Forecasting a key part of solution

Cash flow is critical to the long-term success of every business. It’s the lifeblood of small and medium-sized businesses across Australia. It’s defined as the amount of money entering and then leaving a business over a given period. Having a thorough understanding of cash flow and recognising its importance allows a business not only to meet its financial obligations but, just as importantly, to plan for the future too.

What do we know about cashflow and customers?

Managing cash flow is an ongoing challenge for all businesses, especially during their infancy or when hit with unexpected impacts such as COVID-19 or other unforeseen market changes. Businesses can find it hard to predict what cash flow they will need to ensure they can keep their business afloat, let alone look to the future.

There are many reasons why a business owner may not be financially prepared. The most common reasons include failing to plan properly, setting ambitions too high or too low, not keeping track of costs, and not chasing up payments.

Reviewing business processes

ANZ relationship manager commercial broker Ben Goulding (pictured), says that during the initial COVID-19 shutdowns many businesses were forced to review current business operations.

While this caused businesses angst and stress over what the future may hold, it also meant business owners had time to consider things such as:

- Can processes be completed more efficiently and under a more cost-effective model?

- Alternate ways of revenue generation outside of the ‘norm’ for industries

- A detailed understanding of the cost of doing business and if any discretionary expenses could be minimised

- Having a detailed understanding of their business’ cash flow cycle

Goulding says these considerations helped businesses survive during this period.

How brokers can help their clients

To secure business lending, your client will need to provide an appropriate summary of their cash flow status. However, many assume being an active business will be proof in itself.

As a broker you can help your business clients maximise their chances of business success by being aware of some of the pitfalls associated with cash flow. Recognising these pitfalls and the importance of cash flow can go a long way to keeping a business (your client) on its path to success.

Every business owner knows cash is required to pay the bills, pay wages and buy supplies. But many viable businesses fail due to poor cash flow.

So how should a business best manage its cashflow? One way is through regular cash flow forecasting.

Put simply, this forecasts the incomings and outgoings of cash over a given period – such as the next six months or financial quarter. It also tells the business what cash surplus or deficit should be left over at the end of that period.

Cash flow forecasts can also help a business make day-to-day decisions by assisting them to evaluate:

- Whether they should increase or decrease customer credit terms

- Whether supplier payment terms need negotiating – for example, if cash flow will be slow, the business will likely want more time to pay its suppliers

- Future business overdraft requirements

Perhaps the greatest value of cash flow forecasting comes from its benchmarking qualities.

After the forecasted period has ended, the business owner can go back and compare it to reality by judging the performance of his or her business and identifying unexpected cash flow issues. That can help them refine their cash flow forecasting and so keep more control over future cash flow.

Ideally a cash flow forecast is completed each month and takes the following into account:

- Seasonal aspects of the business – are there known peaks and troughs?

- Cash cycle issues – high volume in a single month but only receiving payment months later

If the business has a previous trading history to go on, the forecasting process will be easier. They can take their reliable data from previous trading periods and increase or decrease the amounts depending on their insights into future markets.

But accuracy is key. For example, if there's a lot of talk about the economy getting worse or turning a corner, the business shouldn’t be too quick to make any blanket assumptions.

Another tip is for your clients to talk to their own customers and suppliers to find out about confidence in their specific sector. Then check their findings with a credible accountant who has experience in that particular industry to fine-tune their data.

The more effort that goes into dispelling assumptions, the more accurate the cash flow forecast will be.

Once your client has completed their cash flow forecast they’ll either find that they’re heading towards a cash surplus or a cash deficit. If it's the latter, they shouldn’t panic – it's actually a good thing that they’ve recognised it so they can adjust their course.

Regardless of your client’s findings, they should:

- Review their completed cash flow forecasts regularly

- Insert actual figures once available

- Investigate any variances between actual figures and their forecasts

It's all about business owners reaching a level of financial wellbeing by staying in control of their finances. It means they can show other stakeholders that they know the direction their business is headed.

Read more: Find the right funding options for business

ANZ support for brokers and clients

Goulding says ANZ provides support for clients and their cash flow and business planning needs in many ways.

“In late 2019, ANZ introduced online support via a hub on anz.com, now called the ANZ Financially Ready Business Hub,” he says.

There are plenty of tools and articles providing information on cash flow and business planning. They cover topics such as:

- Planning for your business

- Forecasting for your business

- Improving business cash flow

- Growing your business

- Using a balance sheet to handle business finance

- Business cash flow checklist

Read more: When alt-doc is the best doc

ANZ also has dedicated in-branch small business specialists, business banking managers and relationship managers.

“They can provide insights via ANZ transaction history to assist in understanding where funds are being spent and possible changes in cash flow cycles to create more positive cash flow impacts,” Goulding says.

“When the client and broker work together to provide a detailed overview of the business including inflows and outflows relating to cash flow, this provides greater confidence in reviewing funding proposals that are being presented.”

Goulding says being able to showcase the differentiation between profit and cash to ensure the ongoing viability of the business shows a solid understanding of how the business gets paid, as well as business expenses, where there is a surplus of funds and where it’s invested.

Having this information and the business’ financial position allows their banker to submit a comprehensive application and hold any necessary internal conversations with credit or risk teams.

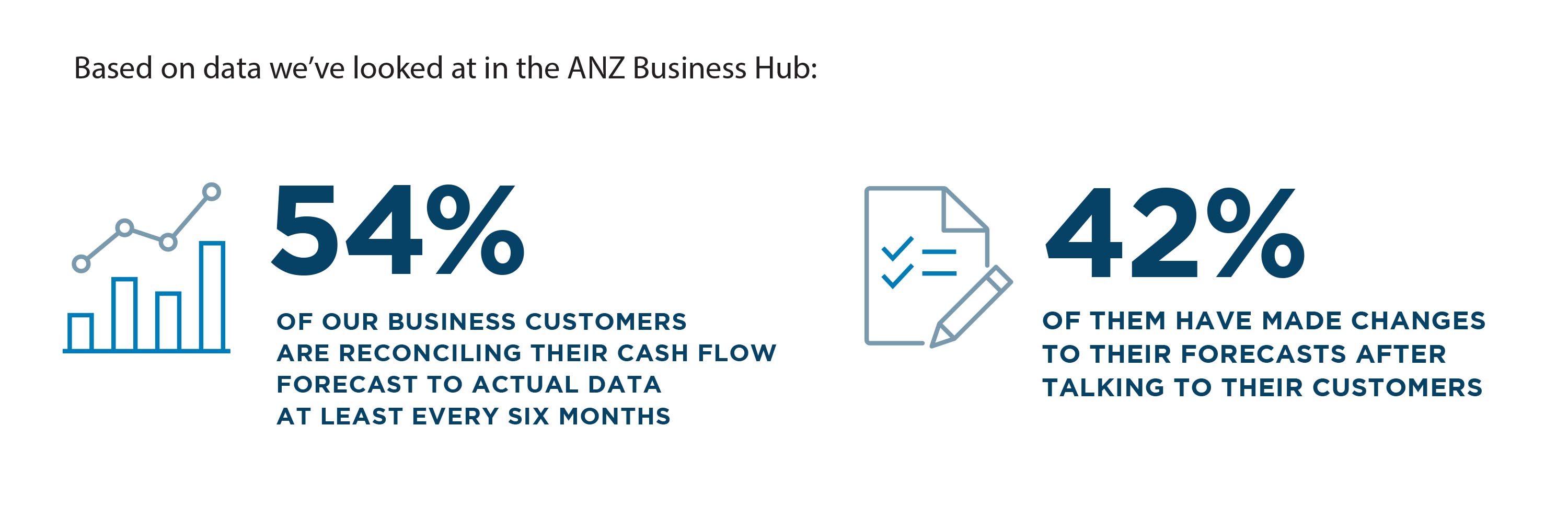

ANZ Financially Ready Business Hub indicates that 54% of our business customers are reconciling their cash flow forecast to actual data at least every six months, while 42% of them have made changes to their forecasts after talking to their customers. They recognise the importance of cash flow and how best to approach it.

Cash flow pressure is part of the stress of running a business. But brokers who help clients stay on top of their cash flow equip those clients for the future. The more brokers are aware of what their clients are going through when it comes to cash flow, the greater knowledge they will have about their funding needs and the ANZ solutions available.

For more information, go to ANZ Commercial Broker

This article is brought to you by ANZ

This is general information and ANZ is not giving you advice or recommendations. Carefully consider what’s right for you, your business and your clients.