This year's survey results showed a shift in tone with brokers feeling the strain of tightened lending policies

This year's survey results showed a shift in tone with brokers feeling the strain of tightened lending policies

The results of this year’s survey came as a bit of a shock. The total ratings for the top 10 banks were signifi cantly lower than last year – so low, in fact, that they wouldn’t even have qualifi ed against the top 10 contenders in last year’s survey.

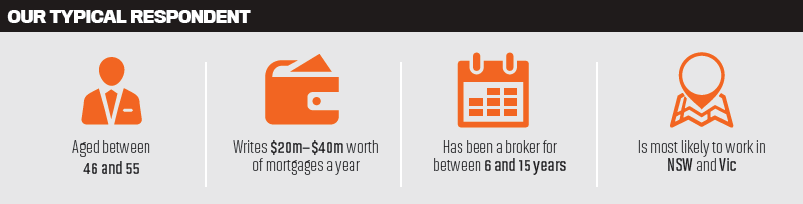

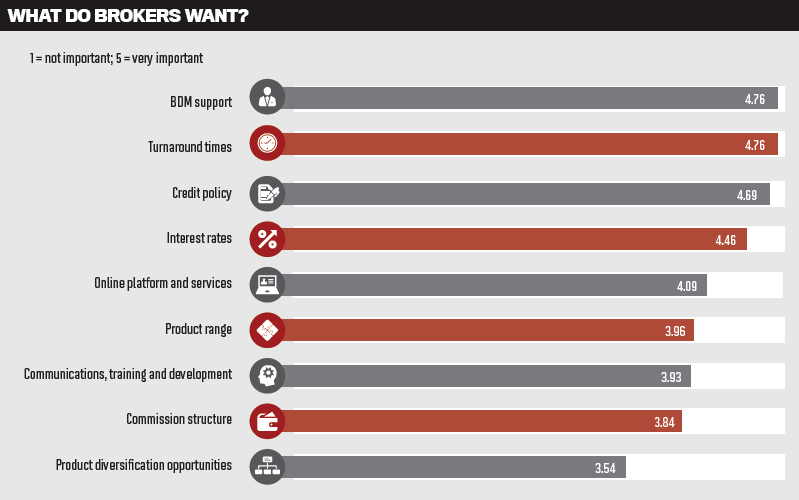

The companies in the top 10 haven’t changed signifi cantly since 2017, and neither has our survey, now in its 15th year. The number and types of respondents were consistent with last year’s, as were the themes and questions covered. Brokers’ priorities also remain the same, with their top concerns being BDM support, turnaround times, credit policy and interest rates.

Despite those constant variables, the results were anything but. Westpac’s overall score in 2017 was 3.72. This year, the winning bank scored a total of 2.76. That shouldn’t diminish that bank’s accomplishments during challenging times, but it does beg the question, why are brokers grading so low?

We all know 2017’s major hits and dips by heart now: APRA cracked down on interestonly and investment lending; ASIC and Sedgwick scrutinised broker remuneration; and the banks reined in their appetites for lending and tightened their serviceability requirements, making it harder for some applicants to qualify for a loan.

The lending landscape changed and brokers were required to do more work, sometimes for less reward. So it’s perhaps not surprising that they didn’t review the banks as favourably as they have in the past.

Despite the mood shift encapsulated by this year’s results, the same trends have emerged: the banks that are listening to and working with brokers, and who are delivering fast and efficient service and turnaround times, are the ones brokers want to work with.

In the end, brokers and banks need each other. If banks want the end customer to have a good experience so they remember who made the biggest purchase of their lives stress-free, they should be thinking of how they can also serve the broker who brought them there.

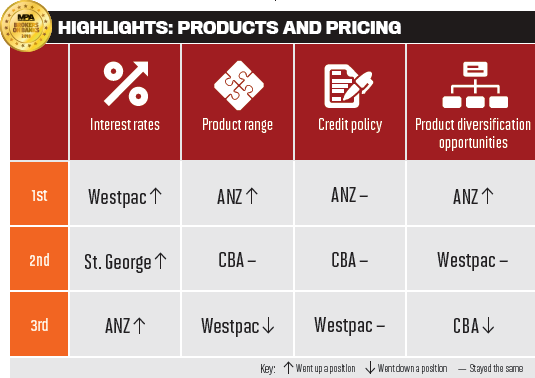

PRODUCTS AND PRICING

This past year proved to be a mixed bag of pricing and policies, especially in regard to investors and banks’ fluctuating appetites. The only consistent theme? The same majors dominated across all categories

In March 2017, APRA told banks to limit new interest-only lending to 30% of new residential mortgage lending. At the time, interest-only lending accounted for 39% of all new lending, so a 9% cut would have been potentially quite disruptive for some banks.

What followed was a flurry of price hikes and then rate slashes – so many it probably set brokers’ heads spinning.

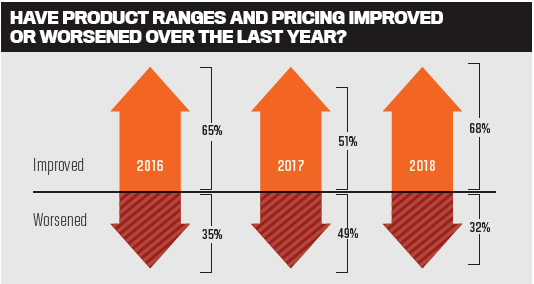

Despite regulatory changes and instability, the majority of brokers, 68%, actually said product ranges and pricing had improved over the last year, versus 32% who said it had worsened.

Surprisingly, this was a somewhat more positive score than in 2017, when 51% said this area had improved, and in 2016, when 65% said likewise.

While non-majors may have dominated in the interest rate category in the past, that wasn’t the case this year. ING, Suncorp and Bankwest were knocked out of the top spots by the majors, with Westpac leading the way, followed by St. George, ANZ, and then CBA in fourth. ING, which last year was in fi rst place for interest rates, slipped to eighth place.

The top three banks for credit policy were again unchanged for the third year in a row: ANZ, CBA and Westpac.

While respondents may have been more positive about overall products and policies this year, when asked which bank offered the most favourable policies and interest rates for interest-only borrowers, there was no clear consensus. Many brokers said they had stepped back from interest-only loans and expressed frustration with the banks’ fl uctuating appetites for these borrowers.

A broker from Kilsyth, Victoria, said he was not targeting IO borrowers. “Given the interest rate differential, I’m recommending clients to take on P&I as the repayments in a lot of cases will be the same to reduce debt as it would be to sit on interest-only.”

Brokers also spoke about the difficulties of dealing with banks’ rapidly changing pricing policies. “[I] can’t pick a particular bank as their appetite for this type of lending fluctuates. One minute they want this business, the next they don’t,” said a broker from Croydon, Victoria.

“Customers choose a bank based on pricing, then that bank puts up rates more than the other as they hit limits imposed, then that affects that decision,” he said.

As for product diversifi cation and opportunities, ANZ, CBA and Westpac were again in the top three.

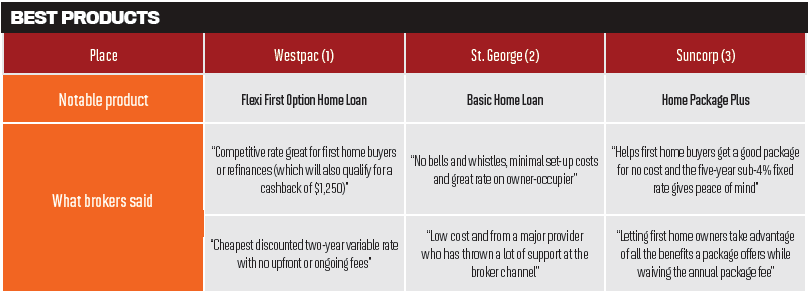

Strangely, though, ANZ and CBA didn’t even make the top five for best mortgage product, outdone by the non-majors.

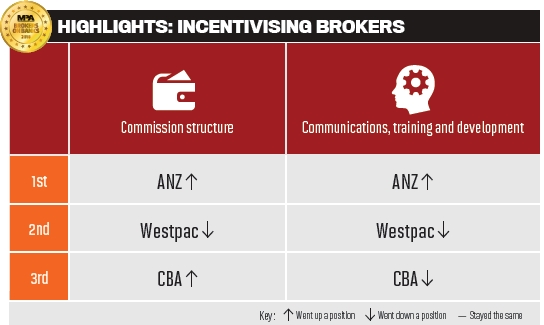

BROKER INCENTIVES

Commissions will continue to be in the spotlight as the Productivity Commission and banking royal commission hone in on the sector. Our survey shows that brokers aren’t too impressed with where things are going

The numbers speak for themselves: this year, the top bank’s score in the category on commissions was so low it wouldn’t even have made it into the top 15 in last year’s survey. In fact, it was lower than every other score from 2017 – out of 52 lenders – except for one.

What has gone so wrong?

The results could be a reflection of the scrutiny brokers’ commissions have endured this past year following ASIC’s Review of Mortgage Broker Remuneration. ASIC pointed out in its report that brokers’ commission structure could be incentivising them to potentially encourage borrowers to take out larger loans in order to earn a bigger pay cheque themselves. With a significant variability in the value of commissions paid by different lenders, ASIC said brokers could face a higher level of "lender choice conflict".

In response, the Combined Industry Forum came together to tackle the commission issues ASIC identified. It proposed that lenders should pay upfront commission on a utilisation basis based on the facility limit drawn down by the customer and net of any offset account balances. It has pledged to achieve this across the board by the end of this year.

“Commissions should be for the net amount borrowed as that is what the broker worked tirelessly to provide for the customer and is entitled to receiving for the work done” Survey respondent

Brokers spoke up clearly on this point, with more than two thirds saying commissions should not be based on facility drawdown net of offset, versus only a third who agreed with the CIF’s proposal.

Brokers argued that there were many legitimate reasons why they offered their clients offset accounts.

“If funds are not used immediately there is usually a good reason, for example they are going to spend the money shortly on renovations or a car. Sometimes clients are just keeping a small amount of funds in case of emergency. Why penalise a broker for that?” asked a broker from Balcatta, WA.

Many banks have embraced the CIF’s proposal to move away from bonus commissions and soft-dollar benefits.

In January, ANZ was the first lender to announce commission structure changes in response to the reports from ASIC, Sedgwick and the CIF. The bank said it would begin paying brokers an upfront commission of 62.5 basis points, up from the current 57.5 basis points, but would no longer give brokers volume-based incentives.

But it’s not exactly clear how other lenders have already – or how they plan to – change their commission structures going forward, leaving brokers in the dark about the future of their salaries.

Former auditor-general Ian McPhee’s independent report assessing the progress the banks have made on implementing the Sedgwick reforms found that many banks were still in the planning phases.

“It is acknowledged that changes to remuneration and incentive arrangements are a complex and significant undertaking, and this is the first status report on a program of work that is scheduled for completion in 2020,” McPhee noted.

While so much was weighing on the outcomes of the ASIC and Sedgwick reviews, it seems the inquiries into broker incentives are only just beginning.

The Productivity Commission and the banking royal commission have both recently projected the spotlight back on brokers and how they are paid, suggesting this will continue to be an area of contention.

So if brokers are already ranking the banks poorly on commissions, it’s likely to be just the tip of the iceberg.

TURNAROUND, TECHNOLOGY AND SERVICE

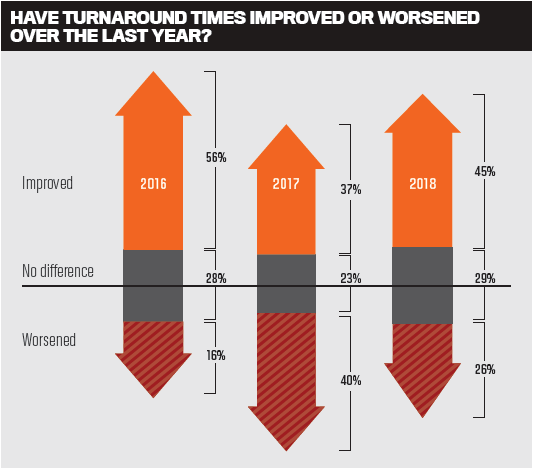

Only a quarter of brokers think turnaround times worsened over the last year, far fewer than in 2017. But brokers say there’s still plenty of room for improvement to the banks’ communication, credit teams and technology

CBA's head of third party banking, Sam Boer, has called turnaround times the “Holy Grail” of the mortgage process. That’s true for banks and for brokers.

Turnaround times can make or break a bank-broker relationship, as the broker comments in the previous section show.

This year’s survey found that the majority of brokers were generally satisfi ed with banks’ turnaround times – at least more so than they were last year.

In 2018, 45% of survey respondents said turnaround times had improved, versus 37% in 2017. However, brokers were still much more satisfi ed with turnaround times two years ago.

Have banks hit a snag in terms of how far their technology platforms can improve turnaround times?

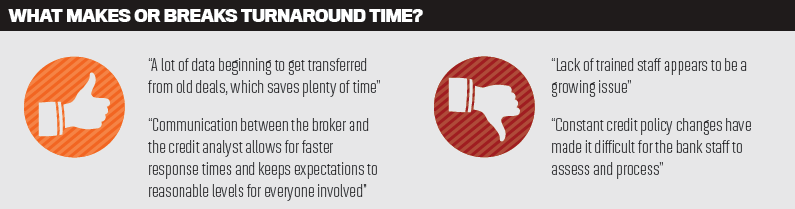

According to brokers, some of the improvements on the tech side include digital document signing, application tracking, upfront valuations, online chat, and being able to upload documents directly to the lender.

Those who said turnaround times had worsened thought changes to credit policy and compliance were making the process more cumbersome and convoluted. Some also said that brokers were now doing all the data entry for lenders.

“Lenders have all overcomplicated, overinterpreted, over-engineered the home loan process, product, credit requirements, rates, and checklists, all under the guise it’s APRA and/or ASIC,” said one broker from Leederville, WA.

A broker from Narellan Vale, NSW, said BDM support and communication were key factors when it came to turnaround times, and urgent files should be prioritised.

“If there are extensive delays within divisions in the bank then that should be communicated to the brokers as it may not suit the turnaround times of what the client needs,” the broker said.

The major bank heads admitted during MPA’s roundtable in February that there was still plenty of room for improvement in reeling in turnaround times. But what some also said was that the quality of a bank’s output also depended on the quality of a broker’s input.

“Turnaround times are a two-way street. It’s actually the whole industry’s problem, not just the bank’s problem. What goes into a bank has as big an impact on turnaround times as the actual operation in the back o ce,” Tony MacRae, Westpac’s general manager of third party distribution, said during the roundtable.

Boer said it was about continuously investing to improve education, communication and training, as well as the systems needed to make the process seamless.

A broker from Ermington, NSW, said that while she understood turnaround times were dictated by the volume of loans being received by the funder, it was up to them to make sure they had enough experienced staff in place to assess loan applications quickly and that they were providing brokers with enough training.

While the banks are quick to point out the changes and updates they’re making to improve turnaround times, brokers want action, not talk.

“We are always told that work is being done to improve turnaround times, but in reality nothing has happened,” said one Sydney broker.

WHAT YOU’RE SAYING

Brokers weigh in on a sticky subject: Are they really offering consumers a wider range of lender options?

Brokers' contribution to consumer choice is a topic that ASIC tried to evaluate in its remuneration review last year, and the matter has come up again in the recent Productivity Commission draft report on competition in the fi nancial system.

The Productivity Commission raised concerns about consumer choice being jeopardised by vertical integration in the broking sector. It also suggested that trailing commissions encouraged broker loyalty to the fi nancial institution rather than the customer.

While our survey was conducted before the release of the Productivity Commission’s report, we did ask brokers whether they agreed with ASIC’s fi nding that most of their loans went to four lenders.

Brokers were understandably split on the matter. Those on the ‘yes’ side said it was largely because the majors offered the right products and consistent service to match the needs of the majority of their clients.

Those on the ‘no’ side said lenders were decided case by case, depending on clients’ needs, circumstances and eligibility, balanced with lender policy and pricing.

Whether it was a yes or no, a lot of the survey comments really amounted to the same thing: brokers are trying to do the best by their customers, but their work isn’t easy when lenders are regularly changing policies and procedures.

We’ve highlighted as our Star Comment (see box below) one response from a new broker that reveals the hurdles brokers are up against. All fi ve brokers will be sent a Google Home Mini for answering the question.

FINAL RESULTS

And the Best Bank of the Year prize goes to… Here we reveal the winners and the losers in this year’s overall survey results

1. ANZ

Position in 2017: 2nd

Position in 2016: 3rd

ANZ did a stellar job this year, overthrowing Westpac’s attempt at four golds in a row to secure the title of 2018 Bank of the Year. The bank earned consistently excellent results, appearing in the top three in every category.

That reliability struck a cord with brokers, especially during a year when regulatory expectations and bank appetites were constantly shifting.

It particularly outshone the other banks in the categories of BDM support, credit policy and turnaround times, lifting its results in the latter category compared to last year, when it didn’t make it into the top three. Brokers mentioned all of these things when asked which bank they had given more business to in the last 12 months.

ANZ also did better in the commission structure category, which had been identified as an area of weakness last year. It will be interesting to see how ANZ being the first bank to remove volume-based incentives will affect brokers' opinions in next year's survey.

The one area the bank didn’t do as well in as expected was the ranking for brokers’ top mortgage product. ANZ didn’t break the top five, but it still came in first place for overall product range and product diversification and opportunities.

It doesn’t seem like much is holding ANZ back, not even with the clampdown on interest-only and investor lending. The bank grew its Australian residential mortgage book by 10% annualised to $98bn in the December 2017 quarter, largely driven by owner-occupier loans, estimated to be 1.2 times faster than the system rate.

It looks like ANZ is in good stead to continue that growth, especially with brokers on board.

2. WESTPAC

Position in 2017: 1st

Position in 2016: 1st

It will come as a disappointment to Westpac that it didn’t clinch the leading position this year, but the major still has a lot to be proud of (not to mention that hat-trick from last year). It took second place in most of the categories usually by only a small margin. It also finished first, far ahead of the rest, for top mortgage product, with brokers again pleased with its Flexi First Option Home Loan and its Rocket line.

This probably explains why brokers also selected Westpac as the number one bank for interest rates, and for having favourable policies for interest-only clients.

But if Westpac wants to beat ANZ next year, it will have to boost its BDM support, credit policy and turnaround times.

3. CBA

Position in 2017: 3rd

Position in 2016: 2nd

Considering CBA’s rocky relationship with brokers of late, the bank really didn’t do that badly, maintaining its third-place finish. The numbers show brokers still rate its online platform and services highly, as well as its product range.

But CBA’s results for turnaround times, interest rates, communications, training and development and BDM support sunk a lot lower than its other major competitors’.

The numbers might put CBA in third place, but the comments from brokers reveal deep criticism of the bank. Brokers didn’t hold back, with many calling the major out for channel conflict, poor turnaround times, arrogance and lack of respect for the broker market.

4. ST. GEORGE GROUP

Position in 2017: 7th

Position in 2016: 7th

St. George Group, which includes the Bank of Melbourne and Bank SA, made massive gains this year, rising from seventh place over the last two years to fourth place, just behind three major banks and ahead of NAB. It came in second for interest rates and third for top mortgage product.

St. George Group was the reigning non-major this year, leaping ahead of Suncorp and Bankwest. Whatever changes St. George Group has made, brokers have noticed, with many of them commenting on its “improved” service levels, BDM support and competitive rates.

5. NAB

Position in 2017: 6th

Position in 2016: 6th

NAB still isn’t playing in the major leagues, but it did show some improvement this year in regard to BDM support and commission structure.

But the major still lags behind the top three when it comes to turnaround times, product diversification opportunities and interest rates. Some brokers did remark on a lack of consistency in service and assessment decisions, and many complained that channel conflict still seemed to be a problem despite being an area that the bank had tried to address.

6. BANKWEST

Position in 2017: 5th

Position in 2016: 8th

Bankwest remains stuck in the middle of the pack. While last year it made a big leap forward to fifth place from eighth in 2016, it wasn’t able to stay ahead of NAB this time around.

Unlike CBA, Bankwest’s owners, the non-major is “significantly third party focused”, according to Ian Rakhit, the bank’s head of third party business, who was recently interviewed by MPA. Last November, it launched a new “one-stop shop” website based on brokers’ feedback. This might explain why it did much better than the other non-majors (excluding St. George Group) in the online platform and services category. If the bank continues to listen to brokers, that will pay dividends.

HOW ANZ STOLE THE SHOW

ANZ’s investment in training and developing its team, being transparent about changes and keeping brokers in the loop has given the bank lots to boast about in this year’s Broker on Banks survey

Why did brokers pick ANZ as their favourite lender this year?

Winning this award is a huge privilege for everyone on the team at ANZ, particularly in a year of transformative change. Our retail broker BDMs work tirelessly to improve how we do things and ensure we’re always producing the best results for customers. This award is also a reflection of our investment in training our team and our consistency in the way we openly communicate with the market.

ANZ dominated in the commission structure section. What has ANZ done to ensure brokers are being compensated fairly for their work, and how does it plan to amend or retain its commission structure going forward in response to the CIF proposals?

Government and community expectations have changed and the expectations we have of our own industry have also changed. The CIF was a key stepping stone to building a stronger reputation for our profession. We believe that the recent changes will provide a simpler commission structure which delivers on ANZ’s and aggregator and broker requirements, and is more transparent for the customer.

ANZ came up from third place last year in the communications, training and development category. What has ANZ done to improve communication between itself and brokers?

It has been a goal for the ANZ team to be known as the most innovative and the most educated in the market, and to really take the education of our BDMs, brokers and our partnerships with aggregators to a new level. In the last 12 months, we’ve had a focus on transparency in the marketplace, alongside further investment in our training and development program. We recognise we have a tremendous amount of work to do, and we need to improve on communicating change as early as possible. In the environment we’re currently all operating in, change is the new normal, but we’ve been partnering with aggregators and brokers to lead with insights to shape our training programs, to ensure all industry participants are equipped with the skills to respond.

ANZ also excelled well above the other lenders for BDM support. What makes a great major bank BDM?

Successful partnerships generally are based on trust, respect and a broader understanding of each other. The most crucial element is ongoing communication and the importance of being responsive.

Our entire BDM team works with 16,800 brokers across Australia, serving approximately 300-plus brokers/BDMs each. Our BDMs are famous for their policy knowledge and are skilled at navigating deals due to their specialist expertise. But above all, they know how to connect and collaborate to get customers into homes.

THE RUNNERS UP

2. WESTPAC

MPA: How does Westpac stay competitive when it comes to o ering brokers a sharp rate, and why is this important to the bank?

Westpac: Our relationship with brokers is about so much more than a sharp rate. Our competitive o ering is about a good deal for the customer, exceptional service and reasonable turnaround. Most importantly, it’s about partnering with brokers to help them grow their business, not just deliver a transaction.

We do that in many ways, including by leading in education, training and support. We know there is a lot of change in the market today and we’ve been working hard to help brokers adapt and ensure we’re all meeting our responsible lending obligations for the benefi t of our customers.

3. CBA

MPA: How has CBA changed or improved its online platform and services over the last year to better respond to brokers’ needs?

CBA: The broker channel is important for customer choice, and we are committed to ensuring great outcomes for customers who apply for a CommBank home loan via a mortgage broker.

It is for this reason that we constantly review our online platform and services to see where improvements can be made.

We will continue to review our systems and services to see where further enhancements can be made in a bid to deliver even better outcomes for our brokers and their customers.

4. ST. GEORGE GROUP

MPA: St. George made massive gains in this year’s survey, taking fourth place just behind three major banks, up from seventh place last year. How did St. George have such a good year with brokers?

St. George Group: We’re really proud of the St. George result and pleased to have two Westpac Group brands in the top four. We’ve been doing a lot of work at St.George to improve service levels and turnaround, as well as system and process delivery.

We’ve also done a lot in the education and training space. Our focus is on becoming a more trusted business partner for brokers. We’ve supported our BDMs with training to help them help brokers transform their businesses and meet the needs of customers of the future. We also launched the industry-first broker content platform, Learning Lab, last year with great feedback.

.PNG)