Steady amid economic challenges

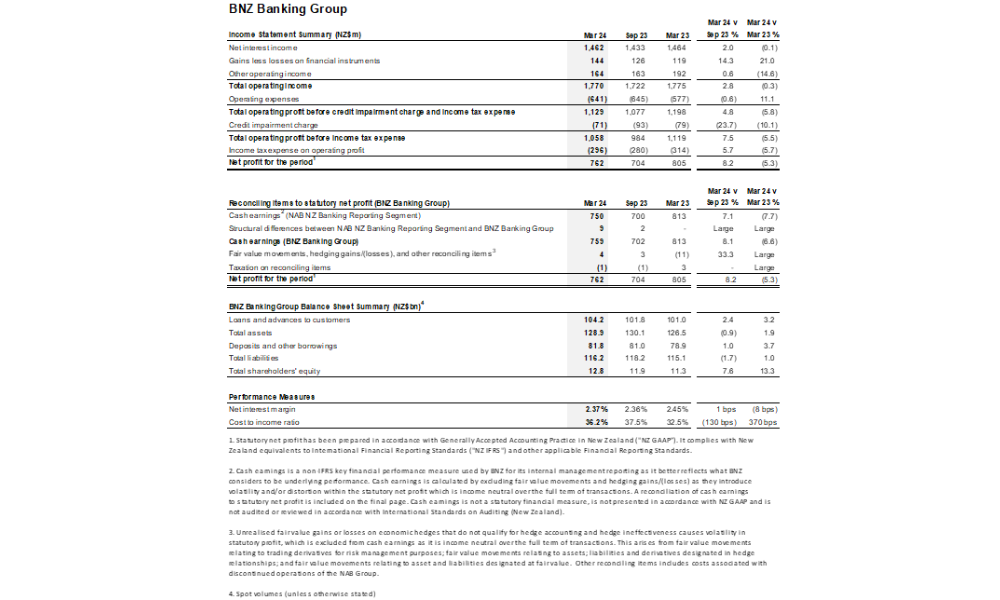

Bank of New Zealand (BNZ) reported a statutory net profit of $762 million for the six months ending March 31, marking a decrease of $43 million or 5.3% compared to the previous year.

Despite the decline, BNZ saw growth in both lending and deposits, and an increase in operating expenses by $64m or 11.1%, reflecting significant investment in personnel and digital capabilities.

Resilience in a subdued economic climate

BNZ CEO Dan Huggins (pictured above) described the results as resilient given the tough economic backdrop.

“High interest rates and cost of living pressures continue to impact business and household finances," Huggins said, emphasising the bank’s commitment to its customers “through these challenging times.”

Stable revenue and expanding client base

Revenue remained stable at $1,770m, while net interest margin fell by eight basis points, evidencing fierce competition in the banking sector and changes in customer deposit behaviours.

Despite these challenges, Huggins highlighted the positive customer response.

“Our team is focused on serving our customers brilliantly every day and supporting their ambitions, whether that’s investing in their business or buying their first, or next, home,” he said. “This focus is paying off with more New Zealanders choosing to bank with BNZ.”

Lending and deposit increases

BNZ’s total lending rose by $2.4bn or 2.4%, with home lending increasing by $1.1bn or 1.9% and business lending by $1.3bn or 3.0%. Total customer deposits saw a rise of $1.5bn or 1.9%.

Advancing technology and enhancing security

BNZ is pioneering efforts to simplify banking and enhance customer experiences through digital innovation.

“We are always looking for new ways to integrate the latest technology into the way we work and how our customers bank to enhance their experience and make banking simpler and easier,” Huggins said.

The bank continues to lead in developing Open Banking APIs, benefiting more than 250,000 customers with tools for secure budgeting, reconciliation, and alternative payment options.

“We’re committed to continuing to drive innovation across our business to provide more value to our customers,” Huggins said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.