These commercial lenders are delivering on what the majors can't

.JPG)

These commercial lenders are delivering on what the majors can't

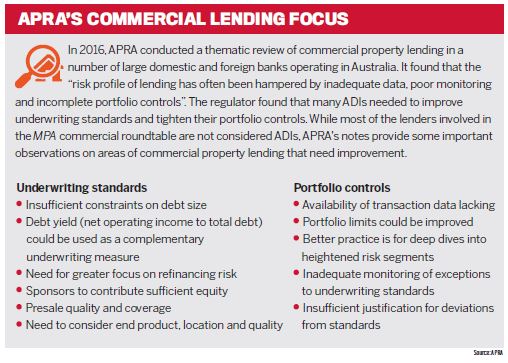

Over the last few months, the royal commission's spotlight has been squarely trained on the residential lending sector, leaving commercial lending matters mostly out of the mainstream conversation.

Meanwhile, in the background commercial business is booming. According to APRA, total commercial property exposures for all ADIs increased to $273.6bn in March 2018, up $8.8bn (3.3%) from March 2017.

MPA’s inaugural Commercial Lenders Roundtable on 21 June at Otto Ristorante in Sydney sought to direct the conversation towards how brokers can take advantage of opportunities in the commercial space. We invited five lenders and two top commercial brokers to share their insights on what’s happening in the space.

The discussion covered the current state of the commercial and small business lending environments; how foreign investment has slowed and what that means for the economy; the growing need for brokers to have more education and training in order to write commercial loans; the challenges and flow-on effects of the royal commission; and where the most opportunities exist for brokers.

Our panellists could have kept talking about all of this for hours, there’s that much going on. What’s obvious is that commercial lending is ripe for brokers who are looking to expand and diversify their businesses, and the non-banks are not shying away from capitalising on the major banks’ distractions.

For the non-bank sector especially, the future looks bright. Many of these lenders are seeing a flood of business as customers look beyond their usual credit providers. While this might be the pricier option, many panellists said customers were willing to pay if it meant they would get speed, service and be treated like a valued business partner over the long term.

While the number of brokers writing commercial loans has increased, it’s still only 17% of the total broker population, according to the MFAA’s Industry Intelligence Service report for April–September 2017.

At the end of that period, brokers settled $8.8bn in commercial loans, up 12% from the period before.

As our panellists reiterated, there are plenty of resources and support systems out there to help eager and engaged brokers make the move into commercial lending, but they need to commit to increasing their skills so they raise the professional bar.

In their eyes, though, it’s worth brokers investing time and effort to learn, because there’s plenty of business to go around.

Many thanks to our panellists for contributing to such a fascinating and wide-ranging discussion: Cory Bannister from La Trobe Financial; John Ewens from Liberty; Robynne Frost from Suncorp; Lachlan Heussler from Spotcap; Jonathan Street from Thinktank; and our two commercial brokers, George Karam from BF Money and Kevin Wheatley from Bayside Residential and Commercial Mortgages.

AROUND THE TABLE

.jpg)

Top from left to right: Cory Bannister, La Trobe Financial; John Ewens, Liberty; Robynne Frost, Suncorp; and Lachlan Heussler, Spotcap

Bottom from left to right: George Karam, BF Money; Jonathan Street ,Thinktank; and Kevin Wheatley, Bayside Residential and Commercial Mortgages

Q: What is the current state of Australia’s commercial lending environment?

The commercial property market is in healthy shape right now, particularly in Brisbane, followed by Sydney and Melbourne.

“Commercial has had a good run, and in the area that we’re in, we’re not seeing the overheating that’s associated with residential,” said Jonathan Street, CEO of Thinktank Commercial Property Finance, which specialises in small-ticket loans up to $3m.

Kicking off the roundtable on an optimistic note, he said the fundamentals were looking solid.

“Lower interest rates, general direction of the economy, low unemployment – those are all good, positive factors for where commercial property should track in the next little while, absent of external factors, Trump, North Korea … a few things there that could easily disrupt,” he said.

“There are a few things that we need to be mindful of in how we communicate risk appetite.”

John Ewens, NSW state sales manager at Liberty Financial, said that with the major banks tightening their lending appetites, the non-bank was jokingly calling itself the “Steven Bradbury of the commercial sector”.

(Steven Bradbury went from last place to first place when he won the short-track speedskating competition at the 2002 Winter Olympics after a massive wipe-out knocked out the rest of his competitors. “Doing a Bradbury” now refers to an unexpected or unusual success.)

Ewens said Liberty had seen a rise in the number of loans for retail and mixed-use businesses.

“A lot of the investors are starting to go for multiple income streams, so mixed shops down in the front, residents up top, and we’ve seen a big influx of that this year in particular,” he said.

“I think the market and the clients are going for rental returns rather than appreciation, so cash flow is becoming an issue.”

The other trend Liberty is seeing is a massive push for SMSF loans.

“We’re seeing a lot of commercial SMSF both for retail shops, office spaces and medical practices,” Ewens said.

Liberty also accepts alternative securities for properties such as boarding houses, childcare centres and adult entertainment establishments.

“What we’re seeing a lot of is no-doc; we’re seeing that come back drastically. It would be our number one selling product in our commercial suite by a long way,” he said.

Q: What is the current state of Australia’s commercial lending environment?

The commercial property market is in healthy shape right now, particularly in Brisbane, followed by Sydney and Melbourne.

“Commercial has had a good run, and in the area that we’re in, we’re not seeing the overheating that’s associated with residential,” said Jonathan Street, CEO of Thinktank Commercial Property Finance, which specialises in small-ticket loans up to $3m.

Kicking off the roundtable on an optimistic note, he said the fundamentals were looking solid.

“Lower interest rates, general direction of the economy, low unemployment – those are all good, positive factors for where commercial property should track in the next little while, absent of external factors, Trump, North Korea … a few things there that could easily disrupt,” he said. “There are a few things that we need to be mindful of in how we communicate risk appetite.”

John Ewens, NSW state sales manager at Liberty Financial, said that with the major banks tightening their lending appetites, the non-bank was jokingly calling itself the “Steven Bradbury of the commercial sector”.

(Steven Bradbury went from last place to first place when he won the short-track speedskating competition at the 2002 Winter Olympics after a massive wipe-out knocked out the rest of his competitors. “Doing a Bradbury” now refers to an unexpected or unusual success.)

“There’s so much in and out, toe in, toe out with the banks’ changing appetites; it’s so hard for, one, consumers and, two, finance brokers to be able to navigate” - Cory Bannister, La Trobe Financial

Ewens said Liberty had seen a rise in the number of loans for retail and mixed-use businesses.

“A lot of the investors are starting to go for multiple income streams, so mixed shops down in the front, residents up top, and we’ve seen a big influx of that this year in particular,” he said.

“I think the market and the clients are going for rental returns rather than appreciation, so cash flow is becoming an issue.”

The other trend Liberty is seeing is a massive push for SMSF loans.

“We’re seeing a lot of commercial SMSF both for retail shops, office spaces and medical practices,” Ewens said.

Liberty also accepts alternative securities for properties such as boarding houses, childcare centres and adult entertainment establishments.

“What we’re seeing a lot of is no-doc; we’re seeing that come back drastically. It would be our number one selling product in our commercial suite by a long way,” he said.

Q: Why are you seeing so many no-doc loans?

“Clients are … not too concerned about rate. They want that short-term asset lend,” Ewens said. “Get in, make it as easy as possible, especially if we’re seeing those more astute investors who have multiple companies and trusts.”

Top commercial broker and director of BF Money George Karam added that the customer didn’t necessarily choose or run towards paying a more expensive rate, “but after the recent experiences they might have had trying to deal with their existing bank … they’re more than happy to pay that rate for a certain certainty of outcome”.

In Karam’s experience, this is actually pushing higher-calibre or more credible applicants to apply to the non-bank lenders for loans.

When once upon a time these customers never would have considered such rates, they were now seeing more value in the loan products and solutions offered – mainly for that ease and reliability, he said.

Another top commercial broker, Kevin Wheatley, managing director of Bayside Residential and Commercial Mortgages, said currently the two key drivers for borrowers were rate in exchange for LVR, and faster processing times, which the nonbanks are offering.

“We can create an industry that is so much more efficient and focused on the customer outcomes … if the quality and education of brokers increases” - George Karam, BF Money

The big four banks just aren’t delivering in this climate, Wheatley said.

“What’s your point of difference? I might as well go offshore to get the money. Australian institutions are the main four now, and they’re running scared, big time,” he said.

With the big four banks tightening their credit assessment and serviceability policies as a result of the royal commission and recent APRA scrutiny, there has been an increased level of unpredictability in the market.

This can make it difficult and even embarrassing for brokers who are on the coalface with clients and have to explain why the bank has suddenly changed its appetite with little notice, Wheatley said.

“We just don’t have the capacity to fund the bigger projects that I work on, so I’m forced to go offshore now. Last month I was in Beijing for two and a half weeks raising capital. And if you think you have some challenges ahead of you, try and get money out of China.”

Wheatley is now getting about half of his funding from offshore sources.

“Anything over $100m, forget it here,” he said.

Q: What are you seeing in the commercial market in regard to foreign buyers, and how might that change in the next few years?

Cory Bannister, vice president and chief lending officer at La Trobe Financial, said it was not that foreign buyers were fleeing Australia; they were just downsizing their property goals and investment strategies.

“The lumpy assets and trophy properties seem to be going out of favour for Chinese buyers. The investment in the country has decreased by 53% in terms of investment in real estate, but it’s still a significant amount. Chinese are still net buyers of commercial real estate in Australia. They’re still investing; it’s just what they’re investing in is changing.”

On the commercial front, while a lot of these investors are stepping away from the larger property developments, retail shopping centres are still in favour, Bannister said.

Based on the larger Asian clients that BF Money represents, Karam said his firm was starting to see more appetite for joint ventures with Australian locals.

“That is part of diversification, but it’s also risk mitigation. So we’re starting to see them now either involve some of the locals in participating in some assets that they already own, or they’re looking to invest in assets in conjunction with Australian locals rather than trying to go at it alone,” Karam said.

Q: What impact will fewer foreign investors have on the Australian economy?

With fewer foreign investors coming into the market and more difficulty accessing foreign funds, the time frames for infrastructure projects and major developments will no doubt draw out, according to Wheatley.

He’s witnessed some of the difficulties already, giving one example of some of the “big players in the market” struggling to get capital and attract offshore investors for a 10-year $3bn plan to transform Sydney’s inner-west suburb of Marrickville.

“Where we have foreign investors who want to come into Australia, there are a lot of tight constraints on them, which is going to slow down what we’re trying to achieve here on the back of political issues,” Wheatley said.

In addition to that, verification of nonresidents is even more complex. “You’ve got to have agents in other countries,” he said. “The agent is responsible for identifying the intended borrower.”

Q: What are some of the trends that you're seeing in the SME sector?

Lachlan Heussler, managing director of Spotcap Australia and New Zealand, an online balance sheet lender, said there was ample amount of capital to supply the SME market.

“It’s more about building the demand side and making sure that the SMEs are aware that this type of financing is available to them and the benefits of it,” he said.

While alternative lenders might be more expensive than a typical mainstream bank facility, they come with other perks, Heussler said.

“We offer the facilities completely unsecured; 24-hour turnaround processes, a very streamlined application process – everything is online,” he said. “It’s more about creating the awareness that this capital is available to them and that we’re a port of call other than the big four banks.”

According to a new report from the Australian Small Business and Family Enterprise Ombudsman, banks’ automated processes that use checklists to assess a borrower’s initial enquiry often shut small businesses out of approvals.

“We tend to see [the royal commission] as a positive in many ways, firstly because of how the majors have retracted from our part of the market, so that’s certainly putting wind in the sails of the non-bank sector” - Jonathan Street, Thinktank

“As SMEs typically have less documentation and shorter financial histories than large corporations, they often fail at this first hurdle,” the Affordable Capital for SME Growth report found. “A successful loan application by these SMEs will always require tailored assessment.”

Just as some other brokers and lenders have experienced, Spotcap has found a different kind of customer knocking on its door, Heussler said. Business clients with yearly revenues of $30–$50m are coming to Spotcap for $250,000 loans because “they’re sick of dealing with the banks”.

“Often the SME owners are after the surety of finance or the availability of capital, and price is the second, third or fourth consideration for them down the track,” Heussler said.

Bannister agreed, saying that clients were often willing to pay for consistency and continuity of service.

“Price isn’t always what they’re chasing,” he said.

“There’s so much in and out, toe in, toe out with the banks’ changing appetites, it’s so hard for, one, consumers, and two, finance brokers to be able to navigate.”

.JPG)

Suncorp has invested prodigiously over the last three years in encouraging brokers to diversify into SME lending. The bank’s two-pronged approach helps brokers to upskill so they can handle small business transactions, and aims to build consumers’ confidence in going to their brokers for their commercial needs.

But Frost said that journey had been a lot harder than expected.

“A typical home loan broker is not skilled around financial analysis, and it’s kind of a little bit scary because there is a phenomenal opportunity there for them. If they’ve got strong relationships with their customers, they should be looking at more than just having a conversation about a home loan,” Frost said.

Heussler said this was something Spotcap had been working on as well: encouraging brokers to go beyond the home loan conversation and ask those second and third questions that could lead to a new revenue stream for their businesses.

“We’re trying to make the products super easy for the layman broker to write, and we also offer all sorts of infrastructure and education materials. ... It might turn into a nice commission cheque without that much work for the broker,” he said.

Liberty’s Ewens said the lender’s ‘Do More’ sessions taught brokers how to become their clients’ go-to financial advocates. The goal was to be more than just “a conduit between a bank and the client for a cheap-rate mortgage”.

“This is what we’re educating all of our members on: that it’s about doing more with that one customer,” Ewens said.

Karam warned, however, that encouraging home loan brokers to become commercial brokers wasn’t just about the sell. He said they needed to understand the legalities, tax implications and fine details of the product or they would not be able to deliver a good consumer outcome.

“This is what we’re educating all of our members on; that it’s about doing more with that one customer” - John Ewens, Liberty

“If you’re too pushy with the broker who doesn’t have that skill set, and try and get them to ask that additional question or make the sale of that particular product before they understand what they’re actually selling, then you are not helping the customer at the other end.”

Unlike home loan brokers who are regulated under the NCCP Act, there is no specific regulation for commercial brokers who help small business borrowers obtain finance or restructure debt. While most brokers who work in the commercial finance space are already licensed home loan brokers and members of one of the broker associations, the lack of commercial regulation shows how important it is to bolster broker education, accreditation and credentials.

Karam doesn’t think the quality of education programs is the problem but the fact that lenders are too focused on driving home loan brokers into selling the occasional commercial deal without providing them with a pathway to becoming experienced commercial brokers. “How is it that you’re vetting the broker who is selling your loan products?” he asked.

Ewens countered that Liberty didn’t just accredit brokers if they ticked a box. He said they were required to complete a 10-step questionnaire and have a commercial BDM visit their office. That BDM would show them Liberty’s platform, talk to them about their business and clientele, and walk them through the lender’s niches and product line. They would help them package the loan, and would continue to do so until the broker felt comfortable doing it on their own.

Bannister said he was not against raising expectations of commercial brokers, but “to be certified or seen as a finance broker, there should be a barrier to entry that ticks a lot of those boxes before you’re able to practice.”

Q: What are some of the key challenges in the commercial space right now?

One of the larger challenges the market will encounter as needs change is the availability of funding, Bannister said.

“I think the royal commission is still probably the greatest headwind facing the industry, which will only impact the availability of funding further. It will be 18 months before that plays out,” he said.

While the royal commission has been cast as a dark cloud over the industry, Thinktank’s Street sees it in a different light. “We tend to see it as a positive in many ways, firstly because of how the majors have retracted from our part of the market, so that’s certainly putting wind in the sails of the non-bank sector,” he said.

“But ultimately, all of this is designed to contribute to a better industry.”

The lenders, aggregators and brokers who increase their professionalism and contribute to a better market will turn things around for the better in the long term, Street said.

“So we’re looking to be as proactive as possible in supporting those principles and themes that are coming out of the royal commission.”

That also comes with backing the industry and helping brokers and aggregators to diversify and strengthen their businesses.

“There will be challenges ahead as interest rates rise and other credit factors intercede, so we’ve got to be there through thick and thin and we’ve got to be prepared for what the future offers, and we might as well embrace it,” Street said.

Bannister highlighted the return of the term ‘shadow banking’ as one of the results of the royal commission.

“They’re talking about the rise of the shadow banking sector, and to me it really doesn’t do justice or service to what we offer in the market,” he said.

“We benchmark ourselves off the APRA guidance model, and we’ve for many years maintained the APRA standards and we meet those standards sufficiently, so there is no lesser standard in how we apply our credit techniques.”

Street said non-bank lenders had actually been faster than the banks in responding to the responsible lending themes that had emerged from the royal commission, and yet they’d actually had to do far less because they already had many of these practices and principles in place.

“If they’ve got strong relationships with their customers, they should be looking at more than just having a conversation about a home loan” - Robynne Frost, Suncorp

Karam suggested that the real challenge would arise as the non-banks became more relevant and saw their volumes grow, and then had to resist starting to act like the big banks.

“How do you maintain the small lender type culture? We’ve already started to see the turnaround times blowing out,” Karam said.

Wheatley added that the non-banks’ point of difference right now was in their processing, speed to market and speed to funding. Where the big banks were failing was in their inability to maintain long-term business relationships.

He said customers were demonstrating that they were prepared to pay for that relationship when they found it.

Bannister’s view was that it all came back to culture and values, but no one was immune to change.

“We’re seeing our turnaround times struggle from where they normally are, and that’s probably only going to stay that way for now. Volumes are up 45% from Christmas to now,” he said.

Q: What are some of the opportunities out there for brokers in commercial and SME lending, and how should they capitalise on it?

There’s good reason why more than half of all consumers are turning to brokers, according to Wheatley. “They’re sick of the banks,” he said.

“The mainstream banks are just out of control. They don’t respect long-term customers, no value at all, so really what this is doing for us and what we’re seeing is an amazing opportunity. Most brokers are honest, hard-working people, and they’ve got diverse knowledge because they don’t represent one particular institution.”

Wheatley said he had 80 lenders on his panel and that he and his staff had to have knowledge of every single one, so much so that sometimes even bankers came to him to ask about one of their own products.

“Brokers in the commercial space who understand complexity are probably the best advisers out there when it comes to providing funding for clients,” he said.

When it came to adding SME finance to their business offering, Heussler urged brokers to have more of a “deep-dive” conversation with their customer base to find out which ones were self-employed.

“It’s an easy question to ask, and for those who are lacking the skill set or confidence, we can help educate them. With the processes that we have designed, it’s really on us to make an informed credit decision.” The broker also has options, Heussler said: they could prequalify clients before introducing them to Spotcap, or they could make a direct referral to the lender.

“We have a very prudent credit policy. We’re here for a long game, not a short game, in terms of building awareness in the sector,” Heussler said.

Ewens said brokers needed to take the “blinders off”. He explained that Liberty had done a survey of 1,000 settled mortgagebroker- introduced customers recently and found that 40% of respondents had a seven-year-old car or older. When they were asked how many brokers had enquired whether they wanted to upgrade their vehicle while being put into a new home, the answer was zero.

“We’re not even identifying opportunities that are staring us in the face right now,” he said. “We all sit here and talk about the royal commission, [but] we need to be seen as a value-add industry. McDonald’s doesn’t ask if you want fries any more; it’s already in a meal deal. They say, ‘Do you want to upsize?’ This industry isn’t even at the fry stage yet.”

The final word

With all that’s going on in the finance sector at the moment, it’s hard not to commiserate with the broker who has to make sense of it all and communicate constant changes to their client.

But this also emphasises the importance of ensuring brokers are adequately qualified.

“A lot of brokers are confused in terms of what their options are for their customers, and that reinforces the importance of a really strong aggregator relationship and a damn good BDM that they can trust and who really knows their stuff, or they’re just going to get lost,” Frost said.

Karam said that if you were to imagine the future of broking, it should be one in which a balance was struck between education, credit and sales.

“We can create an industry that is so much more efficient and focused on the customer outcomes … if the quality and education of brokers increases and if the communication, standards and compliance of the banks are able to be streamlined. Then the commercial mortgage broker can be a real extension of the supply chain of the lender,” Karam said.

Frost agreed that while training was one thing, execution was another. As part of its investment in broker education, Suncorp has identified 150 brokers from around Australia who it will be supporting through an intensive ‘Licence to Lead’ program. Brokers will spend 150–180 hours on the program, using an online educational platform that consists of module-based learnings, with exams and hands-on assistance from the bank’s SME BDM team.

“[If] you really want to move down this path, we’ll partner with you, but it means that there’s skin in the game and you really need to want to be there,” Frost said. “We’re targeting brokers that have big portfolios in home lending and who have supported us. We’ll help you diversify and educate you.”

.JPG)

.JPG)

.JPG)

.JPG)