Inflation eases, challenges remain

Despite a decrease in the inflation rate, many households across the country continue to face significant cost-of-living pressures, according to Infometrics.

Rob Heyes (pictured above), principal consultant at Infometrics, delved into the ongoing economic struggles affecting household finances amid fluctuating prices and varying income levels.

Inflation trends and household impact

Recent inflation report, dropping to 4% from a previous high of 7.3%, signals a moderating trend in price increases, offering some relief. However, Heyes pointed out that this relief is not universal.

“It’s still a challenge for many households to balance their finances and more expensive costs,” he said.

The disparity in experiences highlights the nuanced impacts of national economic policies and market changes on different demographic groups.

Surging household living costs

Despite the overall easing of inflation, the Stats NZ’s Household Living-Costs Price Indexes (HLPIs) showed a significant rise in living costs across various household types, with increases ranging from 21%-24% since March 2020.

Heyes highlighted the long-term accumulation of price hikes, particularly since mid-2021, affecting essentials like food, rent, and petrol, which continued to stretch household budgets.

Regional variations in price increases

Inflation has not impacted all regions equally, with provincial and rural areas experiencing sharper price increases compared to major urban centres. This regional disparity underscores the uneven economic landscape across the country, with some areas feeling the pinch more acutely than others.

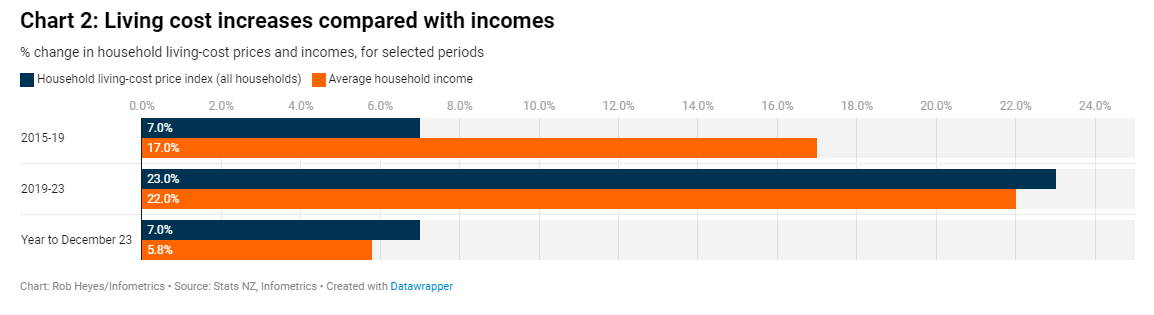

Income trends versus price rises

There is a silver lining, as average household incomes have largely kept pace with the rise in prices.

“Average household incomes have pretty much kept pace with average prices rises," Heyes said, providing a buffer for many families.

However, this balance isn't reflected universally, with lower-income households experiencing greater financial strain.

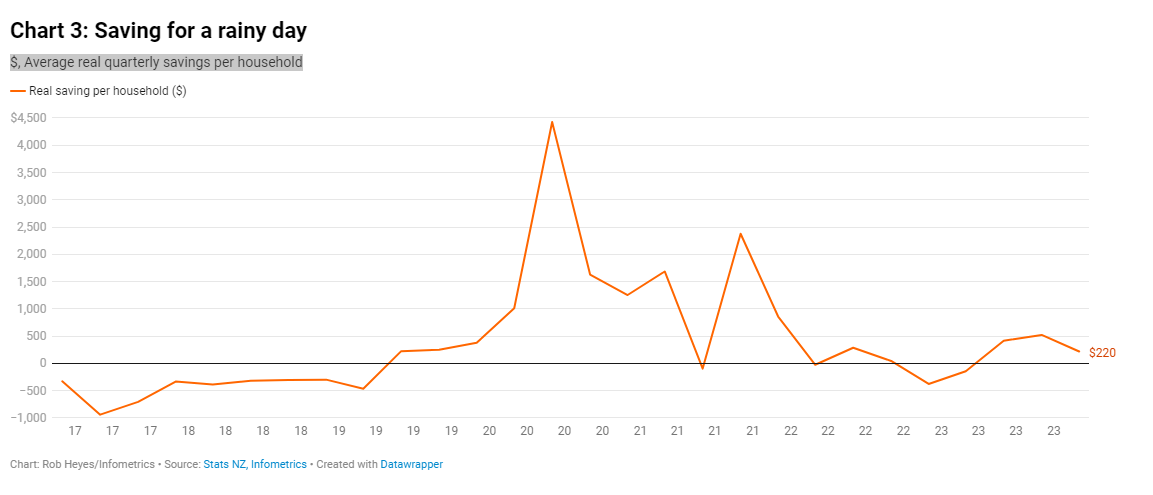

Improvements in household savings

Heyes said it was encouraging to see that households generally lived within their means and managed to increase their savings last year, with the average savings per household at $254 per quarter in inflation-adjusted terms.

While these savings do not match the higher amounts saved during the lockdown periods, when spending options were limited to online shopping and streaming, they still represent an improvement over the 2017 to 2019 period, during which households typically spent beyond their earnings despite incomes rising faster than living costs.

Vulnerabilities in lower income households

Despite the general uptick in incomes, lower-income families have not fared as well. A significant increase in KiwiSaver withdrawals for hardship reasons illustrates the deepening financial distress among the most vulnerable.

“In the past few years, we have seen a steady increase in KiwiSaver fund withdrawals for significant hardship reasons,” Heyes said, highlighting a 67% rise in such withdrawals since February 2020.

Economic hardships and government measures

According to the Infometrics report, despite some economic indicators showing improvement, the most vulnerable populations continued to face significant hardships. The rise in KiwiSaver withdrawals for hardship reasons illustrates the ongoing financial struggles, with a 67% increase in such withdrawals over the past four years.

“In the past few years, we have seen a steady increase in KiwiSaver fund withdrawals for significant hardship reasons,” Heyes said, reflecting the dire financial situations many find themselves in.

Financial uncertainty remains

Although inflation is moderating, Heyes warned of continued economic uncertainty.

“With inflation moderating, you’d be forgiven for thinking that we are through the worst,” Heyes said. “However, with intense domestic price pressure still present, we think it will be another six to nine months before the Reserve Bank thinks it has combatted inflation enough to start to cut interest rates.”

This prolonged period of high costs, coupled with potential rises in unemployment, suggests that households will remain under financial pressure for the foreseeable future.

Read the Infometrics analysis in full here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.