An obscure 1970s Japanese robotics professor helped explain why customers prefer real people instead of lifelike technology

An obscure 1970s Japanese robotics professor helped explain why customers prefer real people instead of lifelike technology

Customer relationship management, increasingly, is simply equated with improving technology and automating everything: send newsletters, follow up emails and even send out birthday cards, without us having to lift a finger.

More widely, the industry has certainly not lost faith in technology: 84% of lenders surveyed by Genworth believed sales through online channels would increase; the figure for mobile devices was 71%. That compared to 61% for the broker channel and a paltry 13% of lenders seeing potential in branches, according to the recently released ‘Home Grown’ report.

Automated systems are undoubtedly great for brokers’ time-management, but let’s not deceive ourselves: clients aren’t fooled so easily. That’s not to say they always dislike automated customer service, but it makes a huge difference how you present it to them, and that’s where the ‘uncanny valley’ comes in.

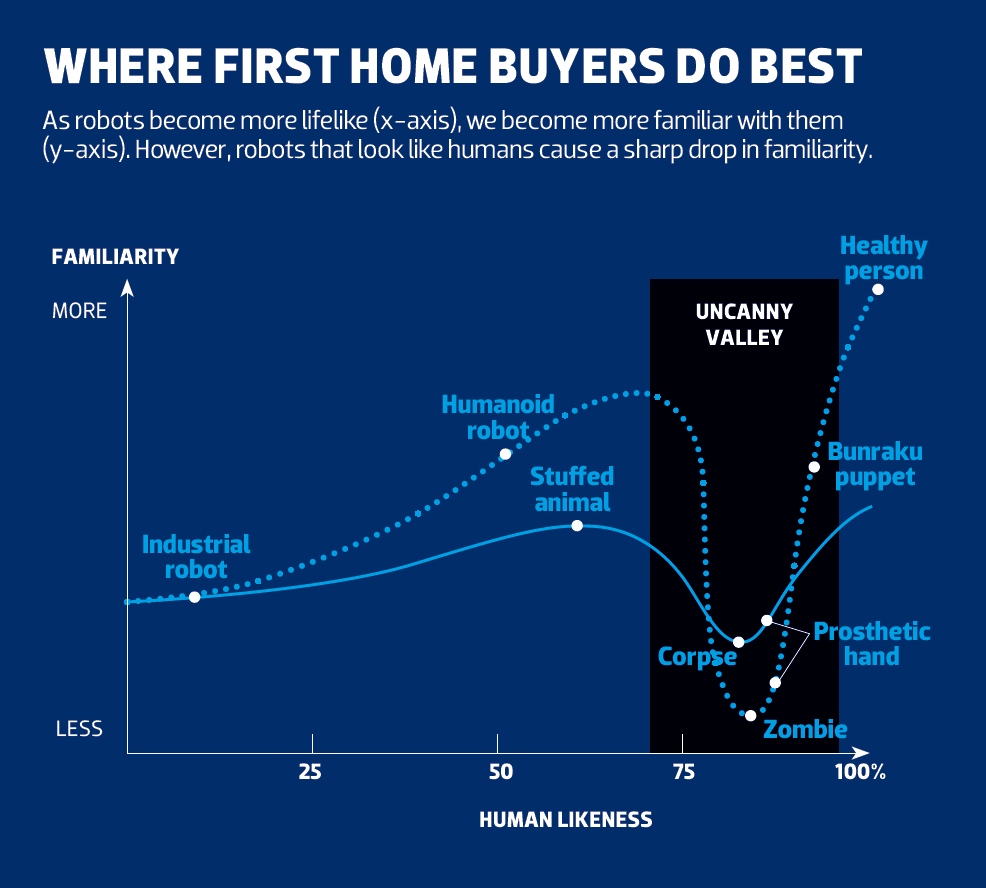

The uncanny valley describes the stage at which robotics begins to look ‘uncannily’ human. Masahiro Mori, a robotics professor at the Tokyo Institute of Technology, coined the term to describe the shift from affinity to revulsion as robots increasingly took on a life-like appearance. As Mori’s graph shows, we become more familiar with robots up to a point – but being too similar to humans freaks us out.

The example Mori uses is the prosthetic hand. It might look reasonably like a hand, Mori explains, but “when we realise the hand, which at first sight looked real, is in fact artificial, we experience an eerie sensation” – the uncanny valley. We have the technology to make a hand move, but cannot make its skin feel realistic: it is difficult to raise it from the uncanny valley to a human level. The conclusion, according to Mori, is “to create a safe level of affinity by deliberately pursuing a non-human design”.

How could this be relevant to CRM systems? Well, the fi rst step may be to separate tasks into human and computerised tasks. Entering addresses can be done through an online form, but a discussion of one’s financial situation is best suited to a human being, as it demands empathy and an ability to react.

Where First Home Buyers Do Best (Click to enlarge)

But more generally, Mori’s message has particular relevance to you as a broker; it urges you to emphasise the human element in your value proposition to customers. As banks retreat into smartphone apps and lifelike automated customer assistance helplines, rather than copy them, you can be that normal trustworthy person who rescues customers from the uncanny valley and provides real empathy and understanding.

Technology can still save you time, but don’t forget why customers come to you in the first place. Even as automated systems become easier to use, the gulf of the uncanny valley will protect the value of the human element, and brokers should be proud of that. So, next time you send out a birthday card, at least remember to sign it.

Source: based on Masahiro Mori ‘The Uncanny Valley’, as translated and adapted by associate professor Kahl F. MacDorman of Indiana University and journalist Norri Kageki for the IEEE Robotics and Automation Magazine