Corelogic RP Data’s head of broker solutions explains how brokers can make the most of their reports, and why data needs to be relevant

Corelogic RP Data’s head of broker solutions explains how brokers can make the most of their reports, and why data needs to be relevant

MPA: From Corelogic’s perspective, how should brokers react to the cooling of Australia’s property market?

Matt Carlson: We think that the existing clients and prospects of the brokers will be looking for more guidance and advice, so that really means having access to real time information to inform and guide those times they may be a bit nervous or wanting some more information about what exactly is happening and what we’re seeing on the headlines.

The reason we think this is important is brokers might be aware of those facts but also that client or prospect on the street probably doesn’t have the same level of information the broker does and it’s a real opportunity for the broker to show their professionalism and work through the ups and downs.

A professional broker will understand not everyone has the same level of information and experience as them and that’s where they can really leverage their knowledge to create that advice and be a professional in the eyes of their client, and hopefully in the eyes of prospects as well. With potentially cooling markets, acquisitions could become more difficult, so [brokers] need to be more focused and working on their lead generation so acquisition of new clients is even more important in those times too.

MPA: What are the most important Corelogic RP Data indices and reports for brokers to follow?

MC: I think we mainly talk about the more bespoke ones rather than the indices, which can be quite broad. The suburb profile reports give the broker the ability to provide in-depth analysis on the suburbs that the client is looking at; to be the local expert and give confidence to that client or prospective borrower. The housing and general economic reports are always good to add context or understand values across a state, and not just to give a client numbers, but to give that broader context and back that up with a more local view on where a client wants to buy or currently lives.

Another one that we think is really valuable, especially with the current investor activity, is the rental indexes, which provides estimates of the yield and good input on serviceability, so when a broker is trying to work on current deals with investors it gives them additional information to settle the client, or understand where current opportunities might be.

MPA: Do we pay too much attention to national housing statistics?

MPA: Do we pay too much attention to national housing statistics?

MC: I don’t think we pay too much attention to those, because they do set the context, lenders’ policies and things like that. That’s what people focus on, but for the broker that localised information is going to be far more useful to the client but you still need to know what’s going on at a national or state level.

MPA: Does the broker have a role in interpreting and explaining your housing market reports?

MC: We believe our reports are consumerbased, as well as being [useful] for professionals in the market. The broker has a big role to play in giving that understanding of the industry and they should be that conduit between all the information that exists and what is relevant to the client. They have a role to play in bringing the facts down to the level of an individual or family to inform them about where they’re going to live or where they’re going to invest.

MPA: How can brokers present housing data to clients – especially when the picture it presents could be negative?

MC: My view on this is to be as transparent as possible, because it can be quite an emotional purchase, obviously, buying a home. But you need to present the facts, and not be afraid of doing that, and I think that’s the role of a professional to be there in the ups and the downs, and to make sure they’re presenting it as transparently as possible because that’s part of the advice process.

Also provide examples: the broker can provide comparable examples of that particular suburb, that number of bedrooms and bathrooms, sales in the last couple of months to support that transparency as well.

MPA: How should brokers view longerterm housing market predictions?

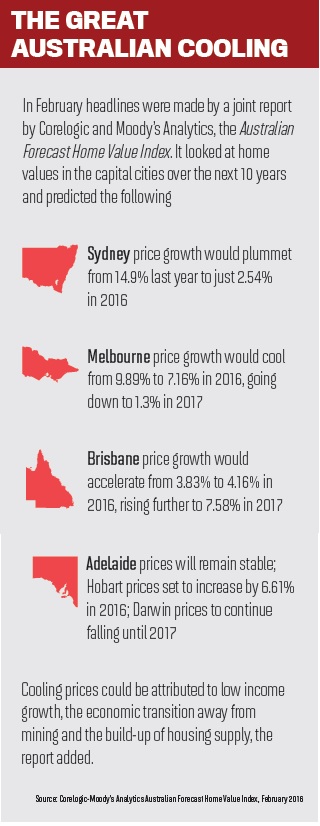

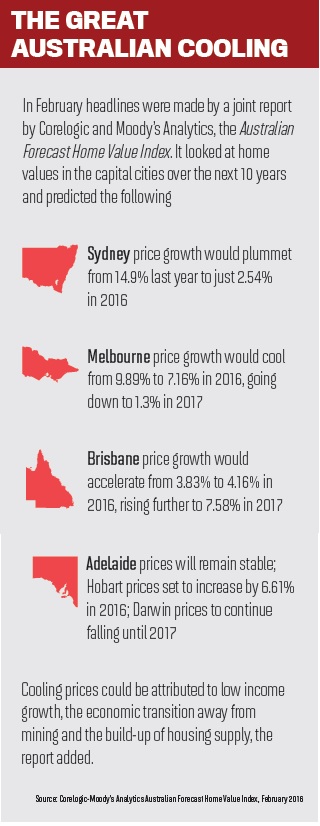

MC: The forecasts are just another element to help brokers inform their clients around decisions that ultimately the client is making; the broker is not making that decision, they’re helping the client keep informed. The futurefacing indices, such as the recent Corelogic – Moody’s Analytics report, are a good collection of tools, but it’s about giving a good opinion of what’s likely to happen – the important bit there is likely to happen – there is no tool that will tell you exactly what will happen. It’s about helping set that context, and as a good broker should know, talking to clients about investment decisions, they are long-term investment decisions, so the consumer should be looking at that longerterm view.

MPA: How can brokers use Corelogic’s services as they look to diversify their businesses beyond residential mortgages?

MC: When it comes to diversification there are a lot of things brokers can be involved in, but we’ve been thinking specifically around the commercial side. Corelogic has recently acquired Cordell Connect, and what that means is brokers now specialising in commercial finance or going into that field can access a lot more information on commercial projects or developments happening in their area, right from the planning through to construction phases. That means there’s much more intelligence they can provide along those lines, so Cordell enables us and brokers with that information to build relationships with developers or organise funding opportunities around those developments. So that’s how we think about diversification outside residential mortgages; there’s a big groundswell of commercial brokers.

Cordell Connect won’t just gather information about the value of the development, but about the planning stages long before it’s been built. Cordell is an information gathering part of our business focused on what happens before it gets sold and hits the secondary markets; it’s about giving those involved in those industries the heads-up on what’s going on in their local market but also broadly across Australia; it’s a very valuable piece of business which we now own.

Once brokers build that relationship, the development is finished and the developer needs to sell the units off into the market, then all of a sudden the broker has the

opportunity to provide finance to the end consumer who’s potentially buying that apartment in the new block.

It’s a separate service; it’ll be under the Corelogic umbrella, but our flagship product RP Data will remain as is, which is focused on property data, report and insights; this will be an additional add-on product which our clients and prospects can purchase. Cordell is an existing offering, but now we’ve acquired it we’re working on a whole integration, ensuring that our clients are aware of all the benefits of Cordell Connect so they can take advantage of it.

MPA: Will Corelogic be launching any products over the next 12 months, and how would you like Corelogic to be perceived by brokers a year from now?

MC: I want to focus on one new service. We are developing a new mobile application specifically for brokers, which is all about improving the interface around the services they may already be using. Developing a mobile solution to that is one of our key goals over the next 12 months. That’ll cover off a broad range of themes, but it is a broker specific tool; we know brokers are on the road all the time and we know having information at your fingertips will be really useful over the next 12 months.

The way we would like to be perceived by the broker community is we want to be known as a key partner across the mortgage industry, trusted for our information, and not just for providing a lot of data at your fingertips, but for ‘actionable insights’. That’s a term that we really want to be known for, because it’s not just information or data but it’s the things that help you retain business, grow your business, and acquire new clients.

We want to be there for all the housing market cycles, not just the positive parts; that also means we’re there for the brokers own’ business cycles. You have brokers that are new to the market; we want to be there, helping them. You have brokers which are more mature and more interested in retention… Corelogic is there as a partner, not just providing reports or a tool, but integrated into their business processes.

MPA: From Corelogic’s perspective, how should brokers react to the cooling of Australia’s property market?

Matt Carlson: We think that the existing clients and prospects of the brokers will be looking for more guidance and advice, so that really means having access to real time information to inform and guide those times they may be a bit nervous or wanting some more information about what exactly is happening and what we’re seeing on the headlines.

The reason we think this is important is brokers might be aware of those facts but also that client or prospect on the street probably doesn’t have the same level of information the broker does and it’s a real opportunity for the broker to show their professionalism and work through the ups and downs.

A professional broker will understand not everyone has the same level of information and experience as them and that’s where they can really leverage their knowledge to create that advice and be a professional in the eyes of their client, and hopefully in the eyes of prospects as well. With potentially cooling markets, acquisitions could become more difficult, so [brokers] need to be more focused and working on their lead generation so acquisition of new clients is even more important in those times too.

MPA: What are the most important Corelogic RP Data indices and reports for brokers to follow?

MC: I think we mainly talk about the more bespoke ones rather than the indices, which can be quite broad. The suburb profile reports give the broker the ability to provide in-depth analysis on the suburbs that the client is looking at; to be the local expert and give confidence to that client or prospective borrower. The housing and general economic reports are always good to add context or understand values across a state, and not just to give a client numbers, but to give that broader context and back that up with a more local view on where a client wants to buy or currently lives.

Another one that we think is really valuable, especially with the current investor activity, is the rental indexes, which provides estimates of the yield and good input on serviceability, so when a broker is trying to work on current deals with investors it gives them additional information to settle the client, or understand where current opportunities might be.

MPA: Do we pay too much attention to national housing statistics?

MPA: Do we pay too much attention to national housing statistics?MC: I don’t think we pay too much attention to those, because they do set the context, lenders’ policies and things like that. That’s what people focus on, but for the broker that localised information is going to be far more useful to the client but you still need to know what’s going on at a national or state level.

MPA: Does the broker have a role in interpreting and explaining your housing market reports?

MC: We believe our reports are consumerbased, as well as being [useful] for professionals in the market. The broker has a big role to play in giving that understanding of the industry and they should be that conduit between all the information that exists and what is relevant to the client. They have a role to play in bringing the facts down to the level of an individual or family to inform them about where they’re going to live or where they’re going to invest.

MPA: How can brokers present housing data to clients – especially when the picture it presents could be negative?

MC: My view on this is to be as transparent as possible, because it can be quite an emotional purchase, obviously, buying a home. But you need to present the facts, and not be afraid of doing that, and I think that’s the role of a professional to be there in the ups and the downs, and to make sure they’re presenting it as transparently as possible because that’s part of the advice process.

Also provide examples: the broker can provide comparable examples of that particular suburb, that number of bedrooms and bathrooms, sales in the last couple of months to support that transparency as well.

MPA: How should brokers view longerterm housing market predictions?

MC: The forecasts are just another element to help brokers inform their clients around decisions that ultimately the client is making; the broker is not making that decision, they’re helping the client keep informed. The futurefacing indices, such as the recent Corelogic – Moody’s Analytics report, are a good collection of tools, but it’s about giving a good opinion of what’s likely to happen – the important bit there is likely to happen – there is no tool that will tell you exactly what will happen. It’s about helping set that context, and as a good broker should know, talking to clients about investment decisions, they are long-term investment decisions, so the consumer should be looking at that longerterm view.

MPA: How can brokers use Corelogic’s services as they look to diversify their businesses beyond residential mortgages?

MC: When it comes to diversification there are a lot of things brokers can be involved in, but we’ve been thinking specifically around the commercial side. Corelogic has recently acquired Cordell Connect, and what that means is brokers now specialising in commercial finance or going into that field can access a lot more information on commercial projects or developments happening in their area, right from the planning through to construction phases. That means there’s much more intelligence they can provide along those lines, so Cordell enables us and brokers with that information to build relationships with developers or organise funding opportunities around those developments. So that’s how we think about diversification outside residential mortgages; there’s a big groundswell of commercial brokers.

Cordell Connect won’t just gather information about the value of the development, but about the planning stages long before it’s been built. Cordell is an information gathering part of our business focused on what happens before it gets sold and hits the secondary markets; it’s about giving those involved in those industries the heads-up on what’s going on in their local market but also broadly across Australia; it’s a very valuable piece of business which we now own.

Once brokers build that relationship, the development is finished and the developer needs to sell the units off into the market, then all of a sudden the broker has the

opportunity to provide finance to the end consumer who’s potentially buying that apartment in the new block.

It’s a separate service; it’ll be under the Corelogic umbrella, but our flagship product RP Data will remain as is, which is focused on property data, report and insights; this will be an additional add-on product which our clients and prospects can purchase. Cordell is an existing offering, but now we’ve acquired it we’re working on a whole integration, ensuring that our clients are aware of all the benefits of Cordell Connect so they can take advantage of it.

MPA: Will Corelogic be launching any products over the next 12 months, and how would you like Corelogic to be perceived by brokers a year from now?

MC: I want to focus on one new service. We are developing a new mobile application specifically for brokers, which is all about improving the interface around the services they may already be using. Developing a mobile solution to that is one of our key goals over the next 12 months. That’ll cover off a broad range of themes, but it is a broker specific tool; we know brokers are on the road all the time and we know having information at your fingertips will be really useful over the next 12 months.

The way we would like to be perceived by the broker community is we want to be known as a key partner across the mortgage industry, trusted for our information, and not just for providing a lot of data at your fingertips, but for ‘actionable insights’. That’s a term that we really want to be known for, because it’s not just information or data but it’s the things that help you retain business, grow your business, and acquire new clients.

We want to be there for all the housing market cycles, not just the positive parts; that also means we’re there for the brokers own’ business cycles. You have brokers that are new to the market; we want to be there, helping them. You have brokers which are more mature and more interested in retention… Corelogic is there as a partner, not just providing reports or a tool, but integrated into their business processes.