Pepper is undergoing a major change as Mario Rehayem takes a strategic managing director role and Aaron Milburn steps into his place. MPA asks whether brokers will still have a place at the non-bank

Pepper is undergoing a major change as Mario Rehayem takes a strategic managing director role and Aaron Milburn steps into his place. MPA asks whether brokers will still have a place as the non-bank becomes an international force

In a climate of regulatory uncertainty, many brokers and lenders have avoided the limelight, putting off plans and curbing their ambitions. That’s not the case at Pepper. MPA visited Pepper’s brand-new office in North Sydney the day after they posted after-tax profit of $61m, an increase of 26% that includes a 36% jump in Australian originations. Now in Australia, New Zealand, the UK, Ireland, Spain and Korea, Pepper is a non-bank with a reach beyond the wildest dreams of most Australian banks.

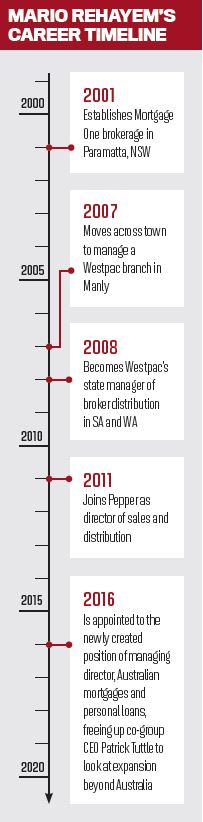

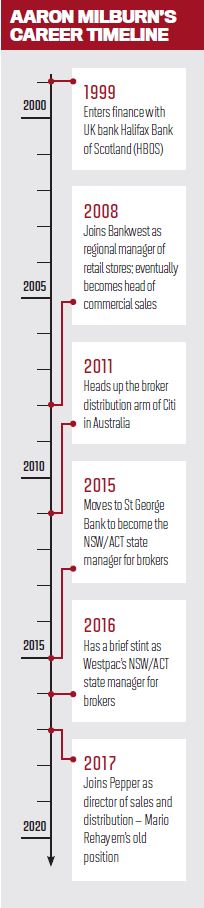

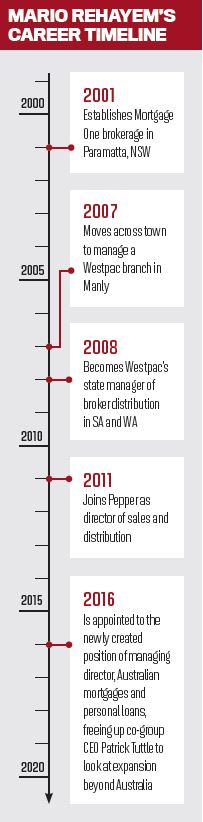

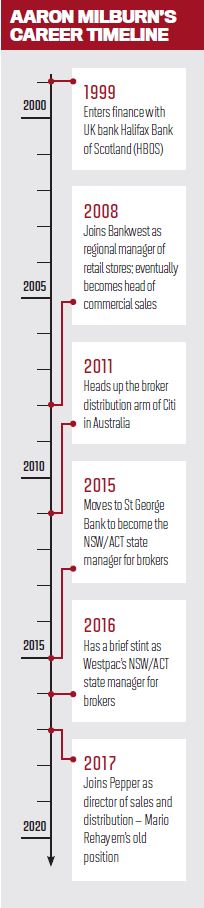

The reason you may not have noticed Pepper’s emerging global brand is that, unlike many Australian lenders, Pepper has enjoyed a degree of stability in the broker channel. Mario Rehayem has headed sales and distribution since 2011, before being appointed in October to the new role of managing director of Australian mortgages and personal loans. In January, Aaron Milburn, previously of Westpac, St George and Citi, stepped into Rehayem’s old role directing sales and distribution.

Rehayem sees his new role as a natural consequence of Pepper’s growth. “I’m not saying we weren’t aligned previously,” he says, “but having a managing director who is physically in the business 24/7 allows us to be a little more focused in our growth and strategy for the Australian business.” Previously, Patrick Tuttle managed the Australian business whilst being co-CEO of Pepper, and the whole executive team pitched in to help; as Rehayem quips: “It’s hard to envisage from outside how a business could function without a managing director – well, there was; there were about 10 of them.”

Dividing up management roles was necessary for Pepper to grow further, Rehayem says, but he’s determined that Pepper won't degenerate into feuding departments seen at large banks. Rehayem’s role, for instance, demands a ‘cradle to grave’ understanding of all facets of lending, including treasury and credit.

“That’s the beauty of our business,” Rehayem says. “We don’t have siloing; we don’t have turf wars like many other finance and corporate businesses. With us, we know we have one team, and we’re aiming for one result together as a team.”

Unfinished business

Unfinished business

For the last six years, the result Pepper has been working to achieve is raising awareness of non-conforming lending through roadshows, online education courses and constant media commentary. Under Milburn, whose background is in prime lending, that’s not going to change.

“I’ve spent 18 years in major banking organisations,” he says. “There’s one thing that unites them all, and that’s trying to help people achieve their dream of home ownership. Pepper puts another lens on that.

It takes people whose dream couldn’t be realised by a major institution and gives them a second chance.”

There is a strong economic argument for Pepper’s awareness strategy. From 2011 to 2016, the number of brokers using Pepper’s products grew from around 700 to almost 3,000, excluding Pepper’s white label products. Many of those brokers are first-time users, Rehayem says.

“We’re seeing a direct correlation with a growth in our volumes, again by double digits,” he says. “That shows the course of business we’ve taken in the third-party channel is working, but it’s a slow burn, and dare I say it’s a very expensive way to go out and build business.” Despite the increase in numbers, Rehayem adds, “it’d be wrong for us to take the foot off the pedal in lifting that awareness, and the reason for that is that would spell a business that is complacent.”

In fact, Pepper is expanding its awareness strategy. Milburn, who brings to the organisation deep experience in direct-toconsumer marketing, believes consumer awareness has a long way to go.

On the consumer side, Pepper already runs radio adverts and sponsors AFL’s St Kilda, the A-League’s Western Sydney Wanderers, and NRL’s Penrith Panthers; in February, the company also started doing TV commercials. Consumers are beginning to respond, Rehayem says.

“Brokers say when they recommend a Pepper product, people have some sort of affiliation to the brand, as opposed to the ‘Pepper who?’ statements they used to get five or six years ago.”

Rehayem admits that this strategy comes at a cost, though. “Unfortunately for the bean counters in the business, that’s going to ratchet up; it’s not going to go down,” he says. “It has to come from the two channels. I can only see us spending more money.”

Overcoming the barriers to entry

It’s one thing to know that non-conforming options are out there; it's another to actually offer them to clients. Pepper has made a number of efforts to make its applications simpler over the years – introducing a single application form for all products, for instance – but non-conforming continues to be viewed as a niche area, which doesn’t always work well in a traditional brokerage and may be too difficult for early-career brokers. To deal with those difficulties, Pepper has long had a scenario and support team in place for brokers. It’s something that Rehayem would like to make more efficient.

“We service thousands of calls and emails on a monthly basis, with brokers contacting us to help them with a scenario they may have, and we help them construct deals,” he says. “That’s becoming more and more a demand from the brokers. The reason for that is we’re getting more and more brokers who are firsttime users … and there’s no other lender that has that kind of support mechanism for them.”

One major pain point is screening, Rehayem adds. “The first barrier of entry is when a broker sits in front of a customer and pre-screens them through predominantly the lens of a bank or non-bank. They quickly prescreen the customer and say, ‘Sorry, I can’t help you’ … 90% of those brokers don’t tend to run the lens of a non-conforming lender as part of their process.”

This year will see Pepper attempt to solve this problem through the introduction of a digital product selector tool. The tool will ensure that “any interview that is done in that broker’s office will give a solution, where possible, to that family in front of them”, Milburn says, by suggesting in real time during the interview, a suitable Pepper product for the customer.

Rehayem sees Pepper’s tool potentially levelling the field between more and less experienced brokers. “It takes two minutes, less than eight questions, and you’re done,” he says. “Whether you’re inexperienced or don’t understand non-conforming products doesn’t matter, because a tool does the work for you.”

Rehayem sees Pepper’s tool potentially levelling the field between more and less experienced brokers. “It takes two minutes, less than eight questions, and you’re done,” he says. “Whether you’re inexperienced or don’t understand non-conforming products doesn’t matter, because a tool does the work for you.”

Rehayem and Milburn believe that by providing automated advice, the digital selector tool will also help take pressure of Pepper’s support team. As of February, the tool was not yet launched, although Milburn indicated that brokers would be able to use it this year. “We’re in the pilot phase now,” he says. “We’ll take the learnings from the pilot and roll out through 2017.”

The digital selector tool will be accompanied by a new personal loan product with no establishment or ongoing fees, which is currently being marketed to consumers but will be rolled out to brokers and eventually in a white label format, Rehayem says.

Although there are no plans for other new products, one area that may see more focus under Milburn’s leadership is lending to the self-employed. “Non-conforming is about non-conforming income as well,” he says. “It’s interesting – mortgage brokers have nonconforming income as well. Sports stars, celebrities, seasonal workers have nonconforming income … some brokers view it like commercial lending or SMSF – they sort of understand it, but it's too hard. My goal, Mario’s goal and Pepper’s goal is to dispel the myths and make it more the norm.”

An ear to the ground

Pepper’s biggest change in 2017 won’t be about products, however, but about listening. Even as the non-bank looks courts consumers in Australia and beyond, Milburn wants to get closer to brokers with a series of roundtables. Starting in March, events in every state will enable brokers to sit across from Pepper’s heads of product, credit, treasury and marketing, with cooperation throughout the year.

“We’re inviting users and non-users of Pepper to come and help our business construct new policies and products we’re seeing a need for in the marketplace,” Milburn says.

And, he adds, any changes Pepper does make in the broker space will be based on broker feedback. “The market moves, and any lender who thinks they can roll out last year’s strategy into this year is fundamentally incorrect, in my opinion. It’d be remiss of me to come up with a strategy without consulting my business partners. So any decision under my leadership that we make here will be in consultation with our brokers, because that’s the only way we’re going to deliver product into the market that’ll best suit their clients.”

With Rehayem's new role as managing director providing vastly extended authority, he's looking at Pepper’s processes; he picks out the support team and turnaround times as particular targets for improvement.

One area where Rehayem is comfortable is Pepper’s reputation in the broker space. The non-bank has experienced exponential growth in recent years, to what Rehayem believes is now 40% of the non-conforming market. “You don’t hold that type of market share by fluke,” he says, “and we are not the cheapest and don’t want to be the cheapest. We want to be the best at what we do.”

The focus is now on maintaining that reputation and avoiding any slippage in the quality of customer service. “It’s not about volume; it’s about how much effort the customer has to put in to deal with our brand,” Rehayem says. “We take that responsibility very seriously because our brand is the broker’s brand as well, because they’ve recommended our brand. We don’t want to change brokers’ perception of us, but we want to take our really good reputation to another level.”

In a climate of regulatory uncertainty, many brokers and lenders have avoided the limelight, putting off plans and curbing their ambitions. That’s not the case at Pepper. MPA visited Pepper’s brand-new office in North Sydney the day after they posted after-tax profit of $61m, an increase of 26% that includes a 36% jump in Australian originations. Now in Australia, New Zealand, the UK, Ireland, Spain and Korea, Pepper is a non-bank with a reach beyond the wildest dreams of most Australian banks.

The reason you may not have noticed Pepper’s emerging global brand is that, unlike many Australian lenders, Pepper has enjoyed a degree of stability in the broker channel. Mario Rehayem has headed sales and distribution since 2011, before being appointed in October to the new role of managing director of Australian mortgages and personal loans. In January, Aaron Milburn, previously of Westpac, St George and Citi, stepped into Rehayem’s old role directing sales and distribution.

Rehayem sees his new role as a natural consequence of Pepper’s growth. “I’m not saying we weren’t aligned previously,” he says, “but having a managing director who is physically in the business 24/7 allows us to be a little more focused in our growth and strategy for the Australian business.” Previously, Patrick Tuttle managed the Australian business whilst being co-CEO of Pepper, and the whole executive team pitched in to help; as Rehayem quips: “It’s hard to envisage from outside how a business could function without a managing director – well, there was; there were about 10 of them.”

Dividing up management roles was necessary for Pepper to grow further, Rehayem says, but he’s determined that Pepper won't degenerate into feuding departments seen at large banks. Rehayem’s role, for instance, demands a ‘cradle to grave’ understanding of all facets of lending, including treasury and credit.

“That’s the beauty of our business,” Rehayem says. “We don’t have siloing; we don’t have turf wars like many other finance and corporate businesses. With us, we know we have one team, and we’re aiming for one result together as a team.”

Unfinished business

Unfinished businessFor the last six years, the result Pepper has been working to achieve is raising awareness of non-conforming lending through roadshows, online education courses and constant media commentary. Under Milburn, whose background is in prime lending, that’s not going to change.

“I’ve spent 18 years in major banking organisations,” he says. “There’s one thing that unites them all, and that’s trying to help people achieve their dream of home ownership. Pepper puts another lens on that.

It takes people whose dream couldn’t be realised by a major institution and gives them a second chance.”

There is a strong economic argument for Pepper’s awareness strategy. From 2011 to 2016, the number of brokers using Pepper’s products grew from around 700 to almost 3,000, excluding Pepper’s white label products. Many of those brokers are first-time users, Rehayem says.

“We’re seeing a direct correlation with a growth in our volumes, again by double digits,” he says. “That shows the course of business we’ve taken in the third-party channel is working, but it’s a slow burn, and dare I say it’s a very expensive way to go out and build business.” Despite the increase in numbers, Rehayem adds, “it’d be wrong for us to take the foot off the pedal in lifting that awareness, and the reason for that is that would spell a business that is complacent.”

In fact, Pepper is expanding its awareness strategy. Milburn, who brings to the organisation deep experience in direct-toconsumer marketing, believes consumer awareness has a long way to go.

“The course of business we’ve taken in the third-party channel is working, but it’s a slow burn, and dare I say it’s a very expensive way to go out and build business” Mario Rehayem

“The stats show that six out of 10 families who get turned down by a broker go without any form of lending,” he says. Those six applicants wait on average three years before applying for another loan, a ruinously expensive delay, given the current state of Melbourne and Sydney’s housing markets.On the consumer side, Pepper already runs radio adverts and sponsors AFL’s St Kilda, the A-League’s Western Sydney Wanderers, and NRL’s Penrith Panthers; in February, the company also started doing TV commercials. Consumers are beginning to respond, Rehayem says.

“Brokers say when they recommend a Pepper product, people have some sort of affiliation to the brand, as opposed to the ‘Pepper who?’ statements they used to get five or six years ago.”

Rehayem admits that this strategy comes at a cost, though. “Unfortunately for the bean counters in the business, that’s going to ratchet up; it’s not going to go down,” he says. “It has to come from the two channels. I can only see us spending more money.”

Overcoming the barriers to entry

It’s one thing to know that non-conforming options are out there; it's another to actually offer them to clients. Pepper has made a number of efforts to make its applications simpler over the years – introducing a single application form for all products, for instance – but non-conforming continues to be viewed as a niche area, which doesn’t always work well in a traditional brokerage and may be too difficult for early-career brokers. To deal with those difficulties, Pepper has long had a scenario and support team in place for brokers. It’s something that Rehayem would like to make more efficient.

“We service thousands of calls and emails on a monthly basis, with brokers contacting us to help them with a scenario they may have, and we help them construct deals,” he says. “That’s becoming more and more a demand from the brokers. The reason for that is we’re getting more and more brokers who are firsttime users … and there’s no other lender that has that kind of support mechanism for them.”

One major pain point is screening, Rehayem adds. “The first barrier of entry is when a broker sits in front of a customer and pre-screens them through predominantly the lens of a bank or non-bank. They quickly prescreen the customer and say, ‘Sorry, I can’t help you’ … 90% of those brokers don’t tend to run the lens of a non-conforming lender as part of their process.”

This year will see Pepper attempt to solve this problem through the introduction of a digital product selector tool. The tool will ensure that “any interview that is done in that broker’s office will give a solution, where possible, to that family in front of them”, Milburn says, by suggesting in real time during the interview, a suitable Pepper product for the customer.

Rehayem sees Pepper’s tool potentially levelling the field between more and less experienced brokers. “It takes two minutes, less than eight questions, and you’re done,” he says. “Whether you’re inexperienced or don’t understand non-conforming products doesn’t matter, because a tool does the work for you.”

Rehayem sees Pepper’s tool potentially levelling the field between more and less experienced brokers. “It takes two minutes, less than eight questions, and you’re done,” he says. “Whether you’re inexperienced or don’t understand non-conforming products doesn’t matter, because a tool does the work for you.”Rehayem and Milburn believe that by providing automated advice, the digital selector tool will also help take pressure of Pepper’s support team. As of February, the tool was not yet launched, although Milburn indicated that brokers would be able to use it this year. “We’re in the pilot phase now,” he says. “We’ll take the learnings from the pilot and roll out through 2017.”

The digital selector tool will be accompanied by a new personal loan product with no establishment or ongoing fees, which is currently being marketed to consumers but will be rolled out to brokers and eventually in a white label format, Rehayem says.

Although there are no plans for other new products, one area that may see more focus under Milburn’s leadership is lending to the self-employed. “Non-conforming is about non-conforming income as well,” he says. “It’s interesting – mortgage brokers have nonconforming income as well. Sports stars, celebrities, seasonal workers have nonconforming income … some brokers view it like commercial lending or SMSF – they sort of understand it, but it's too hard. My goal, Mario’s goal and Pepper’s goal is to dispel the myths and make it more the norm.”

“Some brokers view non-conforming like commercial lending or SMSF. My goal, Mario’s goal and Pepper’s goal is to dispel the myths and make it more the norm” Aaron Milburn

An ear to the groundPepper’s biggest change in 2017 won’t be about products, however, but about listening. Even as the non-bank looks courts consumers in Australia and beyond, Milburn wants to get closer to brokers with a series of roundtables. Starting in March, events in every state will enable brokers to sit across from Pepper’s heads of product, credit, treasury and marketing, with cooperation throughout the year.

“We’re inviting users and non-users of Pepper to come and help our business construct new policies and products we’re seeing a need for in the marketplace,” Milburn says.

And, he adds, any changes Pepper does make in the broker space will be based on broker feedback. “The market moves, and any lender who thinks they can roll out last year’s strategy into this year is fundamentally incorrect, in my opinion. It’d be remiss of me to come up with a strategy without consulting my business partners. So any decision under my leadership that we make here will be in consultation with our brokers, because that’s the only way we’re going to deliver product into the market that’ll best suit their clients.”

With Rehayem's new role as managing director providing vastly extended authority, he's looking at Pepper’s processes; he picks out the support team and turnaround times as particular targets for improvement.

One area where Rehayem is comfortable is Pepper’s reputation in the broker space. The non-bank has experienced exponential growth in recent years, to what Rehayem believes is now 40% of the non-conforming market. “You don’t hold that type of market share by fluke,” he says, “and we are not the cheapest and don’t want to be the cheapest. We want to be the best at what we do.”

The focus is now on maintaining that reputation and avoiding any slippage in the quality of customer service. “It’s not about volume; it’s about how much effort the customer has to put in to deal with our brand,” Rehayem says. “We take that responsibility very seriously because our brand is the broker’s brand as well, because they’ve recommended our brand. We don’t want to change brokers’ perception of us, but we want to take our really good reputation to another level.”