Yellow Brick Road Holdings is going through a major restructuring, and its new heads of wealth management and lending claim brokers at both YBR and Vow will benefit

Yellow Brick Road Holdings is going through a major restructuring, and its new heads of wealth management and lending claim brokers at both YBR and Vow will benefit

MPA: How will this restructuring improve the Yellow Brick Road Group for the brokers and fi nancial planners on the ground?

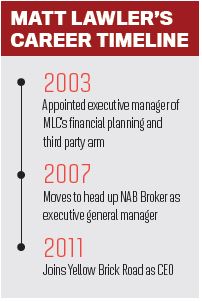

MATT LAWLER: Last year we bought a couple of companies and we’ve been spending a long time integrating them. Integration takes a long time, because you’ve not only got to integrate the functional areas but also the cultures and people. That’s what last year was really focused on.

Last year the mortgage market was really fi ring, so we were also concentrated on mortgages. What we did do was we didn’t give wealth as much focus as we needed to. Going forward, the wealth strategy is really critical across both YBR and Vow as well, because wealth is going to be a really important blend into what we’re doing in mortgages. Mortgages still need to grow; we’ve got new brokers coming on in Vow and new branches in YBR, so we’ve still got an aggressive agenda to build mortgages, but we also want to grow wealth.

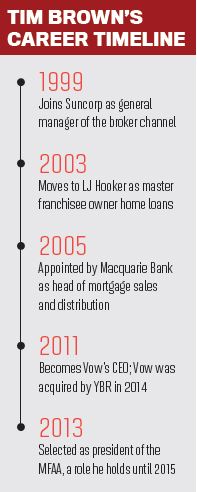

Tim [Brown] has a long and successful background in mortgages; I’ve had a long history in wealth as well, so it’s really about reorganising the resources or the skill bases to really concentrate and go deep on some of the things we need to do. Tim’s job is to grow mortgages across both YBR and Vow, refocus on wealth, and make sure that the wealth business is growing, not just at market but exponentially.

TIM BROWN: It’s also playing to each other’s strengths; it’s what we’re good at, and we’ve proven that consistently.

MPA: Does this process of pushing wealth mean resources will be allocated away from the broking side?

ML: It’s not about cost-cutting or anything like that; it’s about growth, and Tim’s team is all in place and continues to be in place. However, the wealth team is all about focusing and growing. We don’t imagine we’ll be ‘robbing Peter to pay Paul’, but what we will be doing is working out where additional resources need to come in to grow the business overall.

TB: A good analogy is we’re like a five-year old sitting in pyjamas meant for a seven-yearold. So we’ve got room for growth. We don’t need more infrastructure; we just need a lot more revenue in both sides of the business. We can grow exponentially without putting on a lot more resources.

MPA: By making diversified brokerages – those offering broking and financial planning – now report to two different managers, aren’t you increasing their workload?

ML: The important thing is how me and Tim work together, and we have no intention of creating two separate silos in wealth and lending. When we talk to the broker, when we talk to the branches, we’re talking as the YBR group, we’re talking as one organisation, and we’re going to be very coordinated in how we do that.'There is a simple fact that if you’re doing two different things with clients there are two different sets of requirements, but our job is to actually make complex things simple.

ML: The important thing is how me and Tim work together, and we have no intention of creating two separate silos in wealth and lending. When we talk to the broker, when we talk to the branches, we’re talking as the YBR group, we’re talking as one organisation, and we’re going to be very coordinated in how we do that.'There is a simple fact that if you’re doing two different things with clients there are two different sets of requirements, but our job is to actually make complex things simple.

An example of that would be integrating a lot of what we do on the wealth side into the technology brokers are already using. We’ve done that with a couple of products we’ve launched recently, particularly our Loan Protect product, which is a life insurance product. It’s been integrated into the brokerage software Vow are using; it’s been integrated into the broker platform that YBR branches have used. In doing that, we figure out how we allow the broker branches to do wealth without overburdening them with the paperwork and the complexities that could exist.

Tim’s going to be pushing wealth and I’m going to be pushing mortgages in the same conversation. None of us walk away from what we’re doing with the business overall; we’re actually aligned in that.

TB: This isn’t a new structure; a lot of the banks have a similar type of structure and it seems to work well for them. I’m not using them as a benchmark; I think we can always do better because we’re more flexible, we’re more coordinated, and we’ve got less of the legacy systems that’ll hold us back. For those reasons we can make it efficient and simple, and they will utilise it.

MPA: This seems to be a huge step in combining YBR and Vow. Tim, how will you reassure Vow brokers that you’ll remain a separate proposition?

TB: Those brands will stay. The wholesale offer and the retail offer are still very separated, and we’re not looking to change those at all. You come to YBR because you want a brand and structured support to help you build your business. At Vow it’s more about helping them with systems, compliance, commissions, efficiency, and giving them small templated marketing support … we’re not intending to blend those, but it’s about using the infrastructure we’ve got up top, especially in the wealth area … so it’s giving Vow brokers more support, in improving their wealth offers, and helping train and develop brokers who want that in their business.

But we’re not saying to Vow brokers, “You must take up wealth”. That’s not why they joined Vow ... we’ve been saying in Vow for a long time, since when I took over the leadership, that it’s about improving the annuity incomes from their business – and this plays perfectly into that strategy – and supporting them to get greater value and diversification into their business to make it recession-proof. But also, when the time comes to settle, they’ll get a bigger margin on their business because they’ve got more forms of income coming in.

from their business – and this plays perfectly into that strategy – and supporting them to get greater value and diversification into their business to make it recession-proof. But also, when the time comes to settle, they’ll get a bigger margin on their business because they’ve got more forms of income coming in.

ML: I don’t think there’s any argument that this isn’t the right thing for the clients. The average home loan is $400,000, and that’s a huge debt to take on if something goes wrong. It’s not necessarily about full financial planning but about ensuring that they’re at least covered to meet that risk they’re taking on.

MPA: Last year Vow significantly increased its numbers – will this level of recruitment continue, given the push on the wealth side of the YBR group?

TB: My mandate is to continue the growth; it’s not to slow it down, change it, do anything other than keeping it growing at the current rate. And I don’t see anything in the foreseeable future that’s going to change that ... Our numbers haven’t dropped off over the last quarter; they’re as strong as ever, and YBR’s numbers are growing more strongly.

MPA: What role are YBR’s white label products going to play in your consumer marketing over the coming year?

TB: Rate is one part of the equation, but so is value, and so is delivery. It’s important we give the best offer in the market. There’s a lot of discounted rates as you know, which we call honeymoon rates; ours is not one of those. The second component is loading it with fees and hiding the true comparison rate; and again, I think YBR has been strong in making sure the comparison rate is the same as the interest rate. We use the four majors as a benchmark, and when we come up with a white label rate we want to make sure it’s always under the majors, and that won’t change. We’ll continue to deliver all the features and benefits the four majors offer in terms of delivery. The good thing for us is that banks continue to do a bad job when delivering, and continue to hide fees. We won’t; we’re very upfront about that. I think as long as we continue to do that we’ll continue to advance.

MPA: Why did Vow develop a mentoring program, and will it be available to YBR brokers?

MPA: Why did Vow develop a mentoring program, and will it be available to YBR brokers?

TB: The mentoring program was developed because we realised there were a lot of people who wanted to join the industry, and there are a lot of mentoring programs out there, and some are priced at a point people can’t commit to. We were concerned that there was an opportunity to take those people on at a greater margin to Vow and potentially take someone on who would take that on as a fulltime role. So we appointed Adam Flint, who used to be the national trainer for Loan Market, and his job is to mentor new brokers to industry for two years as they move into the industry … we’re going to offer that program to YBR, but we’re just going to finalise what that looks like and how we’ll cover our costs; it will be offered to YBR.

In Vow it’s fully operational. We’ve got our first 10 through; we’ve got another 10 that are about to start next week, and we’ll bring on 10 each corner.

MPA: Matt, where do you want the wealth side of the business to be 12 months from now?

ML: I think getting momentum in the wealth space is really the focus; it’s getting a certain percentage of conversion for the Yellow Brick Road business, because YBR has been on this journey for quite a while. We already have people doing it; it’s about getting that universally used within the business – that’s really my focus with YBR. Vow will have the introductory products, like Loan Protect, which is the life insurance which attaches to the mortgage; that’s where we’ll be concentrating. However, there are some large brokerages within Vow that have been approaching us and saying, “We really want to introduce financial planning to our business, but we don’t know how. Can you help us out?” So I imagine by the end of the year we’ll also have a number of Vow businesses that also have financial planning that’s been integrated into their businesses, and we’ve been helping them project manage that.

MPA: Tim, where do you want the lending side of the business to be 12 months from now?

TB: I think obviously continuing the current growth rate, which will probably be more challenging this year than last year. That’s for two reasons: obviously the property market has begun to show signs of slowing, and I think also ASIC’s going to give us a lot more scrutiny; and add to that, who knows what APRA will do over the next 12 months in terms of lending? So, all those challenges will make that difficult, but in saying that, we don’t see anything changing; we’ll continue the growth rates where they are.

MPA: How will this restructuring improve the Yellow Brick Road Group for the brokers and fi nancial planners on the ground?

MATT LAWLER: Last year we bought a couple of companies and we’ve been spending a long time integrating them. Integration takes a long time, because you’ve not only got to integrate the functional areas but also the cultures and people. That’s what last year was really focused on.

Last year the mortgage market was really fi ring, so we were also concentrated on mortgages. What we did do was we didn’t give wealth as much focus as we needed to. Going forward, the wealth strategy is really critical across both YBR and Vow as well, because wealth is going to be a really important blend into what we’re doing in mortgages. Mortgages still need to grow; we’ve got new brokers coming on in Vow and new branches in YBR, so we’ve still got an aggressive agenda to build mortgages, but we also want to grow wealth.

Tim [Brown] has a long and successful background in mortgages; I’ve had a long history in wealth as well, so it’s really about reorganising the resources or the skill bases to really concentrate and go deep on some of the things we need to do. Tim’s job is to grow mortgages across both YBR and Vow, refocus on wealth, and make sure that the wealth business is growing, not just at market but exponentially.

TIM BROWN: It’s also playing to each other’s strengths; it’s what we’re good at, and we’ve proven that consistently.

MPA: Does this process of pushing wealth mean resources will be allocated away from the broking side?

ML: It’s not about cost-cutting or anything like that; it’s about growth, and Tim’s team is all in place and continues to be in place. However, the wealth team is all about focusing and growing. We don’t imagine we’ll be ‘robbing Peter to pay Paul’, but what we will be doing is working out where additional resources need to come in to grow the business overall.

TB: A good analogy is we’re like a five-year old sitting in pyjamas meant for a seven-yearold. So we’ve got room for growth. We don’t need more infrastructure; we just need a lot more revenue in both sides of the business. We can grow exponentially without putting on a lot more resources.

MPA: By making diversified brokerages – those offering broking and financial planning – now report to two different managers, aren’t you increasing their workload?

ML: The important thing is how me and Tim work together, and we have no intention of creating two separate silos in wealth and lending. When we talk to the broker, when we talk to the branches, we’re talking as the YBR group, we’re talking as one organisation, and we’re going to be very coordinated in how we do that.'There is a simple fact that if you’re doing two different things with clients there are two different sets of requirements, but our job is to actually make complex things simple.

ML: The important thing is how me and Tim work together, and we have no intention of creating two separate silos in wealth and lending. When we talk to the broker, when we talk to the branches, we’re talking as the YBR group, we’re talking as one organisation, and we’re going to be very coordinated in how we do that.'There is a simple fact that if you’re doing two different things with clients there are two different sets of requirements, but our job is to actually make complex things simple.An example of that would be integrating a lot of what we do on the wealth side into the technology brokers are already using. We’ve done that with a couple of products we’ve launched recently, particularly our Loan Protect product, which is a life insurance product. It’s been integrated into the brokerage software Vow are using; it’s been integrated into the broker platform that YBR branches have used. In doing that, we figure out how we allow the broker branches to do wealth without overburdening them with the paperwork and the complexities that could exist.

Tim’s going to be pushing wealth and I’m going to be pushing mortgages in the same conversation. None of us walk away from what we’re doing with the business overall; we’re actually aligned in that.

TB: This isn’t a new structure; a lot of the banks have a similar type of structure and it seems to work well for them. I’m not using them as a benchmark; I think we can always do better because we’re more flexible, we’re more coordinated, and we’ve got less of the legacy systems that’ll hold us back. For those reasons we can make it efficient and simple, and they will utilise it.

MPA: This seems to be a huge step in combining YBR and Vow. Tim, how will you reassure Vow brokers that you’ll remain a separate proposition?

TB: Those brands will stay. The wholesale offer and the retail offer are still very separated, and we’re not looking to change those at all. You come to YBR because you want a brand and structured support to help you build your business. At Vow it’s more about helping them with systems, compliance, commissions, efficiency, and giving them small templated marketing support … we’re not intending to blend those, but it’s about using the infrastructure we’ve got up top, especially in the wealth area … so it’s giving Vow brokers more support, in improving their wealth offers, and helping train and develop brokers who want that in their business.

But we’re not saying to Vow brokers, “You must take up wealth”. That’s not why they joined Vow ... we’ve been saying in Vow for a long time, since when I took over the leadership, that it’s about improving the annuity incomes

from their business – and this plays perfectly into that strategy – and supporting them to get greater value and diversification into their business to make it recession-proof. But also, when the time comes to settle, they’ll get a bigger margin on their business because they’ve got more forms of income coming in.

from their business – and this plays perfectly into that strategy – and supporting them to get greater value and diversification into their business to make it recession-proof. But also, when the time comes to settle, they’ll get a bigger margin on their business because they’ve got more forms of income coming in.ML: I don’t think there’s any argument that this isn’t the right thing for the clients. The average home loan is $400,000, and that’s a huge debt to take on if something goes wrong. It’s not necessarily about full financial planning but about ensuring that they’re at least covered to meet that risk they’re taking on.

MPA: Last year Vow significantly increased its numbers – will this level of recruitment continue, given the push on the wealth side of the YBR group?

TB: My mandate is to continue the growth; it’s not to slow it down, change it, do anything other than keeping it growing at the current rate. And I don’t see anything in the foreseeable future that’s going to change that ... Our numbers haven’t dropped off over the last quarter; they’re as strong as ever, and YBR’s numbers are growing more strongly.

MPA: What role are YBR’s white label products going to play in your consumer marketing over the coming year?

TB: Rate is one part of the equation, but so is value, and so is delivery. It’s important we give the best offer in the market. There’s a lot of discounted rates as you know, which we call honeymoon rates; ours is not one of those. The second component is loading it with fees and hiding the true comparison rate; and again, I think YBR has been strong in making sure the comparison rate is the same as the interest rate. We use the four majors as a benchmark, and when we come up with a white label rate we want to make sure it’s always under the majors, and that won’t change. We’ll continue to deliver all the features and benefits the four majors offer in terms of delivery. The good thing for us is that banks continue to do a bad job when delivering, and continue to hide fees. We won’t; we’re very upfront about that. I think as long as we continue to do that we’ll continue to advance.

MPA: Why did Vow develop a mentoring program, and will it be available to YBR brokers?

MPA: Why did Vow develop a mentoring program, and will it be available to YBR brokers?TB: The mentoring program was developed because we realised there were a lot of people who wanted to join the industry, and there are a lot of mentoring programs out there, and some are priced at a point people can’t commit to. We were concerned that there was an opportunity to take those people on at a greater margin to Vow and potentially take someone on who would take that on as a fulltime role. So we appointed Adam Flint, who used to be the national trainer for Loan Market, and his job is to mentor new brokers to industry for two years as they move into the industry … we’re going to offer that program to YBR, but we’re just going to finalise what that looks like and how we’ll cover our costs; it will be offered to YBR.

In Vow it’s fully operational. We’ve got our first 10 through; we’ve got another 10 that are about to start next week, and we’ll bring on 10 each corner.

MPA: Matt, where do you want the wealth side of the business to be 12 months from now?

ML: I think getting momentum in the wealth space is really the focus; it’s getting a certain percentage of conversion for the Yellow Brick Road business, because YBR has been on this journey for quite a while. We already have people doing it; it’s about getting that universally used within the business – that’s really my focus with YBR. Vow will have the introductory products, like Loan Protect, which is the life insurance which attaches to the mortgage; that’s where we’ll be concentrating. However, there are some large brokerages within Vow that have been approaching us and saying, “We really want to introduce financial planning to our business, but we don’t know how. Can you help us out?” So I imagine by the end of the year we’ll also have a number of Vow businesses that also have financial planning that’s been integrated into their businesses, and we’ve been helping them project manage that.

MPA: Tim, where do you want the lending side of the business to be 12 months from now?

TB: I think obviously continuing the current growth rate, which will probably be more challenging this year than last year. That’s for two reasons: obviously the property market has begun to show signs of slowing, and I think also ASIC’s going to give us a lot more scrutiny; and add to that, who knows what APRA will do over the next 12 months in terms of lending? So, all those challenges will make that difficult, but in saying that, we don’t see anything changing; we’ll continue the growth rates where they are.