Seven representatives took part in a live-streamed discussion looking at the future of third party, remuneration and living expenses

As brokers send more home loans to non-bank lenders, seven representatives took part in a live-streamed discussion looking at the future of third party, remuneration and living expenses

After another year of growing market share for the non-banks, it was great to have seven of their representatives join MPA for the annual non-bank lenders livestreamed panel.

Held at the Hyatt Regency in Sydney at the end of October, it featured a good cross section of non-banks: those that had been around for more than 20 years, newer players, as well as fintech players.

The roundtable panellists were Aaron Milburn from Pepper Money, Cory Bannister from La Trobe Financial, Daniel Carde from Resimac, Joanna James from Mortgage Ezy, John Mohnacheff from Liberty, Michael Burke from OnDeck and Yotta Agamemnonos from Loanworks.

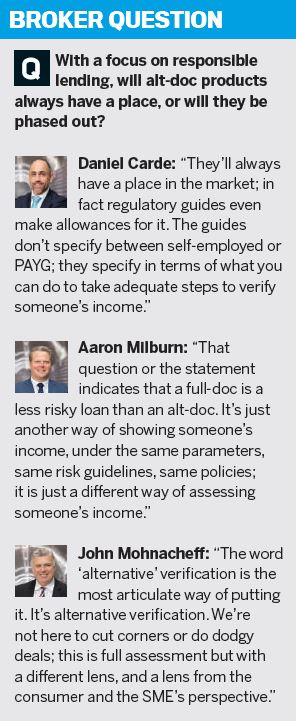

The topics discussed by the group ranged from technology and innovation to the assessment of living expenses, as well as BDM and credit assessor support.

Brokers were able to text in their own questions, and one about the lenders’ strategies for the third party channel led to some very positive and passionate declarations of support for brokers.

The discussion was interesting because non-banks’ distribution sources are primarily brokers, which means they are heavily invested in the channel. Each panellist explained how their organisation was going to invest in broker tools and in human capital to support brokers.

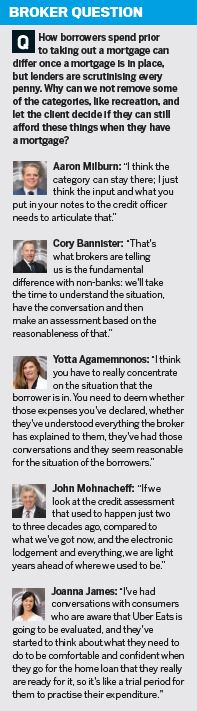

The assessment of living expenses has been a particular area of concern for brokers over the last two years. Not only has it slowed down turnaround times as credit assessors have been taking an overly cautious look at borrowers’ spending, but brokers say they feel scrutinised themselves when the banks call them to ask questions.

Non-banks have the ability to be more flexible, and you will see how they addressed this difficult topic in the following pages.

MPA would like to thank each of the seven non-bank representatives for joining the panel and answering the questions, as well as those brokers who sent in questions ahead of time and throughout the discussion.

Those who missed or would like to watch the live discussion again can find it at www.mpa.com.au/tv.

Q: Brokers are sending more home loan applications to non-banks. Why do you think this is?

According to the latest MFAA Industry Intelligence Service report, the proportion of broker-originated loans going to non-bank lenders currently sits at around 9.4%. The segment has seen continued growth, which has tripled since early 2015.

Joanna James, general manager of Mortgage Ezy, said she believed the growth was down to three factors: the policy changes in relation to things like living expenses; the banks taking a “cookie-cutter approach” to applications; and the wide variety of products non-banks were able to offer.

“The non-bank sector looks at individuals and at individuals’ needs, and I think there’s great sentiment in the market generally amongst brokers and consumers to be considered for their individual situation, and people are realising that non-banks actually offer that,” she said.

Emphasising the range of products that non-bank lenders offer, Liberty Financial’s national head of sales, John Mohnacheff , said people were starting to realise the unique products on offer, particularly for small business owners.

He mentioned borrowers who needed to use alternative verification of income, such as those who were self-employed or received Centrelink payments.

“We take all that into consideration, because our primary driver as a non-bank is to find a solution for as many customers as we can,” he said.

“So not a cookie-cutter approach; we assess everything holistically and try to provide a unique solution for people’s unique situations.”

The growth since 2015 was a result of regulatory changes, added Resimac’s general manager of third party distribution, Daniel Carde. The industry saw tightening of interest-only lending and investment lending, with the majors making “drastic changes” that gave brokers a reason to look at non-banks.

“We weren’t under the same pressures to make those changes, so as brokers started to use us for those particular loans, they actually saw what we could do as a whole,” Carde said.

“I think that trend has continued because they do now see us as a genuine alternative to those major lenders, so the regulatory change drove the behaviours to have a look, and it’s just continued from there.”

Agreeing that brokers want to move away from the major lenders, Loanworks director of lending products Yotta Agamemnonos said the lender was continually frustrated with the service the banks were providing.

She said the best thing about a non-bank was that it could provide that customercentric and broker-centric service and build strong relationships.

“Communication is the key,” she said. “As a non-bank sector we tend to communicate a lot more with our brokers and mortgage managers and originators that come through, and I think that’s very important.”

For OnDeck Australia’s head of sales, Michael Burke, brokers should be considering non-bank lenders for two key reasons: access to capital, and speed.

The online lender conducted a survey earlier this year, which showed that one in four SMEs had been declined fi nance by a bank. Of those that did receive finance, 29% said the time it took for the bank to approve the loan had negatively impacted the revenue of the business.

“Small businesses today are opportunistic in their decision-making; they need to move quickly,” Burke said.

Being a non-bank lender and a digital one at that, Burke said OnDeck had the ability to service that need for speed and assess the transaction differently to the way banks might do it.

“For us it’s really about assessing transactions based on the cash flow merit of the borrower, whereas mainstream have a stronger focus around how much equity is in the house,” he said.

“That’s coupled with the fact that, through technology and established credit decision models, we’re actually able to make informed decisions quickly, so that allows small businesses not only access to capital but access in a timely manner.”

Being able to help customers with their dreams and aspirations is a big reason for brokers to use non-banks, added Pepper Money’s general manager of mortgages and commercial, Aaron Milburn.

He said a customer would go to a broker for help, and that broker could either choose a bank with one product and a changing appetite, or go to a lender like Pepper, which had a variety of options.

“What we’re trying to do through education is say we are here; we have the solutions to help more Australian families, and we’re here to help educate you and your clients on what we can do for them,” he said.

Q: A recent report has also shown that SMEs are more likely to turn to non-banks to fund their growth plans. How are you helping your SME customers and the brokers who are trying to assist them?

The Australian Banking Association report on SME Lending in Australia published in August showed that 60% of people who had thought about starting their own businesses cited access to money as the factor holding them back.

It also indicated that, while most businesses were still turning to banks for funding, the smaller the business the more likely they were to use a finance company instead of a bank.

Small businesses have been struggling with tighter lending restrictions, meaning many of them are turning to non-bank lenders. Treasurer Josh Frydenberg recently called on banks to make it easier for small businesses to access finance, as many of them have been held back by tighter regulations since the royal commission.

Cory Bannister, vice president, chief lending officer at La Trobe Financial, said non-bank lenders were in fact better conditioned to dealing with SMEs and selfemployed borrowers.

As well as offering the options of alt-doc loans and self-managed super fund lending, Bannister said there were a number of ways La Trobe Financial was helping SMEs, such as with Lite-Doc products, SMSF loans and cash-out.

While the banks might have more stringent credit policies when it comes to lending to businesses, Mohnacheff said that was not the case for non-banks like Liberty. He said the lender had always looked at selfemployed people as individuals who had “taken an enormous risk”.

“We understand that every small business person is different, be it from a trade or a fi nance industry or catering. They’re all quite diverse and very different industries,” he said.

“We will engage with the broker to help the small business person have that wonderful personal connection to help them get the outcomes that they need.”

As well as offering the options of alt-doc loans and self-managed super fund lending, Bannister said there were a number of ways La Trobe Financial was helping SMEs, such as with Lite-Doc products, SMSF loans and cash-out.

“Non-banks and the manual assessment process can handle inconsistent or variable incomes as well as seasonal income,” he said. “We understand that [SMEs] have their own unique needs and requirements, and we tailor our products accordingly.”

While the banks might have more stringent credit policies when it comes to lending to businesses, Mohnache said that was not the case for non-banks like Liberty. He said the lender had always looked at self-employed people as individuals who had “taken an enormous risk”.

“We understand that every small business person is different, be it from a trade or a finance industry or catering. They’re all quite diverse and very different industries,” he said.

“We will engage with the broker to help the small business person have that wonderful personal connection to help them get the outcomes that they need.”

Q: In our recent Brokers on Non-Banks survey, brokers said the biggest barrier to using non-banks was their higher rates and fees. What do you say to that?

Forty-three per cent of respondents to the 2019 MPA Brokers on Non-Banks survey said the biggest barrier to using non-bank lenders was their higher rates and fees.

James said this was a “preconceived idea” about non-banks, but it was not true. She said Mortgage Ezy had some of the sharpest rates in the country and had seen growth in volume because of that. The important thing was not just the headline rate, she added. It was the fees and charges over the life of the loan.

Carde added that it was also about the solution non-banks were offering. If a borrower had adverse credit, a bad repayment history or short-term employment, there was a higher risk, and they would not qualify for the best rate.

“If you do have impaired borrowers, we can help those as [we are] solution-based,” he said. “The rate’s not actually the most important factor on those types of transactions; it’s the solution that you’re providing to get the borrower to where they need to be to realise that dream and aspiration.”

Milburn agreed, and said the best rate the customer could get was one specific to the product that could help them. Often, a borrower would start out on one rate, but as their credit journey continued, they would move on to another product.

“They might start on a rate in a specialist or a near prime product, because that’s where their credit journey has them at the moment,” he said. “We will work with them as they cure, to work them through the different products, because everyone is on a journey. This is not a set and forget. We provide solutions that move with the customer.”

Burke pointed out that there was a lot to consider when it came to rates and fees. He said people just wanted to know what the total cost of the facility was going to be.

OnDeck had joined other SME lenders in incorporating the SMARTBox requirement, and Burke said this was a great way that the industry had been making fees and rates much clearer for brokers.

“Our industry has gone through this transformation over the last 18 months or so, where we’ve driven greater transparency, which I think is fantastic, not just for brokers but also the SME owner,” he said.

Milburn acknowledged that it was difficult for brokers because of the various rates offered, as different customers were on different credit journeys.

To help brokers, he said Pepper had a five-step process to guide them on how to position a customer’s credit journey, help them understand why they were suited to a particular product, and look at the future options as the customer’s journey changed.

Q: The Brokers on Non-Banks survey also showed that the biggest thing non-banks could do to improve was to increase their BDMs and credit assessors. What are you doing to ensure brokers have the level of support they need?

Although BDM support was lowest on the list of important criteria for brokers in the Brokers on Non-Banks survey, just over 22% said non-banks could improve by having more BDMs or credit assessors. A little over 21% said they could have bettertrained BDMs or credit assessors.

Agamemnonos said Loanworks saw its BDMs as important because they helped brokers get the direct service and support they needed, but the group actually allowed brokers to talk directly to its credit assessors.

She said this direct relationship with the decision-makers helped brokers look at how they could do things differently.

Loanworks also holds educational days so brokers can learn how the group packages deals and looks at credit.

“I think it’s important,” Agamemnonos said. “Of course you have to have a BDM presence for them to go out and feel the love, but as an organisation we’ve tried to find various other aspects where we can help these brokers and support them in various ways.”

With a focus on investing in human capital, Bannister said La Trobe Financial had increased its sales team by 27% over the last year. However, he added that it was not always as simple as “throwing people at the problem”.

Bannister said he wanted to focus on credit staff and finding strong, credit-skilled people. The non-bank has turned two of its most senior credit analysts into credit coaches, and it quarantines new recruits for two to three months while they learn the processes in a live environment.

“One thing I think is unique in the nonbank business is that manual assessment process, and if you’re recruiting, and a lot of the time you are recruiting from banks, you need to be sure the answer that’s getting back to the brokers fits with your credit appetite and the way you interpret your own credit policy,” he said.

“We looked at a model where we could have desk-bound BDMs to provide that service, and then as a business we’re currently doing a huge review around the tools our BDMs need to then be able to train and educate and leverage, and to help the brokers,” she said.

Carde said Resimac employed the same strategy and had expanded its relationship management team nationally. They sit close to the credit team, so if there is a complex scenario they can talk face-to-face with the credit officer, and if a broker needs a quick response they are available.

“BDMs are busy at the best of times and quite often tied up for anywhere from an hour in an appointment to two hours or three hours at a PD day, and brokers are looking for a fast response,” Carde said.

“Absolutely, BDMs are important to spread the word, but I think in terms of service you can balance that with a really good relationship management team and we’ll continue to expand that relationship management team over the years, because it has worked quite well for us.”

Providing the right tools was also important, Milburn said. Pepper has invested heavily in technology with the Pepper Product Selector, which enables brokers to select products and get all the information they need within a couple of minutes.

“You can have as many BDMs as you like, but if they’re not empowered to do anything, then really what value can you add?” he said.

“If you think about being a broker – where the cost of doing a deal now has increased because of the compliance, the time it takes, and you’ve got 20-odd lender BDMs trying to get hold of you and get you to do different things – where’s the time to do your work?”

With respect to business loans, Burke said brokers wanted to triage scenarios before submitting an application, so he had employed in-office staff to be available to do just that. He said that over the last 12 months OnDeck had tripled the size of its BDM team, but the lender had evolved in this area as it had scaled.

“What’s interesting is there can be a level of confusion in our space as well, because some people do not think fintech means customer service, and they actually go hand in hand,” he said.

“You deliver speed not just through actually processing the transaction but by being able to call out to a broker early and quickly as to whether or not that scenario’s going to fit our credit model as well.”

With 73 BDMs on the road and a 22-year history, Mohnacheff said Liberty had learnt that there needed to be an “amalgam of services”. Its large number of BDMs was necessary because of the variety of spaces the non-bank played in, but there had to be a personal service underpinning that.

If the broker’s BDM was busy, the broker could ring customer support or the underwriter, or could go into the LibertyIQ platform to ensure they found the answer quickly.

“The investment is very much into human capital at every stage of the process, be it an initial engagement with the BDM, be it a scenarios team, an underwriter on the way through, or the settlements officers or post-service of settlement,” Mohnacheff said. “Most of us here have a human person engaging with the broker and the consumer all the way through.”

Q: How are you helping brokers who may want to diversify their customer base?

Particularly since the royal commission final report threatening mortgage broker pay, diversification has been a key topic.

Mohnacheff said he saw the broker as the “financial go-to person” for all consumer needs. With most people’s first experience of taking out fi nance being a credit card or a personal loan, without a broker that person would probably go to a bank, and “all their choices are gone”.

“You as a broker are this amazing conduit for choice, for all finance requirements,” he said. “So this is why we have a lot of BDMs and we spend a lot of time with our ‘do more’ sessions, to educate and help the brokers realise what is there in front of them, and the only thing that’s holding them back is the fear of ‘I don’t know how to do it’.”

In terms of the royal commission report and how brokers would have been affected, Bannister said brokers needed to look after their investments.

“You need to diversify so you don’t have all your eggs in one basket,” he said. “Brokers were staring down the barrel of their business value going overnight because it probably wasn’t diversified well enough.”

To help its brokers diversify, La Trobe Financial has looked at its barriers to entry and removed accreditation requirements across specific product sets. It has also enabled its credit staff to guide brokers through the process so they are not fearful of doing something they don’t understand.

Pepper Money launched into CRE lending at the start of this year, and Milburn said the non-banks were collectively challenging where the major banks had not allowed diversification.

The non-bank has ensured its systems for the commercial side are the same as those for the residential side, to make it as easy as possible for brokers looking to diversify.

“The major banks were saying only this subset of brokers could transact CRE deals,” Milburn said. “So if you had a customer come in, you would have to refer them potentially to someone that’s in competition to get that transaction done for your client.

“That is not a great model for brokers, and so we created a platform where we wanted to smash hub-and-spoke approaches and give the ability for brokers to help their customer or the family in front of them, whether it was a home loan, a car loan, a CRE loan, a personal loan.”

Burke agreed that the broker should be able to keep their customer, having worked hard to build the relationship and earn their trust.

“Clearly, I’m advocating for diversification because my product is essentially a non-core product; it’s not a home loan or it’s not an equipment finance solution, so we’re obviously big about diversification,” he said. “But I look at brokers, and I think you’ve done all the hard work, you’ve got the relationship – ask the questions.”

Mortgage Ezy is also enabling and encouraging brokers to diversify, seeing a real need to do so in this market. The lender has focused recently on SMSF loans, and James said it had spent some time training brokers on how to put the products together.

While many brokers were concerned at first, James said they had seen growth in their businesses, which showed how important it was to diversify.

Mortgage Ezy has also focused over time on non-residential lending.

“Australia is a country based on a diversification of cultures. So I think diversifi cation has also got a cultural element to it as well,” James said.

Although the lenders and those brokers who do diversify are seeing positive results, the prospect of diversifi cation can still be daunting.

Agamemnonos pointed out that there were many different options for brokers to be aware of across many different products. To combat that, she said Loanworks had tried to make the process as simple as possible, acknowledging that the onus was on the lenders to help.

“We’ve tried to simplify and streamline all our processes so that whether you have a full-doc loan, a commercial alt-doc loan, or an SMSF loan, the process that you have to follow is the same,” she said.

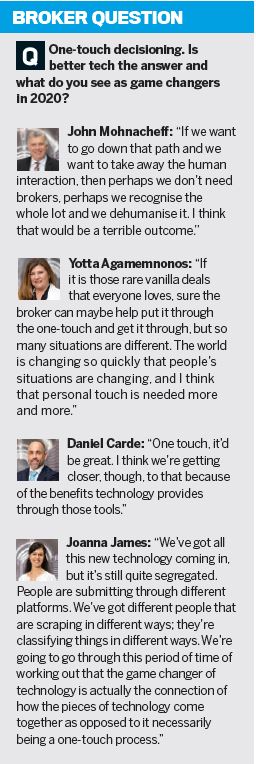

Q: What role is technology playing in lending at the moment, and how are you keeping up?

Loanworks Technologies is part of the Loanworks group, so Agamemnonos said the lender had always been able to stay at the forefront of innovation and automation. It recently teamed up with neobank 86 400 for straight-through processing and she said it would be incorporating that into the broker space.

“We want brokers to be out there doing what they do best,” Agamemnonos said. “So if they can automate processes, the more we can automate the back-end processing stuff , the more they can have time to be out there doing what they do.”

While technology is streamlining processes and making transactions faster and easier, Milburn warned that it should not replace human interaction. Instead, it should be an enabler.

Technology should be used to help a customer or a family with a solution that they could still talk to a broker about, he said. Then, when the loan application was submitted, technology should be used in the right way to expedite that journey.

Pepper Money has recently launched in New Zealand, where Milburn said it had introduced the country’s first end-to-end online submission platform.

“We’re not replacing human contact over there,” he said. “We still have credit staff that will manually assess the deal; we use technology to get the deal to us quicker and then back out quicker.

“We’ll do that in Australia; we’ll continue to build out what we’ve got already, and we’ll continue to invest in it. But caveat, we’ll not look to replace the human element that’s at the heart of that business.”

Agreeing that technology should not replace the human, Carde added, “It’s about improving time and just keeping on top of the flow that comes through. It’s absolutely an enabler.”

For fi ntech OnDeck, technology is a big part of its service offering. Burke said it enabled the lender to make more informed decisions, particularly with tools like bankstatements.com, which allowed the lender to look at real-time statements rather than PDFs.

Comparing the response of customers in this market with those in the US where the brand was first established, Burke has seen a difference in how Australians are adapting to technology.

“North of 75% are taking up bankstatements.com, so the preparedness to embrace technology as a whole in Australia is considerably higher than what we see in the US,” he said.

The use of technology should also mean there are fewer errors, said Mohnacheff. Online systems can tell a broker if they have missed a fi eld in a document or entered something inaccurately, which helps improve the speed of processing from application to settlement.

However, Mohnacheff agreed with Milburn’s point that the human should not be taken out of the process.

That’s where the brokers engage in coming up with the right solution,” he said.

“Machines won’t do that. They can’t sit there and say, ‘I understand this life situation’. Maybe one day who knows, they may. But I’m telling you right now, it just doesn’t happen. So this is where you negotiate and discuss the right solution, but the machines will help the outcome.”