How Suncorp and St. George Bank are backing the third-party channel -- including commissions -- as the majors face the heat

How Suncorp and St. George Bank are backing the third-party channel -- including commissions -- as the majors face the heat

MPA's non-major bank roundtable did not go according to plan, but sometimes a bit of the unexpected actually makes for a more fulfilling and worthwhile outcome. Brokers know that better than most.

A few hours before we were set to go live on 14 March, Bankwest’s Ian Rakhit had to recuse himself from the broadcast. The roundtable was already down to three participants after the confirmed spokesperson from Bank of Queensland, Adrienne Smith, announced just a week before the event that she would be leaving the bank to take a position with AMP.

So the stage was set for two. In the end, MPA was fortunate to have Mark Vilo, head of bank intermediaries at Suncorp, and Sarah Willsallen, NSW/ACT state general manager of broker distribution for St. George Bank, still keen to take on brokers’ questions.

Having fewer participants actually allowed us to have a more intimate and in-depth conversation. Both Vilo and Willsallen covered a lot of ground, explaining where their banks stand in regard to some of your pressing questions about the banking royal commission, the Productivity Commission, trail payments, competition and household living expenses.

While the non-majors aren’t the prime targets of the royal commission, they’re no doubt still feeling the pressure. Hopefully it won’t scare them into silence, because this might actually be the non-majors’ moment to shine – something both Vilo and Willsallen did brilliantly at MPA’s roundtable.

They both championed the progress made by the Combined Industry Forum, lauded collaboration as the key to improving industry standards and professionalism, and expressed unwavering support for the third-party channel, evidenced by the amount of money both banks are investing in education and training resources. While it’s hard to know now what changes might come down the pipe out of all these inquiries, brokers have some allies.

As always, you can watch this panel discussion on our website, www.mpamagazine.com.au. Our next roundtable on 11 May will feature some of the industry’s biggest aggregators. Join us then to hear what they have to say about commissions, accreditation, bank ownership and more.

Q: What changes do you plan to make to broker commission and governance in response to the CIF reforms, and how will these affect brokers going forward?

Despite ongoing inquiries by the banking royal commission and the Productivity Commission, the Combined Industry Forum [CIF] will be ploughing ahead with its reforms to broker commission structures based on the facility utilised, net of off set. It will also be introducing a new ownership disclosure and public reporting framework and commence work on an industry code.

As part of the CIF’s commissions working group, Mark Vilo, Suncorp’s head of bank intermediaries, had a front-row seat to the consultation and debate that went into deciding how to amend upfront commissions to deal with ASIC’s primary concern around the potential for brokers to encourage borrowers to take on larger loans than they required.

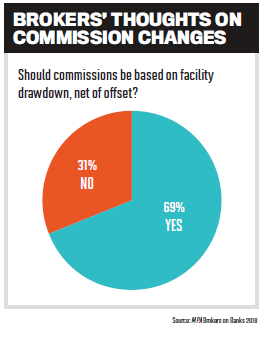

While the CIF has crafted its proposal around this, most lenders haven’t actually touched commissions yet. So as far as brokers are concerned, it’s business as usual, Vilo said. Based on MPA’s latest Brokers on Banks survey, the majority of brokers weren’t happy with the CIF’s commission reform. Sixty nine percent said commissions should not be based on facility drawdown, net of off set, while 31% said it should.

“We need to be willing to contribute and invest in our industry without necessarily expecting an immediate financial return … Brokers are a partnership in an ecosystem that we think is really important in delivering great outcomes for customers” - Sarah Willsallen, St. George Bank

So once this reform is implemented, how will it affect brokers’ profits?

“There has been some healthy debate around the impact that it has on a broker’s back pocket, and certainly from an aggregator’s point of view, but I think the broker community does understand the rationale behind it,” Vilo explained.

“The thinking is we are going to pay on a facility when it is being used, as opposed to when it’s sitting there or lying dormant in an offset account. I think that’s reasonable.”

St. George Bank’s NSW/ACT state general manager of broker distribution, Sarah Willsallen, added that the Westpac Group was also an active participant in the CIF and was fully supportive of the recommendations. St. George Bank will be moving ahead with paying brokers on the ‘facility utilised’ model and is currently making changes to its systems so it can implement that reform. Willsallen said the bank would be in a position to meet the CIF’s target for commission changes to be completed by the end of the year.

Both Vilo and Willsallen spoke highly of the CIF for demonstrating that the industry could work together in a sensible and constructive way. Vilo said that in the early stages of his intermediary role at Suncorp, he was concerned about how the industry would collaborate.

“In my previous lives, that was always very difficult – a lot of kicking and screaming to get everyone at the same table. I’ve been really inspired by the amount of effort that’s gone in from all stakeholders, whether it’s been brokers, aggregators, lenders, consumer groups or associations, all rolling their sleeves up."

The CIF’s crowning achievement, in Willsallen’s opinion, was defining a good customer outcome and clearly articulating what that is and what it involves.

“With all the changes that are going to continue to evolve in the landscape, that becomes your guiding light; it’s your North Star. If we hold true to that, it will always put us in a good position,” she said.

Q: What is holding the non-major banks back from becoming significant challengers to the majors?

ACCC chairman Rod Sims recently said the competition regulator would look at what barriers existed for the non-major banks and why they hadn’t become stronger rivals to the big four banks.

“There’s nothing wrong with having four players in the industry, provided they have the threat of real competition on them,” Sims recently told MPA.

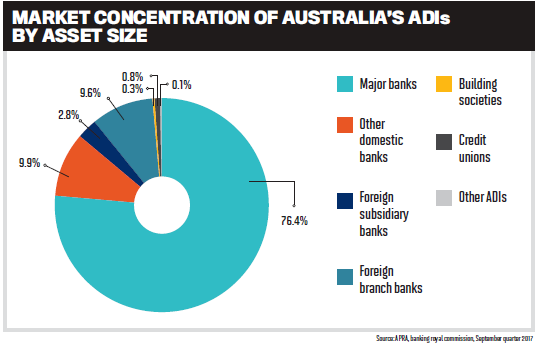

According to the ACCC’s interim report into mortgage pricing, which was published in March, the five biggest banks in Australia held approximately $1.3trn in outstanding residential mortgages as of December 2017, representing about 84% of all mortgages held by all banks in Australia.

Vilo acknowledged that there were a number of challenges for non-majors, including the need to hold more capital and a higher cost of obtaining wholesale funds than the majors. While the bank levy on Australia’s five largest banks had improved the gap, Vilo said non-majors still had to work “a little bit harder to get the business that we need to get and the funds that we need to get access to and the capital we need to hold”.

“The thinking is we are going to pay [commission] on a facility when it is being used, as opposed to when it’s sitting there or lying dormant in an offset account. I think that’s reasonable” - Mark Vilo, Suncorp

That said, he and Willsallen both felt the non-majors deserved a bit more credit than Sims allowed.

“I actually think that the non-majors are doing a tremendous job in being active and driving competition in the marketplace, and I think the winners out of that are customers,” Willsallen said.

She added that across the Westpac Group’s customer base, which is composed of Westpac, St. George Bank, Bank SA and Bank of Melbourne, there was very little crossover because customers appreciated the experience they got from the bank they were with.

“What that says to us is customers do value the choice, and I think the non-majors are doing a tremendous job of driving that competition and customer choice in the market,” she said.

Any opportunity to look at what the industry could do better or diff erently was a good thing, she added.

Vilo agreed that non-majors and others had made a “dramatic difference” to the marketplace and that they would continue to shine by increasing their service proposition.

“It’s kept the market on its toes, and it’s kept us all honest, and it has allowed customers to get better deals, and I think mortgage brokers do an awesome job around all of that,” he said.

With the ACCC looking into competition issues, Vilo said this would allow the nonmajors a chance to step back and reflect on how well they were doing and what obstacles were preventing an even playing field.

Q: Does more need to be done to ensure brokers are acting in their clients’ best interests, or is the current ‘not unsuitable’ obligation enough?

The Productivity Commission has called for a new legal duty to be introduced for mortgage brokers who work under bank-owned aggregators to ensure they act in their clients’ best interests. A few banks have said that if this is introduced they’d like to see it applied across the board. They have also pointed out the challenge of defining what a 'best interest' is for the many diverse clients they serve.

Vilo said the vast majority of brokers already did what was best for their clients, so he didn’t see any reason why that legal duty shouldn’t expand across the whole broker network. While consumer credit products are subject to responsible lending criteria, the broker’s primary obligation is to ensure the loan is not unsuitable in meeting the client's requirements and objectives. Whereas the best-interest duty would exist beyond the first discussion and the recommendations put forward during the encounter to ensure that there was an ongoing review of clients' needs. He said the most important thing was to make sure thehre were "proof points", or documents explaining the rationale behind each decision.

Vilo pointed to the financial planning industry, which has implemented a best interest duty, and while he didn’t suggest that should be replicated with brokers, he believes it is worth studying what other industries and countries have done.

“It’s not to inhibit what a broker is doing. I think any change that we do make should be designed to enable a broker to be able to confidently talk with their customer and know exactly what the purpose of their role is, and it’s defined throughout the course of the customer’s journey,” he said.

Willsallen said she was proud of the work the CIF had done around articulating what a good consumer outcome is, which aligns with what brokers are already doing.

“The vast majority of brokers absolutely do the right thing; they act in their clients’ best interests. They spend lots of time getting across the customer’s requirements and objectives; they make sure they really understand a holistic picture of the customer’s expenses and the circumstances of their situation," she said.

Both Suncorp and St. George believe education is the key to raising the bar, and it's something both banks are invensting in. St. George has launched a webinar campaign and has an online platform where brokers can learn through peer-to-peer sharing, including podcasts. Suncorp offers diversification masterclasses in person and a broad range of diversification modules.

"We need to be willing to contribute and invest in our industry without necessarily expecting an immediate financial return. It's actually not about that. Brokers are a partnership in an ecosystem thatwe think is really important in delivering great outcomes for customers," Willsallen said.

“We help people into their homes; we help people build successful and financially stable retirements …We’re really lucky ... to have something so honourable to do” - Sarah Willsallen, St. George Bank

Q: As the scrutiny and inquries into the broking sector and the home loan market continue, how should brokers stay informed?

Vilo advised brokers to keep close to their member associations, as they have been actively involved in representing the industry and ensuring it remains sustainable, as well as to their aggregators and the leadership within those groups.

Willsallen said that while the inquiries were ongoing, it was important for brokers not to lose sight of having pride in what they did every day.

“We help people into their homes; we help people build successful and financially stable retirements. And I think, yes, staying current is important … but I just keep to the vocation and the sense of purpose. We’re really lucky ... to have something so honourable to do.”