Consumers told MPA their thoughts on brokers' after-settlement service in our latest survey.

In our Consumers on Brokers report for the second year running, we get real consumer opinions, good and bad, to the people who really need them – brokers. Our survey ran for five weeks on Key Media’s consumer-facing yourmortgage.com.au comparison website, and on the website of Your Investment Property magazine. These databases are closely monitored. Furthermore, we made sure all our respondents had actually used a broker – this survey is about real experiences, not just perceptions.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

AFTER-SETTLEMENT SERVICE

2015’s rate rises for existing customers put brokers’ after-settlement service to the test and, sadly, many have failed.

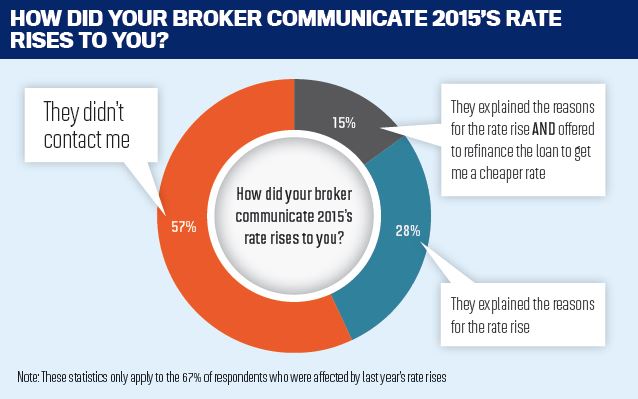

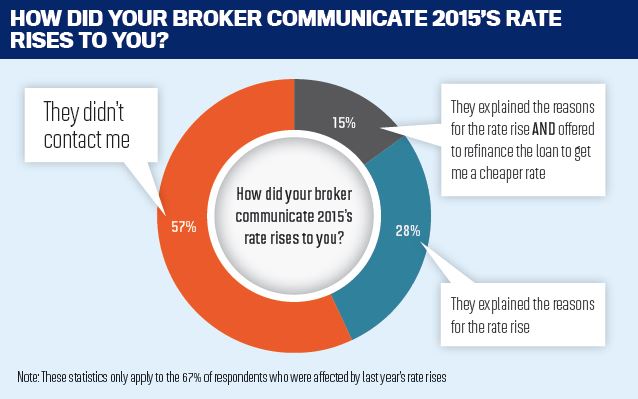

So much for a long-term relationship. Two in five of our respondents have never been contacted by their broker since settling their loan. This isn’t the only alarming statistic emerging from our survey – 57% of respondents whose interest rate went up last year weren’t contacted by their broker. Both findings suggest that, despite increasingly powerful CRM systems, the after-settlement service of some brokers remains woeful, and could be losing them potential business.

Deciding to include after-settlement service in this survey was spurred by recent events. 2015 saw APRA cause banks to raise rates for existing customers, as they attempted to limit investor loan growth and raise capital ratios to match international standards. In our Brokers on Banks survey earlier this year, 65% of respondents said banks didn’t deal with the rate rises in a ‘fair way for new and existing clients’. Their main complaint was lack of communication by banks, both to brokers and their customers, and bank-to-consumer communication that risked marginalising the broker.

Yet it appears a sizeable number of brokers are doing just fine marginalising themselves, by failing to contact borrowers at all. Whether or not you view trail commission as obliging brokers to look after borrowers post-settlement, these brokers missed out on the opportunity to refinance their clients to lower rates. Only 15% of affected respondents were contacted by their broker about refinancing following the rate rises. Furthermore, the failings of some brokers when it comes to offering after-settlement service will hardly reflect well on the industry as ASIC reviews commission structures (more about which you can read in this report’s section on commission).

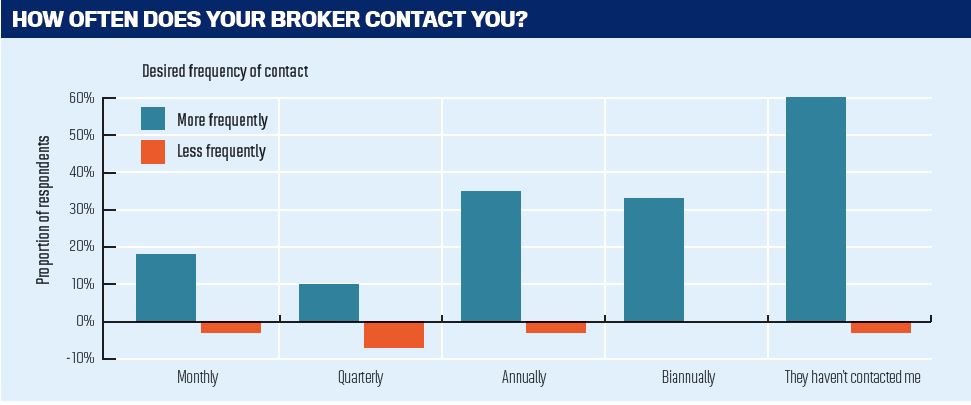

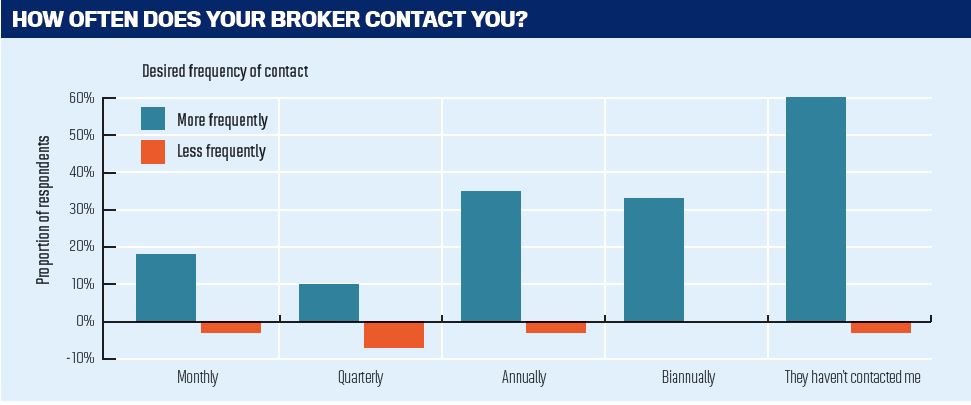

Our findings strongly imply the large majority of borrowers are open to more communication from their broker. We asked respondents how often they’re contacted by their broker, and whether they’d like more communication. Unsurprisingly, 60% of those who have never been contacted would like to be contacted more often – more surprisingly only three per cent of those contacted monthly, and seven per cent of those contacted quarterly, would like less communication.

This finding runs counter to popular assumptions about clients being overwhelmed by broker newsletters and junk mail. What it suggests is that those brokers running monthly and quarterly contact schedules are contacting their clients with interesting, relevant information, which clients are happy to continue receiving. Given that more interaction with the client gives the broker more opportunities for repeat business, then it appears contacting clients more frequently has all of the positives and few of the negatives.

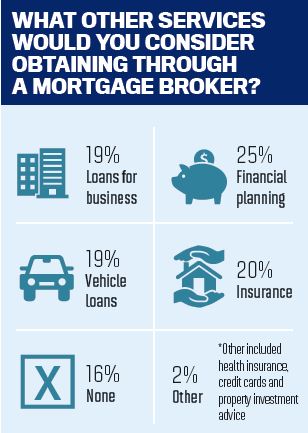

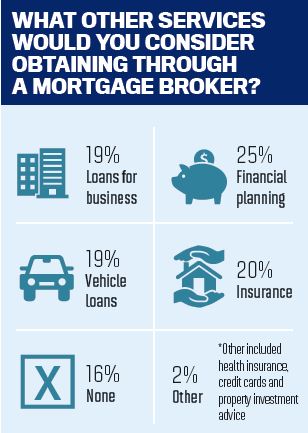

Regularly contacting clients after settlement could generate not just refinancing enquiries, but a number of other revenue streams for brokers, our results suggest.

We asked borrowers whether they’d be open to getting services other than a mortgage from a mortgage broker, and only 17% said they would not be interested in this. Obviously, brokers should target clients with relevant information, but services such as insurance and financial planning have wider appeal.

There are plenty of external developments pushing brokers to contact their clients more – the potential for further APRA-driven rate rises, ASIC’s abovementioned remuneration review, not to mention increasing competition between brokers. Our survey suggests that there’s little danger in communicating more with your clients – but a lot to be lost by not communicating at all.

Our survey is, admittedly, not as big as those of the banks, but unlike the banks we don’t have a message or product to push. Instead, our questions have focused on current issues, namely ASIC’s remuneration review and the rate rises for new and existing customers introduced by banks in 2015. We’ve also included a number of practical questions to help brokers with their marketing and after-settlement service, and distinguished between different income and borrower groups where appropriate.

AFTER-SETTLEMENT SERVICE

2015’s rate rises for existing customers put brokers’ after-settlement service to the test and, sadly, many have failed.

So much for a long-term relationship. Two in five of our respondents have never been contacted by their broker since settling their loan. This isn’t the only alarming statistic emerging from our survey – 57% of respondents whose interest rate went up last year weren’t contacted by their broker. Both findings suggest that, despite increasingly powerful CRM systems, the after-settlement service of some brokers remains woeful, and could be losing them potential business.

Deciding to include after-settlement service in this survey was spurred by recent events. 2015 saw APRA cause banks to raise rates for existing customers, as they attempted to limit investor loan growth and raise capital ratios to match international standards. In our Brokers on Banks survey earlier this year, 65% of respondents said banks didn’t deal with the rate rises in a ‘fair way for new and existing clients’. Their main complaint was lack of communication by banks, both to brokers and their customers, and bank-to-consumer communication that risked marginalising the broker.

Yet it appears a sizeable number of brokers are doing just fine marginalising themselves, by failing to contact borrowers at all. Whether or not you view trail commission as obliging brokers to look after borrowers post-settlement, these brokers missed out on the opportunity to refinance their clients to lower rates. Only 15% of affected respondents were contacted by their broker about refinancing following the rate rises. Furthermore, the failings of some brokers when it comes to offering after-settlement service will hardly reflect well on the industry as ASIC reviews commission structures (more about which you can read in this report’s section on commission).

Our findings strongly imply the large majority of borrowers are open to more communication from their broker. We asked respondents how often they’re contacted by their broker, and whether they’d like more communication. Unsurprisingly, 60% of those who have never been contacted would like to be contacted more often – more surprisingly only three per cent of those contacted monthly, and seven per cent of those contacted quarterly, would like less communication.

This finding runs counter to popular assumptions about clients being overwhelmed by broker newsletters and junk mail. What it suggests is that those brokers running monthly and quarterly contact schedules are contacting their clients with interesting, relevant information, which clients are happy to continue receiving. Given that more interaction with the client gives the broker more opportunities for repeat business, then it appears contacting clients more frequently has all of the positives and few of the negatives.

Regularly contacting clients after settlement could generate not just refinancing enquiries, but a number of other revenue streams for brokers, our results suggest.

We asked borrowers whether they’d be open to getting services other than a mortgage from a mortgage broker, and only 17% said they would not be interested in this. Obviously, brokers should target clients with relevant information, but services such as insurance and financial planning have wider appeal.

There are plenty of external developments pushing brokers to contact their clients more – the potential for further APRA-driven rate rises, ASIC’s abovementioned remuneration review, not to mention increasing competition between brokers. Our survey suggests that there’s little danger in communicating more with your clients – but a lot to be lost by not communicating at all.

A MESSAGE FROM OUR SPONSOR

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank

Information is powerful. Understanding your customer’s needs, financial goals and what led them to you in

the first place will play a defining role in shaping your service proposition. At Suncorp Bank, we recognise the importance of putting the customer at the heart of every decision.

We know customers are increasingly engaging with brokers for their home and investment lending needs. The value lies in knowing why. With this in mind, Suncorp Bank is proud to partner with MPA to bring you the Consumers on Brokers survey, proving valuable insights into consumer behaviour.

Brokers are looking for more than a mortgage broker °– they are looking for a trusted partner. At Suncorp Bank, we see our service as an extension of yours.

Our proposition is built around supporting the broker-customer relationship. Exceptional service is central to this, with our national team of Business Development Managers and local call centre sta˛ ed with lending experts providing on-the-ground, dedicated support.

Suncorp Bank aims to support brokers to do this by providing access to decision makers and other crucial information through the loan process. Transparency is a key part of this, allowing brokers to set and manage expectations with their customers.

Feedback is one of the most powerful tools available to our industry. We hope that the Consumers on Brokers survey provides valuable insights, information and intelligence to support you to enhance your customer service proposition, as we seek to continue to elevate our own for brokers.

Steven Degetto

Head of intermediaries

Suncorp Bank