It’s important to know the difference between loan processors vs underwriters to better understand the loan application process

When it comes to applying for a home loan, there are many moving parts. Loan applications consist of multiple stages, which include gathering documents and assessing the prospective borrower’s information for approval.

Since there are different steps, different loan professionals help you along the way.

Two key roles in the process are loan processors and underwriters. In this article, we will break down the key responsibilities of each role and outline the steps in the loan application process.

Here is everything you need to know about a loan processor vs underwriter.

What is the difference between loan processing vs. underwriting?

Loan processing and underwriting are key steps in the loan approval process. Loan processors are responsible for getting your documents in order. Loan underwriters, meanwhile, assess the risk of lending the client money for a home (or car or debt consolidation).

What is a loan processor?

Loan processors streamline the mortgage application process by organizing and managing the considerable paperwork and documentation involved. Loan processors gather all the materials (such as credit reports, pay stubs, bank statements, and W-2s) to ensure the information is correct.

Once completed, the loan processor gives the documentation to the underwriter. The underwriter then analyzes the applicant’s risk level. The information compiled and verified by the loan processor will make it easier for the underwriter to deny or approve the loan.

Note: loan processors are not licensed, meaning they are unable to provide you with advice about financing options. Loan processors primarily do back-end work, with the loan officer or originator managing the application throughout the entire process.

Key responsibilities of a loan processor

To give you a clear idea of loan processing, here is a look at a loan processor’s responsibilities:

- Gather documents: ensuring that all financial documents are in order is a loan processor’s most important responsibility. It also includes verifying that the documentation is correct when handed over to the underwriter. As mentioned, the required documents usually include tax returns, bank statements, W-2s, salary income, proof of insurance, and proof of assets and debts.

- Review credit reports: loan processors request and review your credit report. At this stage, they’re checking for collections, late payments, and any inaccuracies. Your loan processor may then request letters of explanation from you to better understand your credit history. A good credit score will increase your chances for approval. Essentially, this step is about reviewing your ability to pay bills, which ensures you can pay your mortgage.

- Track mortgage application deadlines: to help you avoid any excess fees, loan processors track mortgage application deadlines for you. This timeline includes finding your potential property, making an offer, getting an appraisal, and completing the underwriting and final loan for your mortgage.

- Finalize application process: loan processors finalize the application process by working directly with an underwriter. The loan processor must pass on all the loan documents to the underwriter for their approval.

What is an underwriter?

Loan underwriters work for lenders to help them evaluate a loan applicant’s level of risk. An underwriter will determine whether you qualify for financing. The underwriter’s primary objective is to establish if the mortgage is safe for all involved. Not only for you as the borrower, but for the lender as well.

Loan underwriters review your financial information. This includes your credit score, income, debt-income ratio, and other assets. The underwriter also looks at the type of property, and its value, to ensure the loan is fair for both the borrower and the lender.

Many financial institutions use a combination of underwriting software to assess the borrower’s level of risk.

Key responsibilities of a loan underwriter

To give you a clear idea of loan underwriting, here is a look at an underwriter’s responsibilities:

- Assess credit history: this is one of the key factors when determining loan approval. The underwriter analyzes your credit history to determine if you make payments on time. They also review payment history on car loans, student loans, or most other credit types. This step helps determine if you will pay back what you borrow.

- Review financial capacity: The underwriter also reviews your income, debt, employment history, and assets. Other areas that fall under your financial capacity include your savings and checking accounts, IRA and 401(k) accounts, tax returns, other income records, and your debt-to-income (DTI) ratio. This is to ensure that you and any co-signers can make payments for the life of the loan.

- Ensure sufficient collateral: Underwriters use the current market value of the property to ensure that it can be sufficient loan collateral. If you default on your loan, this reassures the lender that they have something to collect the unpaid balance. They can determine sufficient collateral either by getting an appraisal or other validation of the property’s value.

What comes first, underwriting or processing?

Mortgage loan processing comes before loan underwriting. After you have submitted your mortgage loan application, your loan processor will gather and organize the necessary financial documents for the underwriter. The mortgage underwriter then uses this information to determine whether to approve or deny your mortgage loan application.

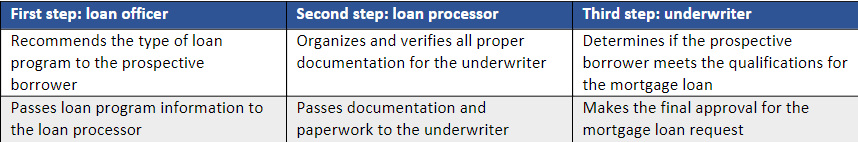

A loan processor acts as a go-between for the loan officer and underwriter. This chart outlines how they work together:

When pushing a mortgage loan request through, these three professionals work together. And as we have seen, each has its own unique set of responsibilities.

Can a loan officer override an underwriter?

No, a loan officer cannot override an underwriter. During the underwriting process, a loan officer cannot influence an underwriter in any way. However, there are some ways that loan officers can help aid in the underwriting process:

Write strong cover letters

When submitting a loan application to the underwriter, the loan officer will want to ensure all the information provided is clear and easy to understand. That means preparing a cover letter summarizing the information included. It might also address any irregularities or explain the borrower’s backstory. Submitting a strong cover letter to the underwriter will also save questions that may need answering throughout the process.

Stay up to date on guidelines

Loan officers must stay up to date on loan guidelines like document expiration dates. Essential to the underwriting process is gathering necessary documents. It is important that loan officers submit documents that meet specific guidelines. If not, the underwriter will request additional information. That added request will prolong the underwriting process.

Provide accurate information

Loan officers must provide accurate and complete information on the borrower before submitting the application to the underwriters. For instance, if the borrower has listed additional income (real estate income, self-employment, alimony, or child support), that additional information must be included with the loan application.

If you gather and provide that information from the beginning, you will help to expedite the underwriting process.

Does a processor do underwriting?

No. A processor does not do underwriting.

However, loan processors and underwriters do work together from a distance. A loan processor works directly with the borrower to gather and provide the required information to the underwriter. The underwriter then evaluates the information.

Loan processors do not attempt to influence any decisions of the underwriter. Instead, loan processors provide information and can ask questions about the denial or approval.

An underwriter, in response, can explain the loan decision. Underwriters can also provide educational information about the loan guidelines and the requirements for loan approval.

The key takeaway here is that loan processors and underwriters each play an independent role in the home loan application process. They must therefore work closely to ensure that the required documentation is gathered and presented. This allows the underwriting process to move forward smoothly.

A good underwriter educates the loan processor on the documentation that is necessary for all possible scenarios. To speed up the process, processors ensure that the right documentation is gathered.

Loan processors and underwriters have distinct roles in the loan application process

When starting the home loan application process, it helps to understand the different steps and know the professionals that will guide you through those steps.

Loan processors act as a go-between for loan officers and underwriters. Processors are responsible for gathering the required information, ensuring it’s accurate, and passing it on to the underwriter. The underwriter then determines if the borrower qualifies for the loan and makes the final approval.

To learn more about the differences between a loan processor vs underwriter, get in touch with one of the mortgage professionals we highlight in our Best in Mortgage section. Here you will find the top performing mortgage professionals across the USA.

Did you find this information on the differences between loan processors and underwriters useful? Did it help clarify the loan application process for you? Let us know in the comment section below.