Returning to his role leading third party at Bankwest, Ian Rakhit has turned to technology, and a new style of management, to give the non-major an edge

.jpg)

Returning to his role leading third party at Bankwest, Ian Rakhit has turned to technology, and a new style of management, to give the non-major an edge

Over a 32-year career in lending, two years can pass in a blip – unless, that is, you work in Australia’s mortgage industry.

Brokers will know Ian Rakhit from his time leading Bankwest’s broker operation between 2010 and 2015, when Stewart Saunders took over the role. Saunders has now become general manager of strategy, risk and governance, and Rakhit has returned – as general manager third party – to a role and a bank that have changed substantially.

Rakhit has also returned to a changed playing field. With ASIC looking at broker incentives and APRA raising capital requirements – and thus interest rates – many of the old tools for an ambitious non-major to increase business are gone. Nor can Rakhit expect much help from Bankwest’s owners at Commonwealth Bank, which has had a torrid year in which its share of broker-originated loans fell for the first time in five years.

Bankwest cannot afford a similar trend: outside of Western Australia, brokers are far more important than the bank’s direct channel. It’s up to Rakhit to come up with a solution.

Self-service broker technology

Rakhit’s solution is technology. In November, Bankwest launched its redesigned broker website, intended to be a ‘one-stop shop’ for brokers.

The website brings together four practical tools for brokers. Rakhit is particularly enthusiastic about the home loan portal. “We believe this is quite a game changer,” he says, “as it gives the broker visibility of all their home loan customers with Bankwest.” Brokers can see details such as clients with expiring fixed rates, for instance, and that visibility extends to the home loan origination process through the website’s live application tracker.

“We’ve embarked on a new way of working, an agile methodology, which is very much around listening to your customers”

Much of the website automates what previously required a phone call, such as Bankwest’s pricing tool and the ability to order upfront valuations. Rakhit is conscious of catering to a mixed audience. “A lot of brokers like to self-service, and this is about giving them the tools to do that. But if the broker needs specific feedback, there are three options,” he says. These include broker support managers, who assist BDMs; the bank’s mortgage support team; and Bankwest’s online Broker Chat function. Agile in action

Agile in actionAs interesting as Bankwest’s new website is the way it was made. “Rather than bring out one all-encompassing new platform after two years of behind-the-scenes development, we’ve been bringing out new developments every few months,” Rakhit tells MPA.

Little of Bankwest’s new website is completely new; it is a combination of tools that were gradually released and tested with small groups of brokers.

“We’ve embarked on a new way of working, an agile methodology, which is very much around listening to your customers,” Rakhit explains. “Everything we’ve built on the Bankwest website is based upon broker feedback – working through an agile methodology that allows you to then create quickly, test quickly and implement quickly.”

Agile management emerged from the tech sector, in which developers would rush to complete small projects, yet Bankwest has applied the methodology just as well offline. This has manifested itself as straightforward, practical improvements.

To improve turnaround times, Rakhit says “we adopted around 18 months ago a very different way of processing home loans to what I believe others do”. Bankwest has introduced a single case owner model in response to broker concerns about files being handed between different staff members.

“In only my first two weeks in the role, every aggregator and every broker state manager I’ve talked to has talked about diversification”

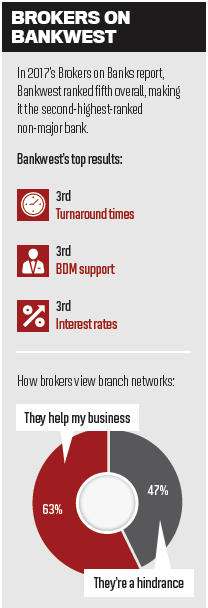

“That’s led to a massive improvement in our turnaround times, because the broker feels he’s working in partnership with the processor in order to make sure we get the right outcome,” Rakhit says. Consequently, Bankwest ranked in the top three for turnaround times in MPA’s 2017 Brokers on Banks report.Rakhit’s challenge

The agility Bankwest is bringing to broking has been well received by its existing brokers, but the real test will be whether Rakhit can encourage more brokers to choose the bank.

Agile management will not, for example, remove APRA’s restrictions on investor lending, although Rakhit insists “we’re absolutely open for business with investors” and vows to update the market in the reality. Rakhit does, however, intended to implement it by February of this year. “I see it as a real opportunity, and it’s driven by the brokers’ desire to diversify income.”

Above all, agile management will not help Bankwest escape a fiercely competitive lending landscape, a fact that Rakhit is mindful of. “As a bank that is significantly third party focused, we naturally need to play in those areas and those markets where price may be a factor,” he says.

But with Rakhit and his team rolling out a steady stream of practical, broker-centred improvements, Bankwest is becoming a fierce competitor.