SE Queensland hit hard by defaults

The average value of invoices (trade receivables) remained high in April despite other leading indicators showing that businesses are coming under increased pressure.

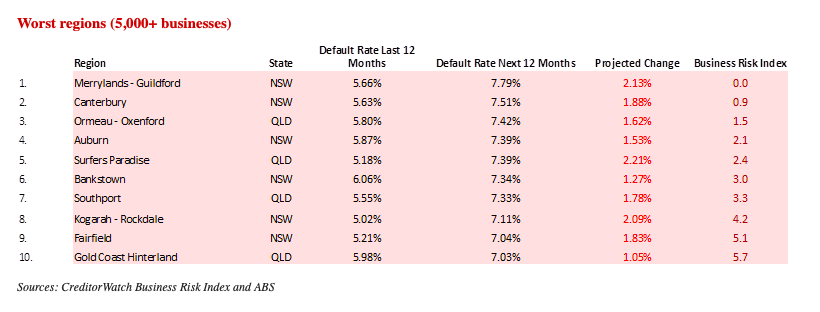

This was according to the April 2023 CreditorWatch Business Risk Index (BRI), which also highlighted that businesses in South-East Queensland were under mounting pressure, with four of the 10 worst-performing regions in that area and Brisbane ranking as the worst-performing capital city.

BRI found a 36% increase in B2B trade receivables year-on-year due to rising inflation but also a resumption of “normal” trading activity post-COVID. But while this increase was encouraging, other leading indicators were a cause for concern, said Patrick Coghlan (pictured above left), CreditorWatch CEO.

“The pick-up in trading activity is great to see but my excitement is tempered by our data on external administrations, in particular, which are rising across almost every industry,” Coghlan said.

External administrations slipped in April month-on-month due to seasonality but remained up 13% year-on-year. CreditorWatch noted that in an environment of still-rising costs for many industries, particularly those reliant on labour, and falling demand, external administrations “almost without doubt” will rise.

“While this is a return to pre-COVID levels in most instances, the rate of external administrations in industries such as healthcare and media/telecommunications is beginning to exceed that,” Coghlan said.

The index also revealed that court actions fell in April due to seasonality but were up 26% YoY. Credit enquiries increased a hefty 139% year-on-year, while B2B trade payment defaults were down from March to April but up 35% YoY.

South-East Queensland has been the hardest hit by defaults, with default rates for businesses in the region considerably higher than the national average. In fact, four of the 10 highest ranking regions in Australia for probability of default were in that area. Factors that drove such results included high rental and property costs, high personal insolvency rates, low median income, and high population density.

The worst regions in the bottom 10 of the index were also very reliant on discretionary spending, which was in decline, and were also impacted by ongoing challenges such as labour shortages.

Food and beverage services remained the industry at highest risk of default, at 7.18%, followed by transport, postal, and warehousing (4.66%) and arts and recreation services (4.62%).

On the other hand, the industries with the lowest probability of default over the next 12 months were health care and social assistance (3.26%), agriculture, forestry and fishing (3.53%), wholesale trade (3.58%).

Port Phillip (VIC), Cairns – South (QLD), and Warringah (NSW) were the regions that posted the biggest improvements in the rate of business failures. In contrast, the regions showing the biggest increases in the rate of business failures were Chatswood-Lane Cove (NSW), Wyong (NSW), and Gosford (NSW).

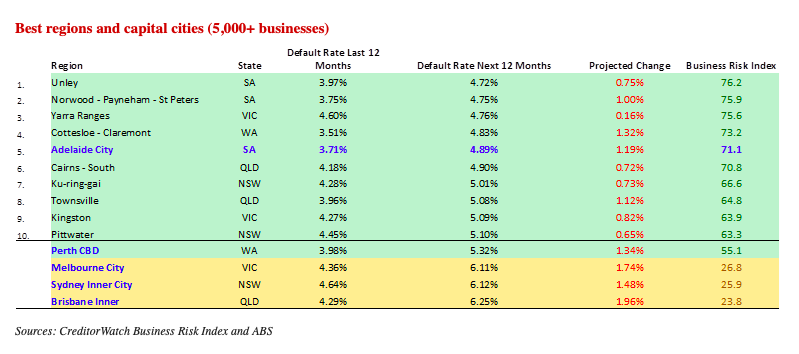

Across regions with more than 5,000 businesses, Unley in South Australia was the region with the lowest insolvency risk, followed by Norwood-Payneham-St Peters, also in SA.

Anneke Thompson (pictured above right), CreditorWatch chief economist, said Australia was at an unsustainable stage in the economic cycle where business conditions are generally good, but consumer demand is plummeting.

“Given all the incoming data, there is little doubt that default rates and external administrations are going to increase,” Thompson said. “The areas that are going to be particularly impacted are those that are most reliant on labour, as labour supply still appears to be in strong demand, despite high overseas migration.”

Use the comment section below to tell us how you felt about this.