Australian businesses are struggling, giving debtor finance an important role in the broker’s toolkit

Debtor finance is not part of a broker’s core offering. Even for commercial brokers, debtor finance stands apart from their usual business, because debtor finance is not primarily about financing new purchases, but instead about a business’s day-to-day cash flow.

For brokers, that requires another shift in thinking: Debtor finance can become a long-term arrangement for a client, providing a long-term income stream and, crucially, keeping the broker in the

loop.

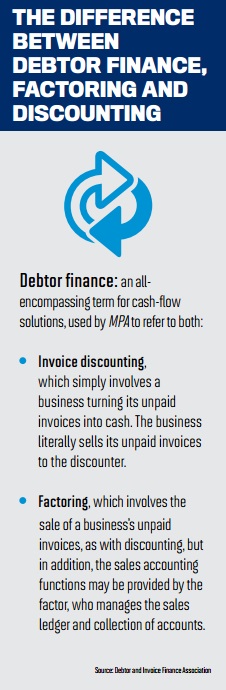

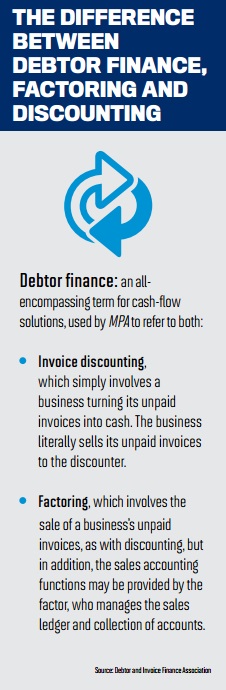

Debtor finance – which incorporates factoring and discounting – is essentially funding for businesses that need immediate cash whilst waiting for customers to pay up (the working capital gap). The funding is secured against the unpaid invoices, and addresses a problem endemic in business-to-business industries, where suppliers expect immediate payment but customers take weeks to settle what they owe. It’s very likely that some of your own clients experience a working capital gap, and as a broker, you could be their first point of contact with debtor finance.

Brokers’ role in debtor finance

Brokers’ role in debtor finance

Specialist lenders realise the critical role that brokers play, according to Peter Langham, Scottish Pacific CEO and chairman of the Debtor and Invoice Finance Association [DIFA], who spoke to MPA earlier this year.

“We know the role that brokers play,” he says. “For us at Scottish Pacific, close to 50% of our business will come from finance brokers. There are an increasing number of brokers who are becoming aware of debtor finance, and certainly within our organisation, we’re meeting new introducers every week … there’s a real focus by all debtor finance companies to say to brokers, ‘Here’s another way to bring in revenue.’”

That revenue is composed of upfront and often trail commission, ranging from 0.25–1% of the amount lent. Langham emphasises that debtor finance is particularly straightforward from the broker’s point of view: “For brokers, it’s an easy way of helping their client; all they need to do is call up the provider and tell the provider a few details about the business.”

There’s another reason for getting involved in debtor finance – and it’s not about making an easy buck. Providing debtor finance can be part of a long-term positioning play, transforming a broker’s role from one-time transactor to trusted financial advisor. Many clients never stop using debtor finance, says Langham, because it forms part of theirday-to-day business model. And for many SMEs, using debtor finance to keep the business running smoothly means other assets – like the owner’s home – can be freedup for further investment, guided by the broker.

The business context

The federal government’s 2015 budget made it quite evident how much small businesses are struggling, given its headline tax deduction for $20,000 worth of new purchases. According to NAB’s June Quarter SME Survey, the budget did make a difference to financial services firms, but harsh conditions in areas like manufacturing were unchanged.

It’s businesses like manufacturing that also struggle with cash flow – Bibby Financial’s March SME Barometer reported that 39.5% of respondents thought cash flow was more difficult to manage than 12 months ago.

MPA asked Bibby CEO Mark Cleaver to explain which industries are most in need of debtor finance. “The typical industries in which debtor finance tends to flourish is in the wholesale, transport, labour hire, manufacturing, construction and print sectors,” he notes, “[and] in 2015, we see subcontractors struggling to access the funding they require to complete stages of work.”

Meanwhile, DIFA’s March quarter statistical report listed wholesale trading as providing the biggest percentage of receivables (38%), followed by manufacturing (18%) and labour hire (10%).

Hand-in-hand with SMEs’ demand for debtor finance is a demand for financial advice. Bibby’s Barometer found 31.8% of respondents already use a financial advisor, whilst 30.3% intend to use one in the future. Medium-sized businesses were the most likely to use a financial advisor (34.8%). Whilst brokers may not be qualified to give full financial advice, facilitating access to debtor finance – and the structural advice that comes with factoring – makes them an essential resource for such SMEs.

How to spot a debtor finance client

Making the most of debtor finance is not about seeking out new clients, but about findingpotential clients within your own database. It’s about being able to recognise shifts in your clients’ financial situations and acting proactively, Cleaver explains: “Bibby’s most productive broker relationships are with advisors who are most aware of the triggers indicating cash-flow requirements for their clients.

“Key triggers for debtor finance are any form of shortfall in cash flow,” he continues. “If a client is experiencing fast growth, they will often be limited by their cash flow. The same applies when a client experiences seasonal demand on their products.”

Cleaver advises brokers to look at “the client’s cash-flow forecast, debtor’s ledger and creditors’ ledgers to investigate the creditor pressures and the aging of debtor payments”.

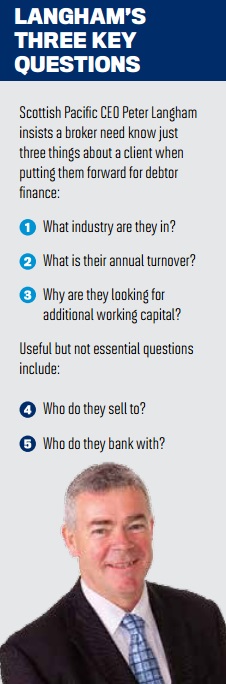

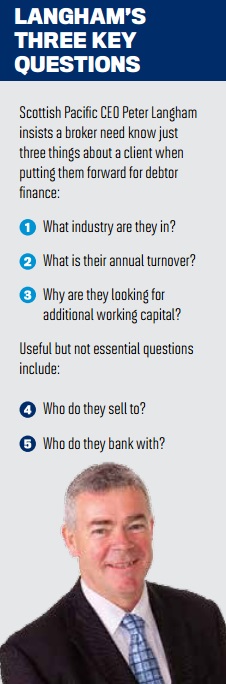

It’s necessary to understand and track these key triggers, but when it comes to applying for debtor finance, the broker doesn’t need a huge amount of information; lenders prefer to do much of the due diligence themselves, according to Langham. “Yes, they would like it prequalified in some way, but that can be done over the phone with the broker in five minutes,” he explains. If you’re able to answer his three core questions (see boxout on page 34) then “nine times out of 10, the provider should be able to say, ‘That looks suitable for our business; we’re happy to call them’”.

There are qualifications available for those wanting to learn more about debtor finance – the Australian Institute of Credit Management runs a two-day course on debtor finance – but neither Cleaver nor Langham believe they’re necessary. “We always encourage any broker who is unfamiliar with debtor finance to meet with one of our local BDMs for a face-to-face meeting,” Cleaver says. “In this meeting, we will work through a variety of illustrative case studies and provide collateral that can be used by the broker to position with their own clients.”

Both lenders say they can take varying degrees of involvement in the debtor finance process, dependent on the broker’s level of experience. August that the sector had now surpassed its pre-GFC peak, providing $60 billion worth of funding to businesses.

Commercial brokers should consider debtor finance an additional tool, one whose potentially long-term nature makes it more ‘sticky’, keeping the client with the broker. Residential brokers should see it as a relatively easy way to assist small business owners, and keep in mind its potential to free up capital for property investment purposes. Finally, all brokers should consider engaging with what is a growing industry with a real hunger for new business.

For brokers, that requires another shift in thinking: Debtor finance can become a long-term arrangement for a client, providing a long-term income stream and, crucially, keeping the broker in the

loop.

Debtor finance – which incorporates factoring and discounting – is essentially funding for businesses that need immediate cash whilst waiting for customers to pay up (the working capital gap). The funding is secured against the unpaid invoices, and addresses a problem endemic in business-to-business industries, where suppliers expect immediate payment but customers take weeks to settle what they owe. It’s very likely that some of your own clients experience a working capital gap, and as a broker, you could be their first point of contact with debtor finance.

Brokers’ role in debtor finance

Brokers’ role in debtor financeSpecialist lenders realise the critical role that brokers play, according to Peter Langham, Scottish Pacific CEO and chairman of the Debtor and Invoice Finance Association [DIFA], who spoke to MPA earlier this year.

“We know the role that brokers play,” he says. “For us at Scottish Pacific, close to 50% of our business will come from finance brokers. There are an increasing number of brokers who are becoming aware of debtor finance, and certainly within our organisation, we’re meeting new introducers every week … there’s a real focus by all debtor finance companies to say to brokers, ‘Here’s another way to bring in revenue.’”

That revenue is composed of upfront and often trail commission, ranging from 0.25–1% of the amount lent. Langham emphasises that debtor finance is particularly straightforward from the broker’s point of view: “For brokers, it’s an easy way of helping their client; all they need to do is call up the provider and tell the provider a few details about the business.”

There’s another reason for getting involved in debtor finance – and it’s not about making an easy buck. Providing debtor finance can be part of a long-term positioning play, transforming a broker’s role from one-time transactor to trusted financial advisor. Many clients never stop using debtor finance, says Langham, because it forms part of theirday-to-day business model. And for many SMEs, using debtor finance to keep the business running smoothly means other assets – like the owner’s home – can be freedup for further investment, guided by the broker.

The business context

The federal government’s 2015 budget made it quite evident how much small businesses are struggling, given its headline tax deduction for $20,000 worth of new purchases. According to NAB’s June Quarter SME Survey, the budget did make a difference to financial services firms, but harsh conditions in areas like manufacturing were unchanged.

It’s businesses like manufacturing that also struggle with cash flow – Bibby Financial’s March SME Barometer reported that 39.5% of respondents thought cash flow was more difficult to manage than 12 months ago.

MPA asked Bibby CEO Mark Cleaver to explain which industries are most in need of debtor finance. “The typical industries in which debtor finance tends to flourish is in the wholesale, transport, labour hire, manufacturing, construction and print sectors,” he notes, “[and] in 2015, we see subcontractors struggling to access the funding they require to complete stages of work.”

Meanwhile, DIFA’s March quarter statistical report listed wholesale trading as providing the biggest percentage of receivables (38%), followed by manufacturing (18%) and labour hire (10%).

Hand-in-hand with SMEs’ demand for debtor finance is a demand for financial advice. Bibby’s Barometer found 31.8% of respondents already use a financial advisor, whilst 30.3% intend to use one in the future. Medium-sized businesses were the most likely to use a financial advisor (34.8%). Whilst brokers may not be qualified to give full financial advice, facilitating access to debtor finance – and the structural advice that comes with factoring – makes them an essential resource for such SMEs.

How to spot a debtor finance client

Making the most of debtor finance is not about seeking out new clients, but about findingpotential clients within your own database. It’s about being able to recognise shifts in your clients’ financial situations and acting proactively, Cleaver explains: “Bibby’s most productive broker relationships are with advisors who are most aware of the triggers indicating cash-flow requirements for their clients.

“Key triggers for debtor finance are any form of shortfall in cash flow,” he continues. “If a client is experiencing fast growth, they will often be limited by their cash flow. The same applies when a client experiences seasonal demand on their products.”

Cleaver advises brokers to look at “the client’s cash-flow forecast, debtor’s ledger and creditors’ ledgers to investigate the creditor pressures and the aging of debtor payments”.

It’s necessary to understand and track these key triggers, but when it comes to applying for debtor finance, the broker doesn’t need a huge amount of information; lenders prefer to do much of the due diligence themselves, according to Langham. “Yes, they would like it prequalified in some way, but that can be done over the phone with the broker in five minutes,” he explains. If you’re able to answer his three core questions (see boxout on page 34) then “nine times out of 10, the provider should be able to say, ‘That looks suitable for our business; we’re happy to call them’”.

There are qualifications available for those wanting to learn more about debtor finance – the Australian Institute of Credit Management runs a two-day course on debtor finance – but neither Cleaver nor Langham believe they’re necessary. “We always encourage any broker who is unfamiliar with debtor finance to meet with one of our local BDMs for a face-to-face meeting,” Cleaver says. “In this meeting, we will work through a variety of illustrative case studies and provide collateral that can be used by the broker to position with their own clients.”

Both lenders say they can take varying degrees of involvement in the debtor finance process, dependent on the broker’s level of experience. August that the sector had now surpassed its pre-GFC peak, providing $60 billion worth of funding to businesses.

Commercial brokers should consider debtor finance an additional tool, one whose potentially long-term nature makes it more ‘sticky’, keeping the client with the broker. Residential brokers should see it as a relatively easy way to assist small business owners, and keep in mind its potential to free up capital for property investment purposes. Finally, all brokers should consider engaging with what is a growing industry with a real hunger for new business.