CoreLogic research director Tim Lawless looks at the concerns about oversupply in some housing markets

CoreLogic research director Tim Lawless looks at the concerns about oversupply in some housing markets.

As Australia moves through the largest housing construction boom on record, debate around housing supply has intensified. The question is, are we building enough homes to house the growing population, and are we building the right types of homes that buyers desire?

The 12 months to October 2015 saw a record number of dwelling approvals across Australia, with almost 241,000 approvals over the period. While not every approval will proceed through to a commencement and ultimately completion, we can still expect the majority of these approvals will proceed, creating a surge in building activity over the coming year and subsequently a substantial addition to housing supply.

Importantly, approved housing supply is diverse across the regions and is also biased towards specific product types.

At the same time as dwelling approvals peaked, the proportional split between house approvals and unit approvals also reached a historic high at 50.5%. This is the first time on record that approvals for detached dwellings have been outnumbered by ‘other dwellings’, which include a mixture of low-rise, medium-rise and high-rise unit projects as well as townhouses. Clearly, the surge in unit approvals has been the primary driver of the swift upward trajectory in dwelling approvals. Detached dwellings have also seen an upswing; however, the number of approvals have been lower than what has been recorded over the peaks in previous building cycles.

Digging further into the approvals data shows that high-rise units are the fastest-growing segment of approvals. High-rise approvals have comprised more than 30% of all annual dwelling approvals since June last year.

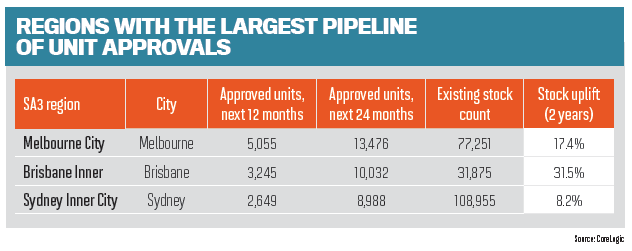

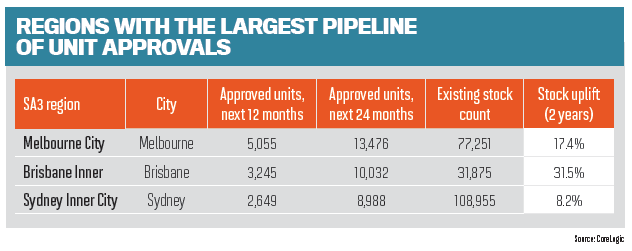

The CoreLogic settlement risk report identifies the inner-city areas of Melbourne,Brisbane and Sydney as the locations where the largest number of unit developments have been approved. Over the next two years, on the assumption that all unit projects proceed (which is unlikely), CoreLogic is expecting 13,476 new apartments to be settled across inner Melbourne, 10,032 across inner Brisbane and 8,988 across inner Sydney.

While the numbers look substantial, it’s important to view the supply additions in the context of the existing number of unit dwellings in the same region. The approved new supply represents a substantial uplift of 17.4% in unit numbers across inner Melbourne. In Brisbane, the approved supply would increase unit stock levels by almost one third; while in Sydney the supply additions are much more moderate, representing only an 8.2% uplift in unit stock.

In this context, the inner-city region facing the most substantial challenge in absorbing this approved apartment supply is likely to be Brisbane, where the supply pipeline is set to increase stock levels by almost one third.

Of course, not all these apartments will proceed, and CoreLogic will be updating the approved supply pipeline each month as more projects are added and some are withdrawn or reconfigured. Historically, the typical withdrawal rate for apartment projects has been approximately 15% (ie 85% of unit approvals proceed through to completion). There is a strong likelihood that the withdrawal rate will increase from the historical average as unit developers face tighter financing obligations or simply decide to delay or withdraw the project from the market due to concerns about high supply.

As Australia moves through the largest housing construction boom on record, debate around housing supply has intensified. The question is, are we building enough homes to house the growing population, and are we building the right types of homes that buyers desire?

The 12 months to October 2015 saw a record number of dwelling approvals across Australia, with almost 241,000 approvals over the period. While not every approval will proceed through to a commencement and ultimately completion, we can still expect the majority of these approvals will proceed, creating a surge in building activity over the coming year and subsequently a substantial addition to housing supply.

Importantly, approved housing supply is diverse across the regions and is also biased towards specific product types.

At the same time as dwelling approvals peaked, the proportional split between house approvals and unit approvals also reached a historic high at 50.5%. This is the first time on record that approvals for detached dwellings have been outnumbered by ‘other dwellings’, which include a mixture of low-rise, medium-rise and high-rise unit projects as well as townhouses. Clearly, the surge in unit approvals has been the primary driver of the swift upward trajectory in dwelling approvals. Detached dwellings have also seen an upswing; however, the number of approvals have been lower than what has been recorded over the peaks in previous building cycles.

Digging further into the approvals data shows that high-rise units are the fastest-growing segment of approvals. High-rise approvals have comprised more than 30% of all annual dwelling approvals since June last year.

"It’s important to view the supply additions in the context of the existing number of unit dwellings in the same region"

The important thing to remember about high-rise unit developments is that these projects are mostly confined to specific precincts, typically around the CBDs of the largest capital cities, and along key transport spines or around major working nodes such as office precincts, hospitals and universities.The CoreLogic settlement risk report identifies the inner-city areas of Melbourne,Brisbane and Sydney as the locations where the largest number of unit developments have been approved. Over the next two years, on the assumption that all unit projects proceed (which is unlikely), CoreLogic is expecting 13,476 new apartments to be settled across inner Melbourne, 10,032 across inner Brisbane and 8,988 across inner Sydney.

While the numbers look substantial, it’s important to view the supply additions in the context of the existing number of unit dwellings in the same region. The approved new supply represents a substantial uplift of 17.4% in unit numbers across inner Melbourne. In Brisbane, the approved supply would increase unit stock levels by almost one third; while in Sydney the supply additions are much more moderate, representing only an 8.2% uplift in unit stock.

In this context, the inner-city region facing the most substantial challenge in absorbing this approved apartment supply is likely to be Brisbane, where the supply pipeline is set to increase stock levels by almost one third.

Of course, not all these apartments will proceed, and CoreLogic will be updating the approved supply pipeline each month as more projects are added and some are withdrawn or reconfigured. Historically, the typical withdrawal rate for apartment projects has been approximately 15% (ie 85% of unit approvals proceed through to completion). There is a strong likelihood that the withdrawal rate will increase from the historical average as unit developers face tighter financing obligations or simply decide to delay or withdraw the project from the market due to concerns about high supply.