MPA speaks to Michael Gottlieb about how brokers can protect themselves and their businesses

.jpg)

MPA speaks to Michael Gottlieb about how brokers can protect themselves and their businesses

Risk management is inherent to running any business, but especially in the world of mortgage broking. Brokers frequently place themselves in the fi ring line on multiple fronts. Yet even with their familiarity with finance, determining which insurance is best for their own business may feel like a daunting task. Brokers looking to secure their present and future business need to be aware of the importance of insurance, and to invest in it accordingly.

For Michael Gottlieb, founder and CEO of BizCover, providing businesses with insurance is more than a career – it’s a passion, one that involves him working closely with finance and mortgage brokers to offer detailed, industry-relevant policies. To date, BizCover has insured more than 2,500 mortgage and finance broker clients across Australia.

“There’s a multitude of circumstances that can give rise to a claim, and even if the broker is found to be not negligent, the costs involved in defending a claim alone are enough to send a broker out of business,” Gottlieb says.

“Even if the broker is found to be not negligent, the costs involved in defending a claim alone are enough to send a broker out of business” - Michael Gottlieb, BizCover

Underinsurance remains an issue, especially when it comes to cyber liability insurance, Gottlieb says. As threats of data security breaches proliferate, anyone who handles personal information – including mortgage and finance brokers – could become a gold mine for cyber criminals. Additionally, suffering computer or network downtime can have major ramifications for a business’s ability to operate and earn income.

“What many SMEs are failing to understand is the crippling effects of losing their entire network and all of their data,” Gottlieb says. “It’s estimated that the average cost of a single cyber attack for an Australian small business is around $10k, yet we’ve seen losses in excess of $90k by the time you add up forensic and data restoration costs, lost man hours and loss of revenue during the downtime.”

Brokers need to be asking whether they can afford to take that kind of risk. With the answer likely to be no, Gottlieb stresses that steps need to be taken to minimise that risk. An effective IT policy is the base to build from, with an appropriate cyber policy as back-up in the event of a cyber incident. “Cyber liability insurance seems like a no-brainer,” he says.

Protecting your reputation

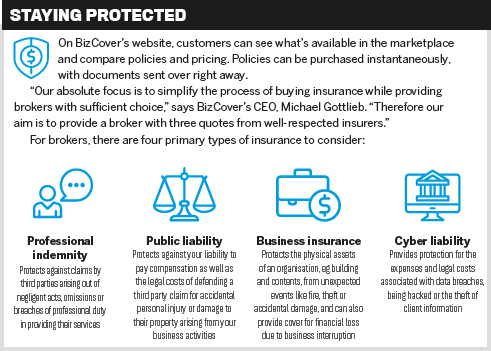

Professional indemnity insurance protects small businesses against losses that occur as a result of negligent acts, errors or omissions in providing their services. It is undoubtedly the most important form of insurance for finance and mortgage professionals.

One of the key benefit is that it not only covers the business against legal costs and claims by third parties for damage arising out of acts, omissions or breaches of professional duty, but it also protects the business financially if it is required to defend itself against such claims, including libel and slander.

“You don’t need to buy all forms of insurance, apart from compulsory professional indemnity cover, but you must purchase insurance to cover you when the financial risks of being uninsured are too large for you to manage,” Gottlieb says.

Are you protected by your aggregator?

While aggregators do sometimes arrange professional indemnity insurance that covers their individual brokers, this isn’t necessarily guaranteed.

“Whether or not a broker is covered by their aggregator’s insurance comes down to the agreement each aggregator has with its brokers,” Gottlieb says. “Typically, a broker would be required to operate under their own policy, but that’s a discussion each broker needs to have with their aggregator. However, irrespective of the agreement with the aggregator, it is the responsibility of the ACL to ensure they are adequately insured.”

The FBAA and the FBAA Code of Conduct dictate that brokers must have professional indemnity insurance, but there is considerable ambiguity around the specifics – the indemnity limit and the endorsements required are largely at the discretion of the individual broker. The MFAA sets clearer requirements, which can serve as useful guidelines for brokers who are unsure about their own needs.

Other considerations

Other things brokers should consider when they take out a policy are the indemnity limit; sub-limit amounts, like loss of documents or attendance at regulatory inquiries; whether the policy is inclusive or exclusive of costs; the run-o cover period; and the retroactive date.

“They should also be looking at the policy wording to check for any endorsements or exclusions that specifically exclude cover for the business activities they perform, and to also ensure it meets the Code of Practice requirements of their industry body,” Gottlieb says. “For example, MFAA requires a minimum of 12 months’ run-off cover, yet we offer up to seven years.”

Unfortunately, no one is immune from mistakes – and when a mistake occurs, it’s often the insurance policy that can keep a company in business. Having the right tools in place now is crucial to preventing issues in the future.