Strong broker partnerships, technology drive success

Unprecedented home loan growth over the past two years has been both a blessing and a curse for Australian banks.

Unable to travel, go to the movies or eat out during COVID lockdowns, many people reassessed their lifestyles and directed their savings towards buying a new home, renovating or refinancing.

Some of the major banks struggled to keep pace with the massive demand for property loans, hampered by a lack of onshore processing staff. This led to delays in turnaround times, which frustrated customers and brokers.

Customer-owned banks have thrived during the pandemic. While they, too, faced the pressure of handling a surge in home loans, they seem to have coped better than the majors, perhaps aided by being smaller, more nimble and quicker to adapt but at the same time more realistic about their limits.

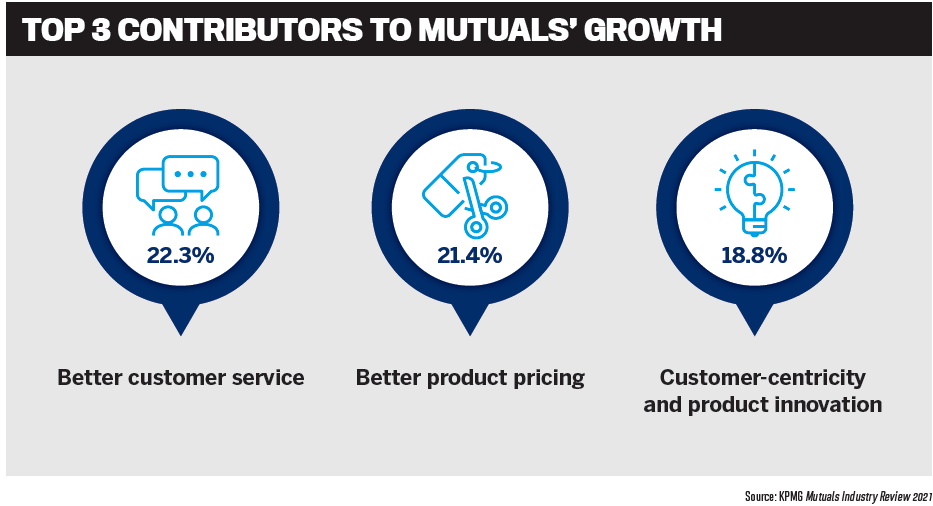

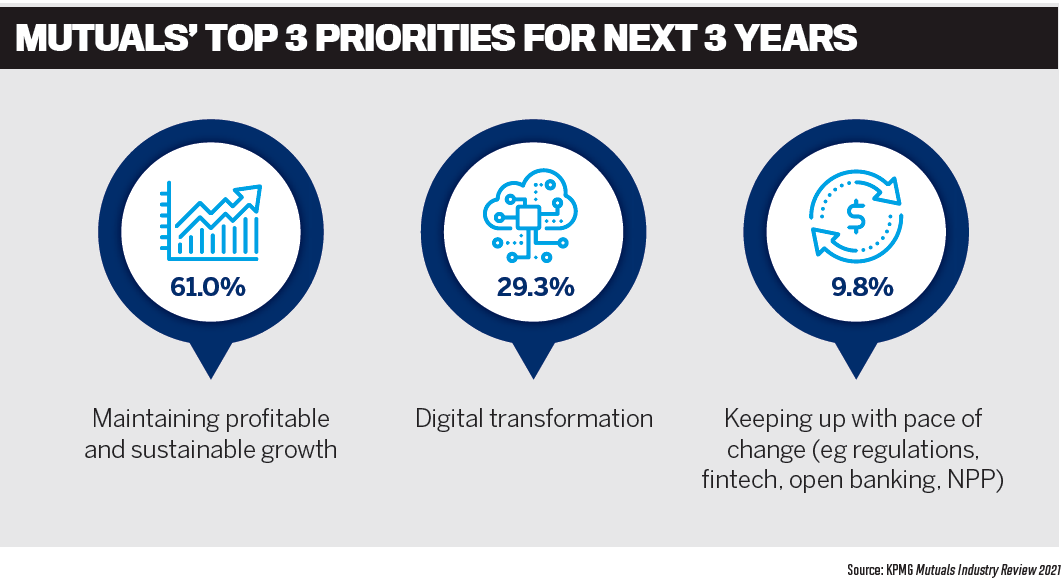

The mutuals have also been boosted by their strong, strategic partnerships with the broker channel, their laser-like focus on customer satisfaction and retention, and their investment in digital tools to make banking and lending a streamlined experience for customers and brokers.

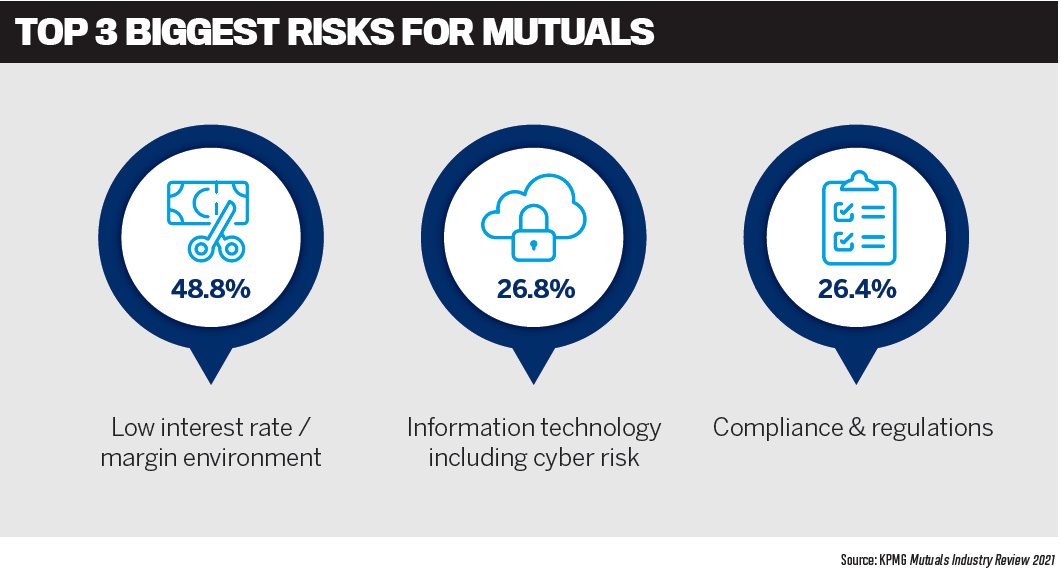

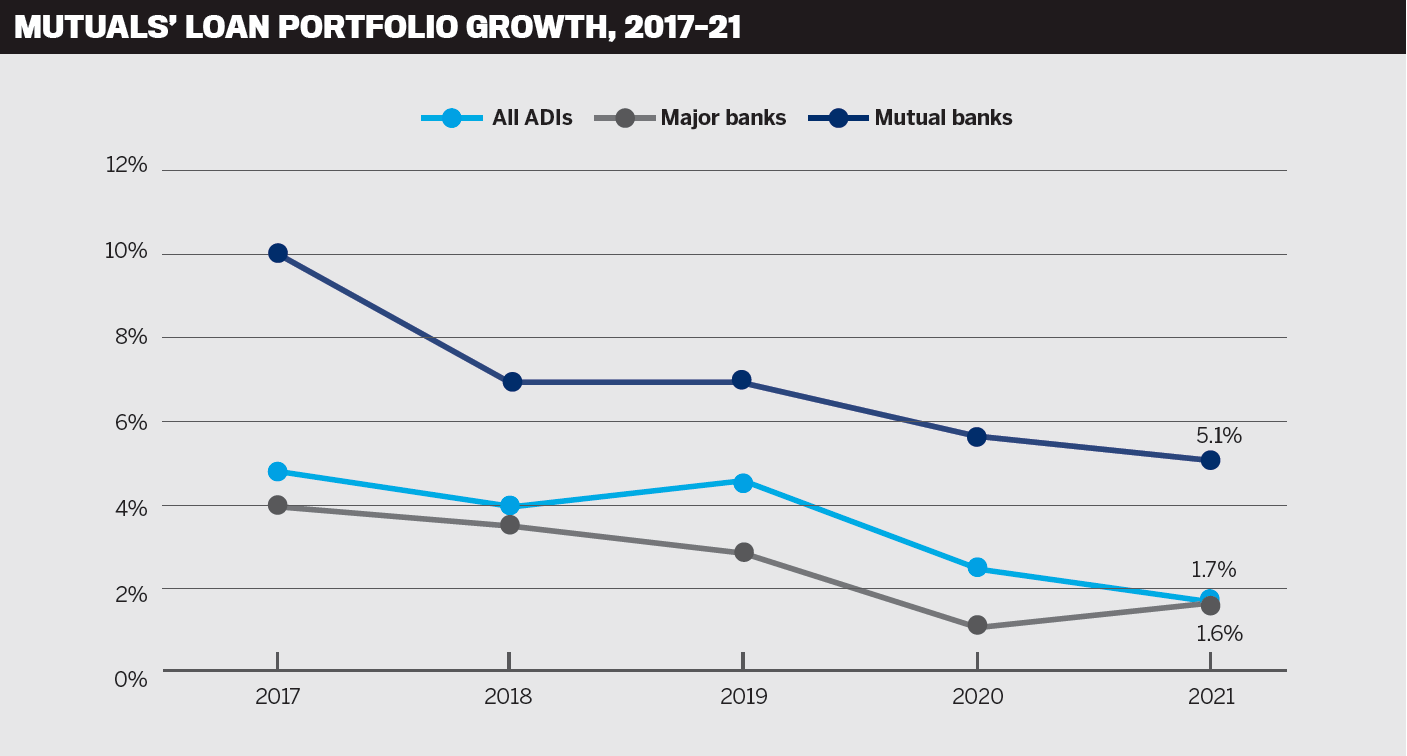

The results are clear: KPMG’s 2021 report on the mutuals sector shows customer-owned banks’ total loan portfolio grew 5.1% to $112bn last year, compared to the overall banking industry, which grew only 1.8%. The mutuals’ net assets were up 5.5% on 2020, increasing to $10.4bn, while overall operating profit before tax rose a whopping 38.6% to $685m.

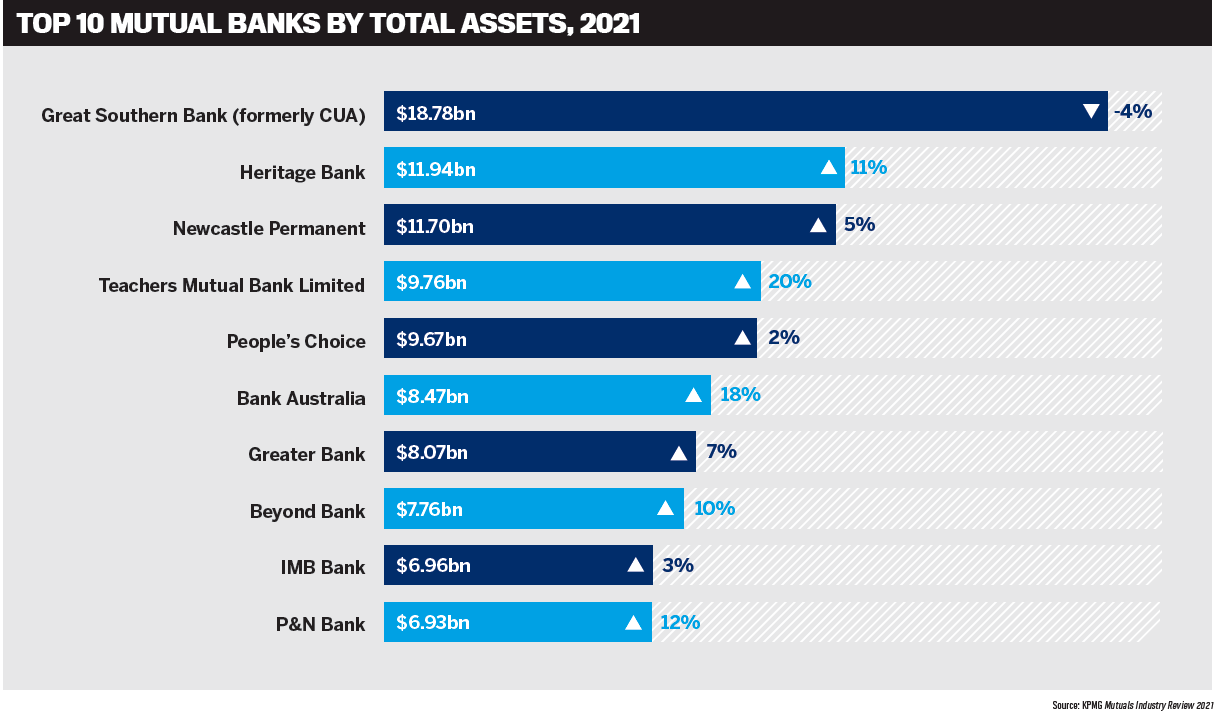

To discuss the growing success of the customer-owned banks, their relationship with the broker channel and their technology initiatives, MPA hosted a roundtable meeting of representatives of six key mutual banks – Heritage Bank, Newcastle Permanent Building Society, Teachers Mutual Bank Limited, Bank Australia, Beyond Bank and Gateway Bank – at Café Sydney. Brokers Michaela McDonald of Ignite Finance and Taras Mencinsky of Runmore Loans also joined the conversation. Thanks to everyone who took part in this valuable discussion.

Q: It’s been a rocky ride for the Australian economy in the last two years. How have customer-owned banks met the challenges?

Like all financial institutions, customer-owned banks have been hit hard by the coronavirus pandemic, with lockdowns forcing staff to work from home and pivot to digital communication with their customers and brokers. At the same time, home loan demand has skyrocketed, putting pressure on resources.

Vincent Lewis, national manager partnerships at Bank Australia, said the bank had not made a significant change to the way it does business, but growth had naturally occurred.

“We’ve got good cost control, and we’ve been diligent about making sure there’ve been no unnecessary expenses,” said Lewis. “We’ve been very cautious about our pricing both to new business but also existing business, because it will keep our deposit customers happy. Around 75% plus of our funding is off our deposits, so it’s really important from a cost-of-funds perspective to do that.”

Lewis said the bank’s running costs had fallen, but profits were significantly higher – last year they were about $40m, compared to $25m in 2020.

Newcastle Permanent’s head of digital customer experience and innovation, Simon Burt, said last year there were nerves about COVID risks to the economy in certain segments, and about unemployment and the end of JobKeeper.

“We had early unease about what might happen, and actually the opposite happened. Business for us has been really strong in the home lending space in particular,” he said.

“While there’s good lending volumes, we all need to do better and more in the digital space and invest in that to improve our processes. There’s been a lot of focus on building better systems and processes to better handle that volume.”

Burt said that as Newcastle Permanent was a smaller bank, a big spike in volume could “bury us much quicker than a major”.

All the banks represented at the table had enjoyed record loan volumes, said Paul Moses, Heritage Bank’s NSW, ACT, Victoria, Tasmania and SA state manager for broker distribution.

“Our sales teams and our BDMs have had to adapt to the challenges and navigate their way through how we’re going to provide a service to our members,” he said.

“A lot of that’s come through Zoom meetings, and that’s been very effective. If you look at how the industry works now as opposed to a couple of years ago, the majority of our meetings are done through Zoom, and we’re able to access our people across the regions as well.”

Darren McLeod, head of third party at Beyond Bank, said the lender had experienced a strong profit result over the last 12 months, with record loan volumes achieved by the bank and brokers.

“So in the last couple of years one of our biggest challenges has been resourcing and keeping up with just the pace of service levels,” he said.

“Beyond Bank’s only been in the broker space six years, so it’s been really good for us because the increase in broker business has meant there’s more focus on broker within the bank. It’s a lot easier now for me to get extra resources to keep up with service and turnaround and invest in technology.”

McLeod said there had been an emphasis on making sure Beyond Bank had the right resources for brokers, including its latest platform for online lodgements.

“We’re building a new broker website, so it’s just been keeping up with the pick-up in volume. I think it will be interesting over the next 12 months to figure out just when the market will land.”

Mark Middleton, head of third party distribution at Teachers Mutual Bank Limited, said in the past two years there had been significant challenges caused by COVID-19 and its impact on how we live and work.

“It’s been an extremely difficult time for the travel, hospitality and entertainment industries that have been hit hard by border closures, lockdowns and restrictions,” he said.

“Fortunately, at Teachers Mutual Bank Limited our people have adapted extremely well to working from home, which has meant we haven’t felt a great deal of disruption. During the past two years over 90% of our 600 staff have worked from home at some points. While our people worked from home, we actually saw an increase in productivity as well as growth in our home loans.”

Middleton said the bank’s staff had worked hard to deliver for brokers and members during times of hardship.

“As a mutual, we’re committed to supporting and serving our members through the good times and the challenging times.”

Gateway Bank’s head of customer operations, Zeb Drummond, said it was clear from research that customer adoption of digital channels would continue during the pandemic and in a post-COVID world.

Drummond said customers had been forced to adapt to new technology, but their satisfaction and comfort with those channels was yet to follow.

“I think there’s a lot of time and effort to go into those digital channels, not just to make them work but to actually deliver a good experience for both customers and brokers.”

Q: What drove overall customer-owned banks’ lending growth of 5.1% last year, and how can this be sustained? Did the trend towards regional living play any part?

The move away from the cities into regional and rural Australia has been a major factor contributing to home loan growth during the pandemic.

Burt said Newcastle Permanent’s customer heartland is Newcastle, the Hunter Valley and the Central Coast, and the building society’s growth was being driven by people moving to these regions and by the broader reach of the broker channel.

“We’ve seen many people who work in Sydney visit for a weekend and think, ‘I could work from here and keep my job’. I wouldn’t call it a sea change, but really it’s that ability to work from home, and that’s driving a lot of migration into Newcastle at a rate I’ve never ever seen before.”

He said customer-owned banks had tried to win business from the majors rather than each other and had done well at that, especially in the refi market.

“Each of us has a separate point of difference. In the broker space, ours is focused on outstanding relationships with brokers, be it from our BDM teams or our credit teams, who are based in Newcastle, as well as great products and competitive pricing supported by leading technology, which allows us to deliver consistent time to yes.”

Middleton agreed there had been growth in the regions, with Southeast Queensland, the Riverina and Mornington Peninsula being particularly popular. He said it had been great to see growth across the mutual sector. At Teachers Mutual, home loan balances had risen 20.1% to $7.7bn in FY21.

Teacher Mutual members had poured money into savings or taken advantage of historically low interest rates to buy a home, creating a buoyant housing market, Middleton said. Most of its members work in education, emergency and health.

“This certainly helped our growth in home loans as our members maintained steady employment throughout the pandemic.”

Middleton said brokers had become an integral part of business growth – they now contributed more to Teachers Mutual’s lending volumes than first party.

McLeod agreed and said mutuals’ lending growth was largely due to the broker channel.

“The broker space is a big part of most of our businesses now. From Beyond Bank’s point of view, the broker has made first party get on their toes a bit – it’s raised the bar for the bank in general. It’s good, healthy competition. Not only is the broker business growing, our first party is growing.”

Lewis said Bank Australia had been very lucky in terms of loan growth.

“I say to my team, we don’t have to look too hard for business; it just comes in the door.

“You can try to grow more aggregator partnerships or break the mould with how many brokers, but we’ve stuck with the game plan, and it’s paid off. Our SLAs have been solid.”

Bank Australia has enjoyed 20% home loan growth for the last few years, and this is ongoing. Lewis said more resources were being considered for brokers as this channel had become vitally important.

“The brokers have rallied the troops in the rest of the bank, and the retail team are now chasing us. Last year we funded $1bn for the first time through broker, and we targeted about $800m. At the moment, we’re looking at $1.3bn this FY year, and they’re about a billion, so we’re all lifting each other.”

Lewis said brokers now wanted to write loans away from the major banks.

“This seems to be happening more and more often – people want those personalised services that a mutual can offer.”

Drummond added that the movement to regional areas was astronomical, driven in part by the changing nature of housing.

“The house now is not just a home; it’s where you work, it’s where you’ll celebrate a wedding or have a funeral for the loss of a loved one in some instances. I think that’s reflected in the growth of house prices.”

Q: What are you doing to increase awareness among mortgage brokers of the value that customer-owned banks offer?

The brokers taking part in the roundtable had some valuable feedback for the customer-owned backs.

Michaela McDonald, owner and home and business finance manager at Ignite Finance in Campbelltown, said customer-owned banks provided much better customer service and interest rates than the major banks.

“I’ve had clients come back to me and say the experience was so good … that they come back to me bringing their second owner-occupied property or another investment property where they wanted to rewrite it with the same bank because they’ve been so happy with the back office.”

McDonald said she had good relationships with the mutuals, and their back offices were completely different to those of the majors.

“These guys are more approachable; whether it be for particular deals, they’ll back you. Major banks, they just don’t have that sort of support … I love the smaller banks and I back them; the rates are better.

She said having a 100% off set account on a fixed rate loan was another feature that many customer-owned banks offered but the majors did not, and it was a big selling point for McDonald’s clients.

Taras Mencinsky, owner and senior credit adviser at Runmore Loans in Sydney, holds similar views. He says about 30% of his loan business goes through community-owned banks.

“You really get to know them, and they get to know you, and you can have a chat to them and it’s really very helpful.”

To encourage more business from brokers, community banks needed to “show how they can provide a full banking experience”, Mencinsky said.

He pointed out that brokers and prospective customers did not know how good a community bank’s online service would be; some feared it wouldn’t be suitable for their needs.

“Community banks really need to focus on educating brokers – this is what we can offer, this is what our internet banking looks like, what you can do with it, how it integrates with the client.”

Mencinsky said that while there was an inertia to change banks, people were prepared to accept a slight premium on their rate if they felt the value of the service was better than their current bank.

“So it means you’re not in a race to the bottom on price; the broker can back up the offering and say, ‘Look, this bank is going to be really good for you because of X, Y, Z’.”

He added that some clients sought intangible benefi ts such as banks’ social impact, and brokers could offer these features as a value-added experience.

Middleton agreed, saying feedback provided by brokers showed that customers were looking for banks that demonstrate corporate sustainability and ethics in their operations.

Teachers Mutual is a member of the Global Alliance of Banking on Values, alongside Bank Australia.

“We believe that banking can be a force for good,” Middleton said.

He explained that the pandemic changed the way Teachers Mutual increased awareness among brokers, given that in-person events run by the MFAA and FBAA and aggregator PD days had not been possible.

“In lieu of this, we focused on our technology and broker experience in 2021. Working with NextGen, we’re always looking to evolve our solution in the market and ensure it’s a smooth process for brokers and their clients,” Middleton said.

Moses said Heritage Bank, headquartered in Toowoomba, Queensland, had opened a branch network in NSW.

“We’re working with the state manager of the branches to meet brokers in person and really foster a positive partnership where the actual branch is assisting the broker to get a member onboarded.”

Burt said that, as people-based organisations, customer-owned banks had great staff who did a good job of calling brokers and introducing clients. “But we also have to do a good job of having the right technology, the mobile app that can support their day-to-day banking, but also sell it,” he said.

Lewis said staff surveys were also important. Bank Australia had just completed one, and early results revealed an increase in staff satisfaction this year.

He said if staff were on board with a bank’s vision, they would do a good job of helping a broker bring a customer into the system.

Drummond added that the banks needed to ensure they used the right channels to communicate with brokers.

“Not every broker is reading EDMs, so it’s around making sure that when we communicate, it syncs, it’s appropriate and reason-ably educational for those brokers.

“So not just ‘our BDM went on holiday to Hawaii’ but, you know, ‘last week we did a scenario of this, and this is the kind of deal we can actually accommodate’.”

Drummond said the key was for banks to ‘overservice’ brokers when it came to communication, to educate them so they “know what we do, what we do well and how we can help their customers”.

“It’s not just one deal and not just one customer, but it’s multiple customers you’re potentially impacting for a better solution.”

At Heritage Bank, Moses said the focus was on increasing personalised service to brokers. “It’s what they really want that sets us apart from the majors. We’re in touch with our broker partners on a very regular basis, and we maintain that.”

Moses agreed that EDMs could be over-done and said Heritage was investing a lot of money in digital technology, which would improve broker communication.

Mencinsky added that another factor that had really helped community banks in the last fi ve years was the remuneration structure for brokers. Now that inducements for writing loans had disappeared, this created more of a level playing fi eld for the mutuals.

Q: Digital disruption, in the form of AI and other technology, is a potential game changer. What are your plans in this space?

Burt said this was his favourite topic, and for Newcastle Permanent this calendar year “would be all about spending money, time and eff ort on being compliant with open banking regulations and having our data in the open banking ecosystem”.

He said banks would reach the tipping point in 2022, when they would be able to make the lending application process so much easier for customers through open banking, enabling them to pull in customer information and populate living expenses and income.

McLeod said Beyond Bank was close to launching digital signatures for the entire loan process in partnership with FMS.

“We’ve also partnered with a company called Eula, who do a lot of AI for retention. We’re going to be launching that as well, using machine learning to predict which customers might leave.”

He said Beyond Bank was also building a new broker website and investing heavily in NextGen’s ApplyOnline platform.

“We’re also upgrading our loan origination platform, which will assist in streamlining the loan approval process and significantly improve turnaround times.

“We’ve also got to jump on board with those strategies and those new initiatives to make sure we are fast and seamless, because we need to be leading the way in this space and not be a follower.”

Burt said Newcastle Permanent was using DocuSign for end-to-end processes, avoiding the need to rely on posting documents in the mail. “In some cases we’ve been able to reduce loan approval time from days to hours. It’s been a real game changer.”

At Heritage Bank, Moses said the team had been working on its home loan origination platform and the introduction of robotics into its back office.

“It’s not to cut costs or staffing, but it’s about providing a better experience for our members.”

Gateway Bank initiated a project in 2020 to bring in a new loan origination platform.

“One of the key elements was that it had to be able to swap and change integrations as quickly as possible,” Drummond said.

This meant the system could add in new solutions offered by fintechs.

“What we’re looking at is an environment where we can celebrate fintechs coming to market, and we can support them because of our size and the nature of mutual banking. We can get them into the market and actually realise the benefit of partnering them with our origination platform.”

Drummond said Gateway Bank was working to extend digital signatures so the verification of the signing of digital documents could be done through proof of life and video.

Teachers Mutual has launched a new digital bank, Hiver, and is also using robotics to extract information from loan applications and speed up the process.

“It’s the first digital bank out there that focuses on the essential service workers and university students and graduates,” Middleton said. “It offers 24/7 access to their money, with instant transactions through OKSO, digital wallet capabilities for seamless tap-and-pay experiences, and even the ability to track spending habits through smart categorisation.”

Lewis said Bank Australia was also using robotics to analyse statements and speed up processes in other parts of the business.

“We’ve been using e-documents for quite some time, and that’s been a great benefit, but we’ve also extended DocuSign into a number of NextGen-type low-docs.”

Bank Australia also plans to change its basic lending platform from Simtrex and replace it with a more up-to-date system.

“Our bank’s board is committed to a significant investment into the platform and CRM upgrades this year,” Lewis said. “We’ve been using IDYou, which is a face-to-face digital application, and I see that as being a significant improvement in our service over the last couple of years.”

Seeking the brokers’ input, MPA asked Mencinsky and McDonald what they thought of the mutuals’ digital offering and how it could be improved.

Mencinsky said banks needed to make the loan process quicker, and the fewer written signatures required the better; eDocs and DocuSign were a blessing.

“People are not working in the office, so they can’t use the office printer. It adds two or three days to the process, and it’s very inconvenient.”

McDonald said it was “a bit backward” to require clients to sign a bank’s loan application physically, so banks that could provide fully digital documents would encourage customers to say, “It’s a bank I want to be with”.

Both Burt and Middleton commented that broker feedback was vital for customer-owned banks to be able to continue to improve their broker offering.

Burt said getting feedback from brokers and acting on it quickly was what set the mutuals apart from the majors.

“The ideas that are coming from you guys now – we hear those ideas, we talk to brokers all the time, and we can make a change next week,” he said.

Being smaller and nimbler, mutuals also needed to set up partnerships with fintechs to benefit from the best technology and remain competitive.

“That whole process and relationship with setting up a partnership with the fintech should be much easier, because we’re not trying to buy them like the majors are trying to,” Burt said. Middleton added that brokers supplied plenty of creativity.

“You tell us what the problem is, and then we go away and try to solve the problem. We take that feedback on, and that’s why you’re seeing the capabilities are being developed today. Keep the feedback coming, because we do actually take it on board.”

Q: There’s been a high number of mergers recently. What do you think of this consolidation trend? Is it good or bad for the industry?

Heritage is in a proposed merger, Moses said. “We’re looking to merge with People’s Choice Credit Union. This merger would create the largest customer-owned banking organisation in the country. We think this would be absolutely positive for the industry, as it would create a powerful national mutual that would have increased size and scale, with greater capacity to compete against the majors.”

Moses explained that the merged organisation would retain its mutual status and its total focus on serving its members.

“The increased size and scale is particularly important in implementing the technology improvements needed to remain competitive and deliver the services that banking consumers want.”

In August 2021, Newcastle Permanent and Greater Bank announced a proposal to merge to create one of Australia’s largest leading customer-owned financial institutions.

Burt said building strength through consolidation was not new – in the past decade the number of mutuals across Australia had halved to fewer than 70 today as a result of smaller players uniting to remain competitive and sustainable.

“That trend is set to continue; the 2021 KPMG Mutuals Report noted that a quarter of Australian customer-owned banking organisations anticipate being involved in merger activity this year alone, and a further 20% are considering the possibility.

“We believe together we can deliver better outcomes for our customers than either Newcastle Permanent or Greater Bank can achieve alone. By pooling our resources and combining our investment, we’ll be able to innovate, to develop and deliver the new banking technologies our customers and our partners, such as our Newcastle Permanent broker partners, want today and will need in the future.”

McLeod said that over the last 15 years Beyond Bank had completed several mergers, and these had been an important part of its national expansion into new areas.

“We believe where the two organisations can come together and create mutually beneficial outcomes for both the community and the organisations, they are a great way of building out a value proposition.

“In every merger BBA has done, we’ve seen growth in that area and development of the people from the merging organisation.”

Drummond said recent mergers had been in the best interests of the respective member bases.

“If the memberships felt otherwise, then the mergers wouldn’t have been approved,” he said.

“A strengthening of the mutual sector through consolidation bolsters the retention and growth of our united member bases and gives greater combined power to the sector.

“This is a good thing for not only our customers but the industry as whole, as the mutual customer-centric approach has huge competitive value, provides a great service to our memberships and will continue into the future.”

Teachers Mutual merged with Firefighters Credit Co-Operative and Pulse Credit Union in Victoria. Middleton said its board of directors had identified these opportunities as “we share a lot of values with these two credit unions”, and they were optimistic about possible future mergers.

“These mergers also allowed us to grow our market share in Victoria and strengthen our ties to the fi refighter, healthcare and tertiary education communities.”

Consolidation would continue in the industry, Middleton said.

“The impacts of digital disruption, reducing margins, regulatory change and challenges from the pandemic are being felt by mutual banks and credit unions. These factors mean it’s likely we will continue to see like-minded mutuals come together.”

Lewis said mergers and consolidations had been ongoing during his 20 years in customer-owned banking.

“I have been involved in at least four acquisitions, albeit on the acquirer side, and each one was a significant step up for the strength and future prosperity of the merged entity,” he said.

“As a general rule I feel mutuals merge well, are respectful of the heritage of the merged entities, and look after their staff during and after the process.”

Lewis said he understood members or customers’ disappointment when their beloved credit union merged into a larger entity, but such mergers were a good thing for the mutual banking sector.

“The remaining institutions are financially stronger and thus are better able to meet market and regulatory demands while competing more aggressively with the broader market,” he said.