Part of a new generation of accountants moving into broking, Darren Sambrooks and his wife Renae are bringing a new approach to the business.

In career terms, broking and banking used to be pretty synonymous; indeed, almost all of the industry’s top performers worked for lenders for several years before branching out on their own. That’s no longer the case, as the success of the mortgage broker model – and its 52% market share – is attracting other financial professionals to try their hand at mortgages, with implications for brokers.

Darren Sambrooks is Mortgage Choice’s broker for Fremantle and a number of other Perth suburbs, and won the franchise’s WA Rising Star of the Year award back in July. But his background is actually in accounting; not as a personal accountant, as many brokers are accustomed to dealing with, but in corporate and public accounting, at organisations including AGL Energy and ConocoPhillips in the UK.

It’s been quite a journey getting to mortgage broking, and to Fremantle. Darren is from Geelong in Victoria, and later spent time in Brisbane and Royal Leamington Spa in the UK. It was his wife Renae, rather than broking, that brought the couple to Fremantle, and to mortgage broking, Darren explains. “We did about all of our life changes within three months: moved home, moved state, had a baby, changed jobs … it was pretty full on!”

Accountants in broking

The surge, real or imagined, of accountants into broking is big news this year. Back in June, Certified Public Accountants Australia applied for an Australian Credit Licence, which could allow them to sell mortgages. And Darren’s approach to broking suggests accountants who make the move could prosper. From day one it’s helped him submit loans, he reflects: “I think my analytical thinking helps me to put the numbers together in the right spots and come up with scenarios for clients.”

Worryingly for traditional brokers, Darren believes the link with accounting helps his marketing. “I think clients have a higher level of trust in me because I do promote my CPA membership and it helps from that perspective.” With accountancy being taught as a university degree and the Cert IV for mortgage broking being taught in as little as three weeks, it’s generally a one-way flow between the professions.

While he advises clients to consult their own accountants, Darren is finding that his technical skills are a value-add for certain clients. “When I see self-employed clients and companies I can read their financials instantly and even give them general advice on things they could do a bit better. So there’s definitely a connection between mortgage broking and accounting, I feel.”

Apart from specific technical skills, Darren has brought the corporate accountant’s long term strategic approach to an industry that has traditionally been focused on getting the best deal on a single transaction, the home loan. “I’ve had quite a lot of multi-clients,” he explains, “where they’ve wanted to refinance their home and cash out to buy an investment property, or are refinancing multiple investment properties.”

What is bringing these clients back isn’t follow-up calls, or database marketing. Inspired by their initial conversations with Darren, clients have gone out and got those investment properties themselves. It all springs from that initial interview. “I try and make clients realise they can see me for everything; that they’re a client for life, and I’m going to set up everything now to help them in the future … at least have that conversation with them, as it might trigger things that they might want to do.”

Staying relevant online

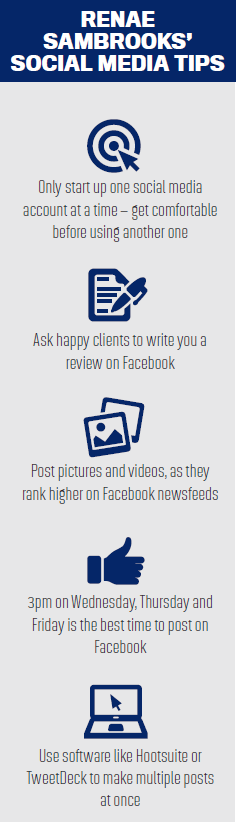

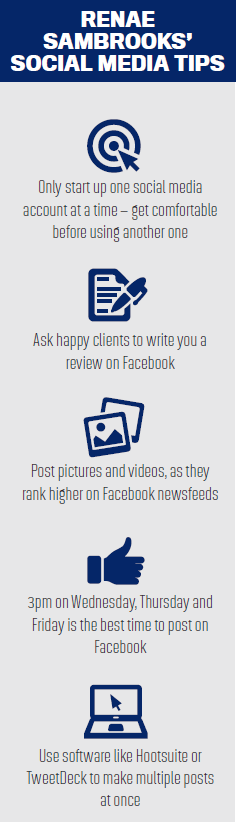

While Darren brings his accountancy skills to the business, it’s his wife Renae who runs their extensive digital presence. Mortgage Choice Fremantle is on Facebook, LinkedIn, Instagram, Gumtree, Twitter and YouTube, while Darren is an active blogger on Mortgage Choice’s website. However, it’s not just about scale; the Sambrooks take the same strategic approach to digital marketing as they do to clients’ loan structures. For a start, Renae utilises the various social media platforms in different ways. “Digital assets each have a different tone, and audiences interact with them in different ways. Instagram is probably a bit more playful and they’re not really interested in business as such.”

For example, the day before MPA talked to the Sambrooks, they posted a picture of Darren with his daughter at the beach. The picture has nothing to do with mortgage broking – instead, Renae explains, “it shows we’re in Fremantle, we’re local, we have a family”.(“We have a life!” Darren jokingly adds.)

Conversely, Darren’s LinkedIn page is highly professional, featuring a bullet point list of the services he provides, a line on the WA Rising Star award, a video and then the usual career history, accompanied by recommendations. The brokerage’s Facebook page is almost a mix between the other two platforms: there are charming photos, articles on celebrities’ houses, but also information on professional events the Sambrooks will be attending and links to Darren’s blogs.

Renae says having a digital presence isn’t all about direct lead generation. “I find when people look for a mortgage broker and someone recommends Darren to them, they’ll go and look at different platforms, and really the reason why we do the social media is just to validate Darren, so they feel comfortable, and there’s something about Darren they like,” she says.

It’s vital that Darren does appear in potential clients’ Google searches.

Even the name Mortgage Choice Fremantle was picked because it was a more obvious search term for clients – the brokerage actually covers a much wider geographical area.

Being attentive to Google’s rules also guides the content they post. While many brokers use articles prepared by their franchise or aggregator, Renae warns that Google penalises duplicated content.

She says maintaining a digital presence doesn’t take too much time out of her day: “You’re on those sites anyway, incidentally, so I often schedule the posts, and if I see an interesting news story come up I will go and post it, although I’m aware of which times in the day will get the most hits; I wouldn’t post something on Facebook on Monday morning at 9am.”

Renae and Darren approach social media through the prism of branding, rather than lead generation. “We’ve had some leads come directly from Facebook and Facebook messaging, but they usually come direct and say we’ve seen your profile and we really like it … we think it really enhances the brand in a way.”

Given that mindset, they’re not overly concerned about the quantity of their posts, Renae adds. “Social media is not about bombarding people with ‘get the best home loan’; it’s about keeping yourselves relevant.”

Moving beyond mobile broking

After just two years in broking, Darren explains that while mobile broking has been good for their young family, they have ambitions to grow the business. “Renae was doing a couple of days’ consulting a week, and I could look after the baby while she was consulting, and then I could do work at nights, the mornings and weekends. The flexibility is brilliant, but I think it’ll get to the point where you can’t grow by working from home, so our plan is to get an office, hopefully in the next financial year, because we can see there’s a point where we’ll need it to get to where we want to get to.”

Darren believes a new office would allow him to take his volumes to the next level. “I think you get to a certain point as a mobile broker where you can’t grow it much further … you can write x amount of loans per month and then you can’t handle any more without support staff, and you can’t really have support staff coming into your home.” They also hope to have a financial planner in the office one day a week.

In the meantime, the Sambrooks will continue to work as a team, Renae explains. “Between Darren and I we have different strengths, and that’s quite a positive: I’m interested in the digital side, and I deal with accountants and solicitors.” Although Darren has a head for the numbers, he’s by his own admission “not great at networking”. With Renae covering the marketing side the two of them are growing the business much faster than Darren would as a lone broker, he says. “If you’re doing broking by yourself you just can’t do it.”

And of course they’ll continue to take a long-term approach, both for themselves and with clients. “That’s where I think a mortgage broker can differentiate themselves,” Darren says. “They can talk more about the strategy, goals and things that clients want to do in the future.”

Darren Sambrooks is Mortgage Choice’s broker for Fremantle and a number of other Perth suburbs, and won the franchise’s WA Rising Star of the Year award back in July. But his background is actually in accounting; not as a personal accountant, as many brokers are accustomed to dealing with, but in corporate and public accounting, at organisations including AGL Energy and ConocoPhillips in the UK.

It’s been quite a journey getting to mortgage broking, and to Fremantle. Darren is from Geelong in Victoria, and later spent time in Brisbane and Royal Leamington Spa in the UK. It was his wife Renae, rather than broking, that brought the couple to Fremantle, and to mortgage broking, Darren explains. “We did about all of our life changes within three months: moved home, moved state, had a baby, changed jobs … it was pretty full on!”

Accountants in broking

The surge, real or imagined, of accountants into broking is big news this year. Back in June, Certified Public Accountants Australia applied for an Australian Credit Licence, which could allow them to sell mortgages. And Darren’s approach to broking suggests accountants who make the move could prosper. From day one it’s helped him submit loans, he reflects: “I think my analytical thinking helps me to put the numbers together in the right spots and come up with scenarios for clients.”

Worryingly for traditional brokers, Darren believes the link with accounting helps his marketing. “I think clients have a higher level of trust in me because I do promote my CPA membership and it helps from that perspective.” With accountancy being taught as a university degree and the Cert IV for mortgage broking being taught in as little as three weeks, it’s generally a one-way flow between the professions.

While he advises clients to consult their own accountants, Darren is finding that his technical skills are a value-add for certain clients. “When I see self-employed clients and companies I can read their financials instantly and even give them general advice on things they could do a bit better. So there’s definitely a connection between mortgage broking and accounting, I feel.”

Apart from specific technical skills, Darren has brought the corporate accountant’s long term strategic approach to an industry that has traditionally been focused on getting the best deal on a single transaction, the home loan. “I’ve had quite a lot of multi-clients,” he explains, “where they’ve wanted to refinance their home and cash out to buy an investment property, or are refinancing multiple investment properties.”

What is bringing these clients back isn’t follow-up calls, or database marketing. Inspired by their initial conversations with Darren, clients have gone out and got those investment properties themselves. It all springs from that initial interview. “I try and make clients realise they can see me for everything; that they’re a client for life, and I’m going to set up everything now to help them in the future … at least have that conversation with them, as it might trigger things that they might want to do.”

Staying relevant online

While Darren brings his accountancy skills to the business, it’s his wife Renae who runs their extensive digital presence. Mortgage Choice Fremantle is on Facebook, LinkedIn, Instagram, Gumtree, Twitter and YouTube, while Darren is an active blogger on Mortgage Choice’s website. However, it’s not just about scale; the Sambrooks take the same strategic approach to digital marketing as they do to clients’ loan structures. For a start, Renae utilises the various social media platforms in different ways. “Digital assets each have a different tone, and audiences interact with them in different ways. Instagram is probably a bit more playful and they’re not really interested in business as such.”

For example, the day before MPA talked to the Sambrooks, they posted a picture of Darren with his daughter at the beach. The picture has nothing to do with mortgage broking – instead, Renae explains, “it shows we’re in Fremantle, we’re local, we have a family”.(“We have a life!” Darren jokingly adds.)

Conversely, Darren’s LinkedIn page is highly professional, featuring a bullet point list of the services he provides, a line on the WA Rising Star award, a video and then the usual career history, accompanied by recommendations. The brokerage’s Facebook page is almost a mix between the other two platforms: there are charming photos, articles on celebrities’ houses, but also information on professional events the Sambrooks will be attending and links to Darren’s blogs.

Renae says having a digital presence isn’t all about direct lead generation. “I find when people look for a mortgage broker and someone recommends Darren to them, they’ll go and look at different platforms, and really the reason why we do the social media is just to validate Darren, so they feel comfortable, and there’s something about Darren they like,” she says.

It’s vital that Darren does appear in potential clients’ Google searches.

Even the name Mortgage Choice Fremantle was picked because it was a more obvious search term for clients – the brokerage actually covers a much wider geographical area.

Being attentive to Google’s rules also guides the content they post. While many brokers use articles prepared by their franchise or aggregator, Renae warns that Google penalises duplicated content.

She says maintaining a digital presence doesn’t take too much time out of her day: “You’re on those sites anyway, incidentally, so I often schedule the posts, and if I see an interesting news story come up I will go and post it, although I’m aware of which times in the day will get the most hits; I wouldn’t post something on Facebook on Monday morning at 9am.”

Renae and Darren approach social media through the prism of branding, rather than lead generation. “We’ve had some leads come directly from Facebook and Facebook messaging, but they usually come direct and say we’ve seen your profile and we really like it … we think it really enhances the brand in a way.”

Given that mindset, they’re not overly concerned about the quantity of their posts, Renae adds. “Social media is not about bombarding people with ‘get the best home loan’; it’s about keeping yourselves relevant.”

Moving beyond mobile broking

After just two years in broking, Darren explains that while mobile broking has been good for their young family, they have ambitions to grow the business. “Renae was doing a couple of days’ consulting a week, and I could look after the baby while she was consulting, and then I could do work at nights, the mornings and weekends. The flexibility is brilliant, but I think it’ll get to the point where you can’t grow by working from home, so our plan is to get an office, hopefully in the next financial year, because we can see there’s a point where we’ll need it to get to where we want to get to.”

Darren believes a new office would allow him to take his volumes to the next level. “I think you get to a certain point as a mobile broker where you can’t grow it much further … you can write x amount of loans per month and then you can’t handle any more without support staff, and you can’t really have support staff coming into your home.” They also hope to have a financial planner in the office one day a week.

In the meantime, the Sambrooks will continue to work as a team, Renae explains. “Between Darren and I we have different strengths, and that’s quite a positive: I’m interested in the digital side, and I deal with accountants and solicitors.” Although Darren has a head for the numbers, he’s by his own admission “not great at networking”. With Renae covering the marketing side the two of them are growing the business much faster than Darren would as a lone broker, he says. “If you’re doing broking by yourself you just can’t do it.”

And of course they’ll continue to take a long-term approach, both for themselves and with clients. “That’s where I think a mortgage broker can differentiate themselves,” Darren says. “They can talk more about the strategy, goals and things that clients want to do in the future.”