, this raises the question of whether such benefits will be regarded as the ‘new normal’ for brokers – a question discussed in the ‘Technology, turnaround and service’ section of this report (p26).

On the other side of the coin, channel conflict and clawbacks remain sources of dissatisfaction for brokers. The results for both were relatively similar to last year, with 77% of brokers saying channel conflict was a problem; 2015’s fi gure was also 77%.

Evidently, banks have done little to deal with this problem, with branches continuing to undercut brokers. Indeed a number of recent stories in the national press have focused on the ease of getting fi nance from branches, including accusations of poorly educated staff , lax assessments and fraudulent documents – and commentators in this survey mentioned all these factors. Where banks were named, they were mainly major banks.

Clawback remains a problem but for a minority, with around seven out of 10 brokers saying it wasn’t a problem.

The FBAA made clawbacks a topic of furious debate in 2015 and these results suggest many brokers don’t take this view, with numerous commentators condemning churning. However, many brokers believed some banks were ‘cut-throat’ and deliberately opportunistic in claiming clawbacks, making no allowances for special cases. This leaves banks facing a dilemma – make money off clawbacks or use the opportunity to curry favour with brokers. Brokers’ comments suggest that different banks have adopted different responses.

TECHNOLOGY, TURNAROUND, AND SERVICE

Turnaround times continue to improve, and BDMs continue to impress; indeed excelling in both categories is integral to securing a broker’s business.

If you're a bank, turnaround times and BDM support simply cannot be ignored if you want to deal with brokers. It’s been that way for quite a while; turnaround times and BDM support were brokers’ first and second priorities again this year (we removed the category ‘Overall service’, believing it to be too vague). It’s no coincidence that the bank that topped both of these rankings went on to win ‘Bank of the Year’.

Turnaround times have continued to improve; 56% of brokers thought so, and 16% believed they’d got worse, with the remainder seeing no change. These results were almost identical to last year’s, reflecting the vast amount of investment by certain banks into staff and processing. It’s noticeable that in the rankings the banks that dominated turnaround times also dominated BDM support. Indeed Westpac and ANZ made this a priority in 2015; Westpac’s Tony MacRae told MPA after last year’s survey that the bank had increased its BDM numbers by 30% in a year.

To an extent, these results imply that maintaining excellent turnaround times is dependent on quality BDMs. We asked brokers whether new technology had improved turnaround times, and many confirmed it had. Online uploading of documents – as opposed to sending hard copies in – was the most noted improvement, and being able to easily order upfront valuations was also popular. Yet being dependent on technology could be a problem. “CBA is more automated now,” commented one respondent, “but that just slows everything up because nobody can make a decision and files continually get stuck in the system”. According to our respondents, when technology breaks down, BDMs play a crucial role in getting the process moving again. See comments on this year’s standout BDMs in the ‘What you’re saying’ section of this report (p28); suffice to say these BDMs earned brokers’ trust by escalating deals, including taking them right to the top if necessary.

Unfortunately the efforts of these excellent BDMs were often undermined by incompetent BDMs or credit staff, creating problems that technology could only go some way to fix.

“Applications are dependent on humans to keep the work flow going,” noted one broker, complimenting Macquarie, where “vanilla deals will be instantly approved so no waiting in the queue for an assessor to pick up”.

Indeed, undereducated and uncommunicative credit staff were among the biggest sources of dissatisfaction for brokers. Overall, our broker respondents wanted a single person to contact who had the ability to solve problems quickly.

Finally, a comment on segmentation strategies. In the ‘Incentivising brokers’ section of this report (p24), we noted that many respondents to the survey were members of elite streams (eg CBA’s Diamond Brokers), and that they had told MPA this status confi rmed important benefi ts in terms of turnaround time and credit support. In Westpac’s case, the bank’s strong contingent of elite-stream brokers appeared to receive excellent service, as refl ected in its rankings. However, other banks with similar schemes – such as CBA and St.George – didn’t perform quite as well in service categories.

That suggests two things: firstly, that a glossy elite broker proposition doesn’t raise service levels by itself; and secondly, that investment in those schemes

could be depriving other brokers of the good service they could be receiving. Both should be of concern to banks.

could be depriving other brokers of the good service they could be receiving. Both should be of concern to banks.

WHAT YOU’RE SAYING

Numbers go a long way, but if you really want to understand brokers, you need to read their comments

THIS IS the second year we’ve included a section dedicated to comments, and they continue to provide important insights that numbers alone can’t provide. Using comments requires care, because of course they are individual views, in a survey of many hundreds of brokers. There is also a perception that commenters are invariably negative; the MFAA’s CEO, Siobhan Hayden, recently warned brokers to be careful about what they post in online comment forums as they risk damaging the industry’s reputation.

For this report, however, we received a good balance of positive and negative comments. Most importantly, these comments were specific, explaining why the respondent had come to their particular conclusion on an issue or view of a particular bank.

Where specific banks were mentioned, we’ve decided to leave these in; you should of course look at the individual rankings to get an idea if the comment reflects the experience of most brokers.

This section does not attempt a complete analysis of every comment in the survey, but instead highlights a few comments that we thought were particularly reflective of the survey and/or insightful.

Our ‘Star Comment’ went further, placing what we regard as internal industry issues in a new light. We would like to thank all those who took the time to provide meaningful comments in this year’s Brokers on Banks survey.

DECONSTRUCTING COMMENTS

We asked brokers how banks could win their business, and counted the top technical terms that came up. Word analysis doesn’t give you the context a word was used in, but it gives you a good idea of what gets brokers talking.

-Turnaround [times]

-BDM

-Credit policy

-Support

-Interest [rates]

STAR COMMENT

One Victorian broker will be flaunting a new Apple Watch after coming up with this year’s Star Comment. While it’s a little cheesy, the comment touches on that essential truth that clients aren’t buying a mortgage, they’re buying a home – and buying into the great Australian dream.

Q: Tell us in 25 words or less: How can banks win more of your business in 2016?

“My job is to make my clients dreams come true, I need the banks help to make this happen! Support in this is crucial!”

BANKS GOING ABOVE AND BEYOND

•“My BDM worked hard with me to ensure a client who’s purchaser looks like rescinding which meant there would be a terrible chain reaction Has now set up a bridging loan that was approved as an exception. Client had been distraught and not sleeping then was extremely relieved at the outcome.”

•“Provided formal approval within 24 hours to enable client to purchase a property on a Friday afternoon prior to auction with additional pricing discount AND annual fee waiver for life of loan.”

•“Westpac, ANZ and Bankwest all promoted my status to their elite broker programs and this has made a big difference for clients. Turnaround times escalations, free upfront valuations, client satisfaction back end support, pricing discretion etc.”

•“My BDM Sam Tang went out of his way to seek for a file review by head of credit. This action reversed the decision on the deal and the client was able to refinance and save $20k in interest each year.”

•“Helped on a personal level. Had a complicated deal and BDM as well as state lending manager and state credit manager got personally involved to complete the deal in a timely manner and even went out and saw the customer at his place of business. Gave customer extra reassurance.”

BANKS FALLING WELL SHORT OF TARGET

•“Despite multiple messages left by the client’s family and myself I could not get a call back from the ‘Distress/Hardship’ team. The client had an acute health issue family had the presence of mind to communicate to the lender and myself. I contacted Bankwest on their behalf to ensure that Bankwest were aware and in receipt of relevant medical evidence etc... No return of call. Awful.”

•“Changed a loan over to them by a customer going into a branch to deposit cash with the teller asking them they could get a better rate simply by talking to a lending manager.”

•“Very poor service by their valuation panel. Took over 5 days for a valuer to contact one of my customers. When he did book appointment [the] valuer was over an hour late. Valuation over $100000 under recent comparable sales. Unable to get application approved. Had it approved with CBA 3 days later.”

•“Sent the letters out advising of changes faster than any other bank announcement – re investment rate changes. Clients were very shocked and didn’t even have a chance to contact them.”

•“Terrible turnaround times delayed numerous of our settlements. Unable to reach BDM unable to reach settlement team unable to reach credit officer. Only contact is mortgage central which they know nothing and each time it’s a different person.”

•“Branch has undercut brokers’ business by offering 3.99% variable for owner occupied loan and higher cash incentives. This has happened twice.”

FRESH THINKING

•Subject: Channel conflict

“It’s slowly getting better but generally it’s uneducated staff that cause issues. Lenders need to better train and educate their staff on the role of the broker especially as our market share continues to increase.”

•Subject: Elite broker streams

“Gives me access to upfront valuations which can speed up applications and give customers an answer quicker. This improves the customer experience and makes me look good!”

•Subject: Clawbacks

“The threat is concerning however all loans under threat have been reviewed and altered/switched for the most competitive options. It’s a good chance to get in touch with clients.”

•Subject: Service levels

“Provide BDM support and same time turnarounds regardless of how much business we put your way. Our clients are about to become your clients, and they are embarking on some of the biggest, most complex financial transaction of their life. Give them an amazing experience and they will be advocates.”

•Subject: Regulatory changes

“Be a leader in communicating to clients how regulatory changes will impact on product pricing by creating YouTube videos, articles on their website. Educate customers.”

•Subject: BDM support

“BDM support is imperative. Being based in Tassie, we aren’t provided with as many PD Days etc. A strong, reliable point of contact is far more important than 10bps of bonus commission.”

FINAL RESULTS

We reveal 2016’s Bank of the Year and present a bank-by-bank analysis of the top 10 performers

.JPG) Position in 2015: 1st

Position in 2015: 1st For the second year running Westpac has claimed the Bank of the Year title, and its results are at least as impressive as last year’s. The key seems to be consistency: Westpac is among the top fi ve banks in every individual category, and topped the crucial turnaround time and BDM categories. It was also number one for communications, training and development, online platform and services, product range, and product diversification opportunities.

What’s evident is that Westpac has a large number of loyal brokers, many of whom are part of their Platinum Broker segment. In numerous comments these brokers noted the excellent service they’d received, not only in terms of turnaround times but also when BDMs and other credit staff stepped in when deals looked like they might go wrong. Following last year’s survey, Tony MacRae told MPA the bank had doubled the number of brokers in its elite segments in 12 months, explaining that “it’s not just a volume play: it’s the quality of business they deliver to us, the relationship we have with them, so it’s multifaceted.”

The danger for Westpac may well lie in the consequences of its success with segmentation. Brokers who aren’t members of these streams may avoid Westpac because they’re worried about being discriminated against when it comes to allocating BDMs and prioritising deals.

.JPG) Position in 2015: 2nd

Position in 2015: 2ndCommonwealth Bank is the runner-up again this year, with very strong performance rankings for its product range, credit policy, product diversifi cation opportunities, communications, training and development and online platform.

.JPG) Position in 2015: 3rd

Position in 2015: 3rd ANZ’s place in the overall top five appears increasingly unassailable, with consistent top five performance across almost all categories and a win in the credit policy category. Additional hiring and training of BDMs, as well as Saturday processing, has clearly paid off in a big way for ANZ.

To further improve, ANZ needs to improve brokers’ perceptions of its commission structure and interest rates. Its results for both were deeply disappointing this year (the lowest score of all banks for interest rates).

Position in 2015: 8th

Position in 2015: 8thSuncorp has shot up the charts to earn the title of 2016’s top non-major. It has excelled in traditional non-major areas of strength like interest rates, while competing with the majors in key areas such as turnaround times and BDM support. Waiving the fees on its Home Package Plus product appears to have garnered a large amount of goodwill from brokers.

However, staying in the top five will be a challenge: to do so Suncorp needs to keep putting out competitive offers.

Position in 2015: 4th

Position in 2015: 4thMacquarie has long competed with the majors in our Brokers on Banks survey, and this year was no exception. Most importantly, it has continued to excel in the areas most important to brokers: turnaround times and BDM support.

What’s preventing Macquarie from rising higher are results outside the top five for online platform and service, interest rates, product range and product diversification opportunities. Macquarie needs to look beyond its traditional strengths to these other areas, and invest accordingly.

NAB Broker will surely be disappointed in this result; after all, they were fi rst in 2014’s Brokers on Banks survey. To add insult to injury, this result came despite ranking first for commission structure this year, with top fi ve results for BDM support and turnaround times.

Clearly, NAB Broker has reason for concern and should also consider channel conflict – a number of complaints specifi cally referred to NAB branches.

Position in 2015: 11th

Position in 2015: 11thRising up the rankings, Bank of Melbourne secured top five results for online platform and services, interest rates, product range and product diversification opportunities, a good scoop for a non-major. It also outperformed other banks in the St.George Group.

Securing top five places in other areas – and thus a better overall result – will be BOM’s target for next year. Credit policy might be an area to focus on, with BOM narrowly missing out on the top five

this year.

.JPG) Position in 2015: 6th

Position in 2015: 6thA slight fall in the rankings for Bankwest was balanced by winning in the interest rates category, and a top five finish for its product range. Bankwest’s online broker chat function, which we highlighted in last year’s report, continued to be positively mentioned in broker comments.

Position in 2015: 15th

Position in 2015: 15thSt.George has seen a considerable improvement in its rankings from last year, aided by solid results across all categories. However, in no category has it made the top five, suggesting brokers don’t see this non-major excelling in any particular area.

.JPG) Position in 2015: 7th

Position in 2015: 7thING Direct achieved a top five result for interest rates, but a slight slide down the rankings will come as a disappointment for the non-major bank. It has been brought down by poor results in the credit policy and online platform and service categories.

OVERALL RESULTS

OVERALL RESULTSTo come up with the overall result, we took an average of every other category combined. This means every category had an equal impact on the final result. We would advise you to also look at the importance ranking at the start of this report to see which categories matter most to brokers.