KPMG report asked consumers to rate their home loan experiences, with brokers coming second on all fronts

.jpg)

KPMG report asked consumers to rate their home loan experiences, with brokers coming second on all fronts

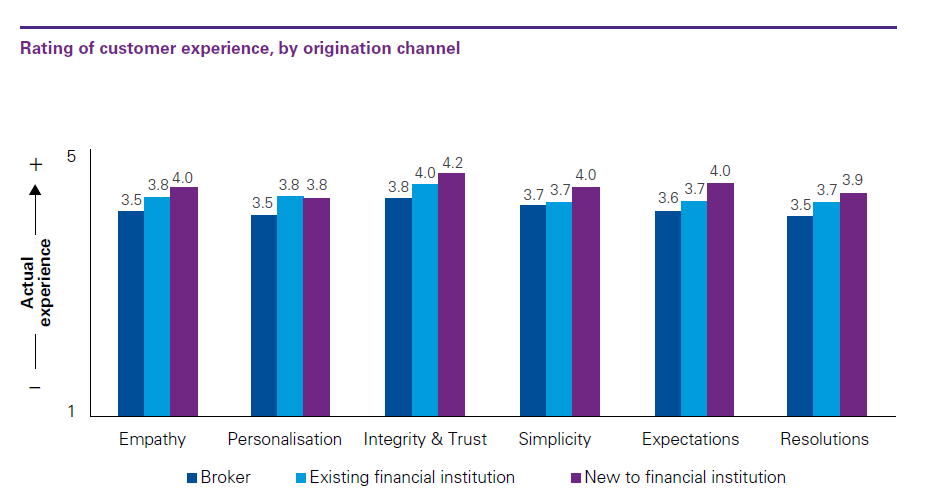

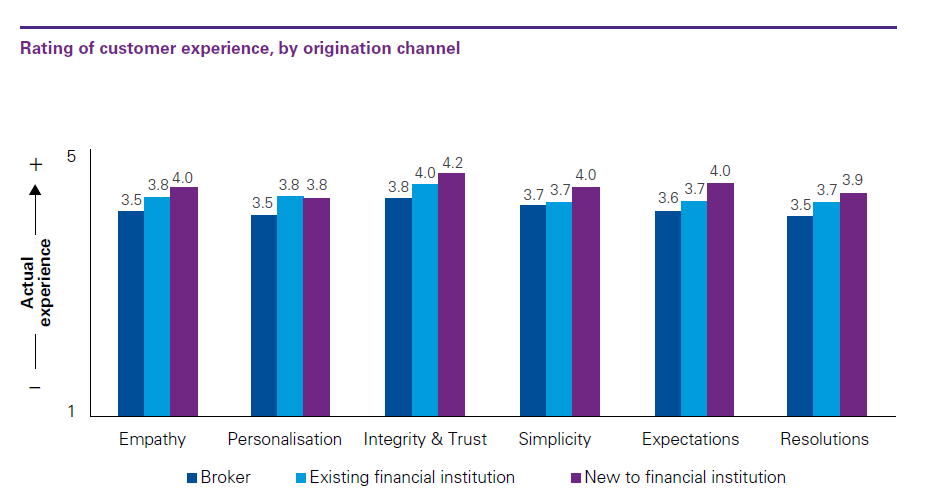

Borrowers who used a broker rated their experience as worse than those who used a bank, a new study by KPMG has found.

KPMG’s Mortgage Report surveyed 622 ‘mass affluent’ consumers - those earning between $70,000 - $250,000p.a - on their mortgage preferences. Existing borrowers who had used a broker rated their experience as worse than bank customers in all of KPMG’s six pillars of customer service: empathy, personalisation, integrity & trust, simplicity, expectations and resolutions.

44% of those surveyed by KPMG used a broker, below brokers' current market share of nearly 54%. KPMG noted the difference: “This is lower than the national average indicating an opportunity for banks to target mass affluent customers through their proprietary channels. “ Middle-aged consumers were more likely to use a broker (45%) than the under 30s (31%).

KPMG’s report is limited by the fact KPMG surveyed 622 of their own employees, thereby discounting the self-employed and business-owning clients who may have a particular reason to use a broker. Given KPMG is a financial services firm, it is questionable whether the level of financial knowledge of a KPMG employee can be taken as an Australian average.

MPA surveyed a number of income-groups in our Consumers on Brokers report and found some differences between the ‘mass affluent’ consumers and the rest. Those earning more than $80,000 were more prepared to do their entire mortgage application online: 38.5% would, as opposed to 28% of those earning less than $80,000. Other than that, MPA’s survey found no evidence that wealthier consumers were less likely to use a broker.

KPMG’s Mortgage Report also found that whilst 87% of their respondents used digital channels to research home loans, 45% preferred to apply in a branch. 61% of respondents renegotiated their home loan at least once every five years, showing the continued important of refinancing.

Borrowers who used a broker rated their experience as worse than those who used a bank, a new study by KPMG has found.

KPMG’s Mortgage Report surveyed 622 ‘mass affluent’ consumers - those earning between $70,000 - $250,000p.a - on their mortgage preferences. Existing borrowers who had used a broker rated their experience as worse than bank customers in all of KPMG’s six pillars of customer service: empathy, personalisation, integrity & trust, simplicity, expectations and resolutions.

44% of those surveyed by KPMG used a broker, below brokers' current market share of nearly 54%. KPMG noted the difference: “This is lower than the national average indicating an opportunity for banks to target mass affluent customers through their proprietary channels. “ Middle-aged consumers were more likely to use a broker (45%) than the under 30s (31%).

KPMG’s report is limited by the fact KPMG surveyed 622 of their own employees, thereby discounting the self-employed and business-owning clients who may have a particular reason to use a broker. Given KPMG is a financial services firm, it is questionable whether the level of financial knowledge of a KPMG employee can be taken as an Australian average.

MPA surveyed a number of income-groups in our Consumers on Brokers report and found some differences between the ‘mass affluent’ consumers and the rest. Those earning more than $80,000 were more prepared to do their entire mortgage application online: 38.5% would, as opposed to 28% of those earning less than $80,000. Other than that, MPA’s survey found no evidence that wealthier consumers were less likely to use a broker.

KPMG’s Mortgage Report also found that whilst 87% of their respondents used digital channels to research home loans, 45% preferred to apply in a branch. 61% of respondents renegotiated their home loan at least once every five years, showing the continued important of refinancing.