The banking giant says only 8% of its customers rely solely on branches

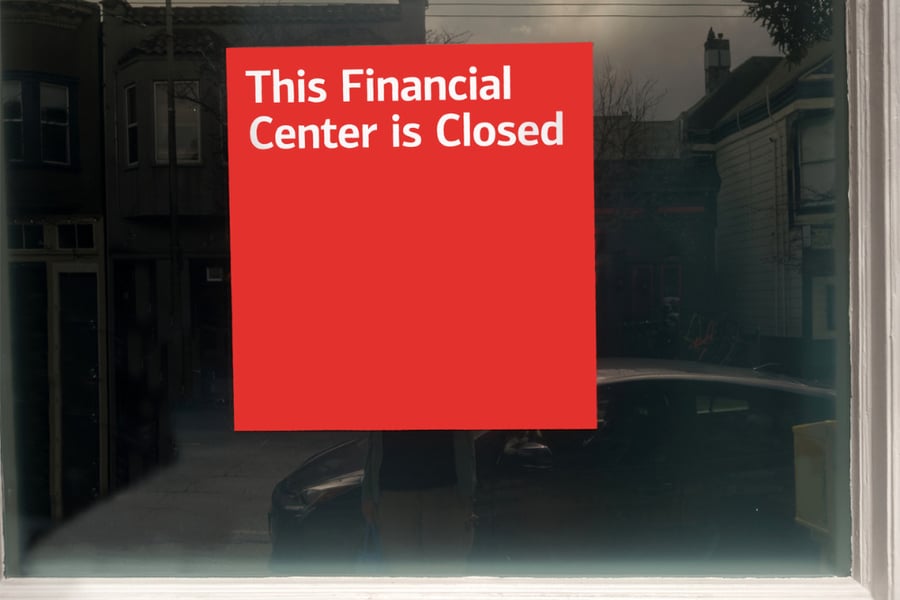

ANZ has said that it is likely to close even more bank branches as customers abandon physical locations in favor of online services.

The banking giant said that only 8% of its customers now rely solely on branches, according to a report by The Australian. The majority of ANZ’s customers use online platforms as a primary service, the bank said.

Banks across the country are shuttering branches at the fastest rate in 20 years. More than 300 physical locations have been shuttered or had closures announced, and ANZ alone had already closed 140 of its branches as of April.

The branch closures across the banking sector have drawn the ire of the Financial Services Union, which accused the industry of using the pandemic as an excuse to shutter locations at a faster rate.

Kath Bray, head of distribution for ANZ, said that branch closures across Australia would be inevitable in the next few years as more people made the switch to online banking. The COVID-19 pandemic accelerated that transition when branches across the country were forced to close, leaving customers dependent on online and telephone banking.

Bray told The Australian that customers have been reluctant to switch back to branches.

“We have not seen a restoration of activity [for everyday banking] in our branches,” she said.

Bray said that while branches would still be part of ANZ’s network, they would be designed to deal with more complex issues like mortgages and financial hardship.

“We still need branches, but fewer of them,” she told The Australian. “They need to be set up differently. You need them oriented around sitting down and having those more meaningful home loan conversations.”

Read more: Australians abandoning bank branches

The restructure of branches will involve fewer traditional teller banking layouts and more staff to sit with customers, The Australian reported.

Bray said staff within branches would also be important to ensure people were educated in how to use the bank’s online systems – particularly older and more vulnerable customers.

Ryan Smith is currently an executive editor at Key Media, where he started as a journalist in 2013. He has since he worked his way up to managing editor and is now an executive editor. He edits content for several B2B publications across the U.S., Canada, Australia, and New Zealand. He also writes feature content for trade publications for the insurance and mortgage industries.

Ryan Smith is currently an executive editor at Key Media, where he started as a journalist in 2013. He has since he worked his way up to managing editor and is now an executive editor. He edits content for several B2B publications across the U.S., Canada, Australia, and New Zealand. He also writes feature content for trade publications for the insurance and mortgage industries.LinkedIn | Email