New documents from the royal commission delve into banks' and brokers' misconduct over the last decade

New documents from the royal commission delve into banks' and brokers' misconduct over the last decade

It was another nightmarish day for the banking and broking sector when the royal commission released a torrent of documents on 7 November detailing hundreds of incidents of misconduct and reprehensible behaviour dating back to 2008.

While most of the worst cases had already been heard during the public hearings, this trove of 215 documents unearths some of the smaller deeds of deception and wrongdoing that have so far evaded public scrutiny, including those involving brokers.

Ninety-four financial services entities, including the major and non-major banks as well as broking franchises, provided written submissions in response to a request made by Commissioner Kenneth Hayne last December. He asked them to identify any misconduct that had occurred over the last decade, detailing the nature, extent and effect of it. He also asked them to explain what steps had been taken to deal with it; what was being done to prevent such behaviour from occurring again; and whether it could be attributed to the group’s culture or governance practices.

“One thing that I may have to look at is what the attitude ... of the industry generally … is to the notion of obedience of the law” - Kenneth Hayne, royal commission

Hayne reprimanded the big four banks in particular for failing to provide sufficient detail, and asked them for comprehensive lists of misconduct from the last five years. During the first round of hearings, he said he understood that things could go wrong for a number of reasons, but “one thing that I may have to look at is what the attitude ... of the industry generally … is to the notion of obedience of the law”.

“There may be a difference between a breakdown in controls and an acknowledgement of breach of law,” he said.

Most of the groups claimed these were isolated incidents that did not indicate broader systemic or cultural issues within the organisations. They addressed the consequences the brokers had incurred – often termination – and the measures they would put in place to prevent it from occurring again.

Aussie Home Loans provided the most extensive list of offences out of all the broking franchise groups by far, detailing 182 incidents of misconduct. Not only were cases of fraud, privacy data breaches, and false and misleading information provided to lenders, but also allegations of abuse, sexual harassment and discriminatory and homophobic remarks directed at customers. In one such case, the customer was paid $10,790 in compensation.

There were also regular customer service complaints, such as “customer claims broker was rude; new broker allocated” or “poor communication by broker, unsatisfactory customer experience”.

Aussie said these were isolated cases of “unacceptable conduct” involving staff and contractors over a period of 10 years. In each instance, it took appropriate and swift disciplinary action, including termination of employment and contractor agreements.

“Aussie provided the royal commission a detailed and exhaustive table of incidents as a result of building a culture of actively encouraging and facilitating staff, contractors and customers to speak up and report unacceptable conduct,” the company said in a statement.

“In the face of financial success, we grew complacent. We were too slow to identify problems ... and too slow to put things right for our customers” - Matt Comyn, CBA

“Aussie will continue to actively encourage reporting of unacceptable conduct, to enforce its zero tolerance policy for such conduct and to enhance its systems and process to prevent, detect and deter such conduct.”

At CBA’s annual general meeting, which happened to pre-empt the release of the documents on 7 November, CEO Matt Comyn acknowledged that there had been far too many instances when it had let customers down.

“In the face of financial success, we grew complacent. We were too slow to identify problems, too slow to fix underlying issues, and too slow to put things right for our customers,” Comyn said. He also announced the establishment of an external advisory panel.

Putting the misconduct into context

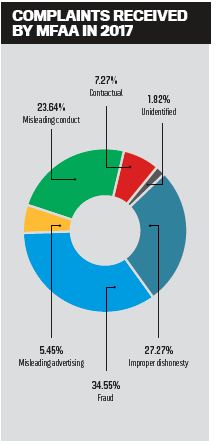

These cases of misconduct should be seen in perspective. Over the last 10 years the MFAA has received a total of 1,470 complaints against brokers, with only 154 matters reaching an adverse finding. In 2017, it received just 55 complaints, with fraud and improper/dishonest behaviour being the top two complaints.

“The industry-wide remedies which the CIF has recommended will be consumer tested to ensure that they are strengthening consumer outcomes, and the new governance and reporting framework which the CIF is developing will ensure that any future practices which lead to poor customer outcomes are identified and addressed,” the MFAA said