Gen Y buyers are now in the market, and they expect modern communications and financial coaching – not technological gimmickry.

MPA partnered with Commonwealth Bank to explore how you can engage the next generation.

Every generation claims to be misunderstood - we’ve all been the spotty teenager slamming the door on their clueless parents.

Yet we’re now reaching the point where misunderstanding of one generation is becoming a business problem; the spotty teenager has grown up to be the cashed-up client sitting right in front of you. It’s time to factor Generation Y into your brokerage’s strategy, or risk slamming the door on potential clients.

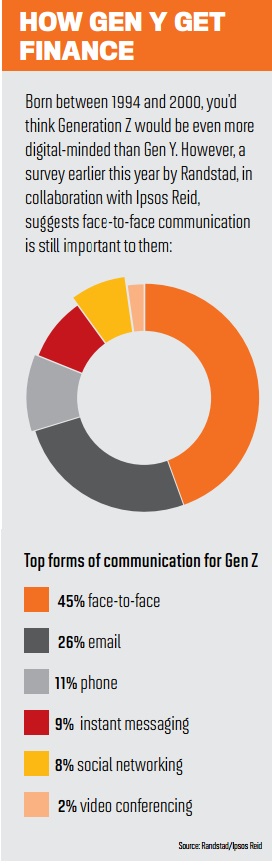

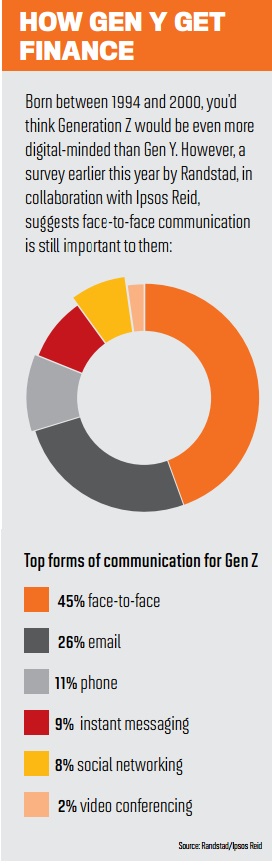

Wake up to Generation Y Oxford Dictionaries defines Generation Y as “the generation born in the 1980s and 1990s, comprising primarily the children of the Baby boomers and typically perceived as increasingly familiar with digital and electronic technology”. Take note of the dates: a Gen Y client could be aged 35 and own a string of investment properties by the time you meet them; most willat least be in their 20s. In fact, today’s children actually fall into another category, Generation Z.

At Commonwealth Bank, customer demographics are seen as a “pipeline”, explains Sam Boer, general manager of broker sales. “As one group moves to retirement, a new group is entering the market to start what will be a 40- to 50-year journey as savers, borrowers and investors.” As many brokers orient themselves towards a service-based proposition – as opposed to acting as a transactor for a single home loan – understanding the different generations’ requirements and marketing appropriately is not only forward-thinking, it’s essential.

At Commonwealth Bank, customer demographics are seen as a “pipeline”, explains Sam Boer, general manager of broker sales. “As one group moves to retirement, a new group is entering the market to start what will be a 40- to 50-year journey as savers, borrowers and investors.” As many brokers orient themselves towards a service-based proposition – as opposed to acting as a transactor for a single home loan – understanding the different generations’ requirements and marketing appropriately is not only forward-thinking, it’s essential.

It’s essential because there’s also a considerable transfer of wealth taking place, according to Boer. “Gen X and Y’s share of financial assets is expected to rise from 36% back in 2010 to 70% in 2030 – the next 15 years will see many Gen Y men and women entering the home loan market.”

Whilst Gen Y was hit hard by the GFC and housing affordability problems, property nevertheless remains important to them; Boer insists that “brokers who are developing their strategy for the future should be thinking about how they can work with and win these customers”.

Get your eyes off that screen

What’s also notable about the above-mentioned definition of Gen Y is the emphasis on “digital and electronic technology”. The relationship between this generation and their smartphones (and computers, tablets and smartwatches) is one of the most comprehensively misunderstood areas of marketing, and it is vital brokers consider the available statistics before blindly investing in digital tools.

Consider this: Four out of five Gen Y borrowers want to speak to a real person, faceto-face, for their home loan. Surprised? So were we, when we first read the “Banking on the Future: Expectations of the Gen Y Professional” report by professional services firm KPMG. The report surveyed 1,400 young KPMG employees about their expectations of different financial services and their favourite channels for different types of banking activity.

Home loans stuck out like a sore thumb – 79% of respondents would visit a branch to get a home loan, compared with just 11% going through online and mobile channels. In comparison, only 20% of respondents would go into a branch to apply for a

credit card.

For CBA’s Boer, the 79% figure is “great news for brokers” and not entirely surprising. “Buying a home is the largest, most important and often the most emotional purchase that someone can make. I think the need to take the utmost care and consideration is inherent and won’t necessarily change from generation to generation.” As use of brokers continues to grow, Boer believes “there is a huge opportunity for brokers who are able to position themselves to service this group”.

KPMG’s report certainly doesn’t mean digital channels are irrelevant; servicing Gen Y clients requires engagement through several platforms. For categories

like day-to-day banking, making a payment and changing details, respondents overwhelmingly preferred online channels. “Gen Y has learnt to expect highly sophisticated digital capabilities and shows little interest in anything less than seamless,” Boer says. “The research reflcts the experience at CommBank,

where we have more than 3 million active users on the CommBank app, which processes more than $2.5 billion in transactions a week.”

where we have more than 3 million active users on the CommBank app, which processes more than $2.5 billion in transactions a week.”

Interaction through online and mobile channels is no longer an optional value-add; it’s non-negotiable in the eyes of Gen Y consumers. When asked which banking features were most important to them, internet banking services, low fees and mobile/tablet banking service were the top three options chosen by respondents

in the KPMG report.

Given the dichotomy between preferred channels for home loans and other banking, CBA’s strategy is to offer their consumers their “channel of choice”.

That means investing in online home loan channels proactively, explains Boer. “Digital mortgage origination is growing but still low; however, we understand that preferences can quickly change, so we are working toward being able to deliver an end-to-end digital process.”

Financial coaching, not advice

Not only do Gen Y clients expect to deal with a broker using different channels, but they expect those dealings themselves to be different. One example of this involves social media, a muchhyped channel that can often be used in the wrong way. KPMG’s “Banking on the Future” report found 70% of respondents didn’t see themselves using social media for banking, a worrying find for brokers who spend time and money on their Facebook, Twitter and LinkedIn platforms.

However, whilst social media might not be an ideal forum for actual transactions, Boer believes its role is still significant with regard to customer insight, marketing and education. “Brokers can use these channels to build a reputation as an expert, which will create trust and opportunity to deepen the relationship with the Gen Y customer. The CommBank Blog has some fantastic articles and insights that brokers can use and share on their own platforms and channels.”

Beyond social media, brokers should be aware of Gen Y’s fundamentally different understanding of financial advice. KPMG’s report also asked about financial advice in the context of financial planning; however, the broader findings are still relevant to brokers. While 84% of Gen Y clients ‘do not need financial advice’, 65% ‘would like financial coaching to help them make smarter investment decisions’.

How can we make sense of these two statistics? It’s worth pointing out, in regard to the 84% figure, that KPMG’s respondents were young professionals working at an international firm; they may have been disproportionately financially literate, which may have led to them feeling like they didn’t need advice. It’s also possible that the wording of ‘financial advice’ is a problem, given the high-profile scandals involving financial planners in recent years.

Perhaps focusing on that interest in financial coaching would be a more constructive response to KPMG’s report, particularly as the idea of coaching fits better with a long-term, service-oriented approach. At a basic level, this involves making customers aware of the tools to help them manage wealth – Boer points to CommBank’s app and Netbank as examples.

Perhaps focusing on that interest in financial coaching would be a more constructive response to KPMG’s report, particularly as the idea of coaching fits better with a long-term, service-oriented approach. At a basic level, this involves making customers aware of the tools to help them manage wealth – Boer points to CommBank’s app and Netbank as examples.

It’s also possible that the proposition of a diversified one-stop-shop brokerage – with financial planners, buyer’s agents and the like – could find particular popularity with Gen Y clients. The key is to start early, Boer says. “There’s an opportunity for financial professionals like brokers to have that conversation with them about their savings plan and provide high-level home loan advice – but, more importantly, build that relationship early.”

Brokers who do go down such a path should take note, however: Gen Ys don’t appear willing to pay for financial coaching KPMG suggests. How much this applies to brokers is somewhat unclear, given most of the survey relates to financial planning and simple banking transactions rather than home loan advice, an area Gen Ys evidently continue to take seriously.

What brokers should note is that Gen Y wants to pay only for what they need, as one respondent described to KPMG: “a low-touch, low-cost product with fees and interest rates aligned to how much interaction I want (none) and the type of service I actually need (digital only).”

The broker’s generation of choice

With slogans abounding along the lines of ‘adapt or be left behind’, it can be easy to see Gen Y clients as a challenge, perhaps even a problem for established brokerages and their processes. Instead, Gen Y may be the generation that values brokers more than ever, for two reasons.

The first is that Gen Ys are more disloyal to lenders than ever; compared to KPMG’s 2012 survey, the proportion of financial professionals holding products at four or more banks has tripled, and the proportion using just one bank has reduced. Given Gen Ys are reluctant to rely entirely on online sources for their home loan, brokers will have the edge on

Every generation claims to be misunderstood - we’ve all been the spotty teenager slamming the door on their clueless parents.

Yet we’re now reaching the point where misunderstanding of one generation is becoming a business problem; the spotty teenager has grown up to be the cashed-up client sitting right in front of you. It’s time to factor Generation Y into your brokerage’s strategy, or risk slamming the door on potential clients.

Wake up to Generation Y Oxford Dictionaries defines Generation Y as “the generation born in the 1980s and 1990s, comprising primarily the children of the Baby boomers and typically perceived as increasingly familiar with digital and electronic technology”. Take note of the dates: a Gen Y client could be aged 35 and own a string of investment properties by the time you meet them; most willat least be in their 20s. In fact, today’s children actually fall into another category, Generation Z.

At Commonwealth Bank, customer demographics are seen as a “pipeline”, explains Sam Boer, general manager of broker sales. “As one group moves to retirement, a new group is entering the market to start what will be a 40- to 50-year journey as savers, borrowers and investors.” As many brokers orient themselves towards a service-based proposition – as opposed to acting as a transactor for a single home loan – understanding the different generations’ requirements and marketing appropriately is not only forward-thinking, it’s essential.

At Commonwealth Bank, customer demographics are seen as a “pipeline”, explains Sam Boer, general manager of broker sales. “As one group moves to retirement, a new group is entering the market to start what will be a 40- to 50-year journey as savers, borrowers and investors.” As many brokers orient themselves towards a service-based proposition – as opposed to acting as a transactor for a single home loan – understanding the different generations’ requirements and marketing appropriately is not only forward-thinking, it’s essential.It’s essential because there’s also a considerable transfer of wealth taking place, according to Boer. “Gen X and Y’s share of financial assets is expected to rise from 36% back in 2010 to 70% in 2030 – the next 15 years will see many Gen Y men and women entering the home loan market.”

Whilst Gen Y was hit hard by the GFC and housing affordability problems, property nevertheless remains important to them; Boer insists that “brokers who are developing their strategy for the future should be thinking about how they can work with and win these customers”.

Get your eyes off that screen

What’s also notable about the above-mentioned definition of Gen Y is the emphasis on “digital and electronic technology”. The relationship between this generation and their smartphones (and computers, tablets and smartwatches) is one of the most comprehensively misunderstood areas of marketing, and it is vital brokers consider the available statistics before blindly investing in digital tools.

Consider this: Four out of five Gen Y borrowers want to speak to a real person, faceto-face, for their home loan. Surprised? So were we, when we first read the “Banking on the Future: Expectations of the Gen Y Professional” report by professional services firm KPMG. The report surveyed 1,400 young KPMG employees about their expectations of different financial services and their favourite channels for different types of banking activity.

Home loans stuck out like a sore thumb – 79% of respondents would visit a branch to get a home loan, compared with just 11% going through online and mobile channels. In comparison, only 20% of respondents would go into a branch to apply for a

credit card.

For CBA’s Boer, the 79% figure is “great news for brokers” and not entirely surprising. “Buying a home is the largest, most important and often the most emotional purchase that someone can make. I think the need to take the utmost care and consideration is inherent and won’t necessarily change from generation to generation.” As use of brokers continues to grow, Boer believes “there is a huge opportunity for brokers who are able to position themselves to service this group”.

KPMG’s report certainly doesn’t mean digital channels are irrelevant; servicing Gen Y clients requires engagement through several platforms. For categories

like day-to-day banking, making a payment and changing details, respondents overwhelmingly preferred online channels. “Gen Y has learnt to expect highly sophisticated digital capabilities and shows little interest in anything less than seamless,” Boer says. “The research reflcts the experience at CommBank,

where we have more than 3 million active users on the CommBank app, which processes more than $2.5 billion in transactions a week.”

where we have more than 3 million active users on the CommBank app, which processes more than $2.5 billion in transactions a week.”Interaction through online and mobile channels is no longer an optional value-add; it’s non-negotiable in the eyes of Gen Y consumers. When asked which banking features were most important to them, internet banking services, low fees and mobile/tablet banking service were the top three options chosen by respondents

in the KPMG report.

Given the dichotomy between preferred channels for home loans and other banking, CBA’s strategy is to offer their consumers their “channel of choice”.

That means investing in online home loan channels proactively, explains Boer. “Digital mortgage origination is growing but still low; however, we understand that preferences can quickly change, so we are working toward being able to deliver an end-to-end digital process.”

Financial coaching, not advice

Not only do Gen Y clients expect to deal with a broker using different channels, but they expect those dealings themselves to be different. One example of this involves social media, a muchhyped channel that can often be used in the wrong way. KPMG’s “Banking on the Future” report found 70% of respondents didn’t see themselves using social media for banking, a worrying find for brokers who spend time and money on their Facebook, Twitter and LinkedIn platforms.

However, whilst social media might not be an ideal forum for actual transactions, Boer believes its role is still significant with regard to customer insight, marketing and education. “Brokers can use these channels to build a reputation as an expert, which will create trust and opportunity to deepen the relationship with the Gen Y customer. The CommBank Blog has some fantastic articles and insights that brokers can use and share on their own platforms and channels.”

Beyond social media, brokers should be aware of Gen Y’s fundamentally different understanding of financial advice. KPMG’s report also asked about financial advice in the context of financial planning; however, the broader findings are still relevant to brokers. While 84% of Gen Y clients ‘do not need financial advice’, 65% ‘would like financial coaching to help them make smarter investment decisions’.

How can we make sense of these two statistics? It’s worth pointing out, in regard to the 84% figure, that KPMG’s respondents were young professionals working at an international firm; they may have been disproportionately financially literate, which may have led to them feeling like they didn’t need advice. It’s also possible that the wording of ‘financial advice’ is a problem, given the high-profile scandals involving financial planners in recent years.

You can’t ignore the financial advice/financial coaching divide, however. Boer explained to MPA where he believes the difference lies: “Financial coaching focuses on education, growth and the decision-making process, as well as overcoming the obstacles that are keeping the customer from reaching their financial goals. It is a light touch, where the customer remains in control by learning how to manage their money smarter and make better-informed decisions, while also being held to account.”

Perhaps focusing on that interest in financial coaching would be a more constructive response to KPMG’s report, particularly as the idea of coaching fits better with a long-term, service-oriented approach. At a basic level, this involves making customers aware of the tools to help them manage wealth – Boer points to CommBank’s app and Netbank as examples.

Perhaps focusing on that interest in financial coaching would be a more constructive response to KPMG’s report, particularly as the idea of coaching fits better with a long-term, service-oriented approach. At a basic level, this involves making customers aware of the tools to help them manage wealth – Boer points to CommBank’s app and Netbank as examples.It’s also possible that the proposition of a diversified one-stop-shop brokerage – with financial planners, buyer’s agents and the like – could find particular popularity with Gen Y clients. The key is to start early, Boer says. “There’s an opportunity for financial professionals like brokers to have that conversation with them about their savings plan and provide high-level home loan advice – but, more importantly, build that relationship early.”

Brokers who do go down such a path should take note, however: Gen Ys don’t appear willing to pay for financial coaching KPMG suggests. How much this applies to brokers is somewhat unclear, given most of the survey relates to financial planning and simple banking transactions rather than home loan advice, an area Gen Ys evidently continue to take seriously.

What brokers should note is that Gen Y wants to pay only for what they need, as one respondent described to KPMG: “a low-touch, low-cost product with fees and interest rates aligned to how much interaction I want (none) and the type of service I actually need (digital only).”

The broker’s generation of choice

With slogans abounding along the lines of ‘adapt or be left behind’, it can be easy to see Gen Y clients as a challenge, perhaps even a problem for established brokerages and their processes. Instead, Gen Y may be the generation that values brokers more than ever, for two reasons.

The first is that Gen Ys are more disloyal to lenders than ever; compared to KPMG’s 2012 survey, the proportion of financial professionals holding products at four or more banks has tripled, and the proportion using just one bank has reduced. Given Gen Ys are reluctant to rely entirely on online sources for their home loan, brokers will have the edge on

comparison sites in providing a guide to an ever more complicated market.

The second reason is that brokers are better than ever, and Gen Ys will take notice. Gen Ys are coming of age (in financial terms) at a time when broking is more professional than ever and brokers offer more services than ever, so Gen Ys may be less likely than their parents to see you purely as a source for mortgages. In turn, you need to appreciate the diversity within Generation Y, utilising different channels to get in contact – but keep in mind that, like you, they appreciate the continuing value of face-to-face, trustworthy broking.

The second reason is that brokers are better than ever, and Gen Ys will take notice. Gen Ys are coming of age (in financial terms) at a time when broking is more professional than ever and brokers offer more services than ever, so Gen Ys may be less likely than their parents to see you purely as a source for mortgages. In turn, you need to appreciate the diversity within Generation Y, utilising different channels to get in contact – but keep in mind that, like you, they appreciate the continuing value of face-to-face, trustworthy broking.