Wide-ranging report also finds interest-only borrowers have higher incomes and often lower rates

Wide-ranging report also finds interest-only borrowers have higher incomes and often lower rates

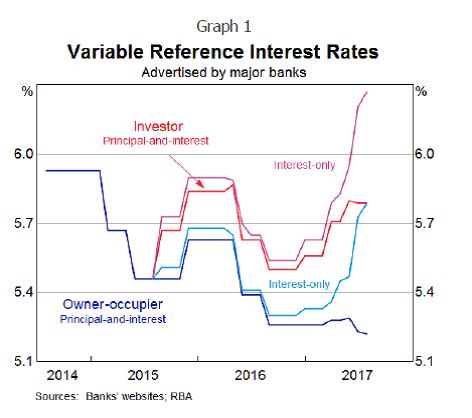

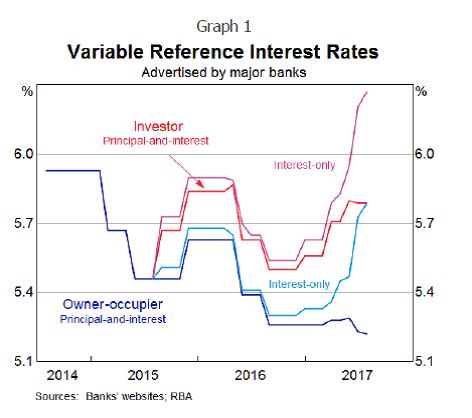

On average, interest rates have only risen by 10bp since late 2016, the RBA’s assistant governor Christopher Kent has claimed.

Kent made the claim yesterday as the RBA unveiled data on residential mortgage backed securities, covering 1.6m individual mortgages across owner occupiers, investors, principal and interest and interest-only loans.

According to Kent, despite the increase in investor and interest-only rates, “interest rates on principal-and-interest loans to owner-occupiers are little changed and remain at very low levels. Pulling this all together, the average interest rate paid on all outstanding loans has increased since late last year, but only by about 10 basis points.”

When interest-only borrowers got lower rates (yes, really)

The low increase can be partially attributed to the low rates paid by interest-only borrowers prior to recent regulatory changes.

“Until most recently, actual rates paid on interest-only loans have been lower than those on principal-and-interest loans” said Kent, a result of customer characteristics as “borrowers with an interest-only loan tend to have larger loan balances (of around $85 000–100 000) and higher incomes (of about $30 000–40 000 per annum).”

The RBA found that interest-only owner-occupiers, in particular, had high balances in offset accounts, which could cushion them in the event of financial stress. However, Kent warned against any watering down of regulations on interest-only lending (including a 30% cap) introduced by APRA earlier this year: “what matters when it comes to financial stability is not what the average borrowers are doing, but what the more marginal borrowers are doing.”

RBA data far from perfect

One major flaw with the RBA’s data, according to Clark, is that loans can take a long time to enter an RMBS pool, meaning the RBA’s data could be out of date.

Comparison site CANSTAR produces monthly data on interest rates based on their own database. In July, according to CANSTAR, rates increased on average between 8 - 20bp for investment P&I and residential and investment interest only loans.

Rates did decrease on average for residential P&I loans, between 6-9bp, with the average standard variable rate now standing at 4.50%.

On average, interest rates have only risen by 10bp since late 2016, the RBA’s assistant governor Christopher Kent has claimed.

Kent made the claim yesterday as the RBA unveiled data on residential mortgage backed securities, covering 1.6m individual mortgages across owner occupiers, investors, principal and interest and interest-only loans.

According to Kent, despite the increase in investor and interest-only rates, “interest rates on principal-and-interest loans to owner-occupiers are little changed and remain at very low levels. Pulling this all together, the average interest rate paid on all outstanding loans has increased since late last year, but only by about 10 basis points.”

When interest-only borrowers got lower rates (yes, really)

The low increase can be partially attributed to the low rates paid by interest-only borrowers prior to recent regulatory changes.

“Until most recently, actual rates paid on interest-only loans have been lower than those on principal-and-interest loans” said Kent, a result of customer characteristics as “borrowers with an interest-only loan tend to have larger loan balances (of around $85 000–100 000) and higher incomes (of about $30 000–40 000 per annum).”

The RBA found that interest-only owner-occupiers, in particular, had high balances in offset accounts, which could cushion them in the event of financial stress. However, Kent warned against any watering down of regulations on interest-only lending (including a 30% cap) introduced by APRA earlier this year: “what matters when it comes to financial stability is not what the average borrowers are doing, but what the more marginal borrowers are doing.”

RBA data far from perfect

One major flaw with the RBA’s data, according to Clark, is that loans can take a long time to enter an RMBS pool, meaning the RBA’s data could be out of date.

Comparison site CANSTAR produces monthly data on interest rates based on their own database. In July, according to CANSTAR, rates increased on average between 8 - 20bp for investment P&I and residential and investment interest only loans.

Rates did decrease on average for residential P&I loans, between 6-9bp, with the average standard variable rate now standing at 4.50%.