Connective lets its brokers build a business that's truly theirs, and the model has piqued interest

Connective lets its brokers build a business that's truly theirs, and the model has piqued interest

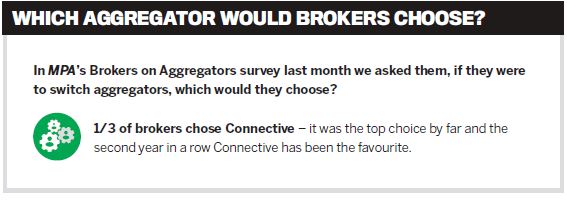

Reflecting on last month’s MPA Brokers on Aggregators survey, it’s clear that most brokers are satisfied with the service they receive – in fact, a whopping 75% said it would be extremely unlikely that they would switch providers any time soon.

Of course, it’s unclear how much of this reluctance is actually due to the encumbrance of changing aggregators. It’s a notoriously tricky and onerous task, and brokers cited more than 20 different obstacles standing in the way of a switch, including contractual obligations, clawbacks and licensing issues.

However, the most prominent obstacle by far was data migration and IT issues. With this deterrent to change receiving 36% of the votes, it seems many brokers are concerned that their valuable client information would be at risk if they switched – and they’re not wrong.

Mark Haron, director of Connective, says brokers often struggle to move customer data or loan data when changing platforms and could face having their trail commissions frozen by their existing aggregators.

“Connective has data import processes for all of the biggest aggregator platforms and independent CRMs. We can synchronise data, workflows and other business-critical processes. Brokers can also choose to keep their data in their independent CRM and complement their business processes with our platform,” Haron says.

Since day one Connective has been committed to removing the obstacles that prevent brokers from being in control of their businesses.

It’s a method that has always suited brokers. When asked in the survey which aggregator they’d opt for if they had to switch tomorrow, one in three selected Connective – for the second year in a row – making it the most appealing partner by far.

“I think one of the reasons a lot of brokers would come to us if they were going to leave their current aggregator is because we don’t put handcuffs on our brokers,” Haron tells MPA.

“We’ve got a very fair agreement which says the data and client information belongs to the broker, so they’re able to export that data when they need to and we’ll help them pull those files off our Mercury platform – likewise, there are no handcuffs on their trail commissions either.

“It means brokers are able to build a business within Connective which is truly theirs – it’s not owned by Connective; it’s owned by them. It’s their customers, their book, and that’s really appealing for a lot of brokers who find the current aggregator they’re with isn’t quite as fair as they might have first thought.”

Of course, giving brokers the freedom to leave without repercussions is only possible because Connective is confident in its own value proposition, says Haron – brokers may have the ability to go elsewhere, but there’s no reason for them to do so.

The Brokers on Aggregators survey supports Haron’s stance. In the survey, brokers pointed to poor IT and CRM support as the top reason they would leave their aggregator – a category in which Connective came out top of the field.

.JPG) “Brokers are able to build a business ... which is truly theirs – it’s not owned by Connective; it’s owned by them” -Mark Haron

“Brokers are able to build a business ... which is truly theirs – it’s not owned by Connective; it’s owned by them” -Mark Haron

“We’re constantly improving Mercury, as a lot of the time it’s the many small, incremental changes that allow brokers to see a big improvement,” Haron says.

One particular upgrade that was embraced by brokers was a refresh of the company’s Connective Wiki, which provides brokers with support and how-to videos on demand.

Brokers can also access a personalised assistant from Connective’s help desk team, and live chat facilities are available within Mercury to help give brokers a better and quicker result.

One of the most significant updates to Connective’s CRM has been its application program interface, which allows different software to interact seamlessly. Brokers are now able to use their favourite programs – such as Xero, MailChimp or Microsoft – within the CRM system itself.

“It allows brokers to choose the best tools that suit what they want to do with their business and the direction they want to take their business in,” says Haron.

The development has also allowed Connective to establish a new marketing automation platform, the Digital Marketing Hub, which gives brokers the opportunity to use and develop customised campaigns in order to boost their revenue and build their businesses.

Importantly, the company has also developed a bank of videos to help brokers understand the improvements that have been made over the last 30 days, and what’s going to be worked on over the upcoming 30 days.

“Brokers are kept informed about any changes, as well as being given guidance on how to leverage them to their full advantage,” Haron says.

These, among many other improvements, come as brokers continue to expect more from their aggregators – something Haron is strongly supportive of.

“Absolutely, brokers should be demanding more,” he says.