Overall distressed home sales have fallen to pre-bubble levels; but for some states, REO and short sales still make up more than 20% of their total sales.

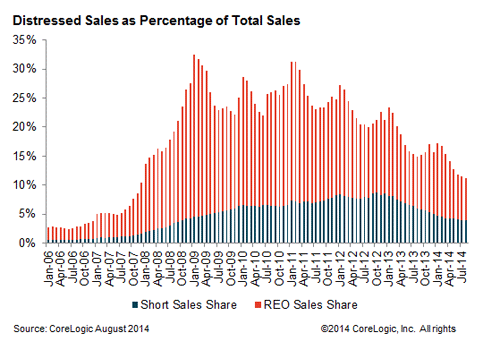

Distressed home sales accounted for 11.2% of all U.S. home sales in August, the lowest share since before the bubble burst. However, for some states, REO and short sales still make up more than 20% of their total sales.

REO and short sales accounted for the lowest share since December 2007, a strong improvement from the same time a year ago when this category made up 15% of total sales, according to the report.

Within this category, REO sales made up 7.2% of total home sales, and short sales made up 4% of total sales in August. At its peak, the distressed sales share totaled 32.4% of all sales in January 2009 with REO sales making up 28% of that share.

“The ongoing shift away from REO sales is a driver of improving home prices, as REOs typically sell at a larger discount than do short sales,” CoreLogic reported. “There will always be some amount of distress in the housing market, so one would never expect a 0% distressed sales share, and by comparison, the pre-crisis share of distressed sales was traditionally about 2%.”

For several states, REO and short sales still make up about 20% their total sales, including Michigan (25.5%), Florida (23.1%), Illinois (22.6%), Nevada (21%) and Georgia (19%). California experienced a 14.6-percentage point drop in the distressed sales share, the largest of any state.

For several states, REO and short sales still make up about 20% their total sales, including Michigan (25.5%), Florida (23.1%), Illinois (22.6%), Nevada (21%) and Georgia (19%). California experienced a 14.6-percentage point drop in the distressed sales share, the largest of any state.

South Dakota experienced a 12.6% drop in its distressed sales share from a year earlier, the largest of any state. California also saw the largest improvement from peak distressed sales share of any state, falling 55.3% from the January 2009 peak share of 67.4%.

Of the largest 25 Core Based Statistical Areas (CBSAs) based on population, Miami-Miami Beach-Kendall, Fla. had the largest share of distressed sales at 25.8%, followed by Chicago-Naperville-Arlington Heights, Ill. (25.7%), Tampa-St. Petersburg-Clearwater, Fla. (24.4%), Orlando-Kissimmee-Sanford, Fla. (24.3%) and Virginia Beach-Norfolk-Newport News, Va. (24.2%).

Riverside-San Bernardino-Ontario, Calif. had the largest drop in its distressed share from a year earlier, falling by 14.7 percentage points from 30.6% August 2013 to 15.8% in August 2014. The area had the largest overall improvement in distressed sales share from its peak value. At the peak in February 2009, distressed sales made up 76.3% of all sales in Riverside compared to its August 2014 rate of 15.8%.