Liberty’s acquisition of nMB has opened up a number of opportunities for the aggregator, managing director Gerald Foley tells MPA editor Sam Richardson

Liberty’s acquisition of nMB has opened up a number of opportunities for the aggregator, managing director Gerald Foley tells MPA editor Sam Richardson

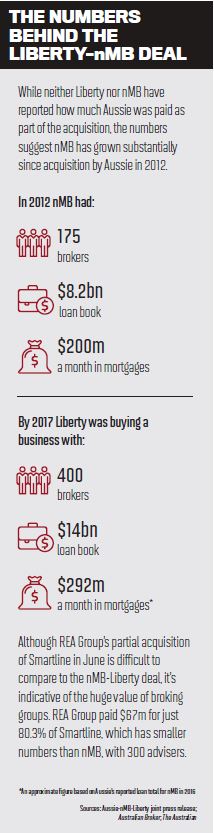

In a normal year, an established wholesale aggregator being bought by an ambitious non-bank lender would make waves in the industry. 2017, however, is not a normal year, and the purchase of nMB by Liberty from Aussie Home Loans has had to compete for the industry’s attention against commission changes, self-regulation, and another major acquisition, as REA Group has taken an 80% stake in Smartline. Yet nMB’s purchase by

Liberty both reflects and contributes to an extraordinary year in broking. Liberty’s interest in nMB did not come entirely come out of the blue, the aggregator’s managing director, Gerald Foley, explains. “They’ve always had a great affinity with, understanding of and relationship with the broker channel, so it makes sense at some point to have more commitment to that part of the industry, which is the only part they don’t do: they raise funds, manufacture products, have quite a broad range of products.”

The timing was certainly right for Liberty, which has profited greatly from the banks’ restrictions on lending to property investors. Furthermore, the two companies have a history – nMB has provided aggregation services to subaggregator Liberty Network Services for three years, and nMB’s office in Melbourne’s CBD is just a block away from Liberty’s.

Why nMB was up for sale at all is another interesting question. Aussie CEO James Symond told the industry that “while nMB has been a very positive contributor to the success of the Aussie Group, the future of Aussie’s long-term strategy is to concentrate solely on our own branded distribution footprint.”

Foley takes a similar view of Aussie’s approach: “In a toughening, changing market, [they needed] to really focus on their branded models.” Aussie is not only looking at the next three years but at its move to 100% bank ownership, with John Symond selling his remaining 20% shareholding to Commonwealth Bank in August.

As Foley told MPA himself in late 2015, “the types of brokers that are coming to [nMB] are very different to the types of brokers that are going to Aussie”. Indeed many in the industry will be surprised that a marriage of elite independent brokers and a controlling, brand-conscious national franchise managed to last for five years.

Foley prefers to look ahead, arguing that Liberty’s resources and appetite will benefit nMB members. “I think Liberty is, for the next three years, very interested in growing through brokers who operate under their own brands – with a massive growth phase ahead of them, not just through nMB but through the market in general.”

Name: Gerald Foley

Title: Managing director

Company: National Mortgage Brokers (nMB)

Years in the industry: 36

Career highlight: “When we sold nMB to Aussie, because it meant that a 10-year plan to build and grow a business resulted in a significantly known branded business identifying the value of the model that had been created and wanting to acquire us.”

Career lowlight: “Managing mortgages and products through the GFC, with all the impact it had on consumers and the market and a lot of uncertainty.”

“I think Liberty is, for the next three years, very interested in growing through brokers and growing through brokers who operate under their own brands”

Foley promises “business as usual” for nMB members over the next few months, yet the market he’s playing in is most unusual.

Like all aggregators, nMB has been told to collect more data about its members and consumer outcomes.

“The data is being collected in any event for loans being written,” Foley explains. “It’s just a matter of making sure we have more data stored on our platform and are reporting the data required.” nMB is making adjustments to its software platform to enable storing of data, although its business platform, nMB Pro, launched just last year, already integrates compliance requirements into the sales process.

Several banks have committed to taking action following the Sedgwick broker remuneration review, which called for commissions to be delinked from loan size by 2020, but according to Foley “there have been no real signals yet that there are going to be drastic changes to commission models, so my starting point is I’m not expecting that to happen … if a lender then decided ‘well, we’re going to focus more on proprietary and less on broker’ then brokers will take their business elsewhere; they will move”.

Now freed from CBA’s clutches, Foley is able to talk more openly about the challenges of vertical integration, but he’s also conscious that Liberty’s acquisition of nMB is itself an example of vertical integration.

“We have no plans to change our supplier panel by taking anyone off who may be in a competing space,” he insists.

“If anything I see a few new suppliers coming onto the panel; there’s more niches being created at the moment as the big banks get out of sectors.”

Foley sees three to four new lenders coming on board in niche areas such as commercial, reverse mortgages and development finance as banks increasingly abandon these areas. nMB brokers will not be paid extra for recommending Liberty products, and nMB and Liberty Network Services will remain separate brands.

Taking on new digital players

Backed up by Liberty, Foley can now put his long-term plans for nMB into action. nMB’s Broker 2020 strategy was developed before the acquisition, aiming to help both new and experienced members develop their businesses. New brokers will be given a helping hand getting started, while nMB will help mature businesses “take it to the next level and enjoy the fruits of their very hard work over many years”.

As nMB looks to grow, Liberty’s marketing capabilities will come in useful. Liberty is the current holder of the Australian Mortgage Award for Best Industry Advertising Campaign. The challenge, in Foley’s eyes, won’t be to overcome the banks but instead the new digital players such as Uno, Tik Tok and the online real estate giants. He sees nMB working with both traditional and digital-first brokers reacting to the disruption hitting the industry.

“There have been no real signals yet that there are going to be drastic changes to commission models, so my starting point is I’m not expecting that to happen”

This will require substantial assistance – and presumably investment – from nMB’s new owners. It’s for that reason the LibertynMB deal is significant, Foley concludes. “It gives really strong ownership, very clear support for the next three years, and I think people will certainly see over the next three years some really unique, strong and supportive brokers to help new brokers, and experienced and very experienced businesses as they go through the business cycle.”