But customer loyalty remains strong, say industry leaders

Mutual banks are losing their competitive edge as customer loyalty is eroding in a price-driven market, S&P Global Ratings has said in a report.

Amid strong competition for mortgages and deposits, mutuals remain at a competitive disadvantage relative to the major banks and further consolidation is likely, the credit ratings agency says.

Customer Owned Banking Association (COBA) CEO Michael Lawrence (pictured above left) and P&N Group CEO Andrew Hadley (pictured above right) accept that the retail banking market is becoming increasingly commoditised.

But the ability to put “people before profits” means customer-owned banks are in a position unmatched by other banks, and this results in strong customer loyalty, they say.

In a report titled Australian Mutual Lenders’ Competitive Edge all but gone, released on Monday, S&P Global said that the commoditised nature of Australian banking made it difficult for mutuals to “stand out from the crowd”.

According to the report, pricing, efficiency, end-to-end processing and product and service features are the four main factors for winning and retaining business.

Competition for mortgages and deposits, a mutual bank’s two key products, is intense, the S&P Global said in the report. As “price-takers”, mutuals focus on delivering sustained competitive pricing to defend and grow market share.

The ratings agency also acknowledged that the ownership structure of mutual banks, which are 100% owned by their members, helped to offset declining customer loyalty, due to the high proportion of funding via common equity and the full retention of profits.

More mergers expected, says ratings agency

There have been two recent mergers in the customer-owned banking sector – Heritage Bank and People’s Choice Credit Union, and Newcastle Permanent and Greater Bank.

S&P Global Ratings credit analyst Lisa Barrett (pictured above centre) said that mergers remained “compelling” for mutuals, providing smaller lenders with greater economies of scale.

“Brand strength and customer loyalty continue to evaporate such that price becomes a key determinant of customer acquisition,” Barrett said.

Over time, S&P Global expects mutuals to become acquisition or consolidation targets.

“We believe the banking landscape will settle with a small number of larger mutual players,” Barrett said.

As a key origination channel for banks in Australia, S&P Global acknowledged that APRA Quarterly ADI property exposure statistics (March 2023 quarter) showed that brokers originate about 60% of total mortgages in the system (MFAA March quarter figures show brokers’ share of new residential lending sits at 69.6%).

The average percentage of broker-originated lending for mutuals has increased from about 30% in 2019 to about 45%, it said. Most rated mutuals originate a portion of new lending through brokers, however S&P Global said that volumes could vary from 0% to over 80% of flow.

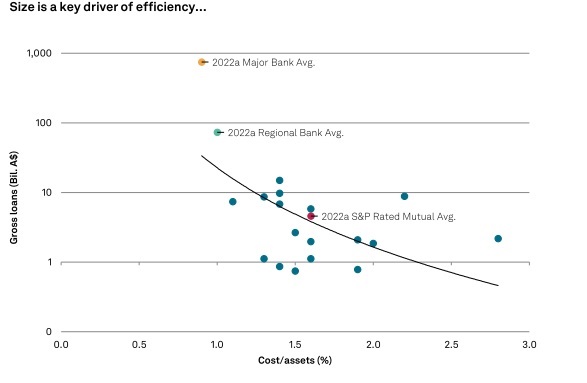

The average mutual rated by S&P Global (across 17 mutuals rated) has a balance sheet size (stock) of $4.5 billion (range: $74 million to $15 billion) with average cost/assets of 1.6%. By comparison, the average major bank has a balance sheet size of $747bn and cost/assets of 0.9%, while the average regional bank has a balance sheet size of $73nn and cost/assets of 1%.

Source: S&P Global

S&P Global said that it expected investment in digitisation, including open banking, lending origination and cyber security to continue to drive mutuals’ technology spending.

Customer loyalty still strong, COBA, P&N Bank say

COBA CEO Michael Lawrence said that the sector’s ethos of putting people before profits meant that customer-owned banks did not need to squeeze customers to pay dividends to shareholders.

This has kept customer loyalty strong, he said.

“Customers time and again say that customer-owned banks are the most trusted financial institutions in Australia and have market-leading customer satisfaction,” Lawrence said.

Lawrence said that this was reflected in above-system mortgage growth, where analysis of APRA quarterly ADI performance statistics showed an average mortgage growth rate over the last five years of 6.94% for COBA members, compared to 3.53% for major banks.

P&N Group CEO Andrew Hadley said that while he accepted the increasing level of commoditisation in retail banking, customer loyalty for mutuals remained a strength relative to their competition.

“Our customer-owned model affords us the opportunity to do what’s right by our customers,” Hadley said. “While price is a key determinant for new borrowers, we do see the benefits of loyalty based on our approach to front book/back book pricing, repeat lending business and overall loan retention.”

Lawrence said that recent polling commissioned by COBA showed that 84% of Australians wanted banks to have a purpose beyond profit. Customer loyalty across the customer-owned banking sector is underpinned through its commitment to customers and communities, he said.

Mutuals not losing price war

Customer-owned banks set prices based on many factors, and prices have always remained competitive, Lawrence said.

“COBA members can offer greater flexibility when cash rates increase, and manage competitive pricing across credit and debt, deposits and loans, because their shareholders are their customers and borrowers,” Lawrence said.

As an example, a number of COBA members had not passed on every rate rise, helping to provide some financial relief to customers during this period, he said.

Hadley said that he agreed that there was a degree to which mutuals were “price-takers”. However, the customer-owned model allowed the bank to maintain competitive pricing, as reflected in comparative analysis.

“Without the need to pay shareholder dividends and with less focus on shorter term returns, we can afford to take a longer-term perspective,” Hadley said.

Consolidation considered “inevitable”

Lawrence acknowledged that mergers were a feature of every industry and therefore not exclusive to mutual banking.

While mergers involving listed entities could increase market concentration, decrease competition and provide less choice for consumers, Lawrence said that mutual mergers could be beneficial to competition where they give banks scale to compete against larger entities, serving a broader audience.

While the S&P Global report raised some reasonable points about the challenges facing mutual lenders, Hadley said that brand awareness and customer loyalty still existed, and that pricing needed to be competitive.

“Scale is increasingly important for many smaller banks to defray necessary technology investments, and therefore industry consolidation is inevitable,” Hadley said.

Turning to technology investment, Lawrence confirmed that significant projects were underway across the COBA membership base.

One of the benefits of being smaller is the ability to be agile and innovate where it matters most, he said.

“Customer owned banks were the first to install a 24-hour ATM, provide home telephone banking, operate an EFTPOS facility, and introduce Android and Apple Pay,” Lawrence said.

“I expect COBA members will continue to pioneer new digital initiatives, driven by their close relationships with their members, which in turn lets them know exactly what they need to do to remain relevant to their members and communities.”

Have something to say about this story? Share your thoughts in the comments section below.