Suncorp Group’s CEO of banking and wealth tells MPA editor Sam Richardson how he plans to stand out through a distinctive mix of finance and insurance

Suncorp Group’s CEO of banking and wealth tells MPA editor Sam Richardson how he plans to stand out through a distinctive mix of finance and insurance

As no doubt intended, Suncorp’s Synergy conference presented a vision of the bank of the future. Delegates, who signed up on touchscreens, came from three corners of financial services: mortgage broking, insurance broking and financial planning. On stage the pattern was repeated, with Suncorp’s heads of risk, customer platforms and banking talking excitedly about sharing expertise and developing a diversified ‘marketplace’ for the future.

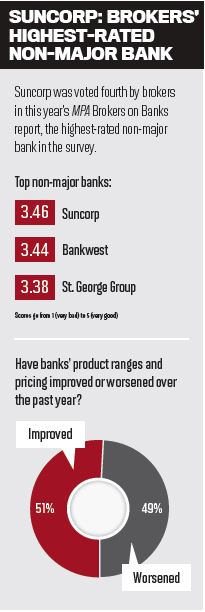

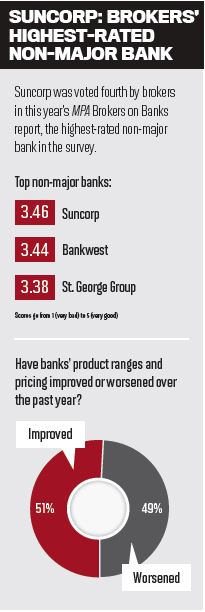

For Suncorp’s banking CEO, David Carter, today’s reality is bittersweet. Suncorp is an insurance giant – which earned $723m in the last financial year – but in banking it is yet another non-major in a crowded market, struggling to differentiate itself. Competitive interest rates worked for Suncorp, until the cash rate bottomed out; broker commission incentives worked, until regulators took a closer look. It’s not clear what comes next.

For Suncorp’s banking CEO, David Carter, today’s reality is bittersweet. Suncorp is an insurance giant – which earned $723m in the last financial year – but in banking it is yet another non-major in a crowded market, struggling to differentiate itself. Competitive interest rates worked for Suncorp, until the cash rate bottomed out; broker commission incentives worked, until regulators took a closer look. It’s not clear what comes next.

“We play in the same market the major banks do, so our targets are quite broad,” Carter explains.

“Within the challenges of the various regulatory macro-prudential settings – when you’re smaller you have to watch some of those things – we’re happy to write good business for most people.”

Restrictions on investor and interest-only lending gave non-major banks an opportunity to increase market share, which they have largely failed to take. In fact, the share of mortgages written by non-majors in AFG’s Competition Index fell from June to August: Suncorp’s own share fell to 4.35%.

Carter admits that the bank “took a lot of time – maybe too much time” in responding to investor lending changes. Nor has Suncorp differentiated itself in the interest-only lending space. In November Suncorp followed the majors in raising interest rates for IO loans.

Carter believes the market is moving in alignment with Suncorp’s position.

The constraints of capital

Suncorp’s conservative policy has given it a point of difference: unlike other banks it has not had to ‘pull the handbrake’ and stop investor lending overnight. Yet two insurmountable obstacles stop Suncorp from consequently rebranding itself as investors’ bank of choice.

Firstly, APRA’s speed limits have created a zero sum game: if other banks cut investor lending it could push Suncorp above the limits. “We’re operating in a market where there’s 20-plus other players, and we’ve all got to manage how much risk we take on,” Carter says.

Secondly, proposed changes to capital requirements could see higher requirements being applied to investor lending. Banks with large numbers of these loans on their books would need to raise capital rapidly, Carter explains, and “the last thing we want to do is take business on and then reprice it”.

So where can Suncorp differentiate itself? Carter sees an opportunity in flexible products. Mortgages “have become relatively more commoditised as a base product, but I think there are opportunities to develop things that are more flexible and change with the customer through their life cycle”. For example, products that are flexible to accommodate households with changing incomes, a major challenge for borrowers with high mortgage repayments.

When it comes to origination, the introduction of comprehensive credit reporting (CCR) could particularly benefit Suncorp. The data provided by CCR could allow banks to personalise pricing, bringing mortgages in line with insurance. As Carter explains it, “my premium will be different to your premium, even if we live next to each other, because my house and the characteristics of my risk are slightly different to yours”. With its existing expertise in insurance pricing and marketing, Suncorp may have a head start on other banks.

Carter is cautious about the promise of CCR, however. Personalised pricing will exacerbate the non-majors’ disadvantageous higher capital requirements when compared to the big four, he argues. “What would be good for competition is more of a level playing field on that best-quality risk … if you want to get the true benefits of comprehensive credit reporting into the market.” While Suncorp has invested “tens of millions of dollars” to gain advanced status, Carter says, “it’s up to APRA to decide we’re ready”.

A $100m marketplace

A $100m marketplace

Rather than wait for APRA, Suncorp has its own plan. Last year the group underwent a huge restructuring, replacing a number of senior staff and vowing to spend $100m on the ‘Suncorp Marketplace’ to make the group “the destination for moments that matter”.

Carter explains the marketplace in more straightforward terms. “The customer need should not be defined in the context of a specific product but as a set of needs that are related to an activity, ie buying and owning a house,” he says. The marketplace will offer financial and insurance products from Suncorp and affiliated partners, with a single digital access point for consumers, making it easier for brokers to cross-sell, although Suncorp rejects that term.

Not only does the marketplace leverage Suncorp’s expertise across finance and insurance, it also leverages the increasingly diversified nature of broking. An increasing number of brokers sell insurance, and Yellow Brick Road and Mortgage Choice have financial planning arms. Carter says “we’re also seeing more and more firms starting to think about their business models and how they can potentially broaden their relationships with their clients by providing more products and services”.

<<quote>“We really have to rethink the value proposition: a lot of these products by themselves aren’t a value proposition”

Above all, the marketplace is realistic and, despite its digital tag, somewhat old-fashioned. Asked about digital disruption by a delegate at the Synergy conference, Carter is adamant that “the basic tenets of relationship-based sales haven’t moved”. The challenge is creating sticky clients and getting clients to engage with what, Carter admits, are far-from-exciting financial services. “We really have to rethink the value proposition: a lot of these products by themselves aren’t a value proposition.”

As no doubt intended, Suncorp’s Synergy conference presented a vision of the bank of the future. Delegates, who signed up on touchscreens, came from three corners of financial services: mortgage broking, insurance broking and financial planning. On stage the pattern was repeated, with Suncorp’s heads of risk, customer platforms and banking talking excitedly about sharing expertise and developing a diversified ‘marketplace’ for the future.

For Suncorp’s banking CEO, David Carter, today’s reality is bittersweet. Suncorp is an insurance giant – which earned $723m in the last financial year – but in banking it is yet another non-major in a crowded market, struggling to differentiate itself. Competitive interest rates worked for Suncorp, until the cash rate bottomed out; broker commission incentives worked, until regulators took a closer look. It’s not clear what comes next.

For Suncorp’s banking CEO, David Carter, today’s reality is bittersweet. Suncorp is an insurance giant – which earned $723m in the last financial year – but in banking it is yet another non-major in a crowded market, struggling to differentiate itself. Competitive interest rates worked for Suncorp, until the cash rate bottomed out; broker commission incentives worked, until regulators took a closer look. It’s not clear what comes next.“We play in the same market the major banks do, so our targets are quite broad,” Carter explains.

“Within the challenges of the various regulatory macro-prudential settings – when you’re smaller you have to watch some of those things – we’re happy to write good business for most people.”

Restrictions on investor and interest-only lending gave non-major banks an opportunity to increase market share, which they have largely failed to take. In fact, the share of mortgages written by non-majors in AFG’s Competition Index fell from June to August: Suncorp’s own share fell to 4.35%.

Carter admits that the bank “took a lot of time – maybe too much time” in responding to investor lending changes. Nor has Suncorp differentiated itself in the interest-only lending space. In November Suncorp followed the majors in raising interest rates for IO loans.

“We’ve positioned ourselves well, so we find ourselves well inside both interest-only and investor settings”

Suncorp’s considered response to last year’s lending changes is now paying off, Carter insists. “That cost us some growth and some share, but we’ve positioned ourselves well, so we find ourselves well inside both interest-only and investor settings, which enables us to write the business we want to write.”Carter believes the market is moving in alignment with Suncorp’s position.

The constraints of capital

Suncorp’s conservative policy has given it a point of difference: unlike other banks it has not had to ‘pull the handbrake’ and stop investor lending overnight. Yet two insurmountable obstacles stop Suncorp from consequently rebranding itself as investors’ bank of choice.

Firstly, APRA’s speed limits have created a zero sum game: if other banks cut investor lending it could push Suncorp above the limits. “We’re operating in a market where there’s 20-plus other players, and we’ve all got to manage how much risk we take on,” Carter says.

Secondly, proposed changes to capital requirements could see higher requirements being applied to investor lending. Banks with large numbers of these loans on their books would need to raise capital rapidly, Carter explains, and “the last thing we want to do is take business on and then reprice it”.

So where can Suncorp differentiate itself? Carter sees an opportunity in flexible products. Mortgages “have become relatively more commoditised as a base product, but I think there are opportunities to develop things that are more flexible and change with the customer through their life cycle”. For example, products that are flexible to accommodate households with changing incomes, a major challenge for borrowers with high mortgage repayments.

When it comes to origination, the introduction of comprehensive credit reporting (CCR) could particularly benefit Suncorp. The data provided by CCR could allow banks to personalise pricing, bringing mortgages in line with insurance. As Carter explains it, “my premium will be different to your premium, even if we live next to each other, because my house and the characteristics of my risk are slightly different to yours”. With its existing expertise in insurance pricing and marketing, Suncorp may have a head start on other banks.

Carter is cautious about the promise of CCR, however. Personalised pricing will exacerbate the non-majors’ disadvantageous higher capital requirements when compared to the big four, he argues. “What would be good for competition is more of a level playing field on that best-quality risk … if you want to get the true benefits of comprehensive credit reporting into the market.” While Suncorp has invested “tens of millions of dollars” to gain advanced status, Carter says, “it’s up to APRA to decide we’re ready”.

A $100m marketplace

A $100m marketplaceRather than wait for APRA, Suncorp has its own plan. Last year the group underwent a huge restructuring, replacing a number of senior staff and vowing to spend $100m on the ‘Suncorp Marketplace’ to make the group “the destination for moments that matter”.

Carter explains the marketplace in more straightforward terms. “The customer need should not be defined in the context of a specific product but as a set of needs that are related to an activity, ie buying and owning a house,” he says. The marketplace will offer financial and insurance products from Suncorp and affiliated partners, with a single digital access point for consumers, making it easier for brokers to cross-sell, although Suncorp rejects that term.

Not only does the marketplace leverage Suncorp’s expertise across finance and insurance, it also leverages the increasingly diversified nature of broking. An increasing number of brokers sell insurance, and Yellow Brick Road and Mortgage Choice have financial planning arms. Carter says “we’re also seeing more and more firms starting to think about their business models and how they can potentially broaden their relationships with their clients by providing more products and services”.

<<quote>“We really have to rethink the value proposition: a lot of these products by themselves aren’t a value proposition”

Above all, the marketplace is realistic and, despite its digital tag, somewhat old-fashioned. Asked about digital disruption by a delegate at the Synergy conference, Carter is adamant that “the basic tenets of relationship-based sales haven’t moved”. The challenge is creating sticky clients and getting clients to engage with what, Carter admits, are far-from-exciting financial services. “We really have to rethink the value proposition: a lot of these products by themselves aren’t a value proposition.”