The election cycle has seen countless promises of infrastructure and housing development, but brokers shouldn’t get caught up in the hype

As with every federal election, there’s been no shortage of ‘pork barrel politics’. This useful term has nothing to do with Australia’s meat industry; rather it refers to politicians promising lavish infrastructure spending to win voters – spending that, if implemented, will have a far bigger effect on house prices, and therefore brokers, than many of the debates dominating this election cycle.

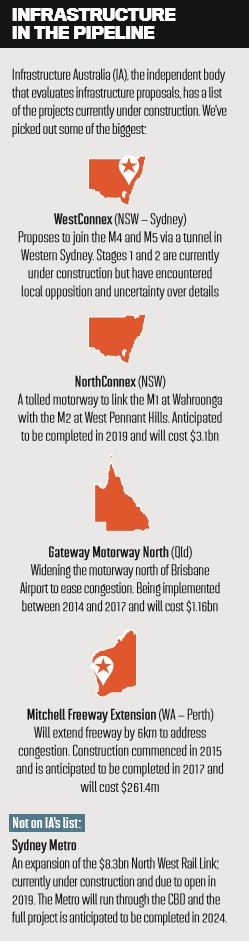

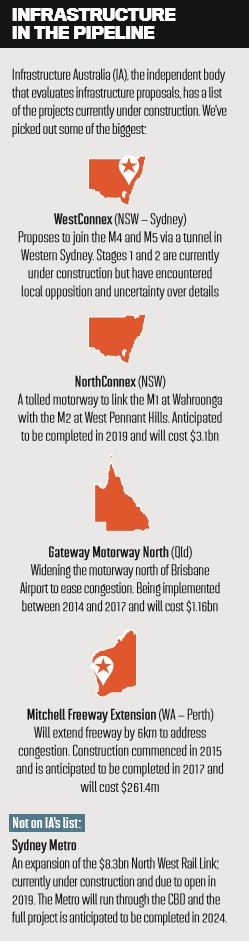

There have been a vast number of infrastructure promises made this year, many at the AFR’s recent National Infrastructure Summit in Sydney. This featured – among several leading politicians – NSW premier Mike Baird, whose presentation included glossy videos and gleaming skyscrapers, managing to drown out protesters against his WestConnex road project.

Then came the minister for resources, energy and Northern Australia, Josh Frydenberg, who trumpeted the Melbourne– Brisbane Inland Rail Link, ‘beef roads’, and light rail in the Gold Coast and beyond. He was followed by Labor’s Anthony Albanese, who claimed that every dollar of spending announced by the Coalition had already been pledged by Labor, while hinting at possible investment in high-speed rail.

Most relevantly, the speakers connected infrastructure to housing. “You can see the numbers,” Baird told the audience. “In 2010 we had just over 20,000 private housing approvals, and now we’re on 70,000. It’s a big leap, and part of that is connected to transport and investment in other infrastructure.”

Knowing when an area is going to take off

Knowing when an area is going to take off

Politicians may talk about the huge sums invested in infrastructure, but what does it look like from a broker’s point of view? MPA talked to three brokers whose businesses are currently being affected by major infrastructure projects: Byblos Finance’s George Karam, currently Australian Mortgage Awards Finance Broker of the Year; Gerard Tiffen, of Top 10 Independent Brokerage Tiffen & Co; and Mortgage Choice Glenelg’s Bianca Long, a Top 100 broker.

In some cases, the impact of infrastructure improvements on brokers is straightforward. One example is Canberra’s airport, which has just gone international. In September 2016 Singapore Airlines will begin flying direct to Australia’s capital from Singapore. Furthermore, the airport, which has no night curfew, is looking to scale up its freight operations.

Speaking to MPA for our Top 10 Independent Brokerages report, Tiffen described how the airport’s transformation will “change the game forever” in Canberra. “It’s creating a lot of interest and pumping the market up on the residential side … based on what’s going to happen over the next four to five years they reckon we’ll get to 420,000 people,” Tiffen said. “That’s what Canberra needs; that’s what has been lacking.”

Keeping an ear to the ground

The development of other regions has been more gradual, as was the case in Parramatta in NSW. Byblos Finance works extensively with developers and took the decision, in 2011, to begin expanding its operations. There were government changes at the time, such as the rezoning of land to allow for higher-density housing, and the releasing of more land for development. There was also a “gradual loosening” of credit policy by lenders, which gave developers more leverage.

For Karam, however, the most valuable information emerged from his constant discussions with developers themselves Byblos Finance was a founding member of the Developers Forum, which brings together developers, builders and financiers. It has not only brought in clients but given Byblos Finance advance warning of oncoming changes. “By being in a room with that many people, we’re listening to what concerns them on the day … we can start to prepare for it; find a funder that’s got that appetite,” Karam says.

“Keeping an ear to the ground”, as Karam puts it, paid off. “You could start seeing the trading of land; the positioning of players within this particular marketplace; their finances. They were gearing themselves up to put their foot on the gas with investments … they were about to invest in a very significant way.”

The area did indeed see huge growth, much of it centred around Parramatta Square, and Byblos Finance subsequently took off, with Karam coming number one in MPA’s 2015 Top 10 Commercial Brokers report and winning an AMA. The brokerage took on four extra staff and at the time of writing was about to move into a new office, in response to the growth in demand from investors.

Infrastructure and finance

In certain instances the connection between infrastructure and housing construction can be far more complicated. Bianca Long has run Mortgage Choice Glenwood, in Sydney’s far northwest, since 2007, long before it became popular. Even then various infrastructure projects were in the pipeline.

“The train stations were planned 10 years ago, although it might even be longer ago than that … look at companies like Woolworths in the northwest; they intentionally went into the area, knowing that public transport was going to increase in that area,” Long says.

Those train stations are due to open in 2017, but the housing boom has already happened, and it happened in 2014. This gap of three years can be explained by the interplay between infrastructure, land being released, and, crucially, the effect of stamp duty and first home buyer grants. In 2014, a block of land in the northwest could be had for under $350,000, meaning buyers didn’t have to pay stamp duty on it. Furthermore, first home buyers could only get grants for new properties, so had an incentive to construct new houses. The resulting influx of first home buyers, Long recalls, “made a massive, massive difference to construction in the area”.

With a large number of new clients, Long found her brokerage struggling to maintain high standards. “The reason we’ve grown like we have is attention to detail, quick turnaround, and always getting back to clients,” she says. “As the business then grows, that falls away, and we found ourselves in a position where it was taking too long to get back to clients, and we were just paper-pushing.”

The brokerage desperately needed staff, but rather than simply expand the existing office Long decided to establish an extra franchise in neighbouring Kellyville. “I sat down and had a holistic view of it, not just in terms of locations but in terms of markets coming up, and that’s when I saw a gap in Kellyville; when I saw the demographics and the construction in the area.”

As well as additional admin staff, Long took on an extra broker to specialise in first home buyers and refinancers, leaving her to specialise in more complicated cases and referrals. She’s planning to take on another broker to cover evening appointments, although she admits that her increased management responsibilities have been challenging.

When the dust settles

Just as the combination of infrastructure, credit and incentives can drive development, it can also kill it. Premier Baird may have bragged about Sydney’s ‘crane index’ and cited huge numbers of housing approvals, but out west (and beyond NSW) brokers are seeing something quite different taking place.

“I know governments are excited about what’s going on,” says Byblos Finance’s Karam, “but the exact opposite is actually happening on the ground at the moment ... there’s record approvals for housing, but less and less of that is actually being delivered.”

Both Karam in Parramatta and Long in Glenwood are currently seeing major declines in property development, despite substantial and ongoing improvements in infrastructure. According to Karam, the recent restrictions on foreign investors are “having a really big impact on developer confidence … that is a conversation that’s happening daily at the moment; that’s the topic of the day”. He’s finding developers are dividing into two camps: those who are now reluctant to move forward, and those who see the slowdown as a buying opportunity.

Another problem has been the changing requirements of banks, particularly regarding investors. Karam believes these have not been properly articulated to the market. “You’ve had many examples of where loans have been awaiting approvals for months, and they don’t come through, and people don’t understand why.”

In the case of Long, the first home buyers that had previously flooded Glenwood have now found their financial loophole has been closed. It’s all connected to stamp duty concessions, Long explains. “With the increase in prices, you had stamp duty concessions up to $350,000, but a block of land has skyrocketed to $550,000. Now we’re back to the same position as we were with established properties … they’re back to square one.”

Infrastructure, it seems, is yet another area in which politicians often promise more than they can deliver, even when their infrastructure promises become reality. “The infrastructure is wonderful,” explains Karam, “but it’s not going to be the cause of additional activity on a macro level; it just determines where the spending is going to go, but the bigger issue right now is availability of credit.”

So, while brokers need to take notice of what’s planned for their areas, the prevailing credit environment will continue to be the main factor determining a brokerage’s direction.

There have been a vast number of infrastructure promises made this year, many at the AFR’s recent National Infrastructure Summit in Sydney. This featured – among several leading politicians – NSW premier Mike Baird, whose presentation included glossy videos and gleaming skyscrapers, managing to drown out protesters against his WestConnex road project.

Then came the minister for resources, energy and Northern Australia, Josh Frydenberg, who trumpeted the Melbourne– Brisbane Inland Rail Link, ‘beef roads’, and light rail in the Gold Coast and beyond. He was followed by Labor’s Anthony Albanese, who claimed that every dollar of spending announced by the Coalition had already been pledged by Labor, while hinting at possible investment in high-speed rail.

Most relevantly, the speakers connected infrastructure to housing. “You can see the numbers,” Baird told the audience. “In 2010 we had just over 20,000 private housing approvals, and now we’re on 70,000. It’s a big leap, and part of that is connected to transport and investment in other infrastructure.”

Knowing when an area is going to take off

Knowing when an area is going to take off Politicians may talk about the huge sums invested in infrastructure, but what does it look like from a broker’s point of view? MPA talked to three brokers whose businesses are currently being affected by major infrastructure projects: Byblos Finance’s George Karam, currently Australian Mortgage Awards Finance Broker of the Year; Gerard Tiffen, of Top 10 Independent Brokerage Tiffen & Co; and Mortgage Choice Glenelg’s Bianca Long, a Top 100 broker.

In some cases, the impact of infrastructure improvements on brokers is straightforward. One example is Canberra’s airport, which has just gone international. In September 2016 Singapore Airlines will begin flying direct to Australia’s capital from Singapore. Furthermore, the airport, which has no night curfew, is looking to scale up its freight operations.

Speaking to MPA for our Top 10 Independent Brokerages report, Tiffen described how the airport’s transformation will “change the game forever” in Canberra. “It’s creating a lot of interest and pumping the market up on the residential side … based on what’s going to happen over the next four to five years they reckon we’ll get to 420,000 people,” Tiffen said. “That’s what Canberra needs; that’s what has been lacking.”

Keeping an ear to the ground

The development of other regions has been more gradual, as was the case in Parramatta in NSW. Byblos Finance works extensively with developers and took the decision, in 2011, to begin expanding its operations. There were government changes at the time, such as the rezoning of land to allow for higher-density housing, and the releasing of more land for development. There was also a “gradual loosening” of credit policy by lenders, which gave developers more leverage.

For Karam, however, the most valuable information emerged from his constant discussions with developers themselves Byblos Finance was a founding member of the Developers Forum, which brings together developers, builders and financiers. It has not only brought in clients but given Byblos Finance advance warning of oncoming changes. “By being in a room with that many people, we’re listening to what concerns them on the day … we can start to prepare for it; find a funder that’s got that appetite,” Karam says.

“Keeping an ear to the ground”, as Karam puts it, paid off. “You could start seeing the trading of land; the positioning of players within this particular marketplace; their finances. They were gearing themselves up to put their foot on the gas with investments … they were about to invest in a very significant way.”

The area did indeed see huge growth, much of it centred around Parramatta Square, and Byblos Finance subsequently took off, with Karam coming number one in MPA’s 2015 Top 10 Commercial Brokers report and winning an AMA. The brokerage took on four extra staff and at the time of writing was about to move into a new office, in response to the growth in demand from investors.

Infrastructure and finance

In certain instances the connection between infrastructure and housing construction can be far more complicated. Bianca Long has run Mortgage Choice Glenwood, in Sydney’s far northwest, since 2007, long before it became popular. Even then various infrastructure projects were in the pipeline.

“The train stations were planned 10 years ago, although it might even be longer ago than that … look at companies like Woolworths in the northwest; they intentionally went into the area, knowing that public transport was going to increase in that area,” Long says.

Those train stations are due to open in 2017, but the housing boom has already happened, and it happened in 2014. This gap of three years can be explained by the interplay between infrastructure, land being released, and, crucially, the effect of stamp duty and first home buyer grants. In 2014, a block of land in the northwest could be had for under $350,000, meaning buyers didn’t have to pay stamp duty on it. Furthermore, first home buyers could only get grants for new properties, so had an incentive to construct new houses. The resulting influx of first home buyers, Long recalls, “made a massive, massive difference to construction in the area”.

With a large number of new clients, Long found her brokerage struggling to maintain high standards. “The reason we’ve grown like we have is attention to detail, quick turnaround, and always getting back to clients,” she says. “As the business then grows, that falls away, and we found ourselves in a position where it was taking too long to get back to clients, and we were just paper-pushing.”

The brokerage desperately needed staff, but rather than simply expand the existing office Long decided to establish an extra franchise in neighbouring Kellyville. “I sat down and had a holistic view of it, not just in terms of locations but in terms of markets coming up, and that’s when I saw a gap in Kellyville; when I saw the demographics and the construction in the area.”

As well as additional admin staff, Long took on an extra broker to specialise in first home buyers and refinancers, leaving her to specialise in more complicated cases and referrals. She’s planning to take on another broker to cover evening appointments, although she admits that her increased management responsibilities have been challenging.

When the dust settles

Just as the combination of infrastructure, credit and incentives can drive development, it can also kill it. Premier Baird may have bragged about Sydney’s ‘crane index’ and cited huge numbers of housing approvals, but out west (and beyond NSW) brokers are seeing something quite different taking place.

“I know governments are excited about what’s going on,” says Byblos Finance’s Karam, “but the exact opposite is actually happening on the ground at the moment ... there’s record approvals for housing, but less and less of that is actually being delivered.”

Both Karam in Parramatta and Long in Glenwood are currently seeing major declines in property development, despite substantial and ongoing improvements in infrastructure. According to Karam, the recent restrictions on foreign investors are “having a really big impact on developer confidence … that is a conversation that’s happening daily at the moment; that’s the topic of the day”. He’s finding developers are dividing into two camps: those who are now reluctant to move forward, and those who see the slowdown as a buying opportunity.

Another problem has been the changing requirements of banks, particularly regarding investors. Karam believes these have not been properly articulated to the market. “You’ve had many examples of where loans have been awaiting approvals for months, and they don’t come through, and people don’t understand why.”

In the case of Long, the first home buyers that had previously flooded Glenwood have now found their financial loophole has been closed. It’s all connected to stamp duty concessions, Long explains. “With the increase in prices, you had stamp duty concessions up to $350,000, but a block of land has skyrocketed to $550,000. Now we’re back to the same position as we were with established properties … they’re back to square one.”

Infrastructure, it seems, is yet another area in which politicians often promise more than they can deliver, even when their infrastructure promises become reality. “The infrastructure is wonderful,” explains Karam, “but it’s not going to be the cause of additional activity on a macro level; it just determines where the spending is going to go, but the bigger issue right now is availability of credit.”

So, while brokers need to take notice of what’s planned for their areas, the prevailing credit environment will continue to be the main factor determining a brokerage’s direction.

VALUE CAPTURE

As governments look to fund infrastructure in new ways, the ‘value capture’ strategy has attracted more attention. Prime Minister Malcolm Turnbull proposed value capture as a way to pay for high-speed rail on Australia’s east coast, noting that “it is not actually a radical new plan at all; it is actually a sensible old plan that’s been forgotten”. Value capture matters to brokers because it relates to valuations. According to Prosper Australia, a government organisation, value capture works in the following way:

1 Government bonds finance the infrastructure project

2 Infrastructure proposal announced = windfall gains for nearby landowners

3 Yearly land valuations quantify the windfall gain

4 Land value capture (a subset of land taxes or, alternatively, council rates) ensures the public receive a share of the increase

5 Over 20 years this higher government income repays the government bonds

As governments look to fund infrastructure in new ways, the ‘value capture’ strategy has attracted more attention. Prime Minister Malcolm Turnbull proposed value capture as a way to pay for high-speed rail on Australia’s east coast, noting that “it is not actually a radical new plan at all; it is actually a sensible old plan that’s been forgotten”. Value capture matters to brokers because it relates to valuations. According to Prosper Australia, a government organisation, value capture works in the following way:

1 Government bonds finance the infrastructure project

2 Infrastructure proposal announced = windfall gains for nearby landowners

3 Yearly land valuations quantify the windfall gain

4 Land value capture (a subset of land taxes or, alternatively, council rates) ensures the public receive a share of the increase

5 Over 20 years this higher government income repays the government bonds