Brokers are working harder and working smarter, not just reaping the benefits of the property boom

Brokers are working harder and working smarter, not just reaping the benefits of the property boom

This week, MPA’s 10th annual Top 100 brokers report will be published, and as ever we hope the feature is faithful reflection of the industry at its best.

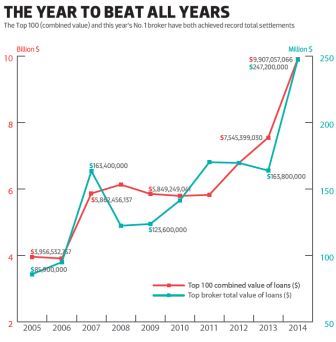

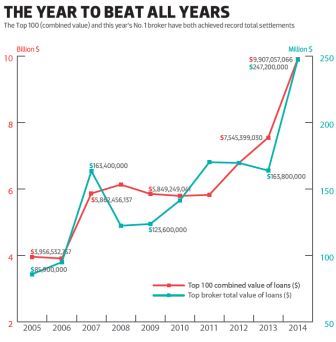

It is ultimately very difficult to quantify talent, and it would be doing a disservice to the pioneers of our industry to judge their contribution based on numbers alone. I do however believe that numbers, when compared over similar and successive years, are a clear indication of change – and the graph below should leave you in no doubt that something has changed considerably over the past year.

The obvious answer is the property market. 2014’s boom in house prices should put in context any statistics you hear this year, given they will inflate a broker’s settlement total. But the advantage of the Top 100 list – which combines statistical analysis with comments and interviews of the top 10 – is that it gives us a number of ways to analyse industry trends. Consider the following:

Perhaps that’s the main message I get from this year’s Top 100. The brokers in it could have happily ridden this year’s house prices and surpassed some records. Instead they have smashed records, by impressive margins, and there are a number of new entrants in the top 10. It’s the willingness to innovate which distinguishes these brokers, whatever the state of the market.

Find out who made MPA’s Top 100 report, sponsored by Westpac Broker Distribution, in MPA issue 14.12, on desks this week

This week, MPA’s 10th annual Top 100 brokers report will be published, and as ever we hope the feature is faithful reflection of the industry at its best.

It is ultimately very difficult to quantify talent, and it would be doing a disservice to the pioneers of our industry to judge their contribution based on numbers alone. I do however believe that numbers, when compared over similar and successive years, are a clear indication of change – and the graph below should leave you in no doubt that something has changed considerably over the past year.

The obvious answer is the property market. 2014’s boom in house prices should put in context any statistics you hear this year, given they will inflate a broker’s settlement total. But the advantage of the Top 100 list – which combines statistical analysis with comments and interviews of the top 10 – is that it gives us a number of ways to analyse industry trends. Consider the following:

26,486

That’s the number of loans written by Top 100 brokers in the 2013/14 financial year – a 25% rise on last year’s numbers. One broker wrote 722 loans in that timeframe. This extraordinary increase indicates that brokers are working harder and that lead generation methods may also be improving.$1,315,198

This number is the average value of each of the 133 loans written by one broker (bear in mind the Top 100 only takes into account residential business). The broker in question wasn’t riding a one-off mining-boom, but instead intensely specialising in broking for one professional group. Whether specialists or generalists, numbers like this one suggest brokers are working smarter than before.$247,205,639

This is the settlement total of 2014's no.1 broker. It’s an astounding number in itself, but I would urge you to read the interview on the same page. This broker attributes his success to two innovations; adopting a new social media network, and completely restructuring the way his support staff process loans. Yes, this broker has been blessed with a housing boom, but arguably, his willingness to identify new opportunities and put them in practice has made him stand out.Perhaps that’s the main message I get from this year’s Top 100. The brokers in it could have happily ridden this year’s house prices and surpassed some records. Instead they have smashed records, by impressive margins, and there are a number of new entrants in the top 10. It’s the willingness to innovate which distinguishes these brokers, whatever the state of the market.

Find out who made MPA’s Top 100 report, sponsored by Westpac Broker Distribution, in MPA issue 14.12, on desks this week